Chapter 1

Investors increasingly rely on ESG or nonfinancial information

Nearly all surveyed say they conduct an evaluation of ESG disclosures and that such information has played a pivotal role in decision-making.

An increasing reliance on ESG

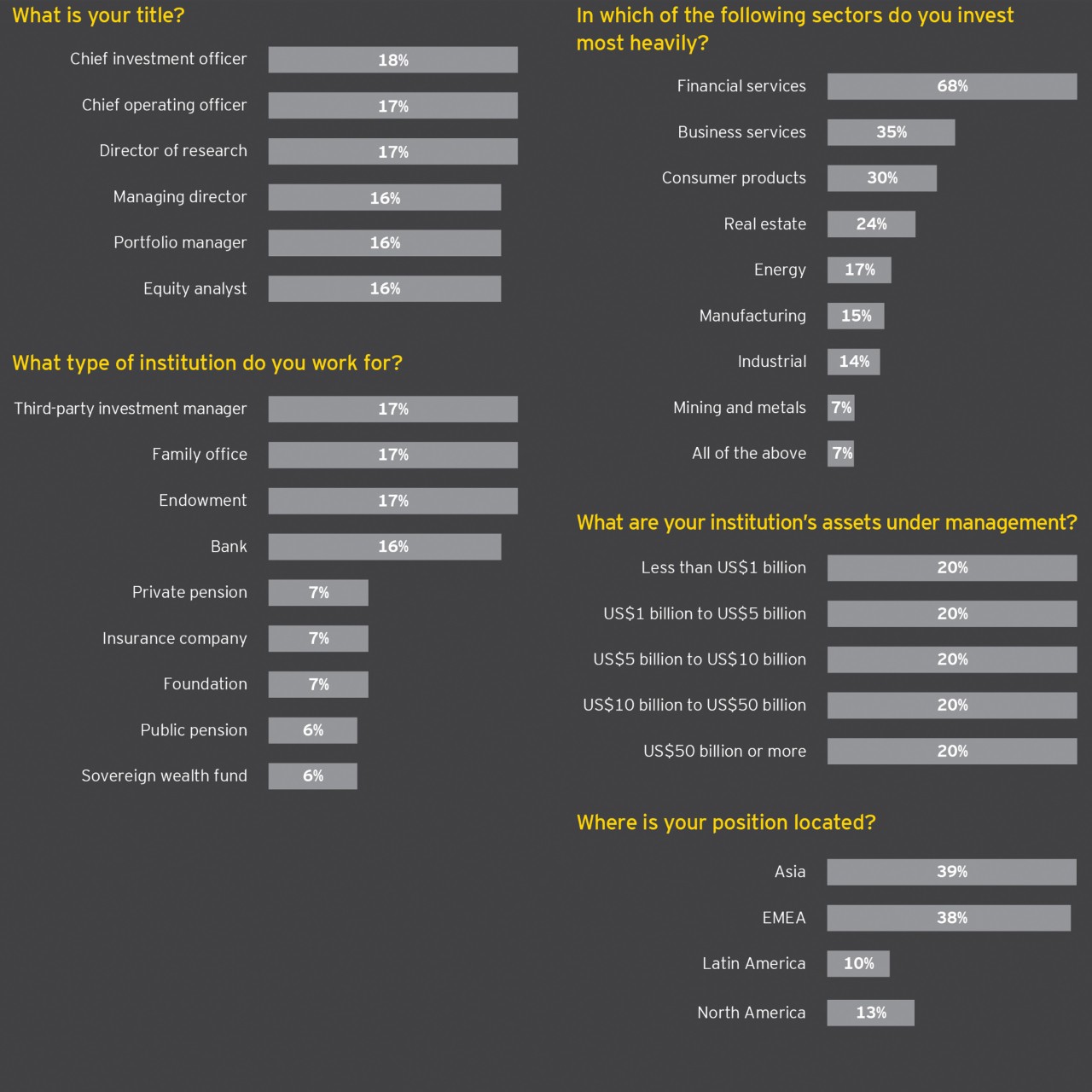

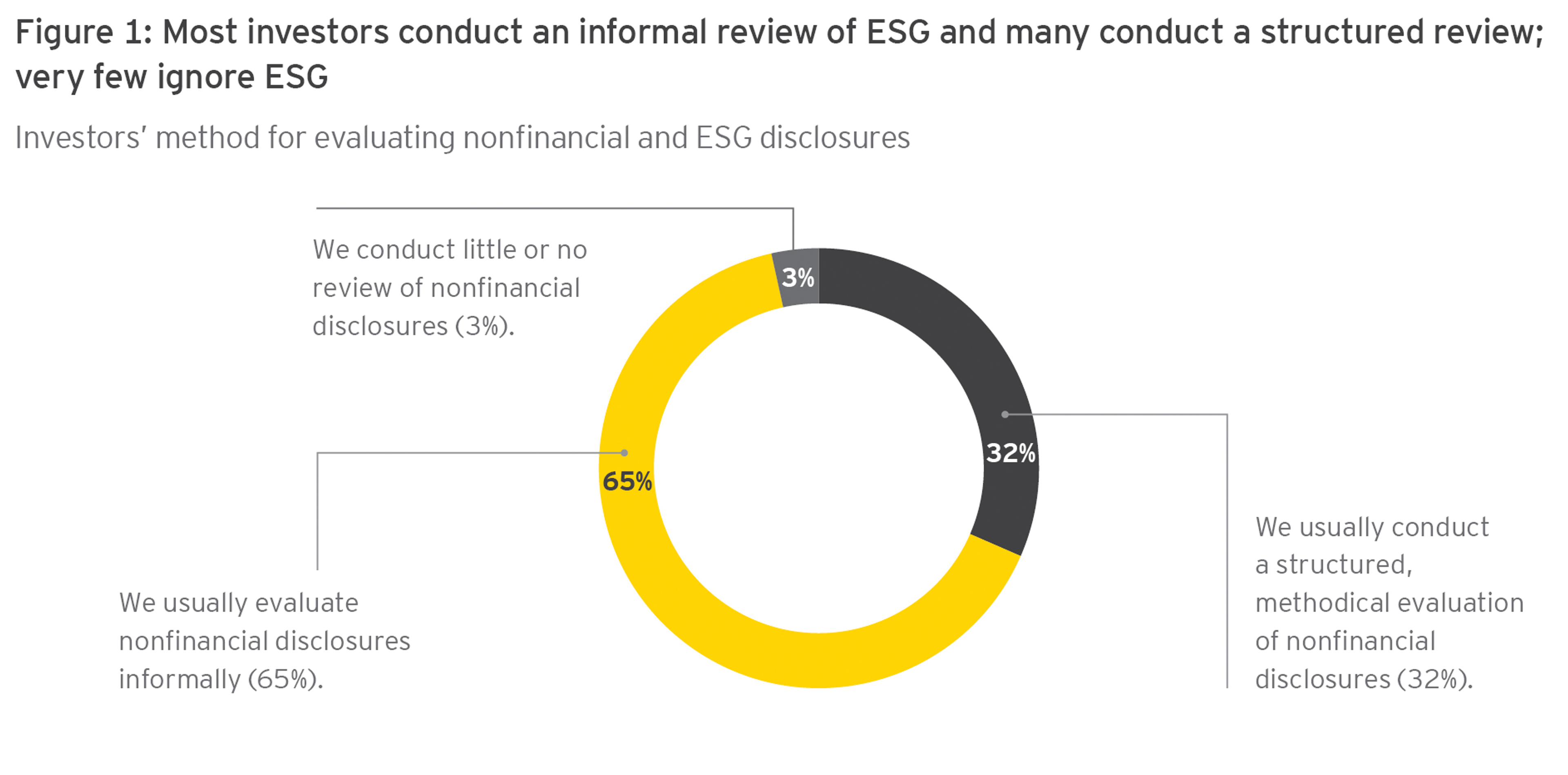

After several years of growing evidence of the impact of commerce on climate change, scandals tied to poor corporate governance and a new appreciation for the social impact of business, institutional investors are increasingly likely to use nonfinancial performance information as an essential component in investment decision-making. Nearly all investors who responded to this survey (97%) say they conduct either an informal (65%) or a structured, methodical evaluation (32%) of a target company’s nonfinancial disclosures.

Investors are evaluating company's nonfinancial disclosures

97%of investors who responded to this survey say they conduct either an informal or structured evaluation.

This represents a rise of nearly 20 percentage points since the 2017 Global Climate Change and Sustainability Services investor survey where 78% of respondents said they conducted either an informal or structured evaluation. In 2018 only 3% of respondents say they conduct little or no review of nonfinancial disclosures, compared to 22% in 2017 and 48% in 2015.

