However, the EY Boardroom Monitor data suggests that women are becoming increasingly better represented at boardroom level. Analysis shows that 42% of female board members have been appointed within the last three years, whereas only 31% of male board members have been appointed within the same period. The average board tenure for female directors is 55 months, compared to the average board tenure for men of 65 months.

On age diversity, 45% of shareholders believe financial services boards need representation from a wide age range to operate effectively in a digital era. Just under a third (31%) of shareholders believe boardrooms do not need representation from a wide age range. Despite these views, only 8% of companies monitored have any board members under the age of 40.

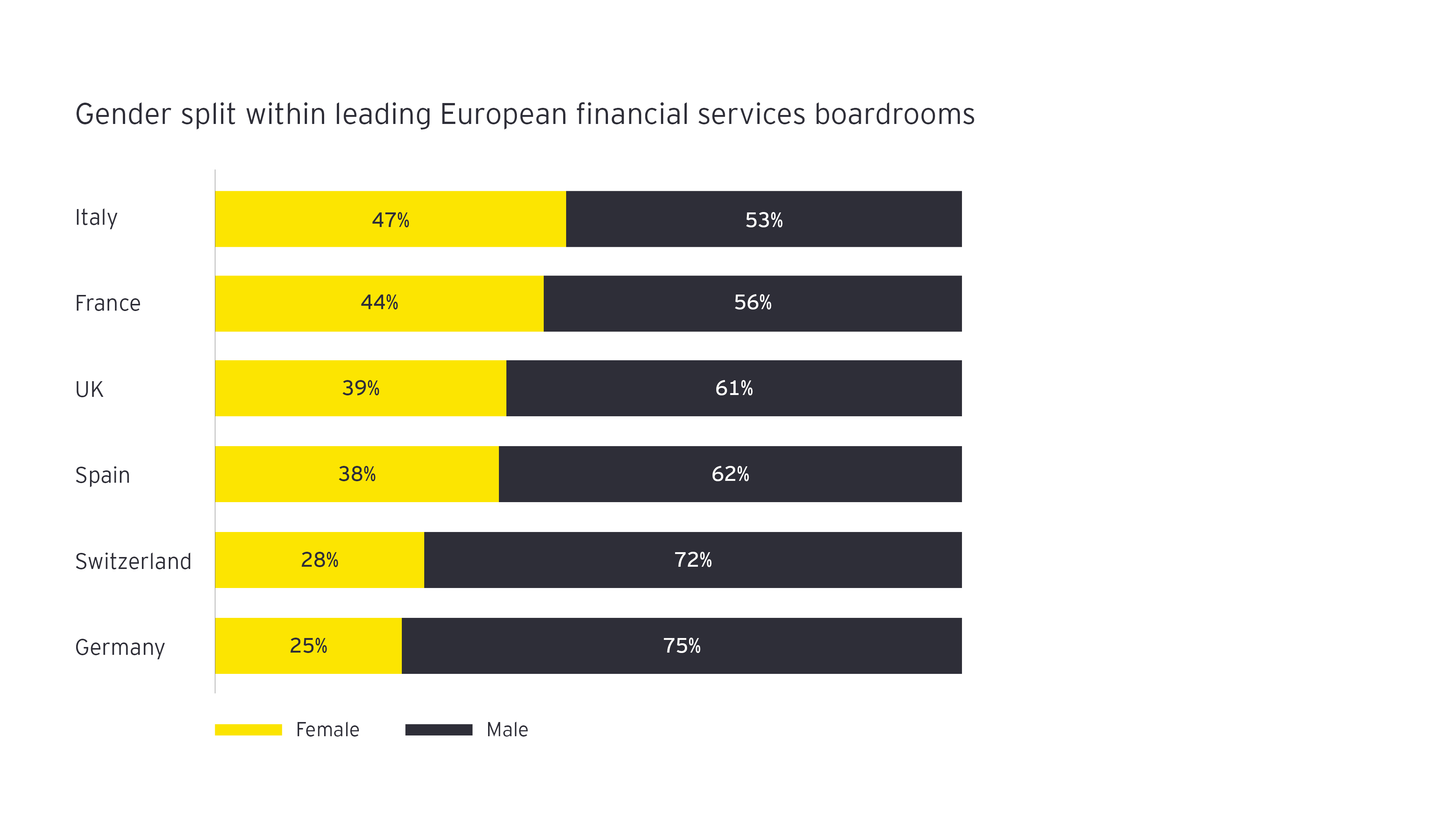

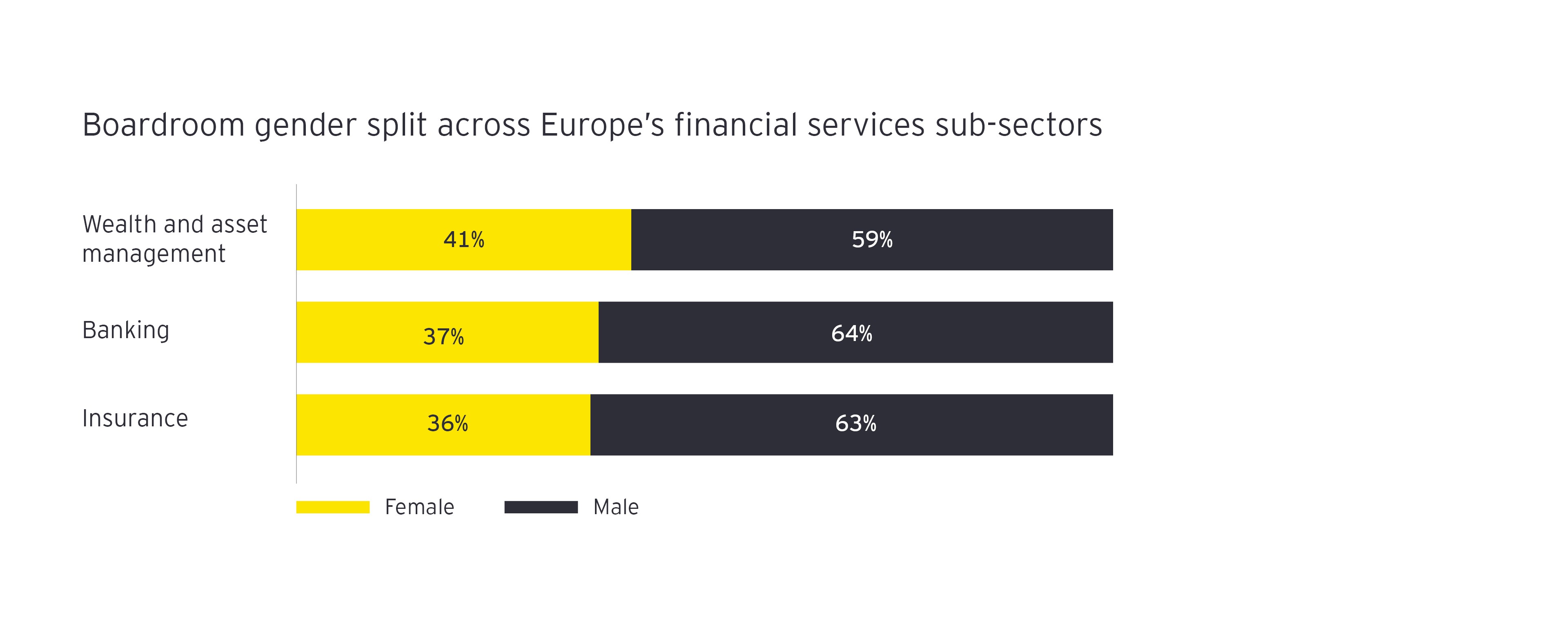

Omar Ali comments: “Although the financial sector in Europe has come a long way, many institutions still have a significant journey ahead to meet investors’ expectations on boardroom diversity. Most shareholders believe that having a gender balance matters, yet women frequently make up less than 40% of major European financial services company boards – this has to change. Most firms will want to be ahead of incoming regulation that will mandate more equal gender diversity from 2026. Investors also rightly emphasise the need for boards to have a more diverse age mix, so they can better reflect their customer needs and society.

“Race and ethnicity diversity is notably absent from our research: this is because the data is not yet effectively captured across the industry in Europe. This also needs to be top of mind for financial services firms as they seek to build boards that represent the communities they serve.”

