Chapter 1

Strategies for growth

Middle-market companies are grasping the upside of disruption, expanding beyond their borders and creating new business opportunities.

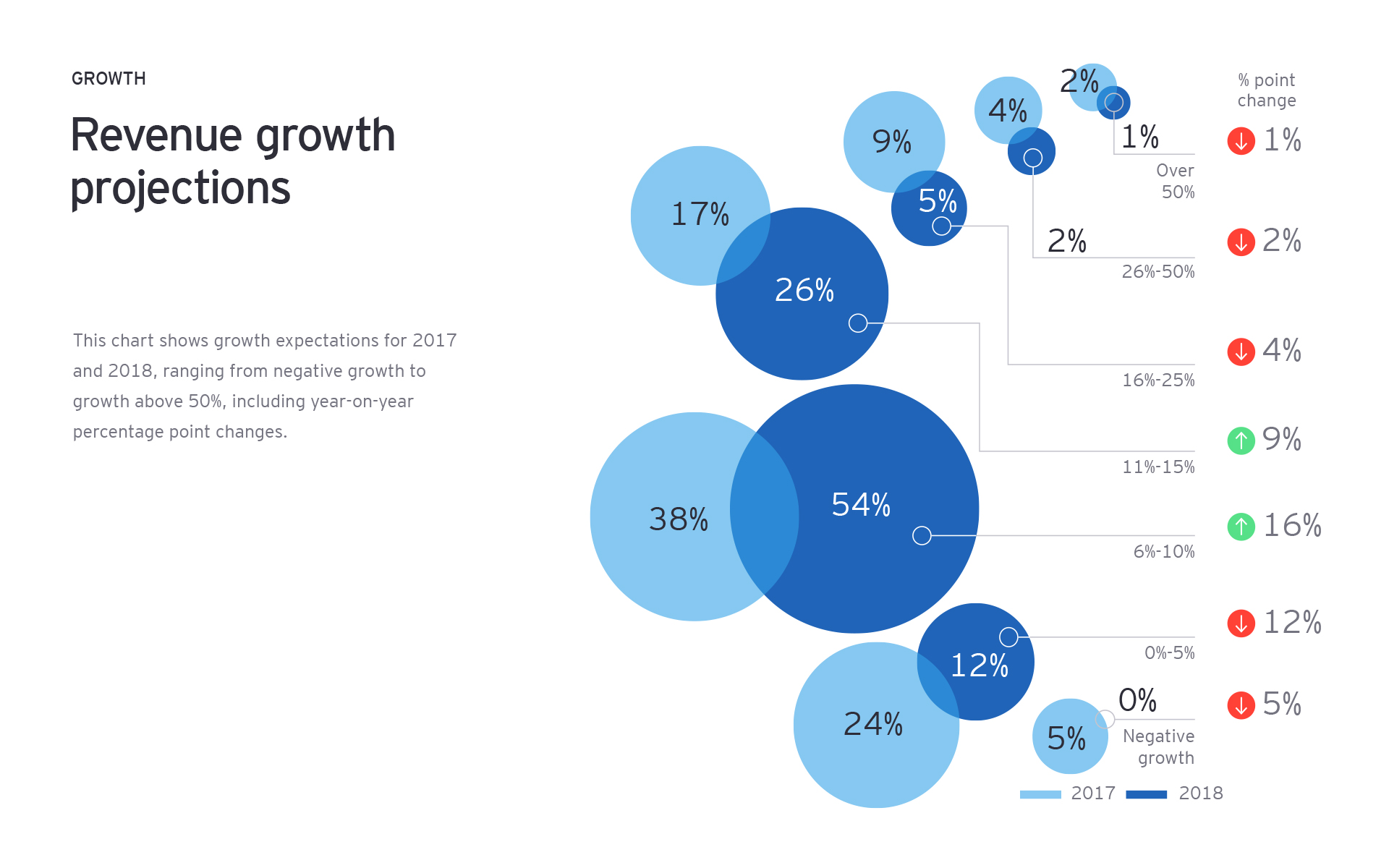

Over one-third (34%) of family businesses are targeting growth rates in double digits (over 10%) compared to one-quarter (26%) of non-family businesses.