Versatile application of ESG factors

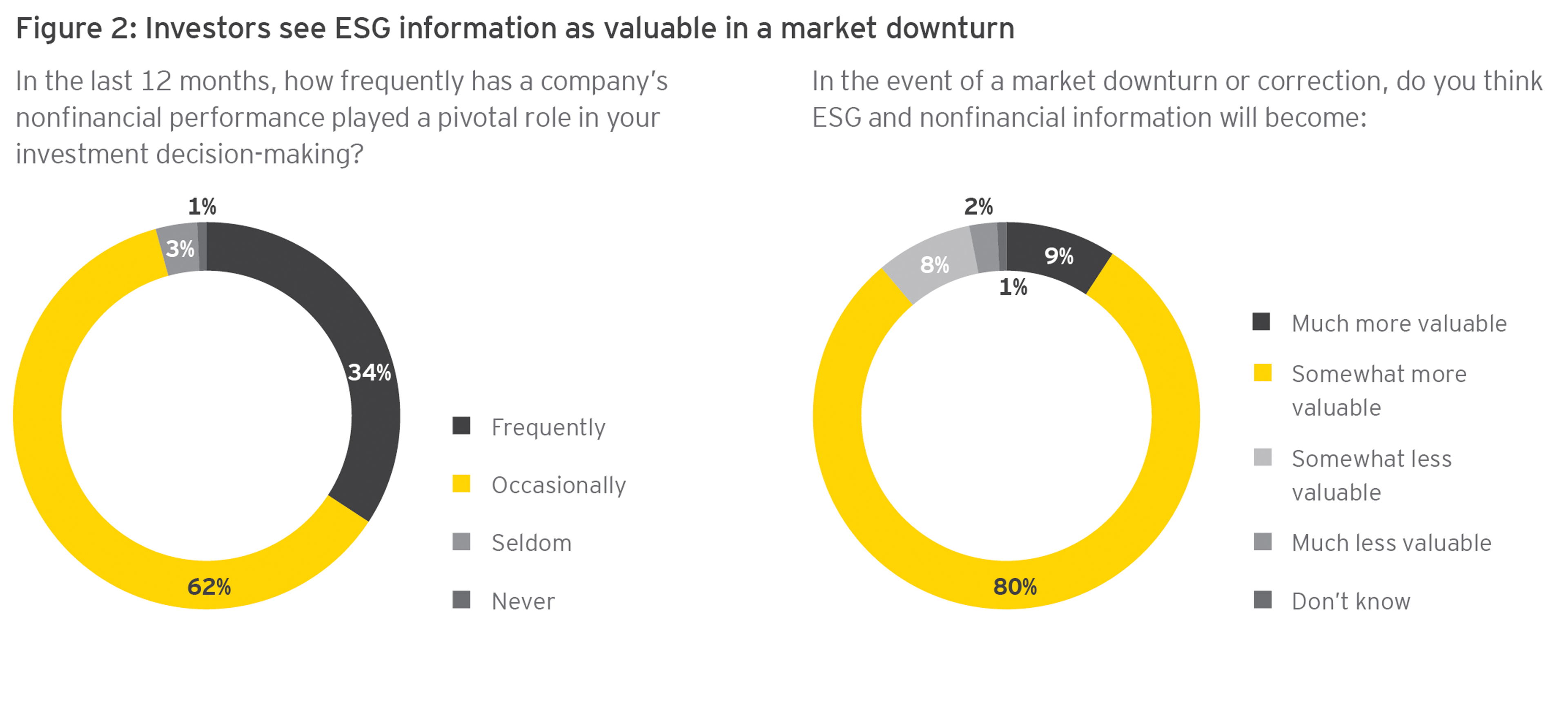

ESG information plays an increasingly important role in the investment decision-making process, and respondents believe that ESG factors can help mitigate downside risk. Nearly all respondents (96%) say that such information has occasionally (62%) or frequently (34%) played a pivotal role in decision-making.

Again this increased use of ESG information is a dramatic rise from the 2017 survey results, where 68% of investors said they used ESG information frequently or occasionally.

Investors say they are more likely to consider nonfinancial information occasionally or frequently when adjusting valuation for risk (70%), examining industry dynamics and regulation (63%) and when reviewing investment results (61%).

