Fiscal performance in FY22 may permit accelerated infrastructure investment

Data from the CGA on monthly central finances showed that the center’s gross tax revenues (GTR) grew by 70.5% during April-August FY22 over the corresponding period of FY21, and by 30.1% over the corresponding period of FY20. Non-tax revenues of the center also showed a high growth of 72.6% during April-August FY22. As a proportion of the budgeted magnitude, non-tax revenues during the first five months stood at 61.2% as compared to just 22.4% last year. Further, the sale of Air India by the central government has reinvigorated the government’s disinvestment agenda. This sale is at an enterprise value of INR18,000 crore, out of which INR15,300 crore is the debt to be retained by Tata Sons. The balance of INR2,700 crore would accrue to the government. As per available information[2], the government plans to privatize a number of PSUs this year including BEML, Shipping Corp, NINL, Pawan Hans, CEL and BPCL and is hopeful to meet its ambitious disinvestment target of INR1.75 lakh crore.

The center’s fiscal deficit in the first five months of FY22 amounted to only 31.1% of the budgeted target as compared to the corresponding average level of 94.7% over the last four years. In fact, fiscal deficit relative to GDP during April-August FY22 was at its lowest level since FY01.

With an improved tax revenue growth performance, government may have the option to reduce the magnitude of the budgeted fiscal deficit, though there will be some pressure due to the impact of enhanced global crude prices on fertilizer and food subsidies. There may also be some slippage in non-tax and non-debt capital receipts as compared to the budget estimates. However, it may still be advisable to prioritize growth with a view to consolidate the ongoing growth momentum rather than looking at any possible reduction in the fiscal deficit as compared to the budgeted magnitude. Thus, the government could stimulate public sector demand while retaining the budgeted fiscal deficit level of 6.8% of GDP for FY22 while raising capital expenditure above budgeted levels in the remaining part of the current fiscal year.

Given that the National Infrastructure Pipeline (NIP) targets could not be met fully due to the adverse impact of COVID, the government should take advantage of the improved tax buoyancy and the recently launched National Monetisation Pipeline (NMP) to make up for some of the shortfalls relative to the original NIP targets.

With respect to COVID vaccination, India crossed the milestone of 100 crore doses on 21 October 2021. As on 25 October 2021, 102.3 crore vaccination doses have been administered of which 71.8 crore persons have received one dose and 15.3 crore persons have received both the doses. This implies that nearly 93% of the estimated eligible population[3], that is, population aged 18 years and above, has been administered with at least one dose. Efforts should be made now to complete the coverage of vaccination by the required two doses for the eligible population before considering expanding the program to cover population aged above 12 years, booster shots to vulnerable population segments, and vaccine exports. Investment in health infrastructure should continue to be the focus area.

