Chapter 1

The five technologies transforming the finance function

The next wave of technology will transform the way finance adds value.

A convergence of technologies is now driving the next phase of finance transformation, accelerating the journey that CFOs began toward delivering greater insight in the 1990s with enterprise resource planning (ERP) implementations. This next wave of technologies will transform the way that finance adds value.

Finance leaders need to understand key emerging technologies, make pragmatic decisions about the optimum time to invest, decide when to run pilots or other initiatives to test new innovations, and determine the people skills and capabilities they will require.

"Technology is changing so rapidly … there is a certain motivation to be cautious. If you take a wait-and-see approach, you run the risk of being put at a severe competitive disadvantage."

We believe five key technologies will play a significant role in transforming the finance function:

1. Advanced data analytics

In the future, contending with volatility and uncertainty will be the new normal. A range of forces — including growing pressure on natural resources, more frequent and severe climate events, and increasingly sophisticated cyber attacks — will create ever-greater challenges for multinational organizations, particularly as global operations become increasingly connected.

To be able to set the right course for the future, finance functions must get better at processing — and extracting forward-looking insights from — large amounts of data, keeping track of new types of data and incorporating them into their models as they emerge. CFOs must actively investigate how they can use sophisticated, forward-looking analytics to enhance their organization’s performance in a range of areas, for example by:

- Deploying big data platforms that are designed to be interrogated by computers rather than humans, using machine learning to analyze massive data sets to make fine-grained predictions such as how an asset on a balance sheet will behave

- Combining structured and unstructured data (such as social media and web monitoring) to identify rogue activities, patterns and trends, and mitigate risks such as fraud or cyber breaches

For Simon Kelly, former CFO and COO at Australian media company Nine Entertainment Co., this means historical data is losing some of its importance. “While historical information is important for areas such as reporting and tax, it doesn’t add a great deal of value beyond that,” he says. “Value-add is in the real-time data about how things are trending in our business right now.”

“In the future, the investment is going to need to be in real-time data and in generating insights so businesses can respond to changing consumer preferences without waiting for accountants to pull together historical financials. The historical transactional part of finance is really a commodity, not a competitive advantage,” said Kelly.

For Vincent dell’Anno, EY Executive Director, Performance Improvement, Ernst & Young LLP, part of the investment CFOs should be making is in real-time data, and the other part is in real-time analytics. "For example, there are sensors that are required to act in real-time or as close to that as possible,” he says. “That means you want to facilitate analytics as close to the source of data as possible, you want to be able to drive streaming analytics where possible and relevant to the business problem.”

This is also reflected by our survey, in which “improving data and analytics capabilities to transform forecasting, risk management and understanding of value drivers” was the priority most cited by CFOs as number one for their finance function.

Top priority

23%say improving data and analytics capabilities to transform forecasting, risk management and understanding of value drivers is their top priority.

Close second

22%say meeting the need for new skills by transforming how finance talent is recruited, retained and developed is their top priority.

Reaching your analytics potential

Many organizations find it difficult to introduce the technology needed to generate forward-looking insights. For example, they are often impeded by multiple ERP systems, legacy applications and non-integrated architecture.

In the future finance function, however, inflexible and costly IT infrastructure will be replaced by scalable and innovative IT. Many CFOs are already incorporating new advances into their ERP systems, such as:

- In-memory computing

- Cloud and hybrid cloud deployments

- Better and more mobile user experiences

- RPA to federate data from different systems.

Choosing the right tools to capture and mobilize data and enable the insight-driven enterprise is a complex challenge, particularly given the rapid pace of technological innovation. But CFOs also need to focus on the “consumption” side. Finance leaders need to think about, for example, where technological innovations such as those cited might come up against the brick wall of organizational resistance, or what incentives systems are needed to encourage adoption.

Change management will be essential to address this critical “people” dimension.