The percentage of respondents in double-digit growth has grown nine percentage points compared to 2017, while those in high single-digit growth is up 16 percentage points compared to last year. Moreover, no company surveyed is in negative growth, while in 2017 five percent of the total cohort of respondents was looking at declining revenues.

"We see here two factors at work," says Marnix van Rij, EY Global Family Business Leader. "Across the world, middle-market companies are grasping the upside of disruption, expanding beyond their borders and creating new business opportunities. But we also see family businesses using the advantages of greater agility and streamlined decision-making to move faster than their non-family business peers."

Family businesses are more likely (27% compared to 22% of non-family businesses) to prioritize entry into a new overseas market as a growth strategy.

"We see great potential to expand into South East Asia," says Niccolò Ricci, CEO of Italian luxury menswear brand, Stefano Ricci. "Vietnam, Philippines, Thailand and Cambodia are countries where I can see a big opportunities for us. We have, for instance, just opened a boutique in Phnom Pen. We are already in Singapore and Macau, where we will open a third boutique later this year, so right across the region there is great potential for us."

As we see in all survey results for 2018, growth is being led by economies in Asia-Pacific with particular strength in India and China. Here, over 70% of family businesses based in these economies are planning a double-digit growth this year.

“President Xi’s significant investment in projects, such as the Belt and Road Initiative, Made in China 2025, the creation of a Silicon Valley in the Greater Bay Area and the ambition to dominate areas of new technologies, especially AI, robotics and biotech, all offer significant opportunities for Chinese millennials,” says Dr Roger King, Professor of Finance, Hong Kong University of Science and Technology Business School.

Chapter 2

Strengthening internal talent

Family businesses have a greater focus on talent as a growth enabler than their peers.

