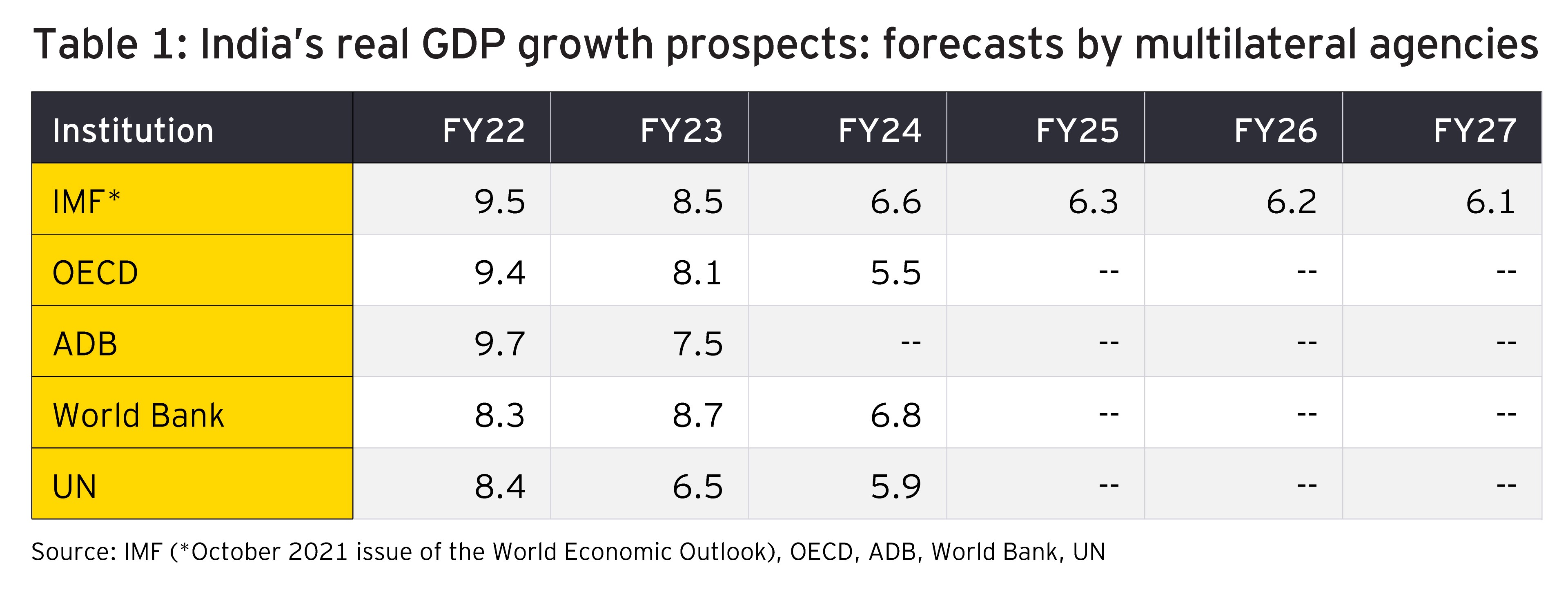

Using this information, we may formulate a view on the prospects of FY23 growth. Available forecasts from the IMF and the OECD have indicated growth rates at 8.5% and 8.1% respectively. However, these may turn out to be on the higher side because the strong base effects characterizing FY22 may not be available. In fact, as per NSO’s advance estimates, at the end of FY22, the magnitude of GDP in real terms is estimated at INR147.5 lakh crore that is only marginally higher than INR145.7 lakh crore in FY20. In other words, due to the three waves of COVID that India has experienced, nearly two years of real growth in economic activities have been wiped out. The economy has to now start on a clean slate in FY23. Growth in this year would depend on the basic determinants such as the saving and investment rates in the economy. As per the FAE, the gross fixed capital formation (GFCF) relative to GDP at current prices stands at 29.6% in FY22. Capacity utilization in India continues to have considerable slack. Available quarterly data indicate a capacity utilization ratio of only 60.0% at the end of 1QFY22 and an average of 61.7% in the preceding four quarters[2]. As such, a recovery in private investment may take some time.