Investors believe that ESG factors can provide downside risk protection – 89% say that ESG information is somewhat more valuable (80%) or much more valuable (9%) in investment decision-making in a market downturn.

Increasing reliance on integrated and annual reports

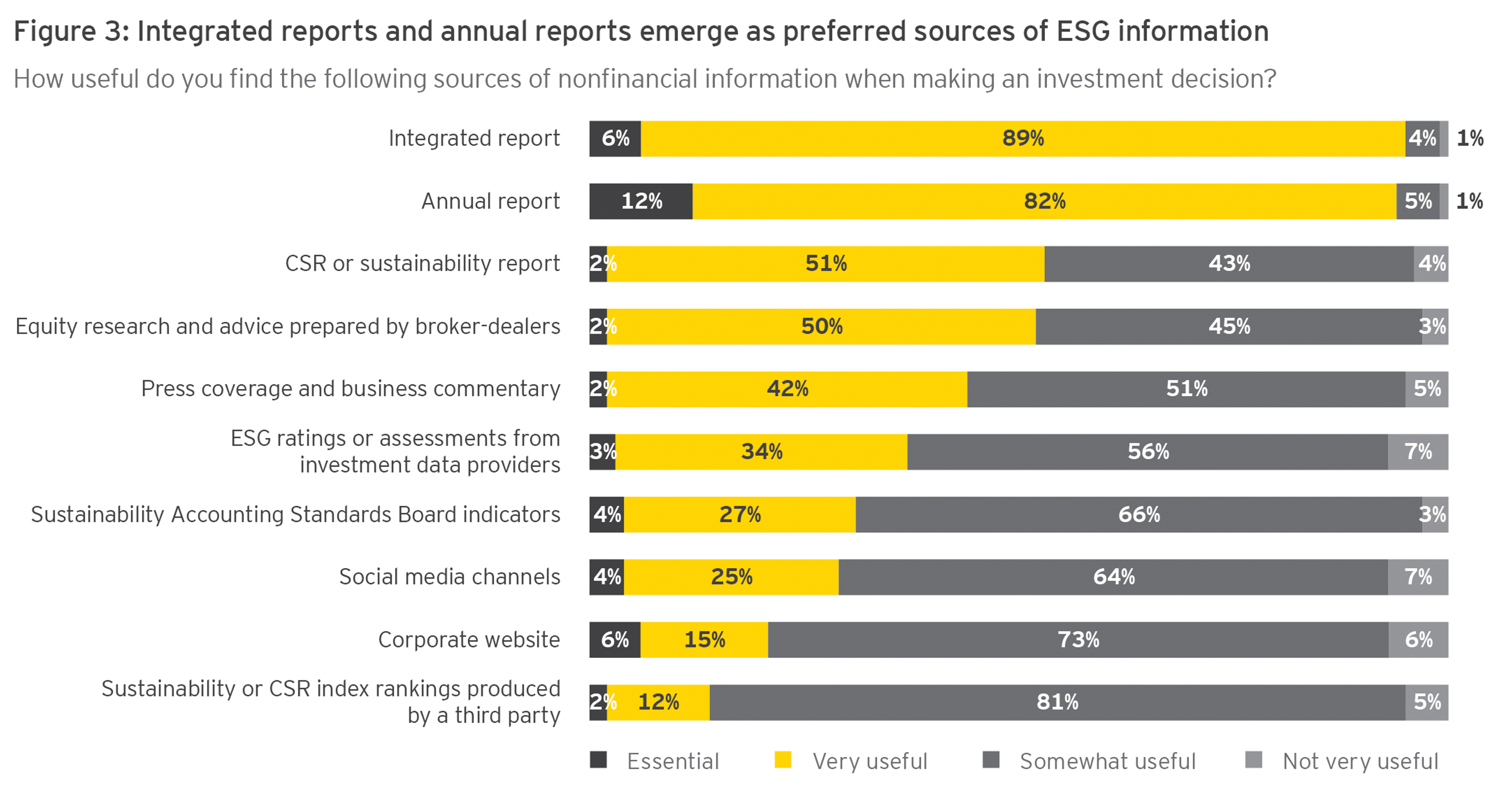

Investors are relying increasingly on ESG disclosures from the target companies themselves, and their use of corporate social responsibility (CSR) or sustainability reports, equity research from broker-dealers, press coverage and other external sources is decreasing or unchanged. Nearly all responders (94%) reported that integrated reports are very useful (88%) or essential (6%) sources of nonfinancial information. The same percentage reported that annual reports are very useful (82%) or essential (12%) sources of nonfinancial information.