2. Robotic process automation (RPA)

Imagine a team member in tomorrow’s finance function who:

- Represents no significant overhead

- Works much faster than their colleagues

- Completes huge volumes of repetitive tasks without ever making an error

- Keeps a perfect audit trail

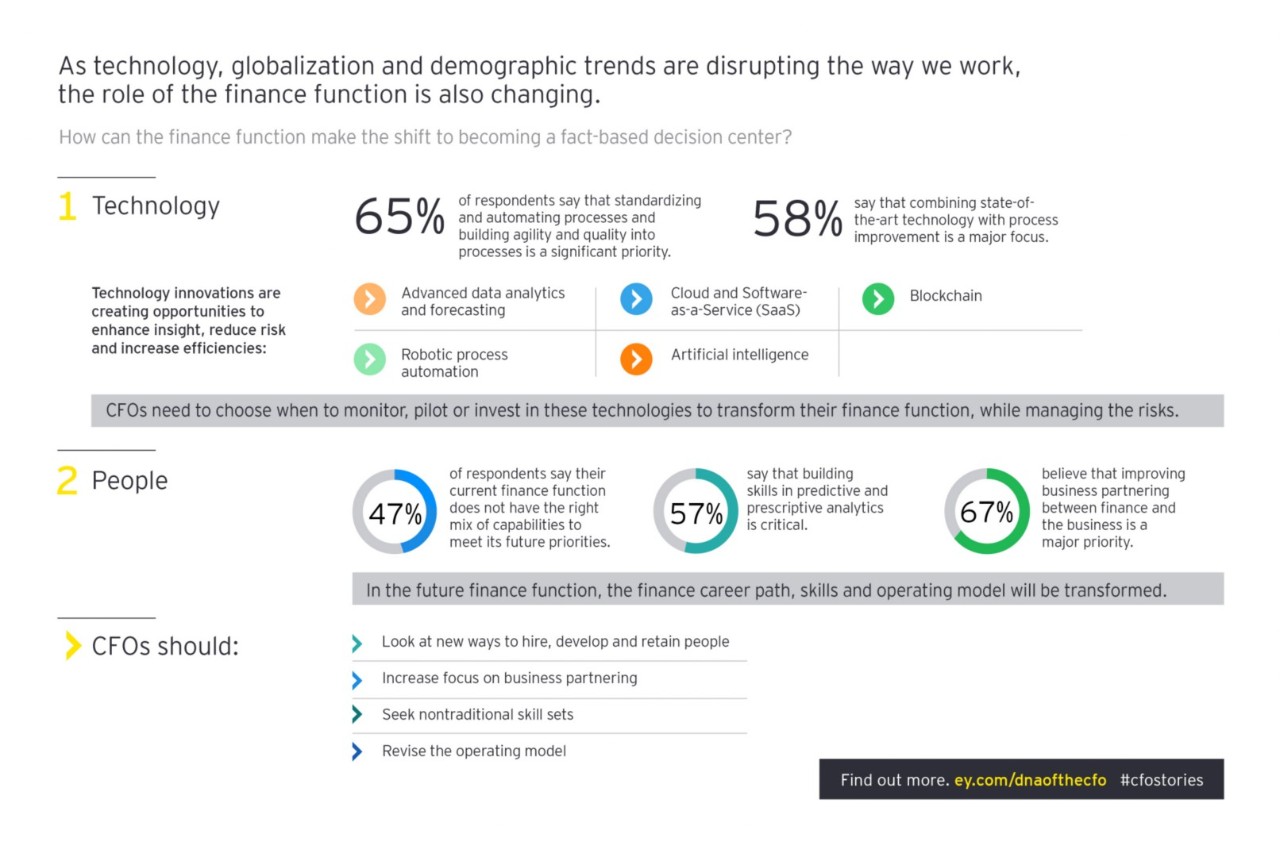

In the future finance function, RPA technology will play an important role. Sixty-five percent of respondents worldwide said that “standardizing and automating processes and building agility and quality” into processes is a significant priority for the finance function.

And while it is a particular priority for cost-focused CFOs, it is also important for those focused on growth.

Cost efficiency

68%Driving cost efficiency is my number one focus of automating processes over the next five years.

Growth

60%Driving growth is my number one focus of automating processes over the next five years.

Claude Changarnier, Vice President of International Finance at Microsoft International, believes that automation plays a key role in helping the finance function strike a balance between adding value and effective control. “The approach we have taken over the past years and that we are continuing to take today is trying to automate, centralize and outsource transaction-based activities,” he says. “This is so that we can free up time for people to be able to do two things. One, to add value to the business by providing business insight. Two, to put in place a very strong controls and compliance environment in the different subsidiaries that we are operating in the world.”

