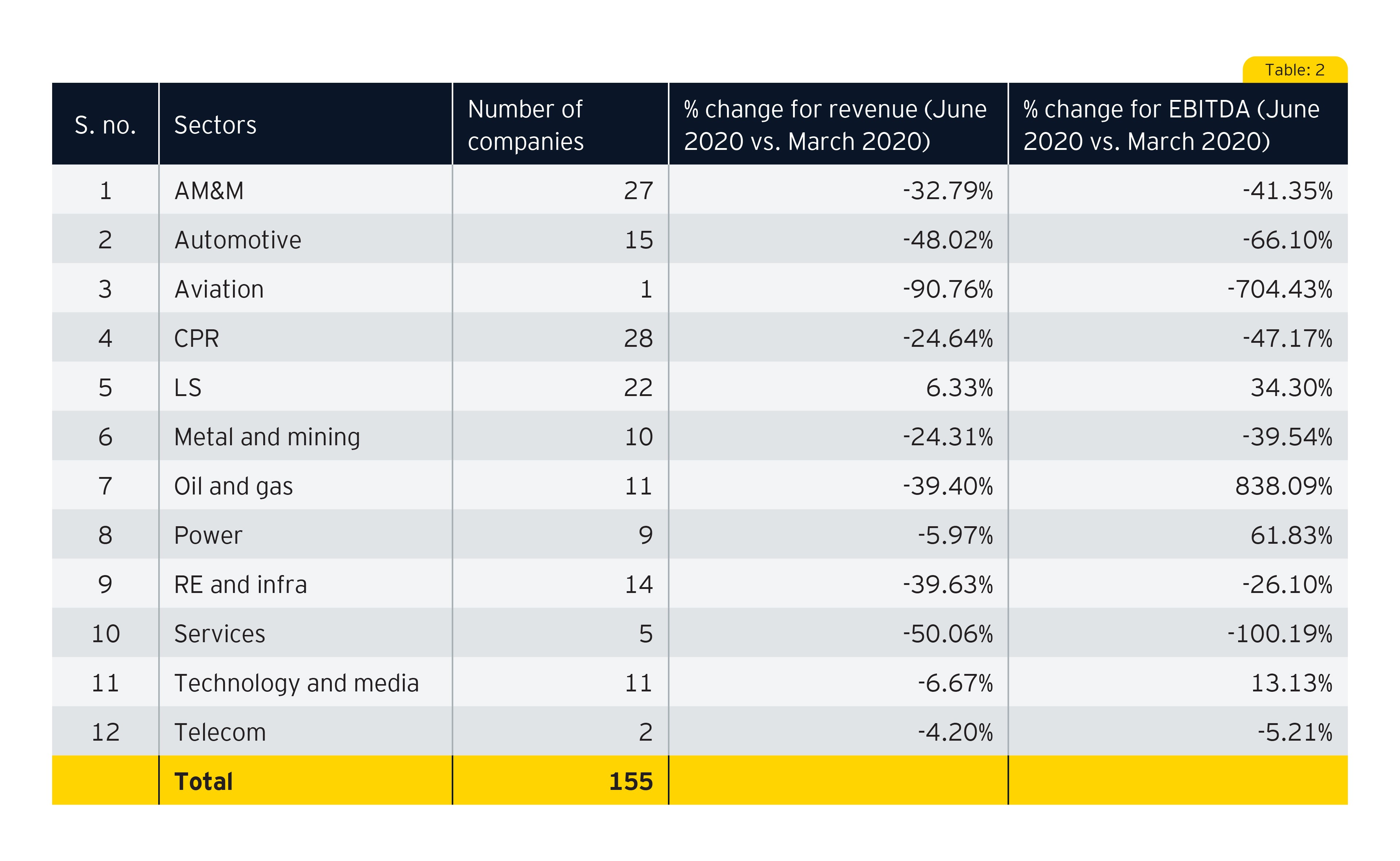

It is notable that most of the companies have implemented cost conservation measures, wherever possible, to commensurate revenue loss to minimize impact on profitability. The sectors having more variable and agile cost structures could successfully implement these measures well, while those with more fixed cost bases have continued to struggle to maintain their profitability.

We also observed a significant shift in investor communication strategies that several companies adopted to provide non-financial disclosures around the ability to restart or continue operations and the potential future impact of COVID-19 disruptions on businesses and response, thereof.

As corporates around the world continue to ride along with this unexpected wave of COVID-19, resulting into remote and fragmented working, it is encouraging that the world is opening and trying to regain the momentum it had before the pandemic. Albeit, the world has changed in many ways and financial reporting is not an exception. Due to the pandemic, the involuntary positive impact of the environment is also driving a shift and larger focus towards sustainable organizations and reporting around the same.

The publication showcases a high-level analysis of the overall sectoral level and does not attempt to provide in-depth exhaustive analysis or conclusive views on the impacts of the outbreak. Our analysis is based solely on publicly available information.