Investors see the benefits of integrated reporting

88%of investors who responded to this survey say that integrated reporting is very useful.

In the 2017 Global Climate Change and Sustainability Services investor survey, only 57% reported that integrated reports where very useful or essential, and 63% reported the same about corporate annual reports.

More than half of respondents (56%) say that a company’s nonfinancial disclosures are either not available or inadequate for meaningful comparison with those of other companies. Investors say that there is a lot of disclosure about formal governance documents, policies and practices that are in place, but what is missing are measures of accountability – information on how nonfinancial metrics are established and managed. Investors look to companies to identify the environmental and social factors that are important to helping them achieve their strategic objectives and to set the targets that will be relevant over that time horizon.

Chapter 2

Issuers are getting better at assessing materiality

Investors are requesting broader ESG data, and are seeking consistent, investment-grade information to support their decision-making.

Companies disclosure of ESG risks is improving – especially governance

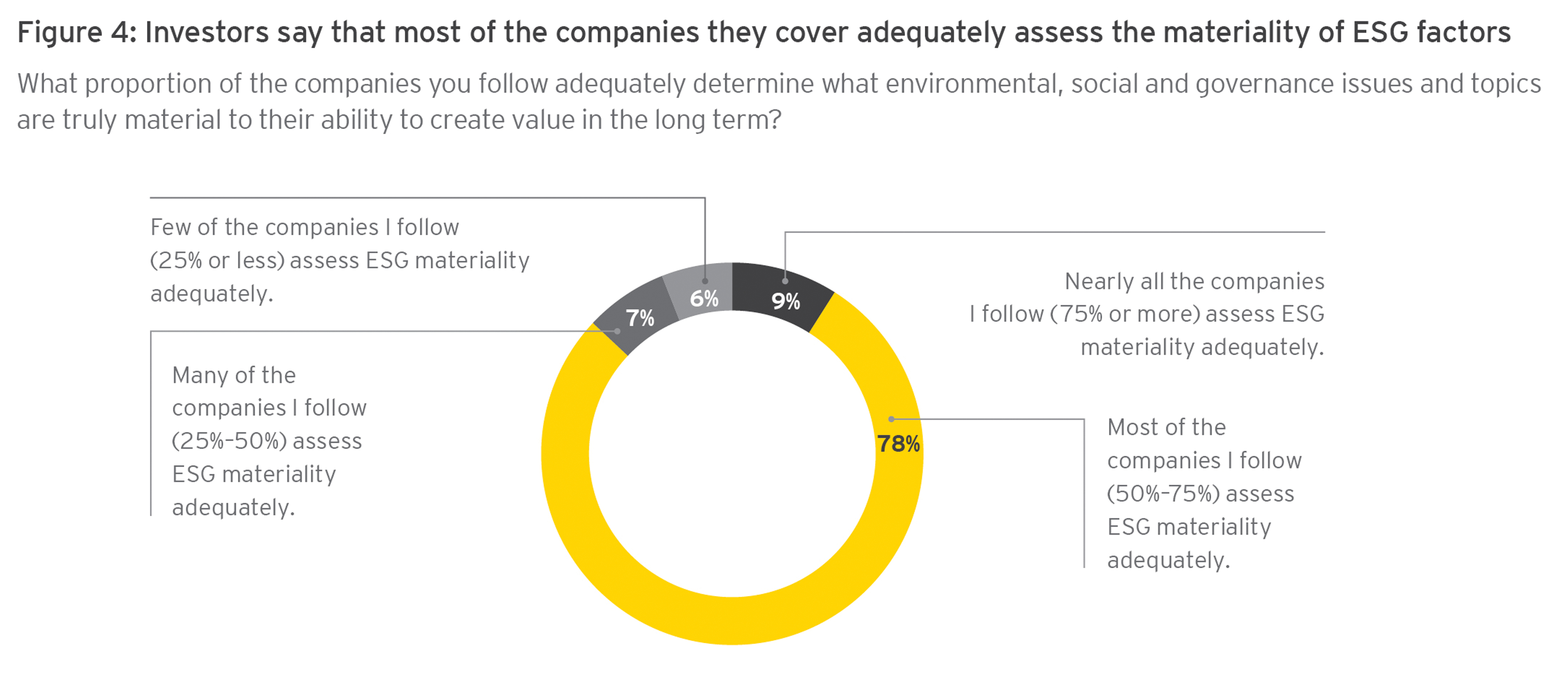

Investors say that most companies are able to assess the materiality of governance factors, with 87% reporting that most (78%) or nearly all (9%) of the companies they follow assess ESG materiality adequately.

Investors say most companies can assess materiality of governance factors

87%of investors who responded to this survey say that most or nearly all companies assess ESG materiality adequately.

The materiality process helps to define key issues when assessing the impact of ESG risk.