Tony Klimas, former Partner with EY, said that automation offers the opportunity to drive the next evolution in how finance is delivered. “The traditional offshore model is starting to fall apart,” he explains. “Many popular offshore locations are becoming more prosperous, and what used to be ‘cheap’ isn’t so ‘cheap’ anymore. People are looking for alternatives and they’re looking to leverage technology advances, from robotics to artificial intelligence.”

This point of view is echoed in our research: 58% of respondents worldwide said that “combining state-of-the-art technology with process improvement” is a significant priority. And it is a particular focus for large and complex global organizations, whose CFOs must often seek to cut waste, standardize approaches and combat bureaucracy and inflexibility.

The shift to RPA can help improve organization performance in a number of ways by enabling CFOs to:

- Automate key finance processes, from data reporting to payments

For example, RPA can be used to improve corporate reporting to access and present data from multiple systems - Target system inefficiencies

RPA can bridge the gaps between different ERP systems in cases where organizations have not yet achieved a single integrated system. They can also act as an interface between an ERP and critical legacy systems. - Improve the quality and speed of finance processes

RPA provides a clear audit trail record, which can make compliance with regulatory requirements easier to manage.

Is the future of finance robotic?

For EY’s Chris Lamberton, Robotics and Process Automation Global Center of Excellence Leader, successful finance functions in the future will be those that find the right balance between robotics and people, with each doing what they do best. “Ultimately, what you want to establish is the right combination of people and robots,” he says. “Quite often it’s not just a cost play. It’s also about how you improve your service or create new services.”

“The best way to think about robots is as the ultimate companion to humans. Let robots do the grunt work and free up people to do things they’re really good at, which is analyzing all the data that robots can pull together,” says Lamberton.

3. Cloud and Software-as-a-service (SaaS)

Although a company’s financial management system is critical to its success, many organizations have outdated and fragmented systems. Cloud and SaaS solutions now offer opportunities to transform system functionality and drive standardization in a faster, smarter way.

Cloud-based infrastructure and cloud-based SaaS applications can:

- Streamline operations

Cloud-based ERP, for example, can allow disparate teams to create and access the same data, which can enable quicker decision-making. - Reduce costs

Because organizations can quickly increase or decrease the number of applications they use, they only pay for what they need, rather than what they thought they would need six months ago. Maintenance costs can also be cut because systems upgrades can happen automatically. Cloud and SaaS solutions may also avoid the need for costly and complex rationalizations of on-premise ERP. - Provide greater flexibility

SaaS can help organizations keep pace with rapid developments in technology, such as new analytics tools, and help the function respond to fluctuations in demand.

While these tools can provide significant opportunities to improve performance, they will need to be weighed against key concerns:

- Security

CFOs will need to proactively manage the associated risks of these tools, particularly in relation to data security and compliance with different regulatory regimes. - Developing the skills to make best use of technologies

In our research, 55% of respondents said that “improving digital technology skills in areas such as mobility, the cloud and SaaS” would be a significant people and skills priority for the future finance function. This improvement in digital technology skills is important across many industries, but it is a particularly high priority in the media and entertainment sector, where companies need a scalable infrastructure to manage and monetize all the digital content they produce.

4. Artificial intelligence (AI)

AI systems are capable of ingesting information and instructions, learning from interactions with human beings and responding to new situations and questions in a human-like way.

In addition, AI complements technologies such as RPA, as it involves systems that do not just follow rules, but can recognize patterns, learn and adapt to new situations. For example, rules-based automation approaches often run up against exceptions to the defined process, and AI can be used to target those exceptions.

With these attributes, AI could be used to transform how tomorrow’s finance function provides key services. AI systems could be trained to ingest tax regulations that are relevant to a business, and also to absorb new regulations as they come online, proactively advise the relevant persons of the changes, and answer questions that they may have about their nature and implications.

Loren Williams, Chief Data Scientist at EY’s Global Analytics Center of Excellence, believes that although AI will play an increasingly important role, it will not do away with the need for human financial experience and insight.

