While organizations have been moving to digital platforms in the lead generation and customer awareness mode, COVID-19 is expected to be the tipping point to fundamentally alter the need for digitally driven front office. This will extend to all dimensions of sales operations, channel engagement and actual sales transactions and account management.

The global pandemic of COVID-19 has caused major disruption in customer engagement and sales operations have been impacted globally. ‘Is contactless sales the new reality for industrial products?’, an EY report focuses on the fundamental shift required in the “Now” phase and how front-end operations of industrial products organizations function in the “Next” and “Beyond” phases.

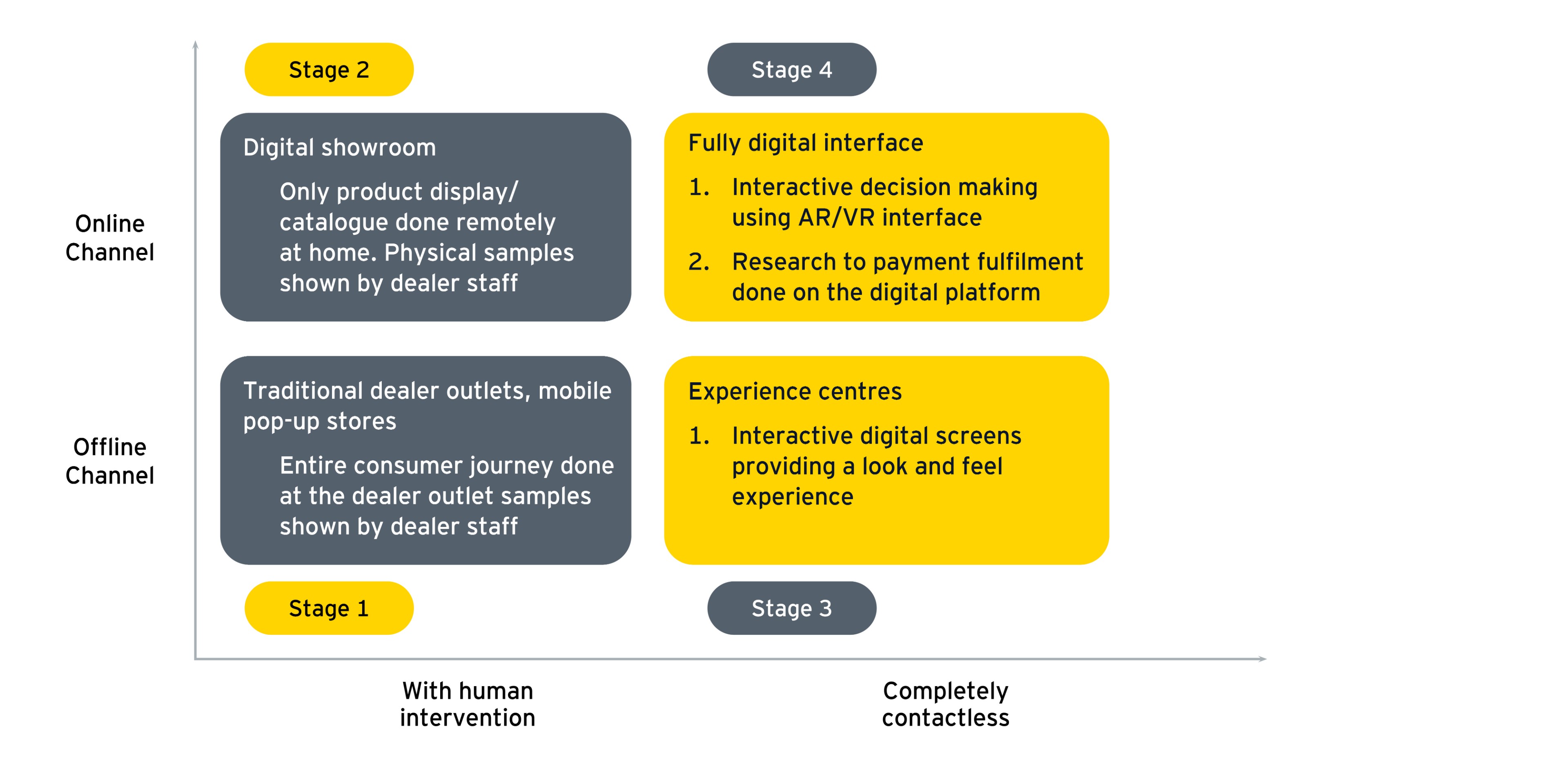

The consumer has already been in transition, even before COVID. Stages such as research and consultation, selection of specific brand/ models are already digital in the purchase process. However, what has now changed is that negotiation, transaction, internal reviews, channel engagement and below the line trade spends have also started to migrate to digital. The fence sitters are left with no option but to change. An integrated platform with a digitally enabled agile salesforce will become a critical criterion for not just consumer engagement and sales conversion but also dealer engagement and internal sales team reviews.

