How can ESG deliver long-term value?

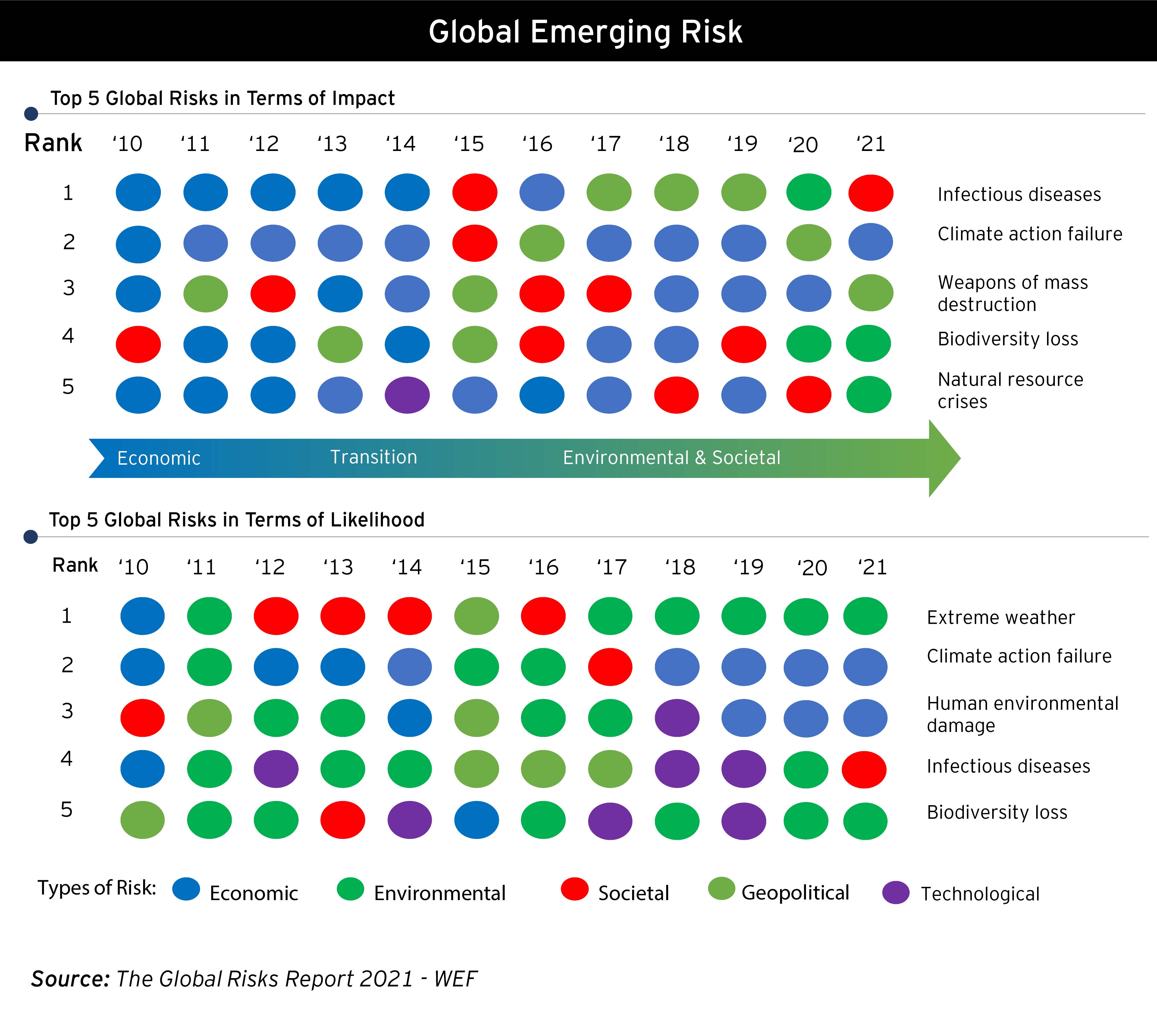

In this global phase of transformation coupled by volatility and uncertainty for the businesses, ESG framework provides businesses long term value by holistically safeguarding profits, people and the planet. Imbibing ESG factors into business therefore becomes necessary as it goes beyond corporate responsibilities and focus on holistic material issues to build resilience in short medium and long term. These aspects vary basis the industry of operation, business model, geography, scale of operations, supply chain, investor base, core values and business strategy of the organization.