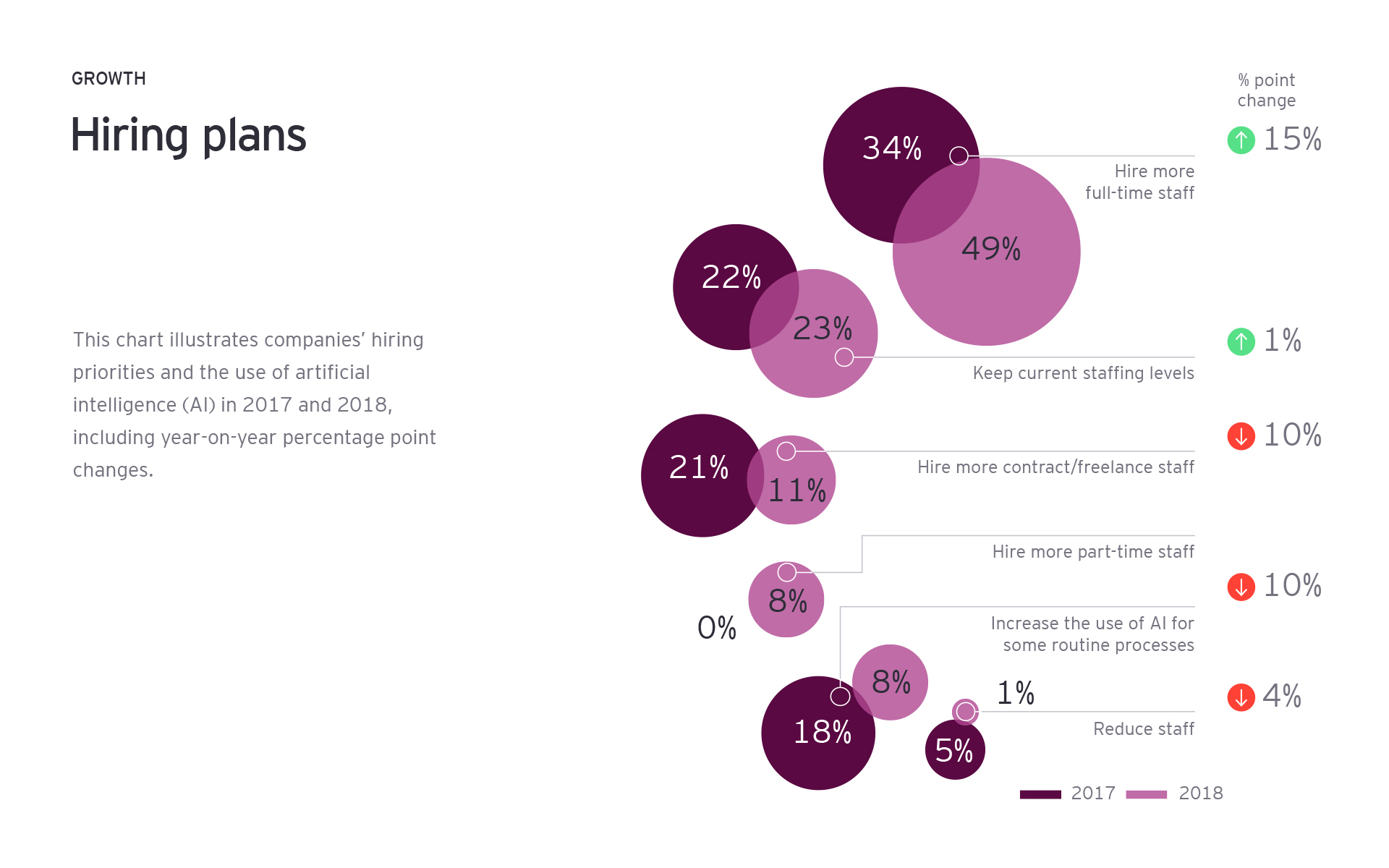

As last year, family businesses have a greater focus on talent as a growth enabler than their peers. Almost half (49%) in 2018 plan to hire full-time staff, compared to 38% of non-family businesses.

"We see family businesses seeking to lock in scarce talent," says van Rij, "building on established skills in motivating staff over the long term, while determinedly looking to attract young digital talent into their organizations."

Diversity has shot up the middle-market recruitment agenda – 40% cite it as their biggest priority, 37 percentage points up on 2017. Given the many studies proving diversity as a key contributor to team efficiency, success and decision-making, it is good to see middle-market leaders embrace the proven gains of more diverse teams.

“I’m now involved in Örum Oy Ab, an automotive spare parts business," says Maria Aminoff, Deputy Chairman of Mercantile Oy Ab, the family holding company of a range of Finnish businesses owned by the Aminoff family. "For a long time, I have been the only woman on the board, but we have just hired a new board member and I particularly wanted to hire a woman. Even in very male-dominated sectors, such as automotive, I think women have a lot to offer.”

Family-owned businesses seem to offer environments that are somewhat more conducive to successful female leadership compared to their non-family business counterparts. Nine percent of family businesses are helmed by a woman (compared to 3% in the rest of the cohort) and 24% of executive leadership is female. Leaders of family business acknowledge they have more to do, though, and still put diversity at the top of the recruitment agenda (40% of responses).

Talent with specialist skills is also up (11 percentage points) on 2017 and runs second only to diversity (with 16% of responses).

"We believe it’s hugely important to build a strong foundation for science, technology, engineering and mathematics (STEM) subjects in education and so we spend a lot of time working with schools and universities," says Craig Wilson, Managing Director of Williams Advanced Engineering. "Even so, it’s a drop in the ocean compared with the need for qualified people with a good grounding in STEM subjects and in engineering across the industry."

As talent becomes ever more mobile, "family businesses are leveraging the special characteristics that can build loyalty and trust to attract scarce talent," says van Rij.

“I think people like being employed by family businesses because they can feel part of a vision, part of something that has a specific character, where the owners of the business are working alongside them," says Brett Franklin, the second generation of Franklin Companies, a San Antonio-based real estate company specializing in development, construction and management of senior housing.

The focus on talent extends to factors that would most accelerate the growth of family-owned companies. Here it is the top-rated option, with over third of responses (34%), up seven percentage points on 2017 and 5% ahead of non-family businesses.

Chapter 3

Challenges to growth

Slow global growth is the top-rated external risk to growth.

With family business leaders' focus on overseas expansion, unsurprisingly slow global growth is the top-rated external risk to growth, with a third (33%) of responses, nine percent more than non-family business peers, and a clear 17 percentage points clear of the second-rated risk of slow local growth.