Growth can be further accelerated by uplifting investment and saving rates

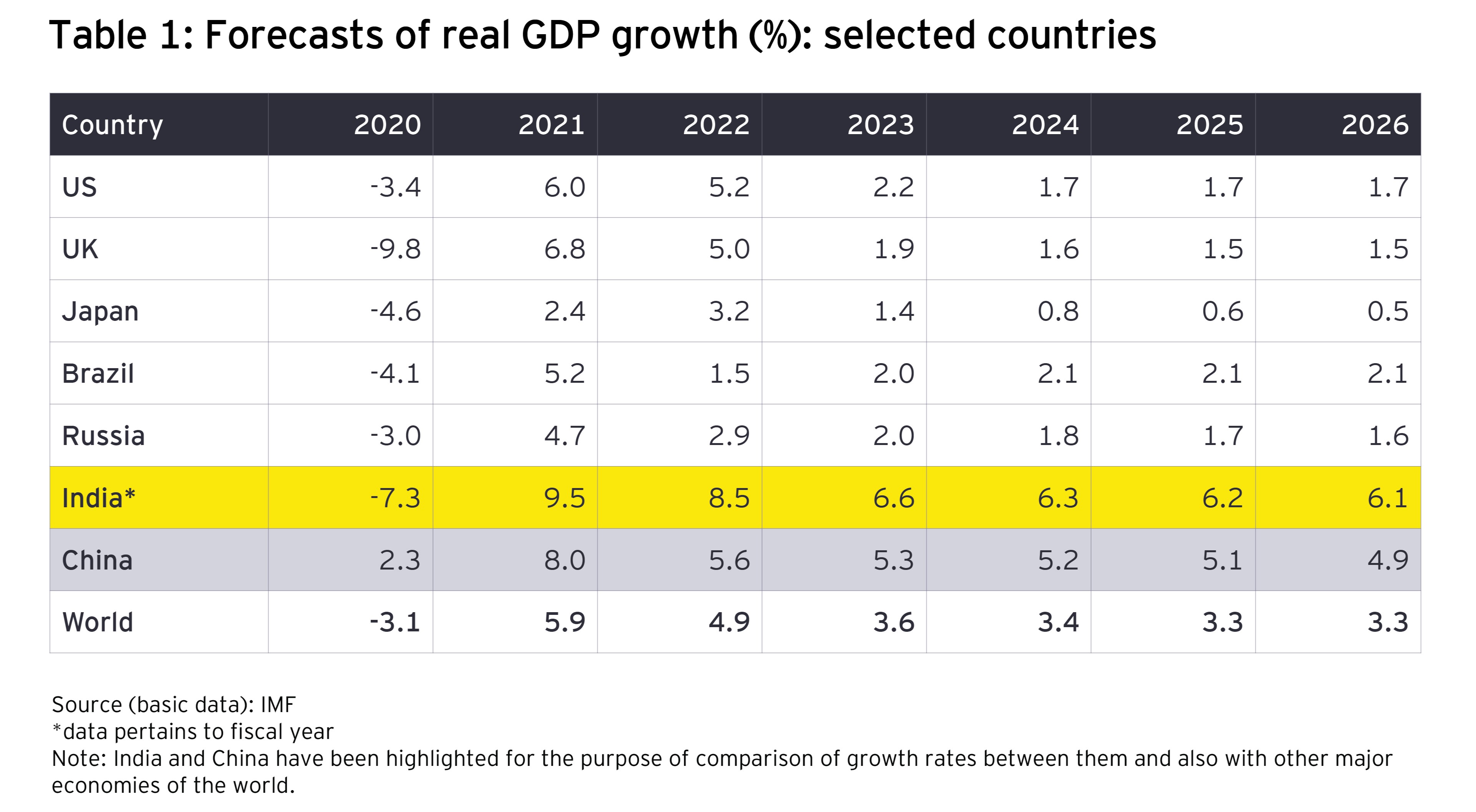

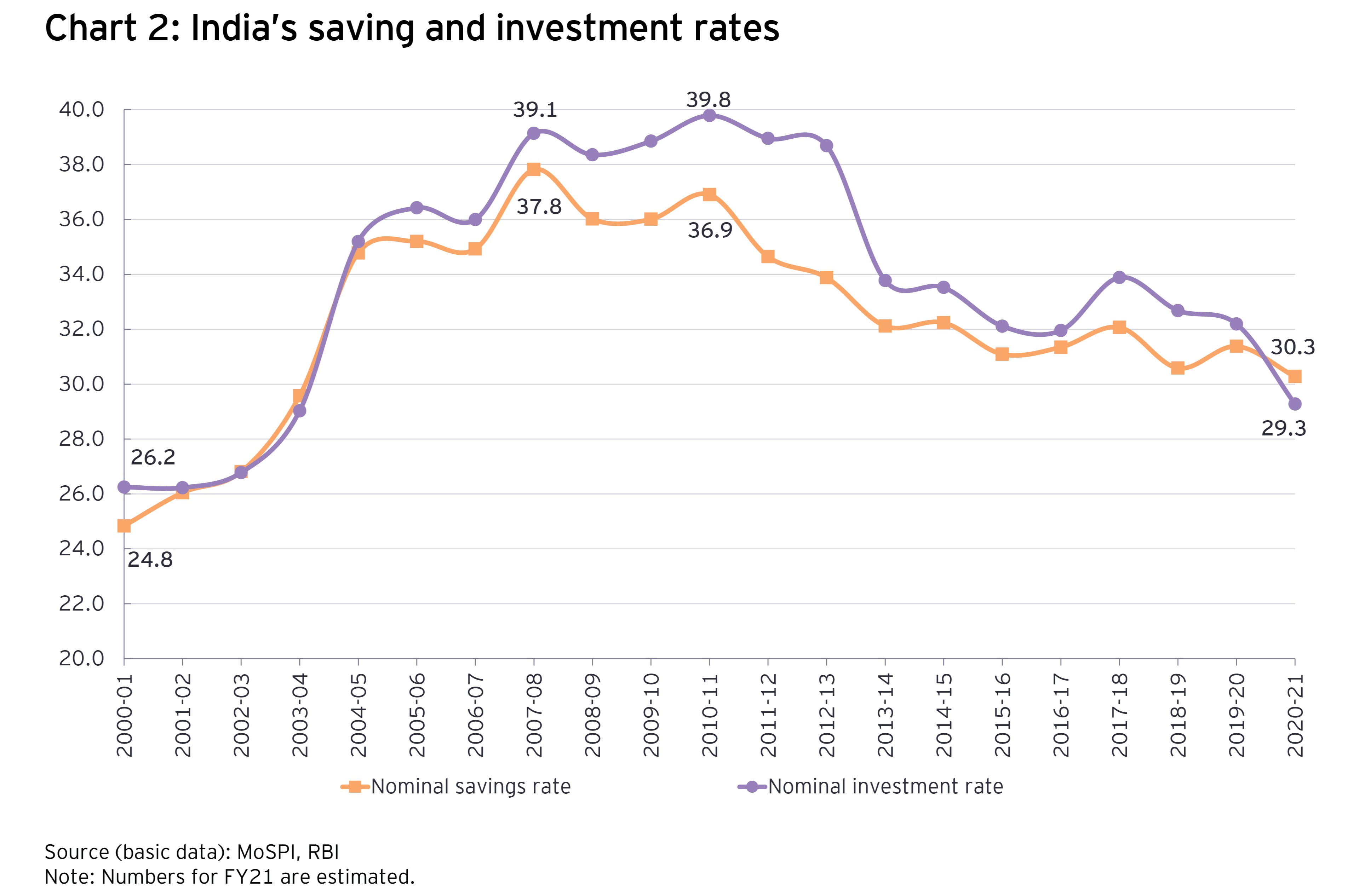

India’s medium-term growth prospects, as per the IMF forecasts up to FY23, indicate a convergence of real GDP growth towards 6%. This is still lower than the previous peak of trend growth rate of around 7.0% during the four years from FY08 to FY11. In fact, if we include the forecasted growth of 9.5% for FY22 and 8.5% for FY23, the trend growth rate is uplifted to only 4.9% by FY23. These trends indicate that more policy initiatives are needed to uplift the trend growth rate to 7% or above in the medium-term. In particular, the public sector, as a whole, led by the central government may do well to substantially increase its investment from the recent level of 7.2% of GDP in FY20, in nominal terms. Increased public sector investment is expected to induce an increase in private sector investment also. It is the falling trend in the overall investment rate from a peak of 39.8% of GDP in FY11 to an estimated 29.3% in FY21 that requires to be reversed (Chart 2). This would require increase in government capital expenditure which can be financed by augmenting the tax and non-tax revenues relative to GDP and containing the revenue account deficit to progressively lower levels.