At present, PFCE continues to show a low growth. As per the FAE, this growth has been estimated at 6.9% in FY22. Any pick-up in demand would continue to be constrained by low-income growth in sectors characterized by a high marginal propensity to consume (MPC) such as the trade, transport, hotels et. al. sector and the MSME sector more broadly. Growth in FY23 may also continue to be constrained by supply-side bottlenecks and high prices of global crude and primary products. As such, it may not be prudent to expect a real GDP growth which is tangibly higher than 7%.

Inflationary pressures

In December 2021, CPI inflation increased to a five-month high of 5.6% from 4.9% in November 2021. Core CPI inflation also remained elevated at 6.1%. WPI inflation had surged to an all-time high (2011-12 series) of 14.2% in November 2021. In December 2021, it remained elevated at 13.6%. These inflationary pressures have largely emanated from high prices of global crude and primary commodities. There have also been supply-side bottlenecks putting pressure on prices. In the first step, these global pressures affect India’s WPI inflation rate which is slowly transmitted into the CPI inflation rate. There is one positive spinoff of these inflation pressures emanating from the fact that the implicit price deflator (IPD)-based inflation is mainly a weighted combination of the WPI and CPI inflation rates. In recent quarters, the weight of WPI inflation has been in the range of 75-80% in determining the IPD-based inflation. Accordingly, as per NSO’s FAE, the IPD-based inflation rate is estimated to be as high as 7.7% in FY22. This is the main reason for the excess of the nominal GDP growth at 17.6% over the real GDP growth of 9.2% by a margin of 8.4% points. This has resulted in a significantly improved growth in center’s gross tax revenues (GTR) in FY22.

FY22: likely budget outcomes

High nominal growth combined with base effects resulted in center’s GTR growth of 50.3% during the first eight months of FY22. In the first six months of FY22, this growth was even higher at 64.2%. In October and November 2021, the average growth in center’s GTR has fallen to about 17.4% as the base effect is now weakening. This trend is likely to continue in the remaining part of the fiscal year. Taking this into account, we assess that the annual growth in center’s GTR may be close to 35% implying a buoyancy of nearly 2. With these buoyant tax revenues, government may be able to limit the FY22 fiscal deficit to its budgeted level of 6.8% of GDP although a marginal slippage may not be ruled out. There may be some shortfall in disinvestment targets. Also, two supplementary expenditure demands have already been announced which require to be accommodated.

The budgeted disinvestment target for FY22 is quite ambitious at INR1.75 lakh crore. As per available information, disinvestment receipts as of 21 January 2022 stood at INR9,329.9 crores, that is 5.3% of the FY22 BE. Disinvestment initiatives require to be accelerated in the remaining two months of the fiscal year if the shortfall from the target is to be kept at a minimum.

FY23 union budget

a. The revenue side

In FY23, we expect the real GDP growth rates to moderate to 7%. With the IPD-based inflation also expected to come down in the range of 6-6.5%, we may expect a nominal GDP growth of about 14%. Since the base effects in center’s GTR would have weakened, we may expect a lower annual GTR growth of about 16% in FY23 which, in combination with a nominal GDP growth of 14%, implies a buoyancy of little less than 1.2. This would still compare well with center’s GTR growth performance in the pre-COVID years which averaged only 5.6% during FY18 to FY20. The major CIT reform undertaken in FY20 had provided among other things, a concessional CIT rate of 15% for fresh investment in manufacturing by domestic companies provided their production took off on or before 31 March 2023[3]. Since nearly two years have been lost due to COVID, government may consider extending the time limit for availing this benefit. The GST compensation provision would also come to an end in June 2022. This would cause a major revenue shock at least for some states. This matter may be considered by the GST Council, if the compensation arrangement is extended for say, about two years. Although it may not have a direct impact on center’s net tax revenues, any continuation of the compensation cess arrangement may delay a more comprehensive reform of GST. With respect to non-tax receipts, the scope of National Monetization Pipeline (NMP) may be extended to cover monetization of government-owned land assets.