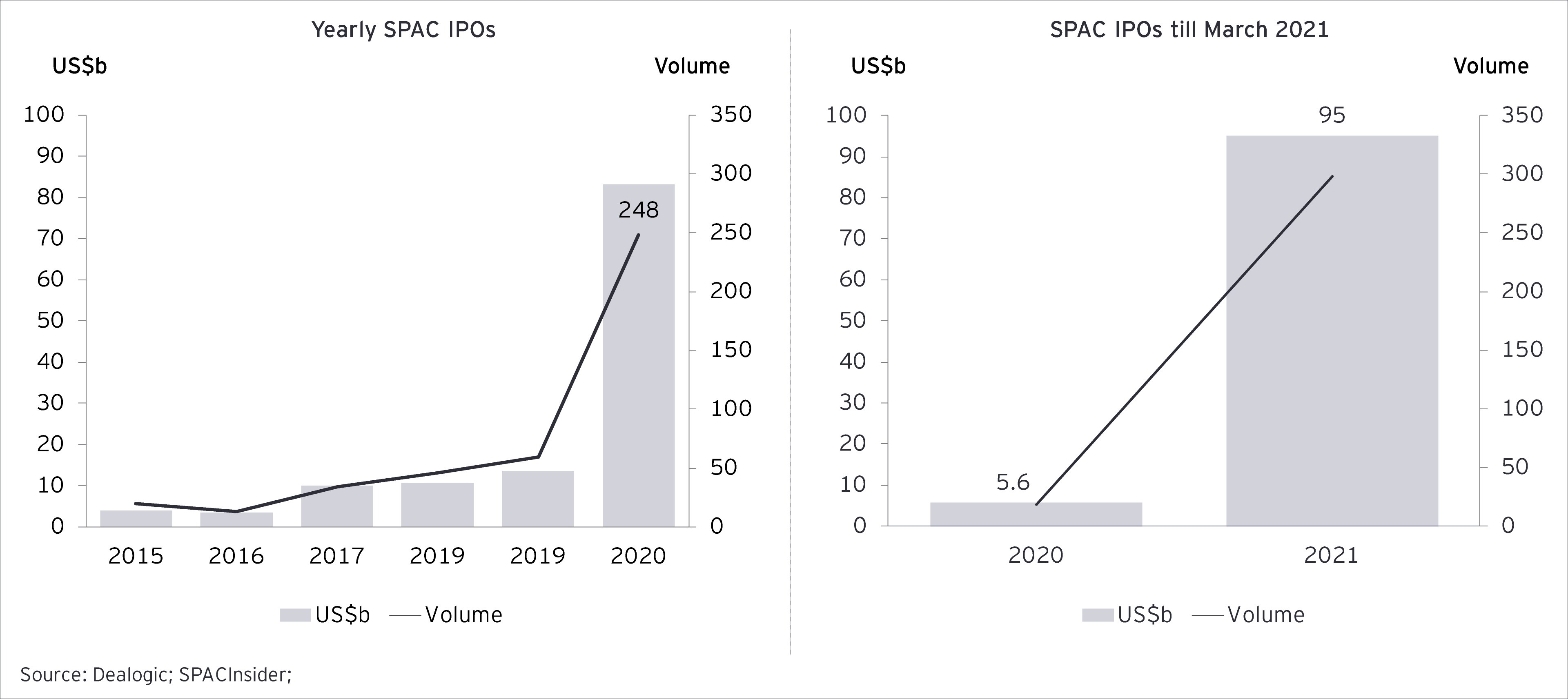

As you would note from the charts above, SPACs have raised a record US$83 billion in previous calendar year 2020, and an additional US$95 billion has been raised in the first three months of this year itself (as compared to just over US$5 billion in the first three months of the last year). Based on news reports, it is understood that there are 400+ active SPACs as on date, with a total cash capital of US$140+ billion waiting to be deployed in potential targets around the globe in the next 12 to 18 months.

SPACs are companies that raise capital from investors and public - with no operations as on the IPO date, but with the objective to acquire an attractive target in the future. Accordingly, SPACs are typically founded and backed by seasoned professionals with well-established track records (known as sponsors). Sponsors typically have 18 to 24 months to identify the target and deploy the funds, failing which they must refund the listing proceeds to the investors.

As far as targets are concerned, consolidating or merging with a SPAC is an efficient way to achieve listed company status. Most importantly, SPACs help private companies to go public relatively quickly without being subject to multiple investor/underwriter negotiations, valuation uncertainty, and overwhelming documentations and filings.

In India, while historic SPAC deals are few and far between (most notable names being the Silver Eagle - Videocon d2h deal and the Terrapin - Yatra Online deal), there has been a recent spike in interest – with renewable energy major ReNew Power going down the SPAC route with RMG Acquisition Corporation.

Considering the wide-spread anxiety and interest around this new vehicle, International Financial Services Centre Authority (IFSCA) is also now looking to facilitate the listing of SPACs in the GIFT City of India. A new consultation paper has been issued by IFSCA for this purpose – the key features of the SPAC in the GIFT City seems to be a minimum public offer size of US$50 million, compulsory sponsor holding of at least 20% (of post issue paid-up capital), minimum application size of US$250,000 and a minimum subscription of at least 75% of the offer size. Companies will have to wait and watch how these regulations evolve further.