“There are many cases where an AI system will augment the intelligence, knowledge and awareness of an expert like a finance executive,” he says. “With routine transactions, the AI system could have the authority to declare something out of bounds or to respond in a particular way to something that’s unusual. But with big, important and complex decisions, you may see AI systems providing advice or recommendations to help the human decision-maker, and back up those recommendations based on its ability to gather, ingest and make sense of vast amounts of structured and unstructured data.”

5. Blockchain

Blockchain has the power to challenge many of the accepted principles and norms of global trade, global financing and global supply chain management. It reinvents that basic building block of commerce, the ledger, for a digital, connected age.

A blockchain is a digital ledger — a distributed database that can be shared across a network of computers based in different sites and geographies.

An identical copy of the ledger is held by all of the people participating in a blockchain network. Any changes to the ledger are reflected in just minutes or even seconds, thus providing all involved with real-time information and the capacity to track trends.

The security of the information in the ledger, and its accuracy, are protected cryptographically, with the participants in the network agreeing who can do what within the ledger.

With Bitcoin, for example, individuals within the network (called “miners”) had permission to validate an aggregated group of transactions (a “block”), with these miners rewarded for their efforts with 25 Bitcoins. Once validated, the block was placed in the “chain.” Instead of a central authority, such as a bank, validating transactions, validation for Bitcoin is essentially crowd-sourced.

While blockchain emerged as a technology for Bitcoin, its attraction is more the algorithmic technologies that underpin it. This technology makes it possible to transform the ability of a ledger to record, enable and secure a huge number of transactions, and could be used in multiple sectors, from financial services to tax collection in the public sector.

In the future finance function, CFOs will use blockchains to:

- Increase IT security

Blockchains are considered by commentators to be tamper-proof, providing unprecedented protection against fraud and hacking. There have been incidents where users have entrusted their private keys to exchange operators and the operators have had their security broken, but the blockchain security itself has not been breached. - Manage extended value chains

Instead of having to reconcile the internal system of record with information from suppliers and partners, CFOs will be able to pull data from multiple blockchains to create their system of record. - Streamline contract enforcement

A smart contract feature means that the delivery and payment relating to a transaction can be integrated into the contract itself. With blockchains, the ledger is programmable and contains logic, so that you can have a rule that makes a payment on the completion of a service.

Paul Brody, EY Americas Technology Strategy Leader, outlines how smart contracts could transform international trade, saying: “Imagine a container ship, carrying cotton from an Australian farmer to a Chinese vendor for processing into clothing, with an internet-of-ihings (IoT) device tracking the ship as it travels across the ocean. The farmer has a contract with the Chinese vendor that states that the farmer gets paid based on the weight of the cotton adjusted for its humidity level when it enters the port of Hong Kong — you could actually write that into the blockchain software code as a smart contract.

“When the GPS of the container ship enters Hong Kong harbor, and the digitally connected weighing and humidity sensors assess the cotton, then those two pieces of data combine and trigger the smart contract. That then pays the Australian farmer from the Chinese vendor, transfers ownership of the cotton to the Chinese textile mill and automatically pays and files the documentation for customs and duty with the Chinese Government. Smart contracts automate this process that, today, has a lot of manual steps and paperwork involved.”

However, blockchain is still a new technology that still requires development in areas such as contract dispute management. “What has yet to be fully designed is a mechanism for handling disputes in smart contracts, a topic that I believe will emerge as an important area of blockchain research in the future” says Paul Brody. “Ultimately, I expect to see hybrid contracts that blend the automation of smart contracts with the provisions for dispute resolution that exist in traditional agreements.”

Blockchain technology is likely to play an important role in the finance function in coming years. CFOs should be anticipating how they are going to build the relevant competencies and skill sets. They also need to start discussing the future of their system of record, given that organizations could move from working with a single, monolithic system of record inside the enterprise to working with many different systems.

New technology, but old challenges remain

Before making large investments and diving into major overhauls, CFOs will of course want to build a clear understanding of which new technologies will be most beneficial to their finance function, and they will need to be highly selective.

Importantly, CFOs must also remember that the success of any technology greatly depends on the skills of the people using it. In our research, CFOs cited “staff capacity to adapt to change” as the main barrier to adopting new technologies. Effective change management — including transparency about the rationale and continuous communication — will be critical for technology transformations to be a success.