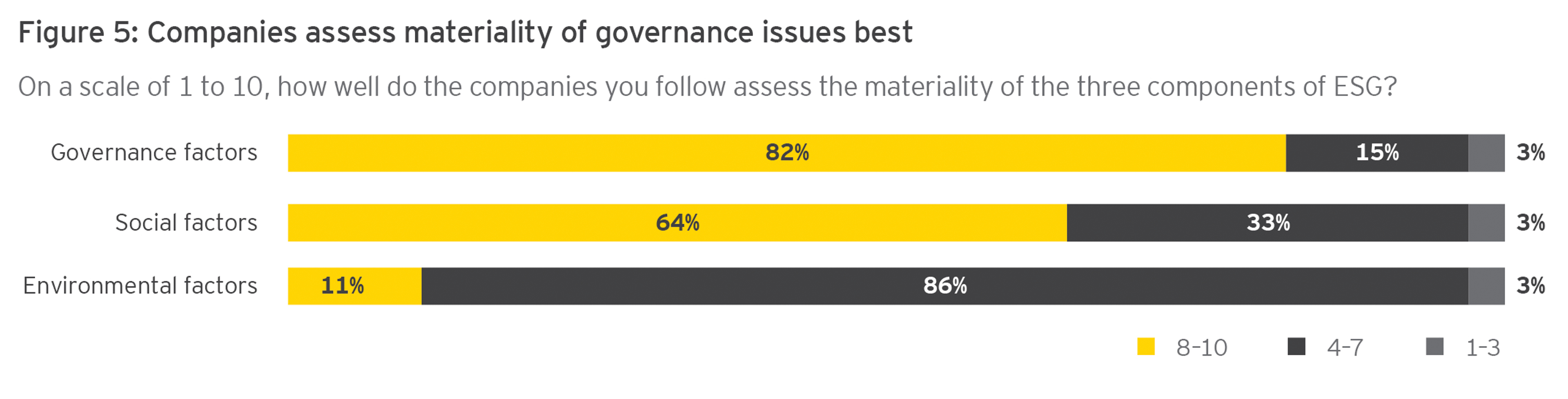

Investors rate companies’ assessment of governance materiality best (8.28 on a scale of 1 to 10), followed by social (7.72) and environmental (6.19). However, while governance risk may be reported most thoroughly, it can be difficult to value and measure.

Related

Compliance and risk management are motivators

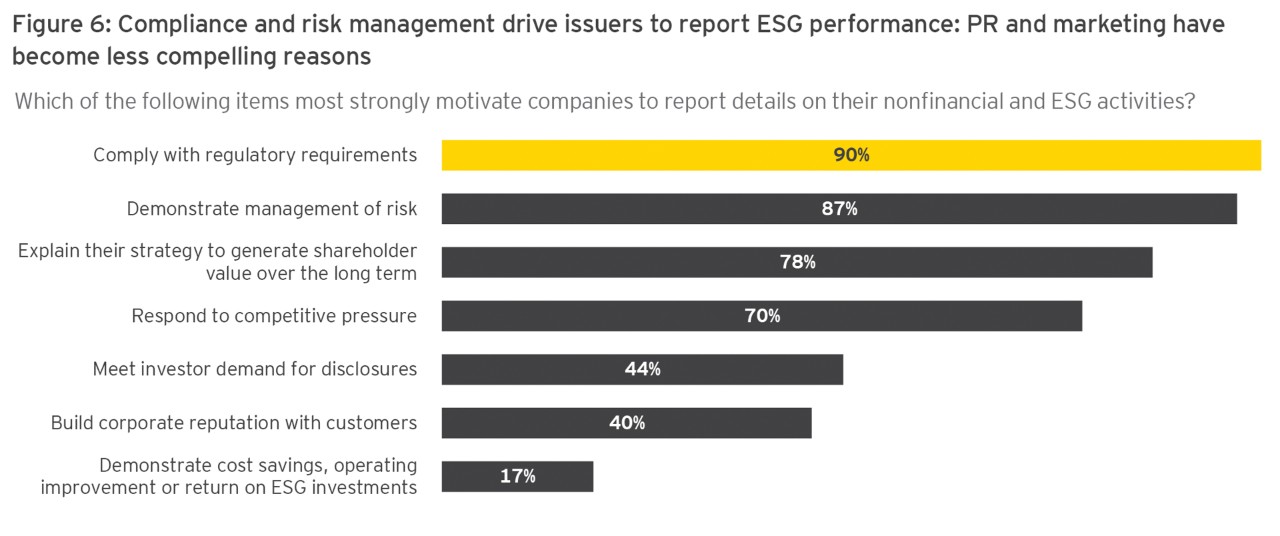

Overwhelmingly, investors report that they believe regulatory compliance (90%), followed by risk management (87%), most motivates companies to report details on nonfinancial and ESG activities. Strategy for long-term value (78%) and competitive pressure (70%) were deemed to be other compelling reasons.

Chapter 3

Four factors emerge as the most important in decision-making

The main ESG factors in investment decision making are governance, supply chain, human rights and climate change.

