More effective, but certainly not efficient

Notwithstanding the fact that risk capabilities have matured overall, most banks have designed their risk management approach in light of new regulations or supervisory findings — and in short time frames. As a result, enhancements were often implemented using highly manual processes and suboptimal approaches, many of which are cumbersome and expensive to operate, especially in an environment where scrutiny on costs remains high.

As a result, banks are seeking opportunities to become more efficient by rationalizing processes and increasing automation. Almost three-quarters (73%) expect to improve the efficiency of risk management over the next three years.

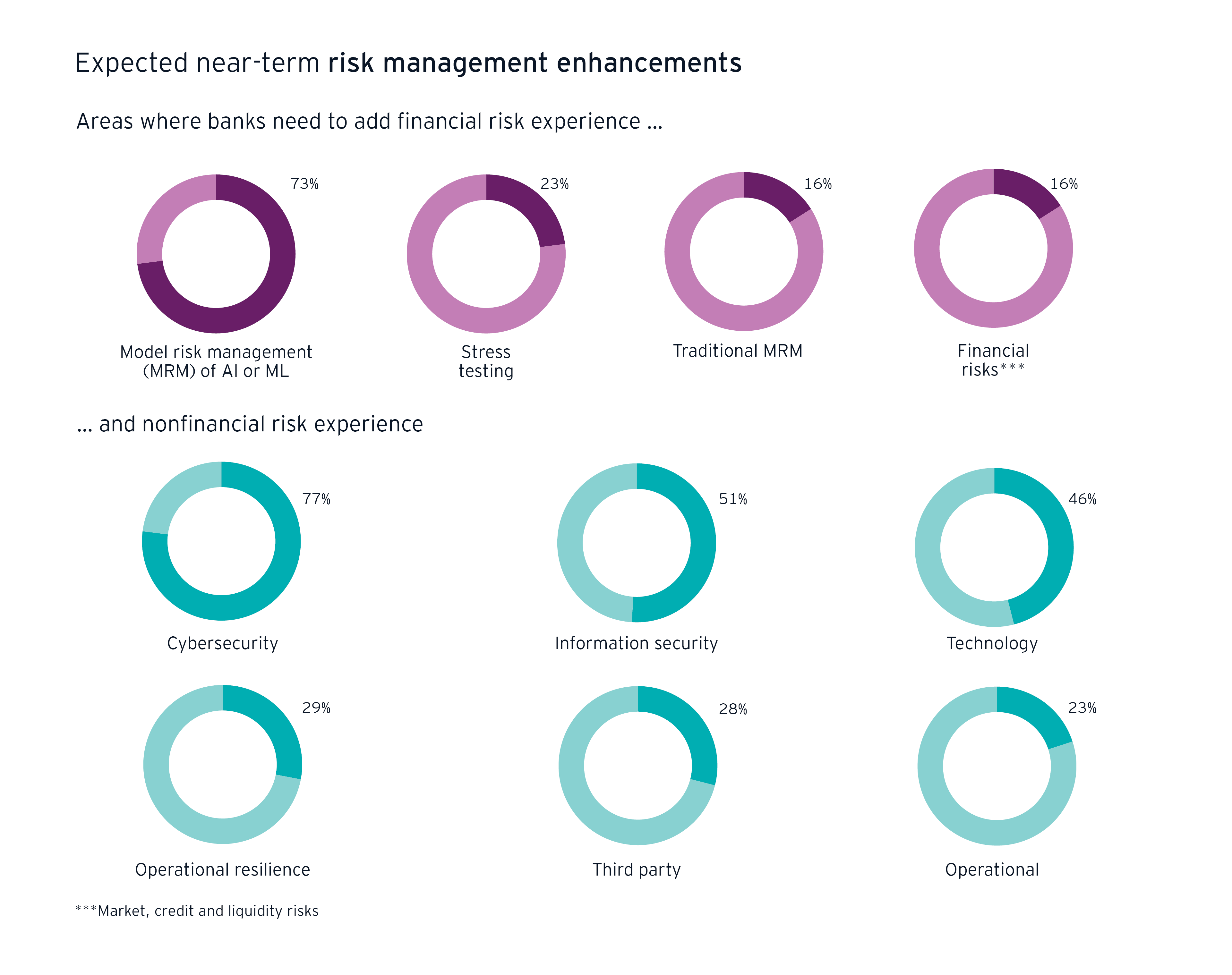

Yet, transition to more automated and more digitized strategies, business models and operations is creating new risks. The industry was on the cusp of change in last year’s survey – gradually moving to the use of machine learning and artificial intelligence. This year, their use is a concern for over half of CROs (59%).

Focus on altering talent strategy

Future challenges will call for new talent strategies in banking. A large majority (69%) expect to add specialist talent, and nearly as many (62%) will work to obtain the right mix of skills. Tracking the broad trend, there is a major focus on skills around managing nonfinancial risks.