Only 3% of European financial firms have no political experience in the boardroom

More than half (51%) of institutional investors say having political experience within the boardroom is ‘significant’ in terms of making a company an attractive investment, including a quarter (25%) who think it is ‘highly significant’. Ninety-seven percent of financial services firms monitored have at least one board member with experience of working in politics or for a government industry body, and 44% of all businesses monitored have more than a third of their boards comprised of individuals with political experience.

The market with the lowest political expertise is Italy, where just 20% of board directors have this skillset. At a sector level, 100% of asset management and insurance boardrooms contain political experience, while in banking, 94% of firms have political experience within their boardrooms.

All firms have at least one board member with accountancy and finance experience

Half (50%) of investors believe that having experience in accountancy within the boardroom has a ‘significant’ or ‘highly significant’ impact in terms of making a company an attractive investment, compared to only 17% who say it has a ‘not at all significant’ impact. All financial companies monitored demonstrated at least one board member with experience in accountancy and finance, and 70% of companies have two or more board members with experience in accountancy.

Six in ten firms have legal and compliance experience within the boardroom

More than half (51%) of shareholders say it is a ‘significant issue’ if a firm has little or no board-level experience in legal and compliance, with 22% of this group of institutional investors believing it is a ‘highly significant’ issue. Fifty-nine percent of companies monitored have a board director with a legal and compliance career background.

When compared with wealth and asset managers, banks and insurers have a markedly higher degree of experience in legal and compliance within their boardrooms. Seventy-one percent of insurers, and 69% of banks, have individuals with experience in legal and compliance within their boardrooms. Only 28% of wealth and asset management firms have board directors with similar experience.

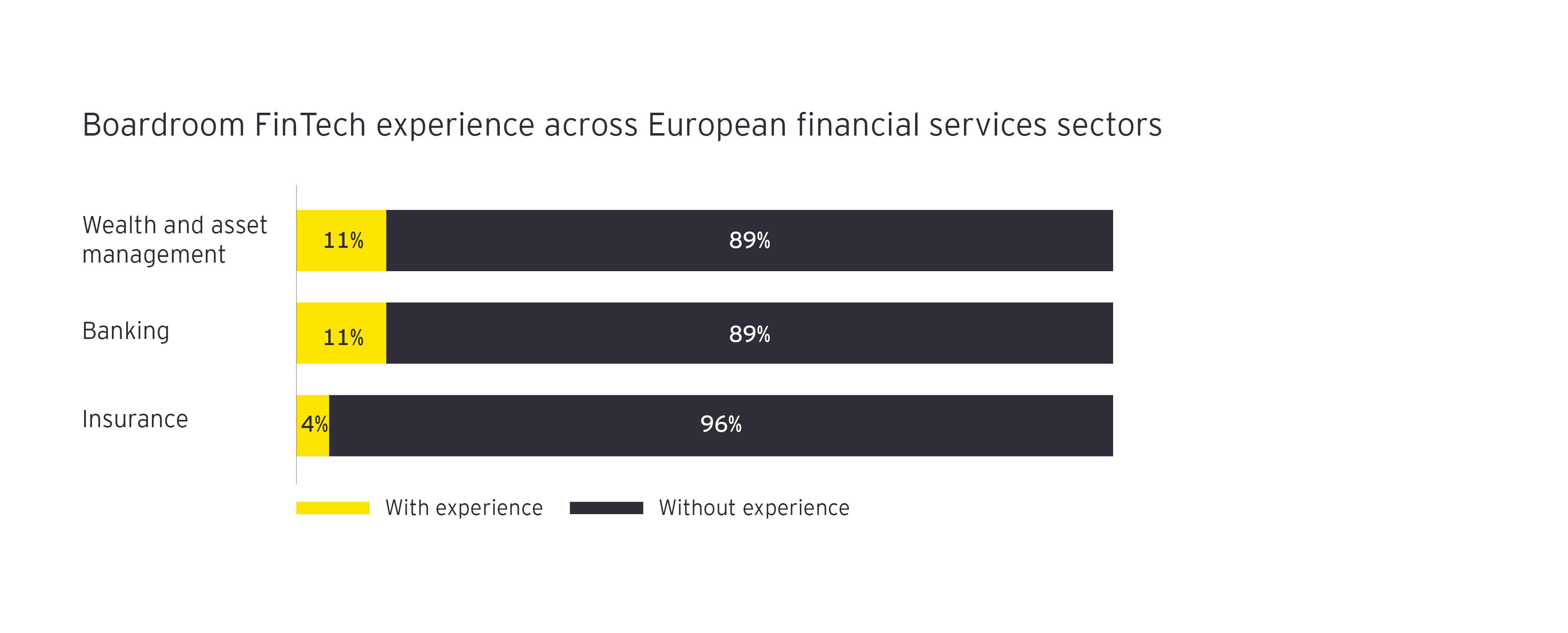

Sustainability, FinTech and cybersecurity experience expected to be in high demand going forward