Chapter 2

The finance role will evolve

CFOs will need to look for different skills on their teams, as well as people who are motivated to embrace change.

Technological breakthroughs are disrupting both business strategy and the ways that finance teams work and collaborate. As CFOs build tomorrow’s finance function, they will need to find people with the skills — and motivation — to complement the technological innovations, as well as to embrace rapid change, different roles and new approaches.

As the tools of tomorrow begin to arrive and play a role, the importance of finance people will not abate, but the skills they require will evolve.

Traditional approaches to finding and developing talent are under pressure as a result of major demographic and technological shifts:

- A talent shortage has hit in the developed world.

Organizations face extremely tough competition for the best data analytics and digital talent. - Millennials will become increasingly influential.

The millennial generation is a digital generation, and they collaborate in different ways to their older colleagues, challenging assumptions and breaking down organizational boundaries. - Increasing use of smart machines means that organizations must remodel the roles of smart people.

As technology advances, people’s roles will also have to change. Smart machines should be used in a way that drives value and complements an organization’s people, impacting productivity and making day-to-day roles more engaging.

Given these challenges, CFOs will need to:

- Design a future operating model that focuses their best people on key priorities and delivers a smarter, more forward-looking and resilient finance function

- Challenge their own and others’ assumptions about what constitutes finance talent, how to find the right profiles and develop the skills needed to thrive in an increasingly connected, data-rich future

Building a smarter, more forward-looking and resilient finance function

The transformation of finance function operating models has already delivered greater efficiency and has freed to focus on high-value activities.

Many CFOs have brought transactional accounting and finance processes into centralized “finance factory” models, featuring shared services, managed services and outsourcing. Where this has occurred, finance functions have become leaner and more efficient, and CFOs and their key executives have more time to focus on their organization’s strategic priorities.

The next evolution for the finance function will be to become a data-driven decision center. Finance professionals will be even less focused on generating reports and information, and far more focused on using the available data to drive decision-making.

The finance function’s operating model must evolve to support this shift. The future operating model will need to be:

- Smarter

All transactional finance processes will be fully automated in outsourced or captive finance factories. Finance head count in these factories will reduce, with teams focused largely on managing exceptions. - More forward-looking

The future finance function will combine finance data with external information to help model and predict business outcomes, identifying the most profitable opportunities. - Better aligned to the business

There will be much closer alignment and engagement with the business, with finance professionals spending more time working alongside key internal stakeholders, challenging their strategic plans and modeling and predicting different scenarios. - More resilient

The future finance function will be more focused on managing uncertainty through strategic risk management. Finance will use predictive analytics to investigate the implications of strategic decisions to plan for possible shocks and to manage the growing threat of cyber risk.

CFOs believe that strategic risk management is among the top capabilities that organizations will demand of their future finance functions. This capability is considered particularly important by Group CFOs, 62% of whom consider it critical, compared with 53% of Regional and Divisional CFOs.

The role of finance in data analytics and forecasting is, I think, at the core of what we have to do, and what we’re going to have to do more and more.

Designing the future finance operating model

Tomorrow’s finance operating model will look very different from today’s as finance leaders respond to a more demanding and connected world. The future operating model will be shaped by a number of drivers:

- As the CFO role in many organizations expands to such a degree that it becomes too big for one individual to do well, CFOs will need to pull their best leaders into a finance executive function. This team will lead on major priorities, from back office operations and shared services to accounting and control. Job titles will become less important as people demonstrate their value through the skills they bring and the responsibilities they assume.

- As the economy becomes more connected, and collaboration and effective information flows become increasingly important, finance business partners and centers of excellence will provide the interface not only with internal stakeholders, but also external stakeholders and their counterparts in ecosystem partners. Business partners and centers of excellence will become the heart of the function, with permeable organizational borders that allow them to build effective relationships and accelerate data and information flows to (and from) external stakeholders, such as technology partners.

- As finance and accounting processes are increasingly automated, the finance back office will shrink, as a virtual workforce begins to replace large numbers of full-time employees in shared service or outsourced arrangements.

Centers of excellence:

Finance centers of excellence emerged as a means of streamlining and centralizing expertise for the use of stakeholders across the business. However, as demands on finance functions and tools available to them change, finance leaders should be open minded about revisiting how to use these centers to their best advantage.

