Related content

Summary

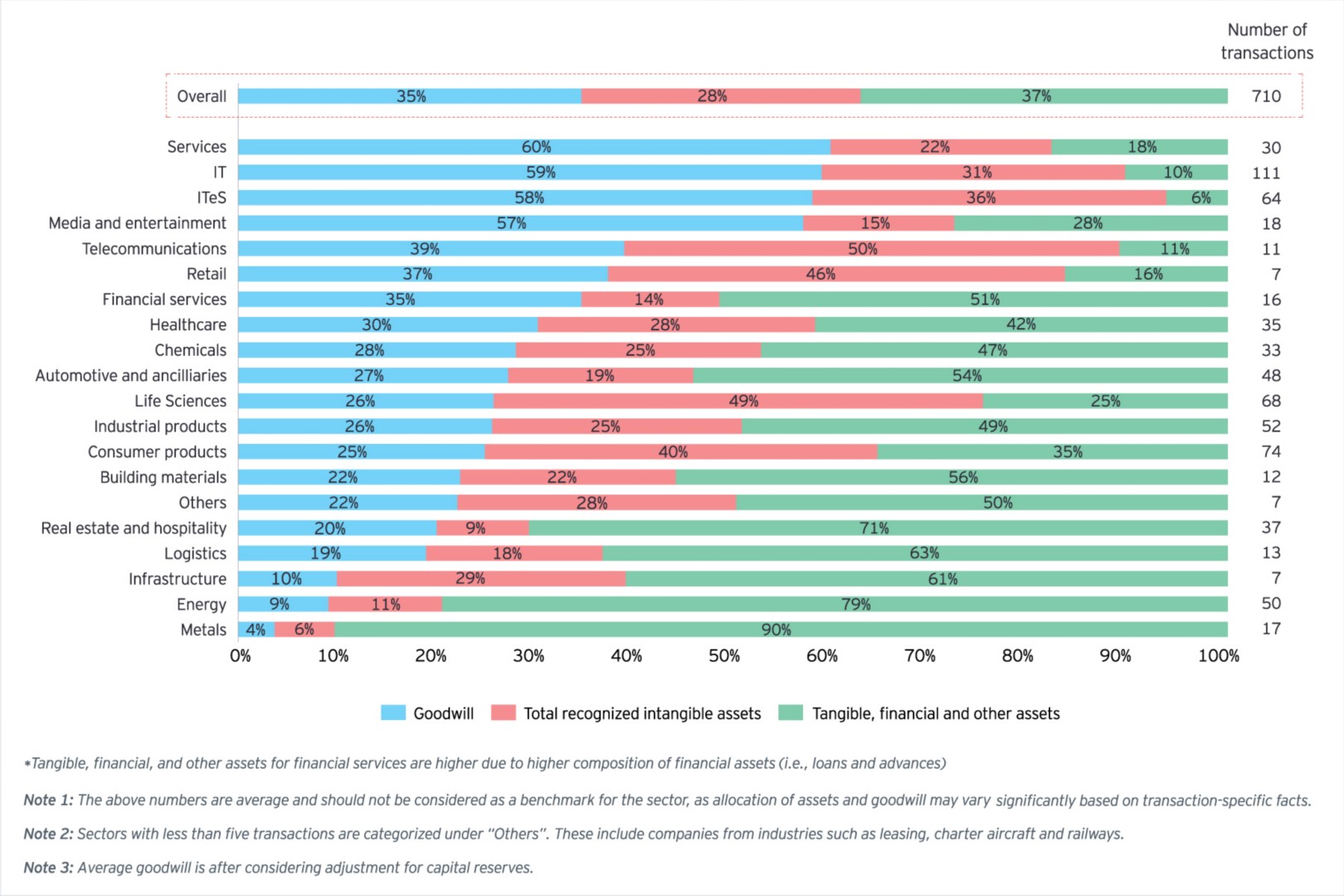

Understanding the implications of Ind AS 103 is crucial for companies as it impacts balance sheets and taxation. It involves identifying key intangible assets and estimating their contribution to deal value during business combinations. EY's study of top Indian companies reveals that 28% of enterprise value is allocated to intangible assets and 35% to goodwill. Allocation varies by industry, with sectors like Services, IT, ITeS telecom emphasizing on intangibles. Real estate and energy sectors prioritize tangible assets. Marketing-related intangibles drive acquisitions in certain sectors. Non-compete agreements, though common, receive lower value allocation. PPA's relevance extends to tax treatment, requiring fair value assessment and allocation to goodwill.