Recommendations of the Fifteenth Finance Commission (FC)

The final report of the FC 15 was tabled in the Parliament on 1 February 2021. The Center has accepted the substantive recommendations relating to tax devolution to states, revenue deficit grants, local body grants, and grants for natural calamities. It has however put on hold state-specific and sector-specific grants regarding which a decision may be taken later on.

Vertical devolution

The FC 15 has recommended the vertical share of the states in the divisible pool at 41%, comparable to 42% as recommended by Fourteenth Finance Commission (FC 14) since the number of states has now been reduced from 29 to 28 following the change in the status of Jammu and Kashmir. A noticeable trend relates to a significant increase in central cesses and surcharges which are not sharable with states. This has led to a significant reduction in the share of divisible pool in gross central taxes which has fallen to 28.9% in FC 15 (1) period from 34.9% in the FC 14 period.

Sharing of central taxes

In the final report of FC 15, no change has been incorporated with respect to the devolution criteria and their respective weights, as compared to their first report. If we compare both of these reports with the criteria used by the preceding Commission namely, FC 14, there has been a total reduction of 7.5% points in the weights of the income-distance formula (5% points) and population criterion (2.5% points). This difference of 7.5% points was used to increase the weight of three criteria namely, tax effort, demographic change, and forest cover by 2.5% points each.

Grants vs. devolution

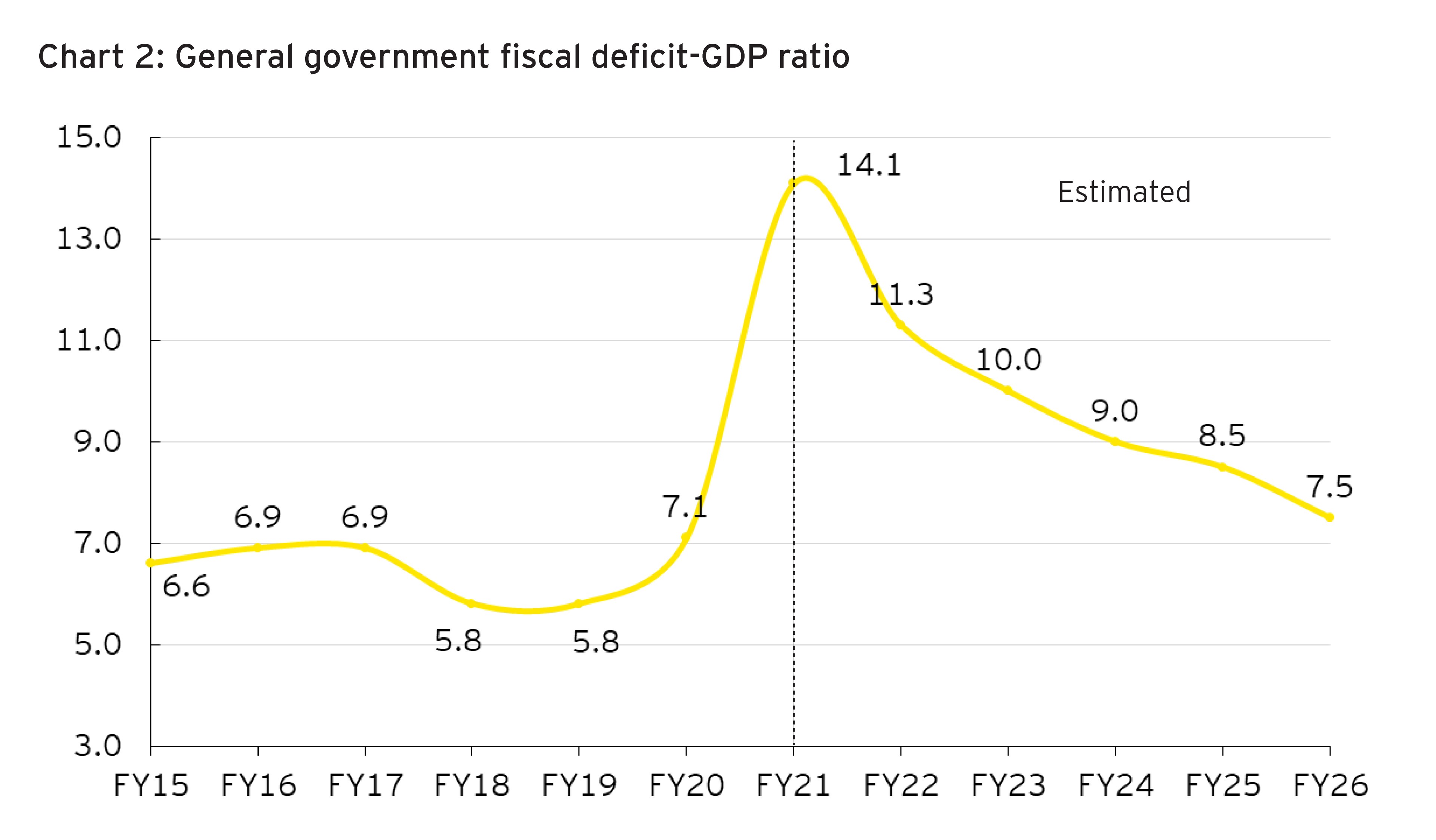

The FC 15 has emphasised the relative importance of grants considering the high degree of uncertainty affecting the central tax base in FY21. This may be considered desirable since transfers in the form of grants are ensured independent of the performance of the central taxes. Comparing the relative share of tax devolution vis-à-vis. grants, for FC 12 period, the share of tax devolution was 82.4%. This increased to nearly 86% by FC 13 and 89% by FC 14. However, the FC 15 has brought this share down to 81% in their first report and 80.6% in their second report with respect to their recommended transfers. These shares may be revised to 81.5% - [FC 15 (1)] and 83.3% [FC 15 (2)] with respect to the transfers accepted by the central government so far.

Revenue deficit grants: issues with underlying principles

Although grants in general have certain desirable features, revenue deficit grants implicitly incentivize revenue gaps produced due to low tax efforts and inefficient service deliveries. The FC 15 (2) has not only continued the practice of providing revenue deficit grants but has also increased the coverage to 17 states as compared to 10 and 7 states, excluding Jammu & Kashmir, under FC 14 and FC 13 respectively. Ideally, the approach to determining revenue gap grants under Article 275 (1) should be guided by the equalization principle which takes into account the cost and need disabilities.

Incidence of per-capita transfers: patterns of regressivity

An analysis of the recommended per-capita total transfers to states by FC 15 (2) indicates patterns of regressivity within two groups of states namely, medium and large states (ML) and small and hilly states (SH). Within the group of ML states, low per-capita income states such as Bihar and Uttar Pradesh get much lower per-capita transfers as compared to some of the higher-income states such as Chhattisgarh, Odisha, Assam, and Andhra Pradesh. At the higher income end of these states, Kerala has been given much higher per-capita transfers compared to Gujarat, Maharashtra, Tamil Nadu, Karnataka and Telangana. Within the group of SH states, low income states such as Manipur, Meghalaya, Tripura and Uttarakhand receive much lower per-capita transfers as compared to Arunachal Pradesh, Nagaland, Mizoram and Sikkim. On average, SH states receive per-capita transfers which are 3.7 times higher than that of MH group. This may largely be the result of following the old approach where historical gaps are projected forward with some application of limited norms. A much better approach would have been to follow the equalization principle which guides horizontal transfers in some of the well-established federal countries such as Australia and Canada.