Aligning people management with the new operating model

Driving value from new structures will have significant people implications. In the future model, there will be people whose main focus is on running the business, and others who are more concerned with changing the business, driving growth and business model innovation.

For Chris Chen, COO and CFO at Shanghai-headquartered marketing agency DDB Greater China, this split has effectively created two finance teams. “One team, based in Shanghai, is like a machine, dealing with the daily accounting transactions,” he says. “The other is the commercial side, including budgeting and analytics, which creates more value for the company. That team can really perform well and the value is tremendous.”

For this operating model to work effectively, CFOs will need to put the right people management approach in place for each constituency, including:

- Skills profile

- Ongoing education and training, including exposure to new technologies and analytic approaches

- Career path and development

- Performance measurement and rewards framework

For example, the leader of a finance factory will need to have skills and experience in driving process excellence through lean techniques and state-of-the-art technologies. This is a very different profile from that of an economist in the forecasting center of excellence, whose skills and experience may be in analyzing and modeling changes to the business model such as the introduction of new digital services and products.

To realize the promise of the future operating model, CFOs will need to rethink how they develop, measure and reward people with very different skills, from financial insight to operational management.

A new form of business partnering

If organizations are to succeed in turning increasing amounts of data into better strategic decision-making, then finance functions will have to make business partnering even more of a priority. CFOs must have a team of highly credible finance executives who are capable of acting as finance’s interface with its internal clients. This team’s role will include helping to align the work of the analytics teams with business priorities, and helping leaders to understand the implications of their data.

Our research shows that 67% of CFOs worldwide believe that “improving business partnering between finance and the business” is a major priority for the finance function. It is a priority for organizations of all sizes, but a particular focus for large and complex organizations.

Finding people with these abilities is not easy. Zlatko Todorcevski, CFO at Australian-headquartered supply chain logistics company Brambles, believes that finance functions often struggle to get the right people to serve as partners to the wider business. He says that those chosen are often more inclined, or better suited, to act in a controller role: “Their natural inclination is to get into financial reporting without necessarily having the ability or desire to sit back and think about what's happening in the market.”

He also argues that many who do have the right skill set for the partnering role often find themselves unable to take it on. “Because of the lack of clarity around [the partnering role] — and how their [own] roles have been developed or how their organizations have been constructed — they're actually being tasked with developing statutory accounts, filing tax returns, running a whole bunch of analysis on a country basis and so on.”

To build that partnering capability, CFOs must:

- Shift what is expected of finance business partners, from challenging budgets to challenging business models

- Find and reward those who combine subject matter expertise with the right abilities and skills to challenge business units’ strategies

Challenging the assumptions about what constitutes finance talent

As CFOs transform their function’s operating model, they will need to abandon many of traditional ideas about what a finance executive and members of the finance team bring to the table:

- Look beyond traditional financial analysis skills. Data gurus — such as statisticians and data scientists, and even behavioral scientists — will be critical in helping the finance function of the future turn data into fresh perspectives and strategic insight.

- Find digital finance talent. In the digital age, finance functions will increasingly rely on those rare executives who are steeped in finance but are also literate in technologies such as blockchain and AI. Digital expertise will be needed not only to lead technology-driven changes to the finance operating model, but also to identify the implications of digital for the organization’s business model and growth agenda.

- Develop better finance business partners. Great business partners have the influencing and communication skills to be able to convey fresh insights to internal clients on the strategic challenges faced by the business.

- Use alliances to go beyond what your organization can deliver alone. As the world becomes more volatile, uncertain, complex and ambiguous, organizations are increasingly needing to look beyond their own borders to address business challenges and keep on top of innovations. Alliances with universities, start-ups and other third parties will be essential to providing the ongoing development that will be necessary for the organization to remain nimble and continually adapt.

Competing for talent

Finding the right talent for the future finance function is becoming an ever more critical challenge, complicated by demographic trends, intense competition and changes in the ambitions and expectations of young finance professionals. In fact, 22% of CFOs cited “meeting the need for new skills by transforming how finance talent is recruited, retained and developed” as their number one strategic priority for the finance function of the future.