Key ESG factors

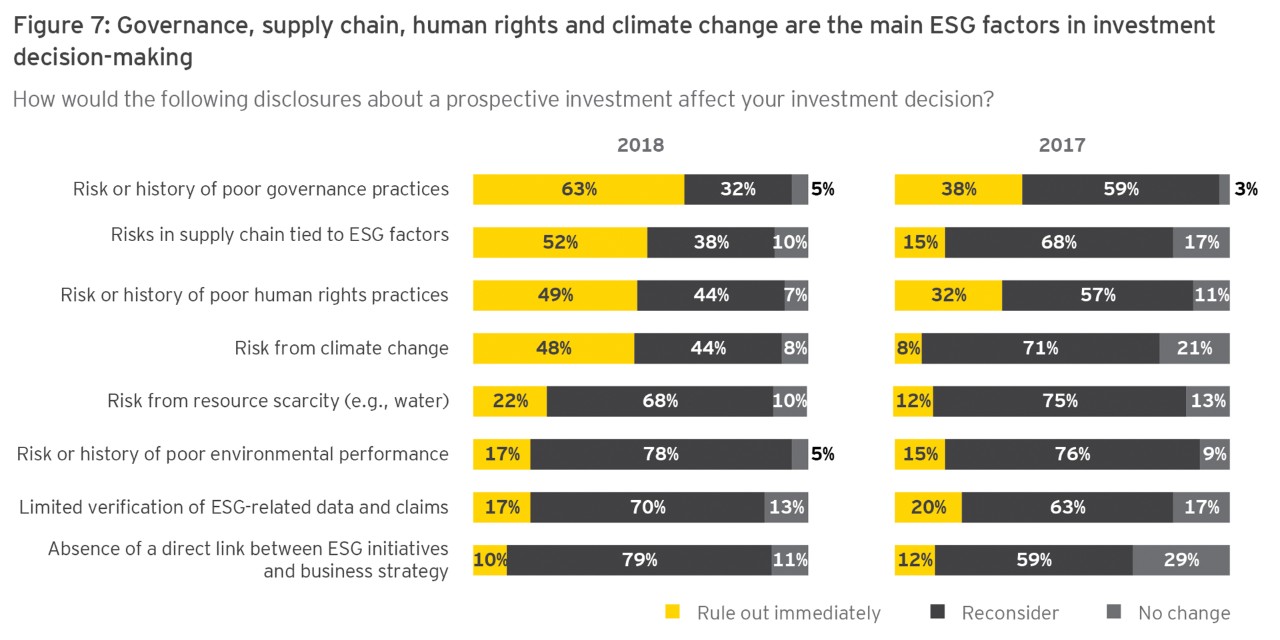

Investors in this year’s study report that the main ESG factors in investment decision-making have to do with risks related to governance, supply chain, human rights and climate change.

The risk or history of poor governance practices would cause 63% to rule out an investment immediately. Similarly, supply chain risks tied to ESG (52%), risk or history of poor human rights practices (49%), and risk from climate change (48%) are also triggers to avoid an investment. This compares to the 2017 Global Climate Change and Sustainability Services investor survey, where investors reported that they would rule out an investment immediately based on governance (38%), human rights (32%), ability to verify ESG data and claims (20%), and supply chain (15%). Climate change was the lowest-scoring factor, at only 8%.

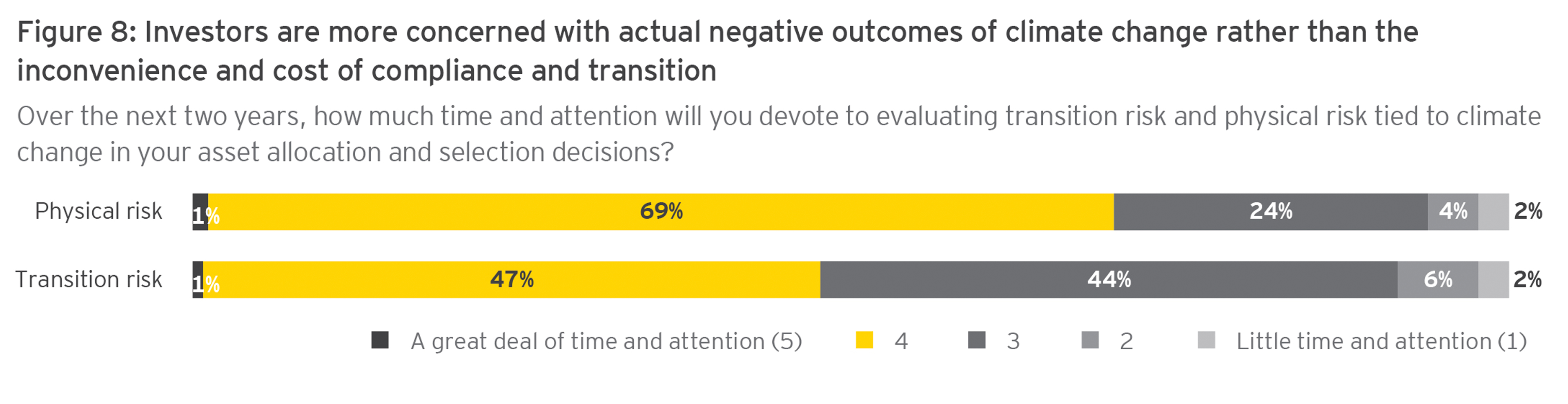

Transition risk versus physical risk in climate change

Investors continue to tell us that climate change is consistently one of the most material issues identified by reporters. However, in this survey they told us they are more concerned about the physical implications of climate change risk than the transitional risks such as those tied to adapting to new regulations, practices and processes. Seventy percent say that, over the next two years, they will pay a fair amount or a great deal of time and attention to physical risks. Forty-eight percent say the same of transition risk.

Chapter 4

Investment objectives drive use of screening and portfolio tilts

ESG factors can be used as both positive and negative screens for potential investments.

