A growing economy, combined with a positive M&A environment, make India an attractive destination for M&E investment — but there are risks

Economically, over the last five years India has been the growth leader among major economies, including emerging markets and developing economies. It surpassed China in terms of real GDP growth in 2014 and has remained higher since.

Per capita nominal GDP grew 10.6% in 2018, and according to the latest International Monetary Fund World Economic Outlook, India is projected to become the fifth largest economy in 2019 and the third largest on the basis of purchasing power parity (PPP).

India’s M&E sector is ripe for consolidation

The M&E sector witnessed an interesting mix of deal activity in 2018, both on the traditional as well as the new media front. It’s a sector ripe for consolidation. Digital media, multiplex, radio and TV distribution segments will continue acquiring strong business verticals to expand and complement their existing businesses. This is a trend likely to continue going forward as large media companies look to further strengthen their positions in this fast-growing sector.

Investors need to balance the opportunities with the risks

India offers global M&E investors enormous opportunities for growth. However, there also are several persistent challenges to consider before making the leap.

Increasing use of digital media has accelerated video consumption, but it also has increased the piracy threat. In fact, growing piracy is likely to restrict full monetization of content, as well as large-scale acceptance of subscription video on demand (SVoD) in India.

The Indian market is highly price sensitive and is majorly advertising-driven. Sectors such as print, digital, television and radio get revenues from advertising. The average subscription cost for newspapers is about USD2 for a month, cable/VoD in India is USD1-USD4 per month and average film ticket prices are around USD2.

While India’s ease of doing business 2019 ranking improved 23 spots to reach No. 77, its position worsened on “paying taxes” and “resolving insolvency.”

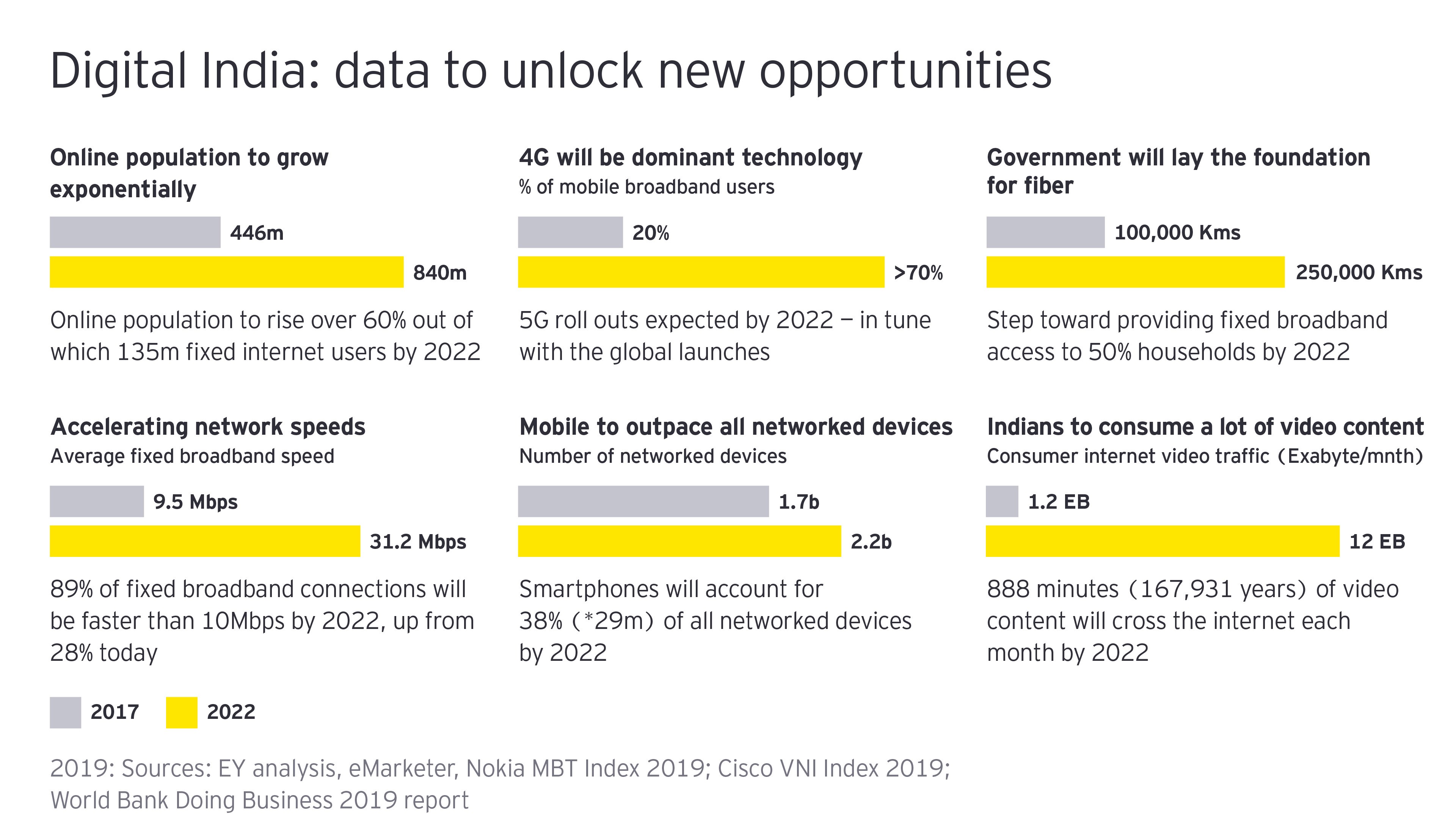

There are a billion screens of opportunity for companies looking to expand in a fast-growing market

With a billion screens of opportunity, India is a prime destination for M&E companies looking to expand into a fast-growing market — as long as they are comfortable assuming the inherent risks that such opportunities bring with them.