To help attract, retain and develop the right talent, CFOs should consider these two key steps:

1. Plan today for tomorrow’s critical talent

CFOs need to get better at strategic workforce planning for their finance function. Drawing on market trends and business units’ forward-looking plans, finance leaders can more accurately forecast what talent is going to be needed, where the major gaps are and how those gaps can be addressed.

Our research revealed that CFOs see skills in sophisticated analytics and deep regulatory knowledge as critical over the coming years.

As increasing automation of transactional finance tasks alters the finance professional’s traditional career path, finance leaders will need to redefine a new development curve. This will include mapping out how they intend to develop people to acquire the breadth of skills necessary to progress through the finance function, and nurture the finance leaders of the future.

As they plan, CFOs may also keep their eye on several time horizons in the near, medium and distant future. For Richard Baker, EY Thames Valley and South Markets Leader, UKI, while technical skills are at a premium now, they may ultimately take a back seat. “If I were advising a teenager on what to study now, I would recommend they learn IT and digital skills, as demand for those skills will continue to grow for at least the next 10 years. But for the generation being born now, the skills needed when they enter the workforce may be different. Many jobs that are done today will be largely automated. However, the interpersonal and strategic skills that technology cannot replace will be more in-demand than ever,” he says.

2. Make use of the diverse workforce models of tomorrow’s on-demand economy

In the future, organizations will increasingly rely not only on their own workforce to get the job done, but also on non-employees — in other words, the external or contingent workforce, including freelancers and sub-contractors.

A number of trends, from demographic changes to technology shifts, are driving the move toward a contingent workforce. Many workers now do not want to be tethered to one company, and so they seek more flexible employment conditions.

And in volatile markets, the need for specific skills fluctuates wildly as technologies change and consumer behavior shifts. This means that companies must take a flexible approach to sourcing the skills they need to confirm they meet capacity demands without scaling up in areas that may then become obsolete.

For Carl Smith, EY Global Talent Marketplace Leader, this requires a fundamental shift as most large organizations and multinationals are not well equipped to manage contingent workers. “Many companies do not have a good handle on the sourcing and management of their contingent workforce, because organizations have been built over the years to deal with a permanent employee base,” he says. “Organizations need to think about 'integrated strategic workforce planning' and rationalize processes, systems, roles and responsibilities, and analytics to enable effective sourcing and management of their contingent workforce.”

Chapter 3

Three priorities for CFOs of the future

We share some final thoughts on how to build tomorrow's digitally enabled and talent-rich finance function.

The synthesis of technology and people will be critical for the future finance function. Tomorrow’s finance function will only succeed if it has people who can lead the technology debate and who are willing to innovate in finance’s risk-averse culture.

Equally, the function’s team members will only be able to focus on higher value tasks, such as analytics and forecasting, if the technology is in place both to take care of transactional processes and to provide the data needed for the generation of strategic insight.

To build tomorrow’s digitally enabled and talent-rich finance function, we suggest three priorities for CFOs:

- A clear vision for the future finance function, which is aligned with the organization’s overall purpose and business strategy, gives finance team members around the world a common ambition and provides focus for efforts and investment decisions. In the digital age, this vision needs to include how smart technology and smart people should work together to create value.

- A bold technology strategy for the finance function should include systems and tools that enable disparate teams to share information and make connected, data-driven decisions. CFOs should establish processes for the organization to continually identify and assess new technologies, model the potential return and make timely investments. Robust and sustained change management will also be crucial for the successful implementation of any new technology investments.

- As state-of-the-art automation increasingly takes care of the transactional components of finance, finance people will be freed up to focus on higher-value activities. Different skill sets will be required to exploit the new technologies and the increasing volumes of data, and to derive the insights to drive business decisions. Better business partnering and softer skills will also be required to align finance’s efforts with the business, as organizations as a whole strive to become more nimble and innovative, and adapt to a rapidly changing and increasingly volatile business context.

A coordinated approach across all these elements will be one of the cornerstones to an effective finance function in the future.

Summary

As a new wave of technologies enters the finance department, the role of finance people will change. This report examines the five technologies that will change finance, and offers CFOs thoughts on how to prepare for them. To learn more, download part 2 (pdf) of our three-part DNA of the CFO report.