However, when it comes to challenges closer to home, insufficient cash flow rises to the top, selected by over a third (35%) of leaders, and 21 percentage points up on 2017. “Top-line revenue growth can lead to a squeeze on cash flow without strict cash flow management,” says Dr Joseph Astrachan, Professor Emeritus, Kennesaw State University. “As new markets are explored, the terms and conditions covering receivables may lengthen. Adjusting to new patterns of cash out and in requires good data analysis.”

The pressure on working capital is not matched by access to capital, which hardly registers. “The issue is not accessing long-term finance,” says can Rij, “but finding working capital fast to respond to the rapidly changing business environment leaders find themselves in."

Chapter 4

Embracing business change

In line with all middle market leaders, family business CEOs are racing to embrace AI.

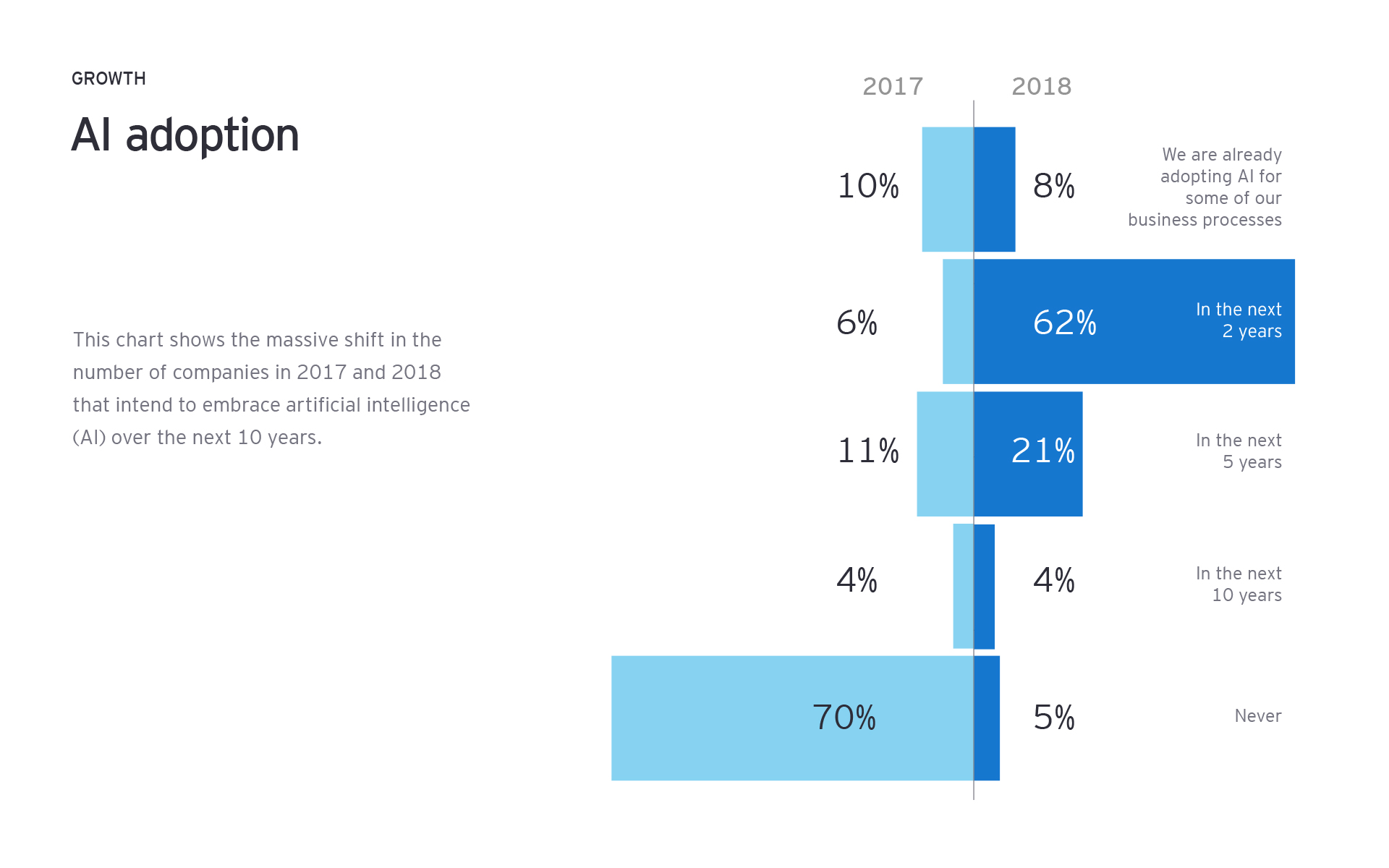

The digitization of everything, while long-predicted, is now happening at such an accelerated pace, that, in line with all middle market leaders, family business CEOs are racing to embrace AI. As with all respondents, 62% of family business leaders plan to adopt AI within two years, a massive 56 percentage point swing upward from just 12 months ago.