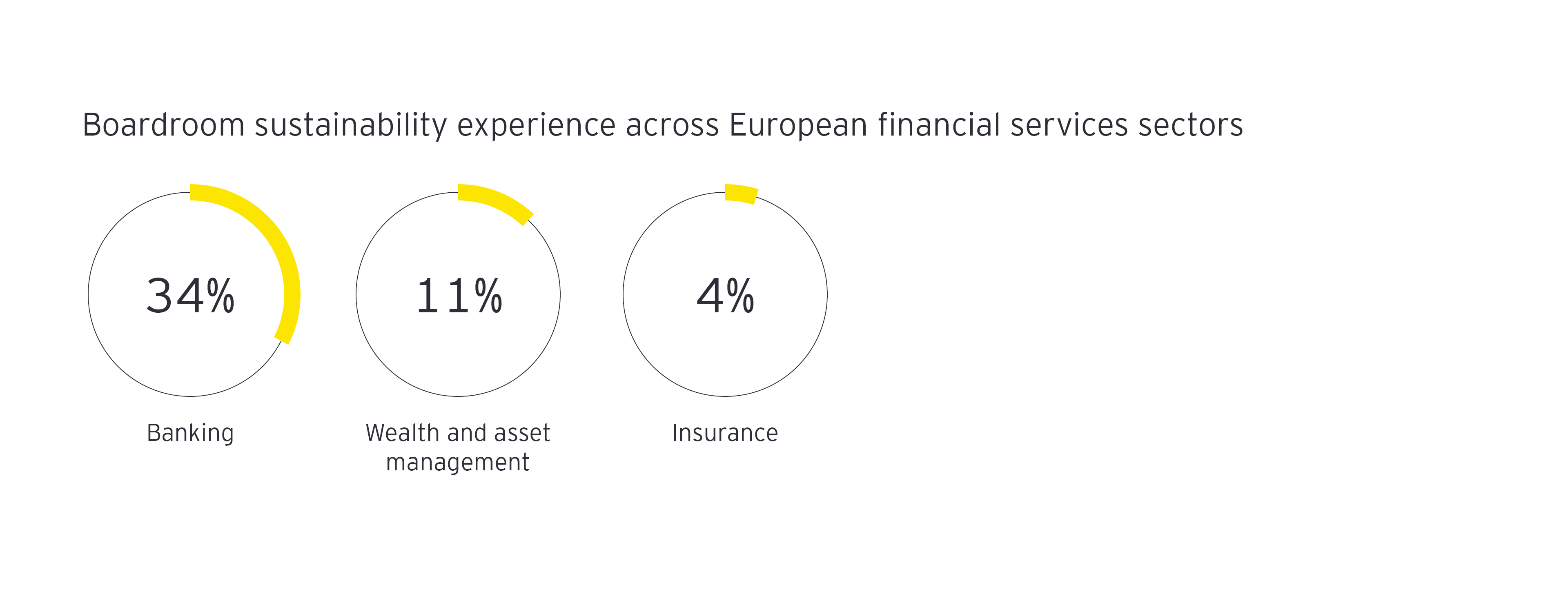

More than half (51%) of investors believe boardroom experience in sustainability has a ‘significant’ impact in terms of making a company an attractive investment, with 22% indicating it has a ‘highly significant’ impact on a company’s investment case. However, less than a fifth (19%) of companies monitored currently have board directors with any background experience in sustainability.

Insurers and wealth and asset managers significantly lag banks in terms of their level of sustainability experience within the boardroom. While 34% of bank boards have individuals with sustainability backgrounds, only 11% of wealth and asset managers, and just 4% of insurers, have similar experience at board level.