Currently, the biggest apprehension for Indian companies (with Indian resident promoters and shareholders) contemplating the SPAC route is the tax and regulatory considerations governing transitioning into a SPAC. Typical structures to transition into a SPAC include a share-swap or a merger of the target into the SPAC. Under both the options, resident shareholders would eventually give up their current holdings in the Indian target in exchange for shares of the overseas SPAC/listed company – this would result, inter alia, in following two challenges for the shareholders:

- A specific RBI approval may be required by Indian resident shareholders for transitioning into a SPAC which may involve considerable uncertainty. Amongst other considerations, either of the options discussed above is likely to result in a round-trip structure, whereby Indian resident shareholders may hold shares in an overseas company owning significant majority in an Indian target. Seeking RBI approval is likely to be a rigorous process and would depend on merits of each case and is likely to be subjected to scrutiny by the regulators. Additionally, uncertainty around timelines may also create concerns for the SPAC — which needs to deploy its funds within 18 to 24 months

- Also, there would be capital gains tax for the shareholders under both the options, despite the fact that they may not have monetized their investment, and merely got shares in the SPAC. This would be a clear impediment for the shareholders to transition into a SPAC, and one may need to evaluate the potential tax consequences, and consider/explore alternate structures and possibilities depending on the facts of each case to ensure smooth transition into the SPAC structure

On a related note, following critical future considerations of a SPAC (deriving substantial value from Indian companies) needs to be kept in mind while firming up the decision to transition into a SPAC:

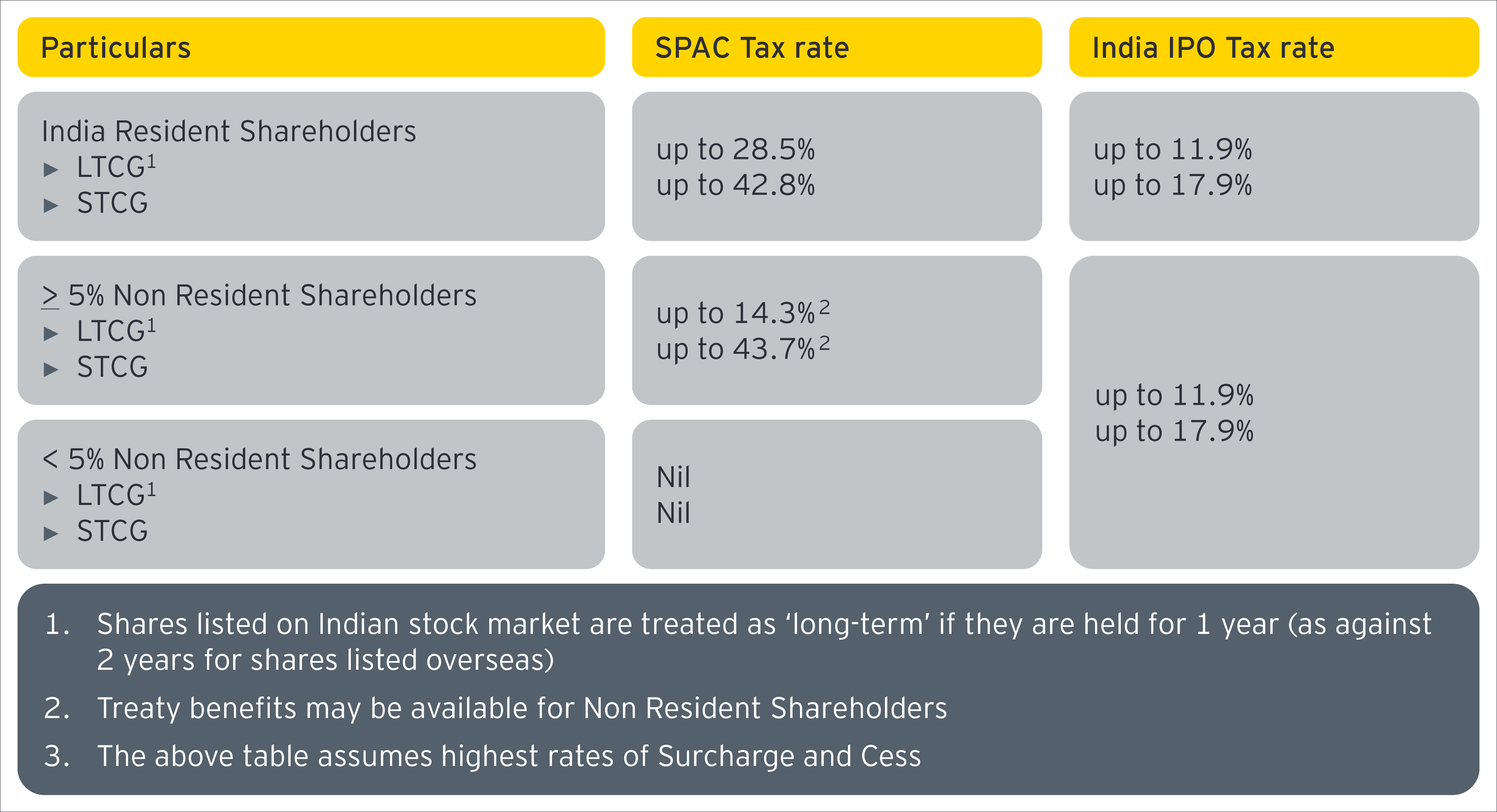

- Different India tax considerations applies on sale of shares in an overseas SPAC compared to shares sold in a company listed in India, for both Indian resident and non-resident shareholders – refer table below