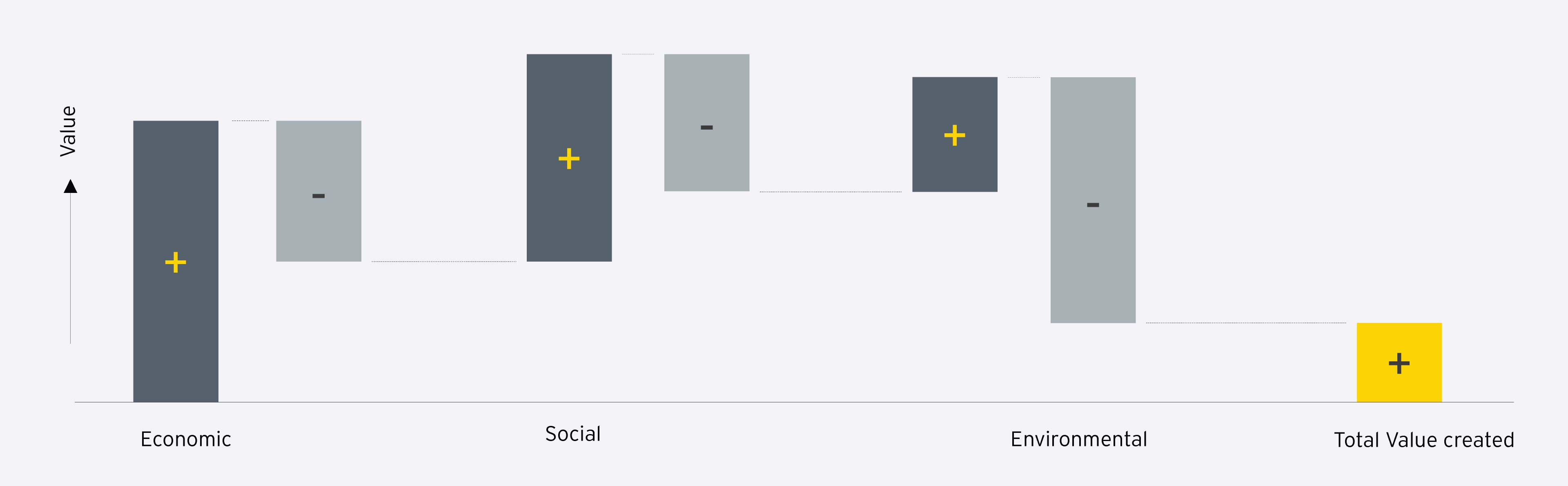

Creating a long-term value goes much beyond mere financial profit and loss but we need to look at the bigger picture. Integrating non-tangible factors and measuring the impact created helps in future proofing of business with respect to the risk that cannot often be measured. Therefore, companies are moving from non-financial reporting to integrated profit loss statement which attempts to correlate or monetize the positive and negative impacts of the business operations and products through a range of capitals.

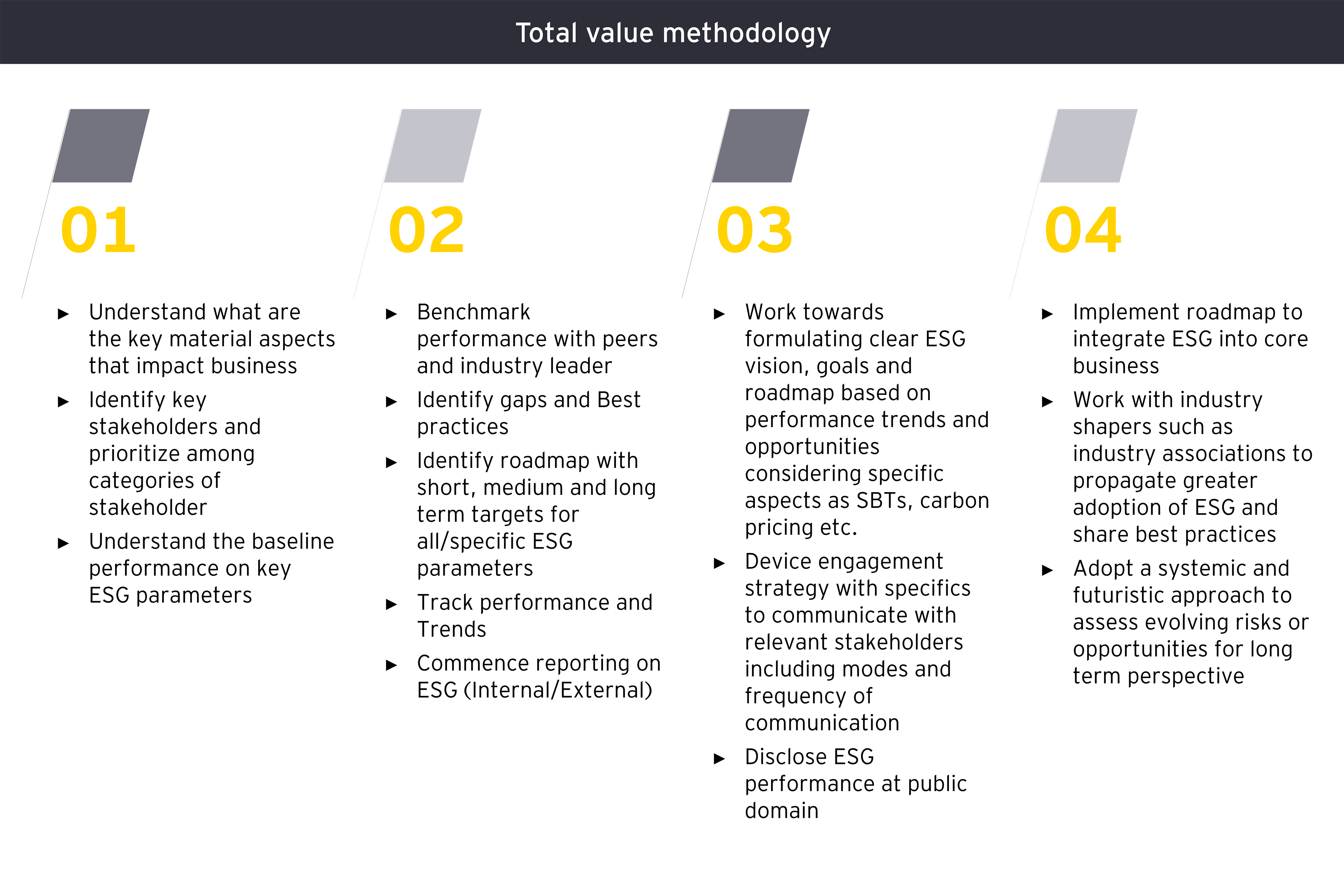

EY total value approach

To support such efforts of organizations, move towards integrated value statements, EY has developed the Total Value approach to address this need and measure the value created by the company, the value it shares with its stakeholders and the broader impact of the company on society at large. A Total Value analysis provides insights on the monetized impacts, outcomes and their materiality.