Execution challenges that the industry is facing in the new normal

Limited in person engagement with customer, dealer or influencers, both due to the reluctance to physically meet and travel restrictions will change the advantages of reach that leading Indian organizations have traditionally relied on. While lead generation and customer awareness was a transition well underway the handoffs and capability gaps for sale closure, financial closure, delivery, old stock liquidation and collections are new to most organizations. Interesting questions that organizations need to ask themselves are if digital leads are leading to online sales or is it falling between the gap somewhere, or if reviews are happening with the same rigour and is everyone accessing one source of truth in data?

Plausible solutions

Immediate modifications done on existing platforms for “Now” requirements- little tweaks that go a long way, especially on using data roadblocks (e.g. Customer Engagement Centre applications, account information and purchase/ sales history for sales teams) are being prioritized to enable the start of contactless engagement. To support that cost effective and quick technology enablement that can enable working in present times (such as, pipeline and contract management) are being put up on a war footing. While the transaction ability is coming up quickly, industrial consumerism and changes in how sales teams function is where the new normal will have a greater impact.

Industrial products organizations could benefit from the four strategies in these uncertain times:

- Contactless sales operations and customer engagement- While the physical sales process is becoming remote, sales pitch, smart communication, stories and personal experiences will remain crucial even going forward. However, sales teams won’t have to spend long days at dealers and no longer hours of travel far away. Customers will be engaged with a mix of online, offline and omnichannel depending not just on sales team assessment but also customer preferences and prevailing regulations. Similarly, organizations will learn the key rule of digital- You win when the ecosystem you work in wins and you can’t do it all alone. This the big do it all industrial heavy weights will need some getting used to.

- Distributor/dealer liquidity management and operations oversight- The contactless model needs to identify and onboard distributors along with the earlier planned front-end sales team, to drive the planned change. There is a need to map existing fulfilment centres for delivery while the contact centres act as co-ordination centres for enquiry and deciding on the other commercial agreements.

- Trade spend planning and execution: net revenue management- Creating analytical existing spend map and identify top micro-markets affected by prevailing conditions. Developing analytical triggers for spend management (descriptive dashboards to aid decision making rather than prescriptive analytical models, refined later to more evolved pricing and trade spend tools) will not just be needed but actually increase spend ROI

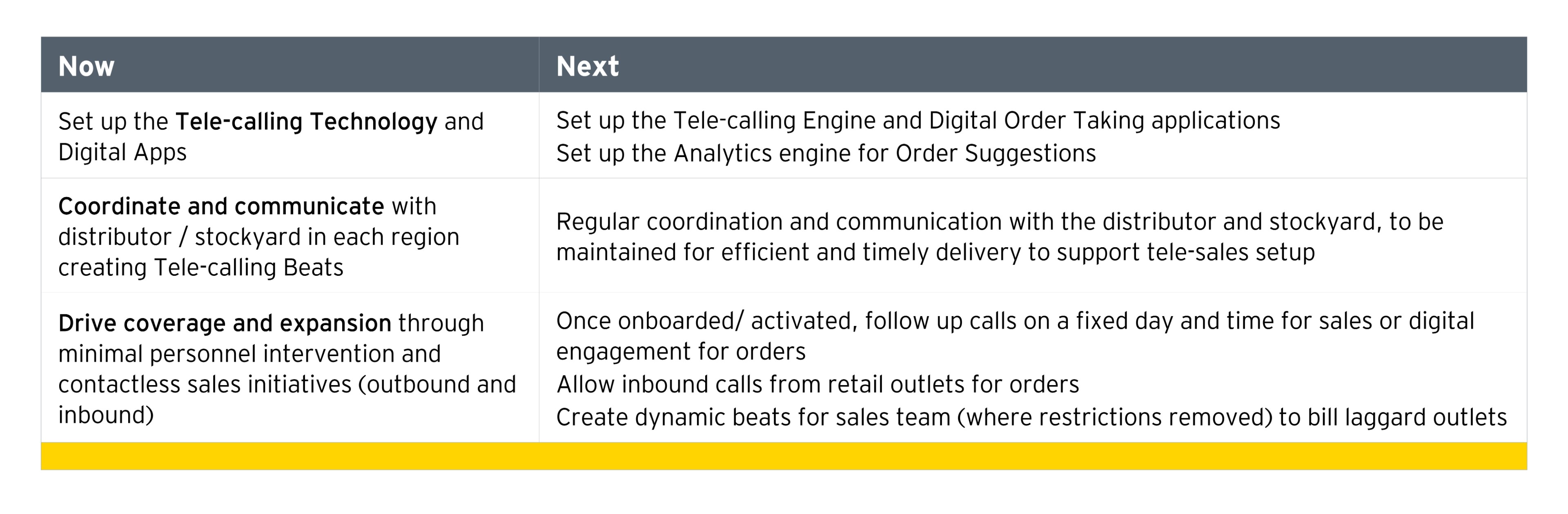

- Enablers for activation of contactless engagement- To run the contact centre and digital engagement, one needs to adapt, Now and Next initiatives.