Negative and positive screening

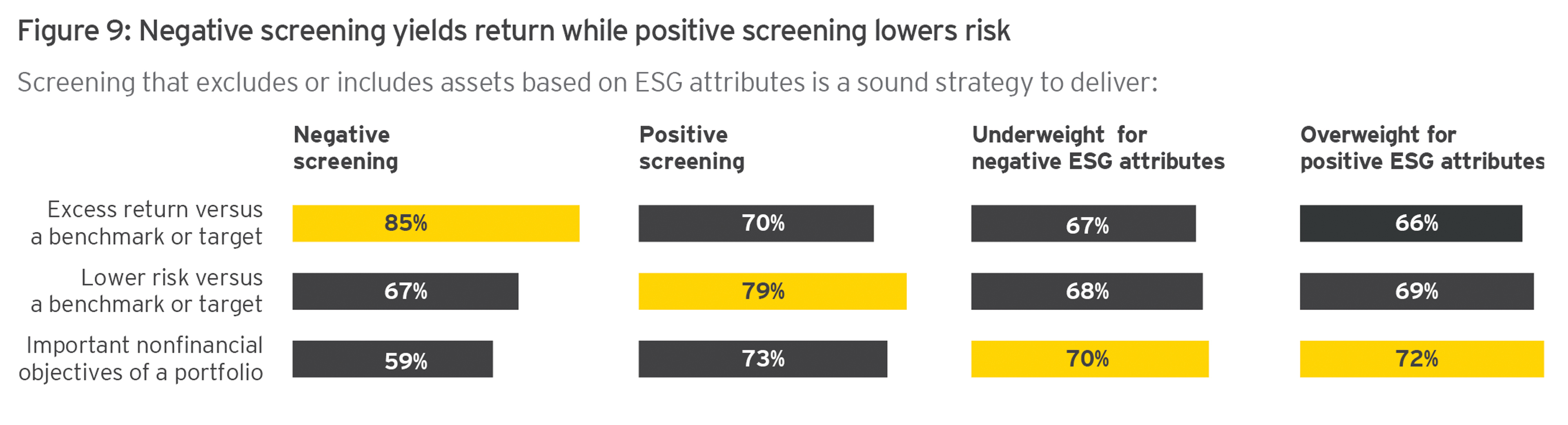

Investors who responded to the survey say that negative screening yields excess return (85%) and lowers risk (67%) versus a benchmark or target. Investors also said that positive screening lowers risk (79%) and achieves the important nonfinancial objectives of a portfolio (73%).

Investors also support portfolio tilts based on ESG

Respondents say that underweighting for negative ESG attributes lowers risk (67%) and yields excess return (68%) versus a benchmark or target, while overweighting for positive ESG attributes achieves important nonfinancial objectives of a portfolio (72%) and lowers risk versus a benchmark or target (69%).

ESG-specific instruments

Investors surveyed say that ESG-specific instruments, such as green bonds, can lower risk versus a benchmark or target (72%), achieve nonfinancial objectives of a portfolio (71%) and provide excess return versus a benchmark or target (69%).

Related

Chapter 5

Investors seek collaboration to establish ESG reporting standards

Investor demand for nonfinancial accounting standards is rising, and governments, regulators and business should collaborate.

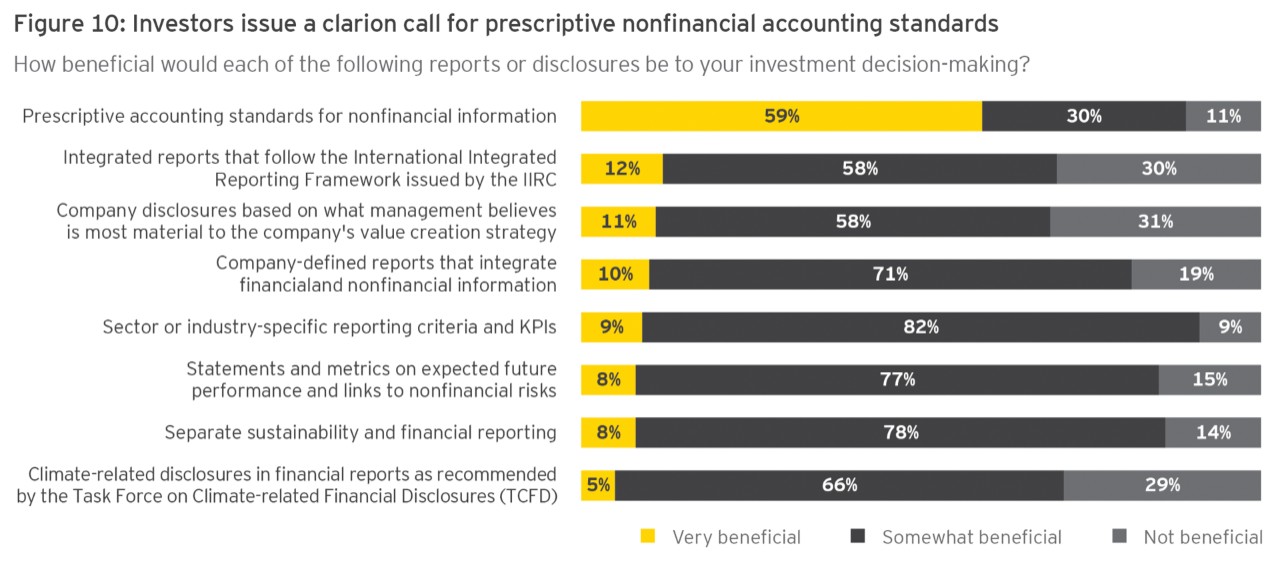

A call for standards

Investors express an urgent need for prescriptive nonfinancial accounting standards. Fifty-nine percent said that prescriptive accounting standards for nonfinancial information would be very beneficial. This is a rise of 26 percentage points since the 2017 Global Climate Change and Sustainability Services investor survey.

Furthermore, the relative demand for standards has overshadowed that for the next three factors ranked by importance: integrated reports that follow the International Integrated Reporting Council (IIRC) framework, company disclosures based on what management believes is most material to the company’s value creation strategy, and company-defined reports that integrate financial and nonfinancial information.

