Securitization

Securitization at EY is building a better working world by providing more confidence to investors on financial information related to the financial assets they invest in.

Our Team

How EY can help

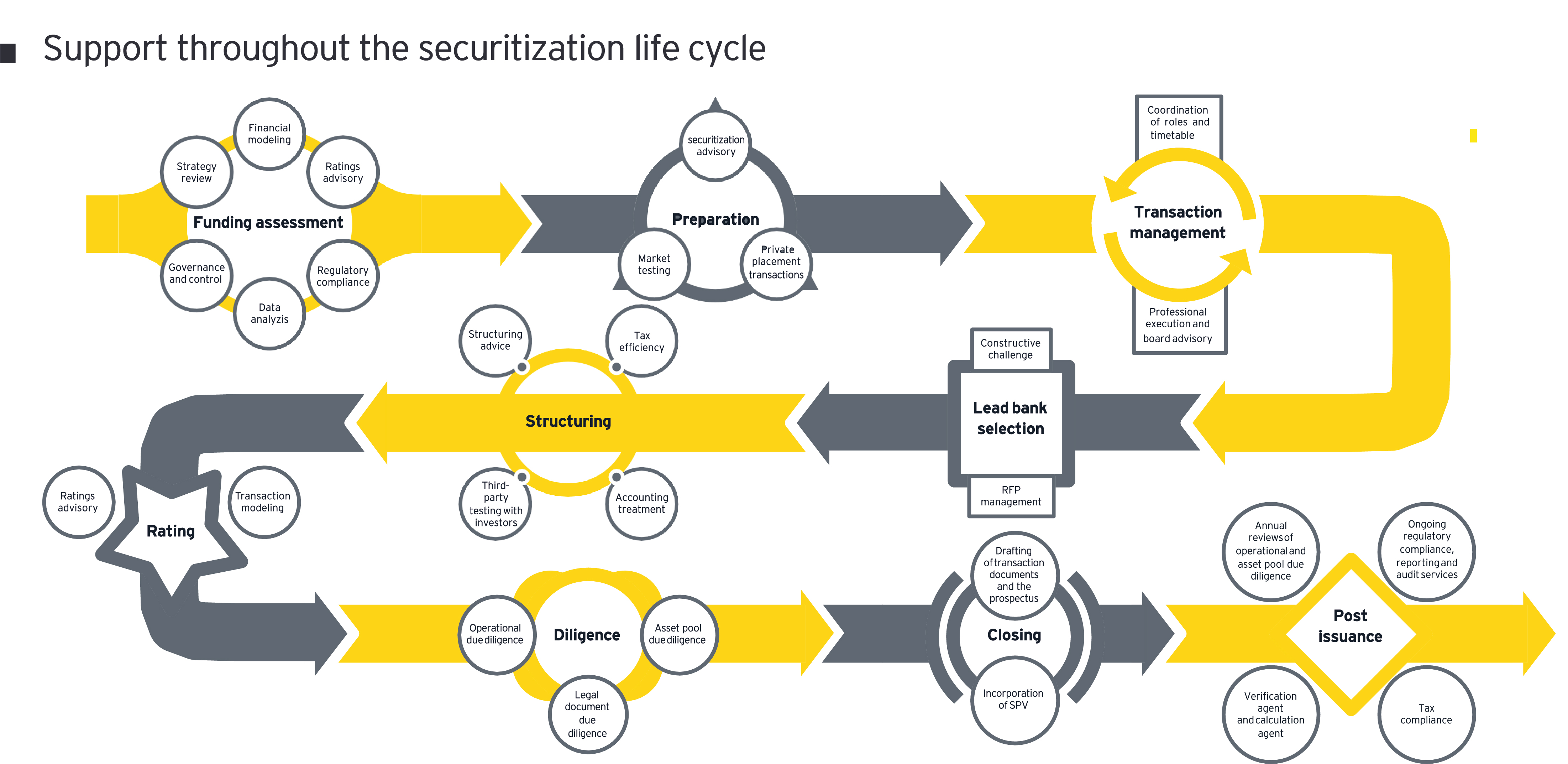

EY offers highly integrated securitisation services, which comprises professionals providing assurance, advisory, risk management and strategy and transactions to securitisation issuers, originators, sponsors, underwriters, investors and other market participants in the structured finance and securitisation marketplace.

EY securitisation services are a key hub in the global EY network, where people and ideas come together to develop thought leadership and insights for the benefit of clients.

Our latest thinking

Our events archive

2023 February: Securitization market: Is the current economic environment leading to more growth and opportunities? |

|

2022 May: Verbriefung in Luxemburg - Update Markt and Regulatorik (DE) |

|

2022 February: Securitization: Regulatory and market updates: Main challenges for the Luxembourg market |

|

2021 February: Securitization in Luxembourg: Market and regulatory updates |

|

2020 February: Securitization in Luxembourg: Where do we stand? And next steps |