"We have certain roles within the company, in our factory for instance, that could in time be entirely automated. I can see that happening, says Ibrahim Ashemimry, Co-Founder and Chairman of Jeddah-based Munch Bakery. "We also see the potential in 3D printing. If we could 3D print a custom cake that would be a dream come true. AI also has potentially huge benefit to our business, whether in customer engagement via our e-commerce platform, or in enterprise resource planning (ERP), where we could use AI to help predict what we need to produce."

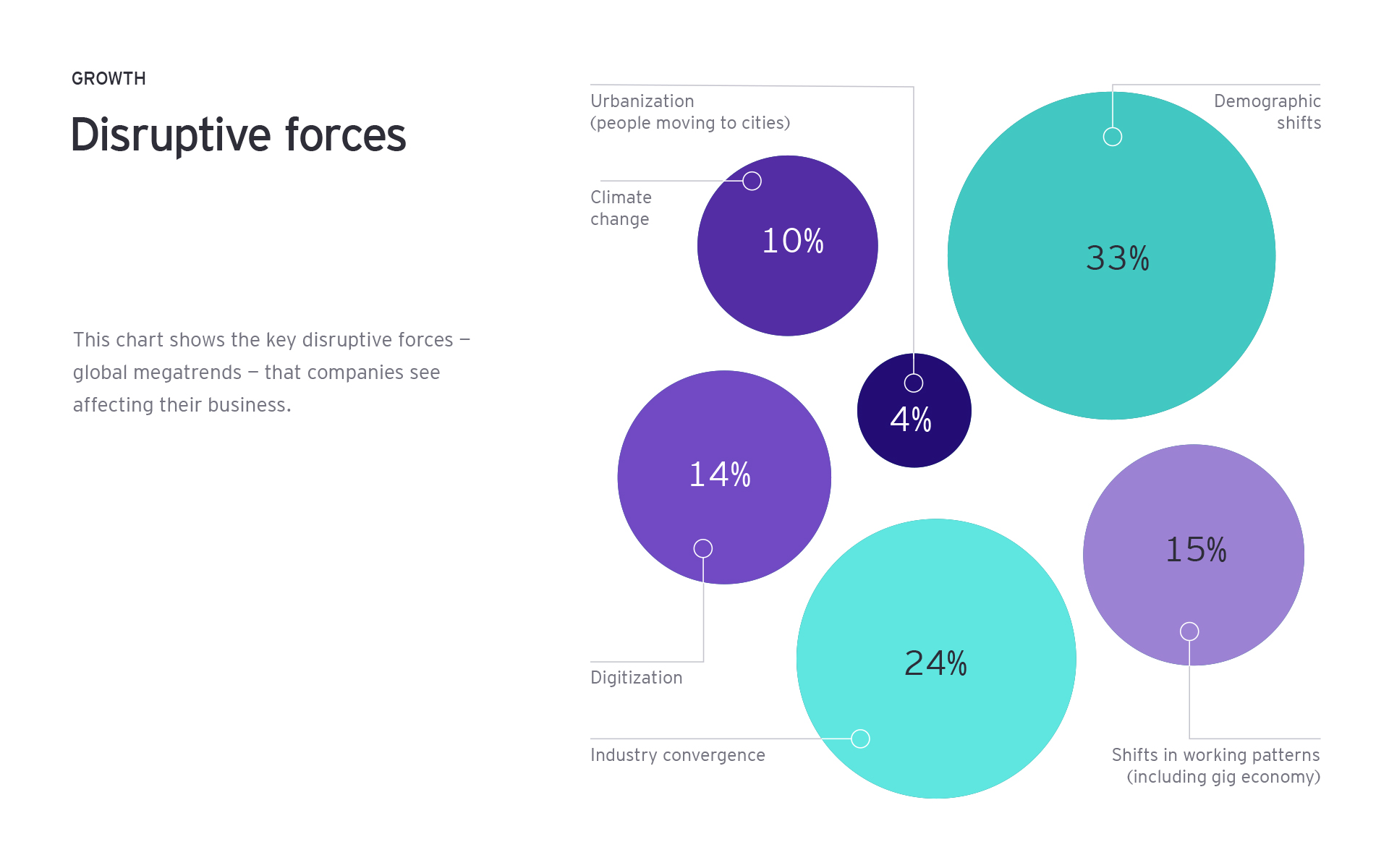

Cognitive systems are transforming almost every area of business processes from routine back-office to the customer experience. Almost one in three (29%) family business C-suite are employing technology to improve productivity, just as almost one in four (24%) see sector convergence as the disruptive megatrend having the biggest impact on business (after demographic shifts with 33% of responses).

"I only see opportunities with digitization," says Ingrid Faber of Dutch family business, Pooling Partners, Europe's leading full-service pooler and provider of wooden pallets and boxes. "For example Bitcoin’s underlying technology – distributed ledger technology – could potentially offer some use and benefit in our business. I’m not talking about investing in bitcoins, rather what the technology could mean for our business and operations.

"I expect automation in the palette production side of our business to continue to increase. The processes have, over time, become increasingly robotic, which has helped support the speed and accuracy of production," she adds.

These views are reflected in our EY Growth Barometer 2018 survey results. Here, leaders say technology investment will transform processes (31%); deliver an improved customer experience (21%) and create new business models (21%). Companies are at different stages of AI adoption, but none doubt its critical role in the future.

Related article

Chapter 5

Innovation: drivers and strategies

Regulation emerges as a new force in stimulating innovation.

In a clear shift from last year, regulation emerges as a new force in stimulating innovation (only 2 percentage points below profitability) for more than one in four (27%) of family business executives globally: a 14 percentage point rise from 2017.

"We have seen the impact of regulation on carbon emissions in helping accelerate innovations in electric vehicles," says van Rij, "and new European data privacy laws will spawn a new subsector of startups focused on helping companies comply with these stringent new regulations."

