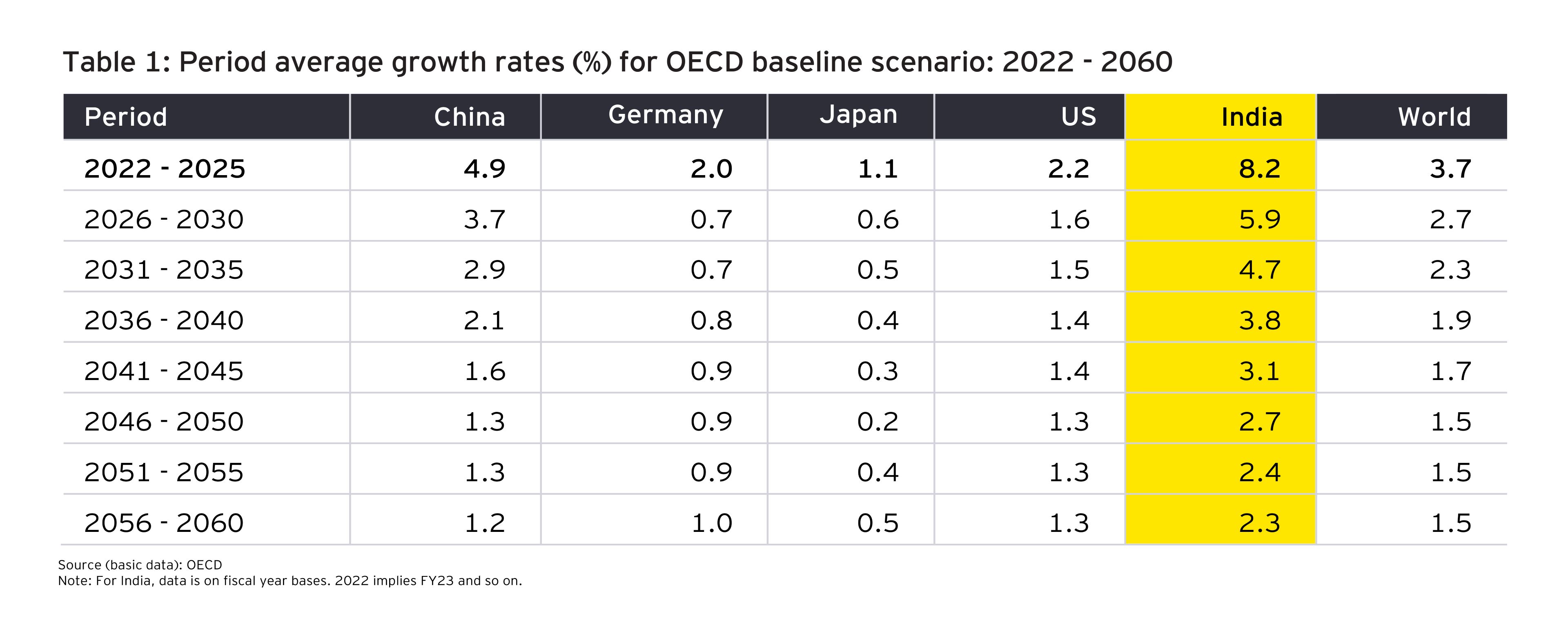

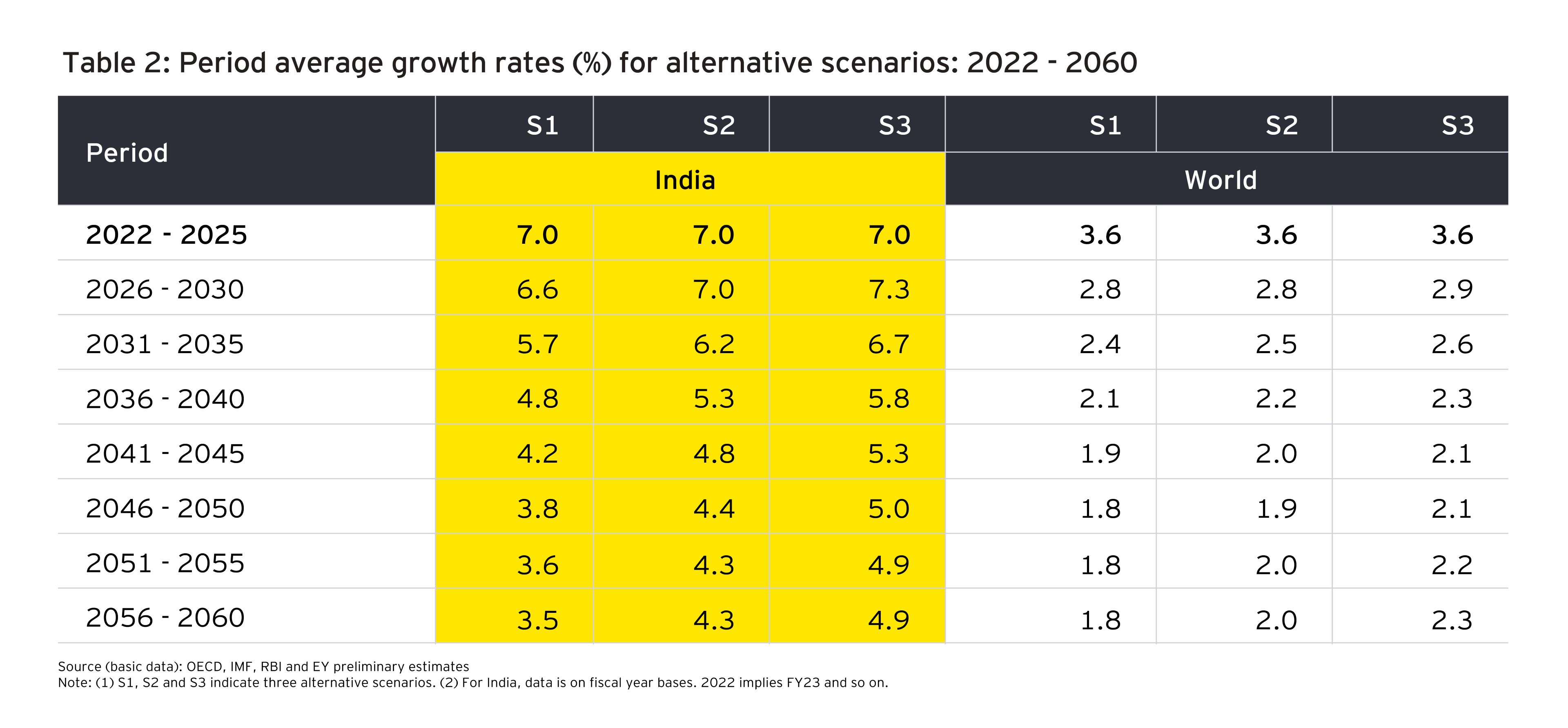

As compared to the average growth rates given in Table 1 for India, we work on alternative growth paths for India, leaving projections for other countries as per the OECD baseline scenario (Table 2). However, the world growth and India’s share in world output changes with each simulation as the share of India in world output increases. In the initial period covering 2022 to 2025 (FY23 to FY26 for India), we have taken a lower average growth for India as compared to the OECD projections based on more recent information (RBI Monetary Policy Review, August 2022 and IMF World Economic Outlook, April 2022).

