With the regulatory environment becoming more stringent, regulator’s and other stakeholder’s expectations from companies are increasing and they now demand enhanced level of transparency and disclosures. Consequently, there is a need for companies to proactively understand the changes, assess their impact and prepare their systems and processes to ensure smooth adjustment to these regulatory changes.

With these changes significantly affecting reporting for March 2021 and onwards, we have summarized the key changes, their impact and key points to consider for assisting companies in ensuring their compliance with CSR Amendments and CSR Rules, 2021.

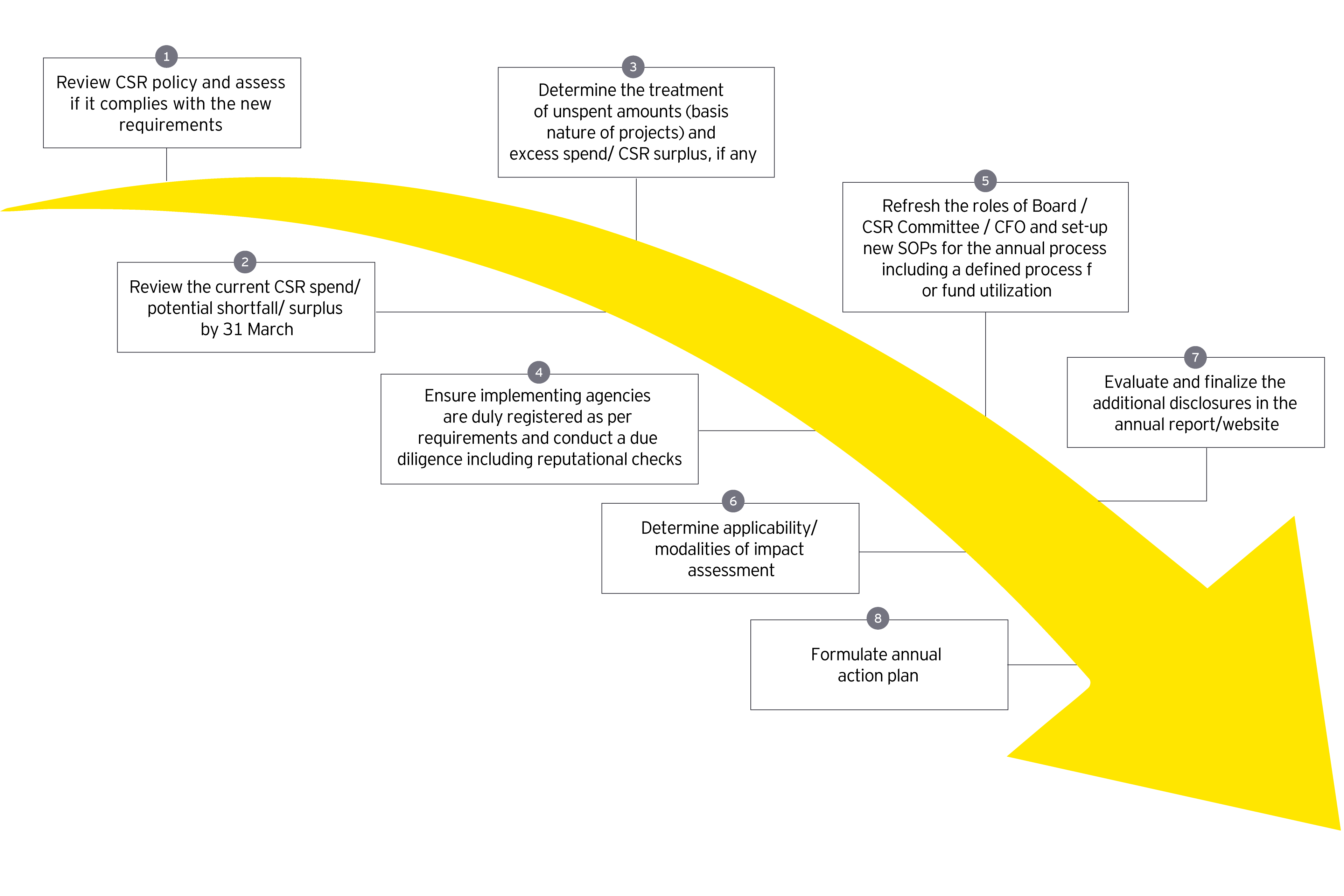

Companies will have to consider these changes holistically from the systems, processes, compliance and reporting perspective. They may have to re-visit their existing policy and procedures to ensure that their CSR policy, procedures and systems are in compliance with these changes at all times. This will also require regular monitoring and checks and balances in balances for certain more onerous provisions such as last mile monitoring of funds spent by companies.

Introduction of negative list in definition of CSR with aim to ensure promotion of public good and regulate spending of the CSR fund for their own benefit. Financial transactions undertaken out of the CSR fund should not benefit the company or its employees and any benefit incidental is perfunctory. Introduction of need for impact assessment and mandatory registration of CSR vehicles are other steps in the aforesaid direction. Further, introduction of ceiling on the expenses incurred towards administrative activities, carrying forward of the excess spend and set-off excess spent in earlier period will require setting up of processes and systems to track these matters. Points to ponder relating to key changes are as below: