A shift toward value creation

CEOs have realized that focusing merely on profits is no longer enough. There’s a pressing need to consider broader stakeholder considerations around customers, financial growth, and society at large. The companies’ KPIs should capture the value created for stakeholders – including traditional measures like revenue and costs as well as brand value, diversity and inclusion, sustainability, community impact, and other measures. This is not a compliance issue alone

The renewable energy sector dollar volume in the equity capital markets reached a four-year high of US$14.8 billion globally in 2020, while the sector hit a record 74 transactions, according to Dealogic.

From oil and gas companies reassessing alternative energy investments to auto companies embracing electric vehicles, investors and stakeholders are influencing ESG-related transaction decisions. Simultaneously, a rise in ESG-focused activist funds is impelling a review of corporate portfolios and ESG narratives, calling out “greenwashing” when they see it.

Creating long-term, sustainable value

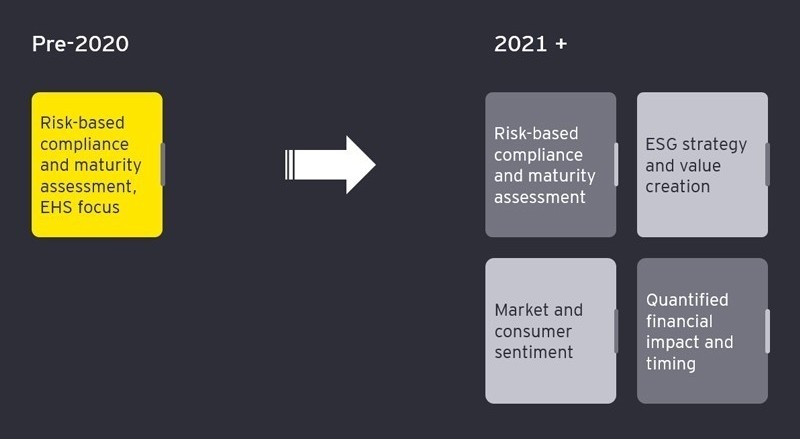

The question is: how can we turn around a risk mitigation and compliance tool to one that creates long-term and sustained value for stakeholders –companies, investors, employees, and the society at large?

In the initial stages, ESG due diligence will help ascertain where the company lies in its journey. The next step would be to chart a pathway that will help companies progress along the ‘Reactive to Progressive to Mature’ continuum.

There will be winners and losers, and those who manage to navigate will reap rich dividends through the value creation framework. Building capacity along with corrective actions and improvement programs will be key to creating the lasting legacy.

While this can be achieved through investor and stakeholder engagement bringing forth access to capital, it will require developing robust methodologies across each point of the investment lifecycle. Coupling these methodologies with ESG risk due diligence will require strategic adjustments to ESG targets based on market shifts.

For companies already part of PE portfolios, operators can mitigate ESG risks or capitalize on value-adding opportunities by assessing assets to identify emission-intensive opportunities and reducing carbon footprints. Other approaches include training deal teams in ESG skills and investing in ESG initiatives in portfolio companies.

PE and portfolio company management teams may also consider asking: What ESG metrics are best suited to measure a company’s success? What should be the reporting requirements? Who will implement and oversee the ESG strategy and policy?

PE can uncover opportunities for value creation as more stakeholders embrace ESG. An ESG strategy must create purpose-driven businesses that can attract a broader base of customers and talent and create value by embedding sustainability.