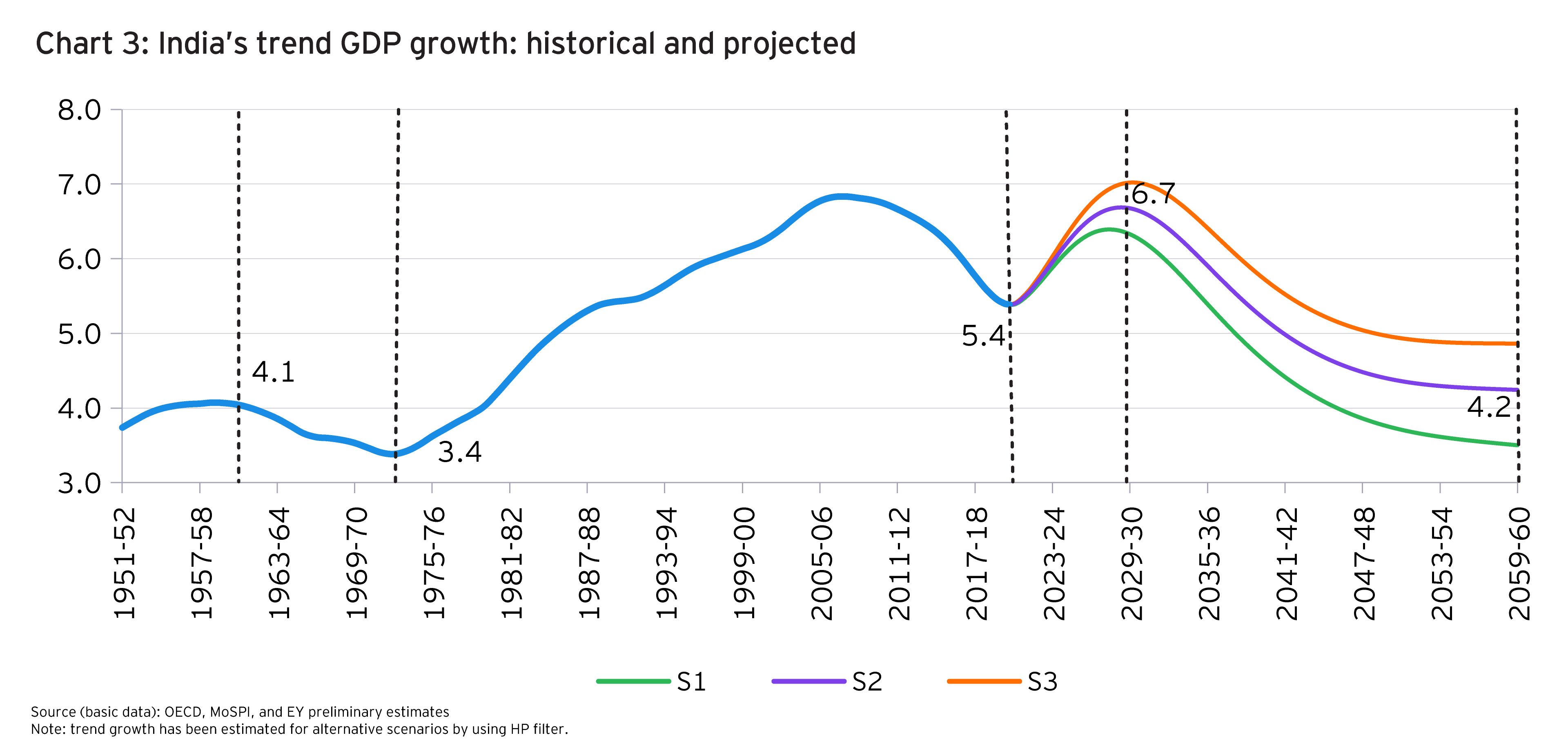

However, 2026 (FY27) onwards, in each of the three simulations (S1, S2, and S3), there may be a slight increase in India’s assessed average growth as compared to the OECD baseline scenario. This is dependent on India taking fuller advantage of the population growth trends, which results in both increased rate of accumulation of capital stock and increased employment. If India is able to follow suitable growth-supporting policies, its average five-year growth rates would turn out to be higher than those projected by the OECD, especially in the latter decades. However, in each scenario, average five-year growth rates continue to fall, similar to the trend in the OECD baseline scenario. Thus, in the most optimistic scenario (S3), the average growth rate in the 2050s is 4.9% each in the two five-year blocks as compared to the OECD projections of 2.4% and 2.3%, respectively.