Almost one in five family business leaders is increasing innovation by building external alliances (17%). These external alliances can take many shapes, from project-based collaboration, to whole supply chain ecosystems. Other companies are systematically scanning the horizon for start-ups that can accelerate their innovation strategy.

"We recently teamed up with Foresight Group, an investment manager, to create a £20m seed fund," says Craig Wilson, Managing Director of Williams Advanced Engineering, part of the UK-based Grand Prix Engineering firm. "The idea is to identify and invest in companies that will benefit from our expertise and Foresight’s financial acumen."

As the pace of change ramps up, company agility becomes more critical to survival and growth. Globally, CEOs rate rapid decision-making as the number one factor in improving agility (27% of responses) and family business leaders are the same.

“Owners of family businesses are tightly linked with the management and execution of strategy,” says Thomas Zellweger, Professor of Business Administration with a focus on Family Business at the University of St Galen. “This allows them to make decisions fast and execute on them. However, it is also true that they can wait out periods of uncertainty, waiting for clarity and then acting fast, but later in the cycle.”

Family business executives are responding to accelerated change with one in four (25%) saying they are spending at least half their time on future strategy, eight percent more than their non-family business peers. Of those that agree that even this isn't enough, four in ten (40%) are looking for a wider pool of managers to help take on some operational activities to free them up to focus on the future.

“Family businesses are focused on sustainable growth, protecting the assets of the business in the long term. Decisions are also made with the involvement of fewer people, they are made fast and with a percentage of gut rather than data. In that sense, they are more entrepreneurial. Being long-term focused and entrepreneurial in the same time is a luxury public or non-family owned businesses don’t often have," says Abdulrahman M. AlBassam, of the Middle-Eastern diversified industrial products group that bears his name.

Summary

A long-term focus allows family businesses to be more strategic, to invest for the long-term in both people and technology and to respond fast to the accelerated pace of change. They are growing faster and hiring more than non-family peers.