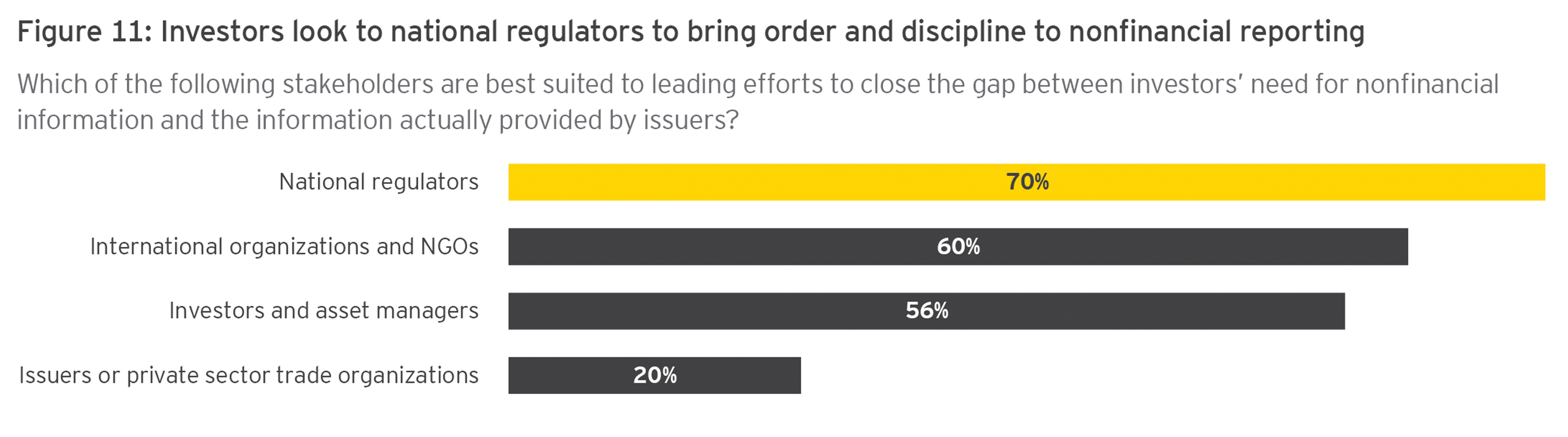

A call for state-led efforts

Investors responded saying that national regulators are best suited (70%) to lead efforts to close the gap between investors’ demand for nonfinancial information and the information actually provided by issuers. Others that should play a role include international organizations and NGOs (60%), and investors and asset managers themselves (56%). Only 20% of respondents think issuers or private sector trade organizations should take the lead.

Chapter 6

What next?

Organizations should seek to build a strategic story on how they are seeking to grow intangible value to help their business to thrive.

Investors’ increasing demand for reporting on nonfinancial assets reflect a more sophisticated understanding by investors of the link between performance and ESG factors. This means that, alongside your financial reporting, there should be a coherent and strategic story on how you are seeking to grow intangible value to help your business thrive.

Having this framework and the data may help support your organization’s position to have conversations with investors and prepare for future regulatory development.

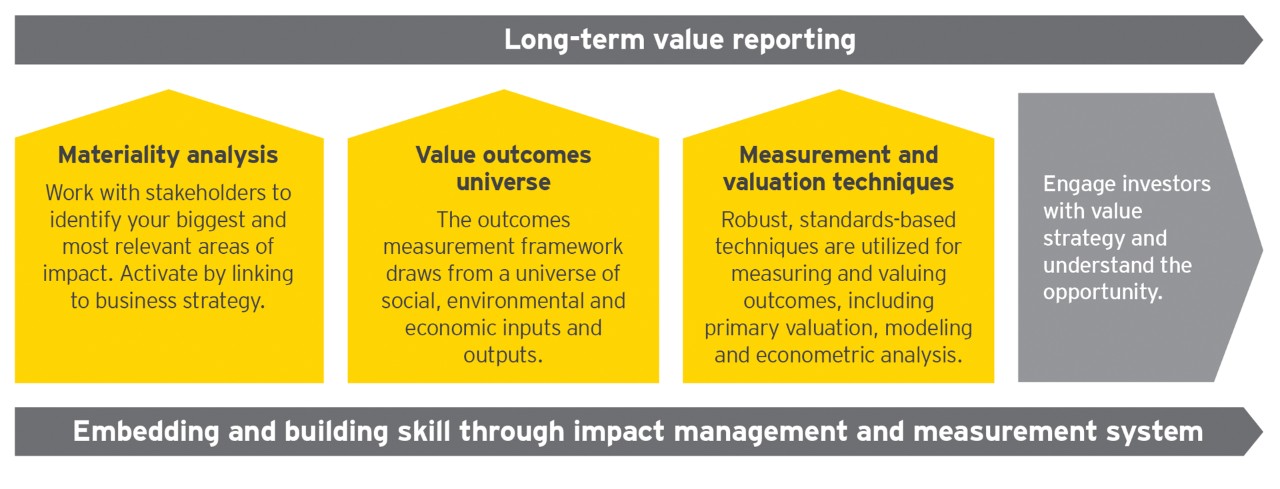

It is believed there are four main areas organizations should consider:

- Establishing a structured materiality analysis process

- Measuring and reporting social and environmental outcomes

- Measuring and reporting long-term value

- Reporting more comprehensively on all climate risks and engaging with stakeholders, including investors

The views of third parties set out in this article are not necessarily the views of the global EY organization or its member firms. Moreover, they should be seen in the context of the time they were made.

Summary

This is the fourth edition of EY Climate Change and Sustainability Services’ research into investors’ attitudes towards ESG and nonfinancial reporting and its role in their decision-making.

This year’s study reveals a notable consensus on the importance of ESG or nonfinancial information in investor decision-making. Globally, investors expect more abundant and more useful reporting of material nonfinancial performance information at a consistent and high level of quality. Implementing these practices, will deliver broader value-driven reporting to help support greater trust between businesses and their key stakeholders.