Your fast-track SFDR/TCFD and EET implementation

Discover more about this topic in the sections below. Request a demo to find out more about our fast-track approach or contact us for further information.

EY’s ESG reporting service for asset managers and life-insurers

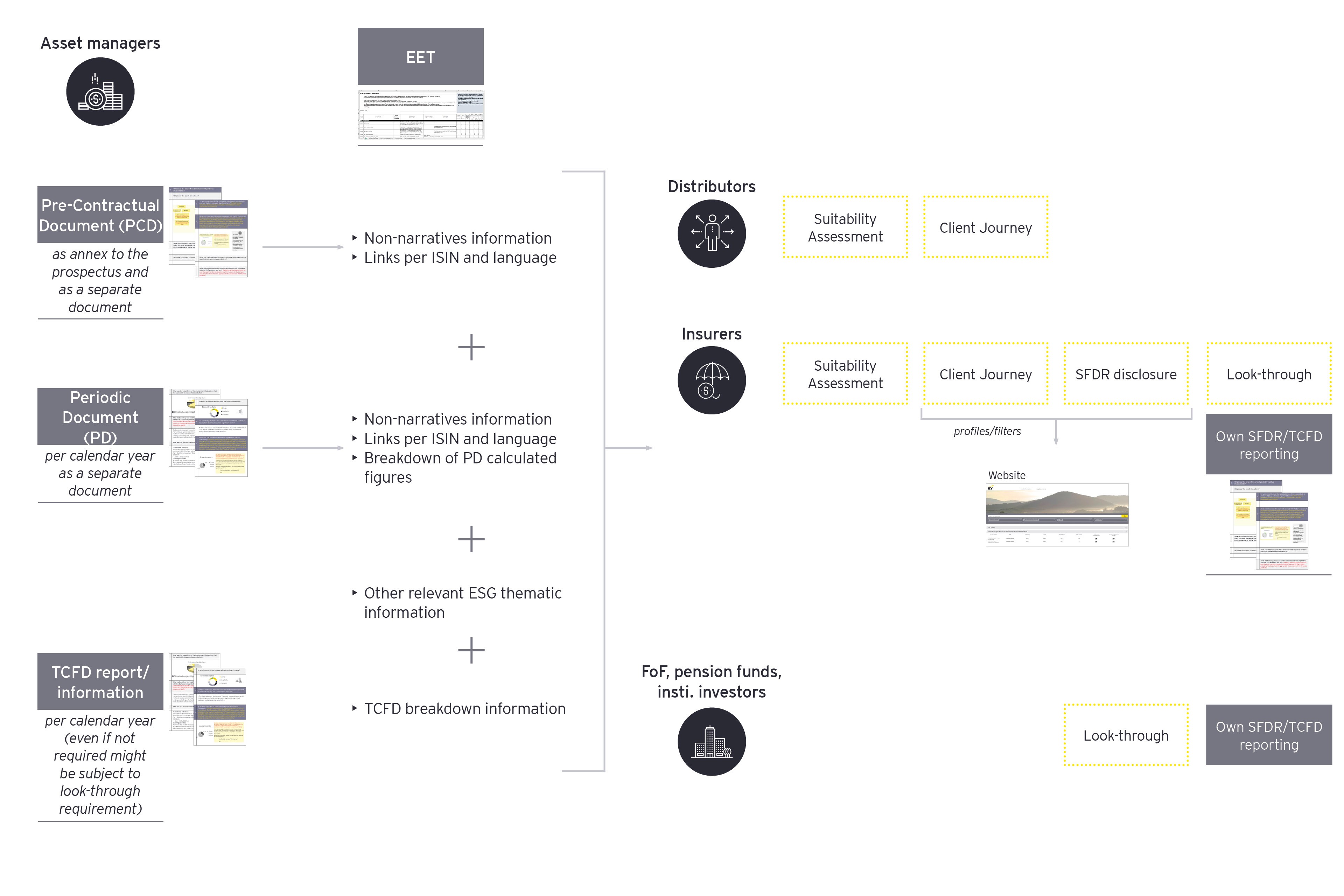

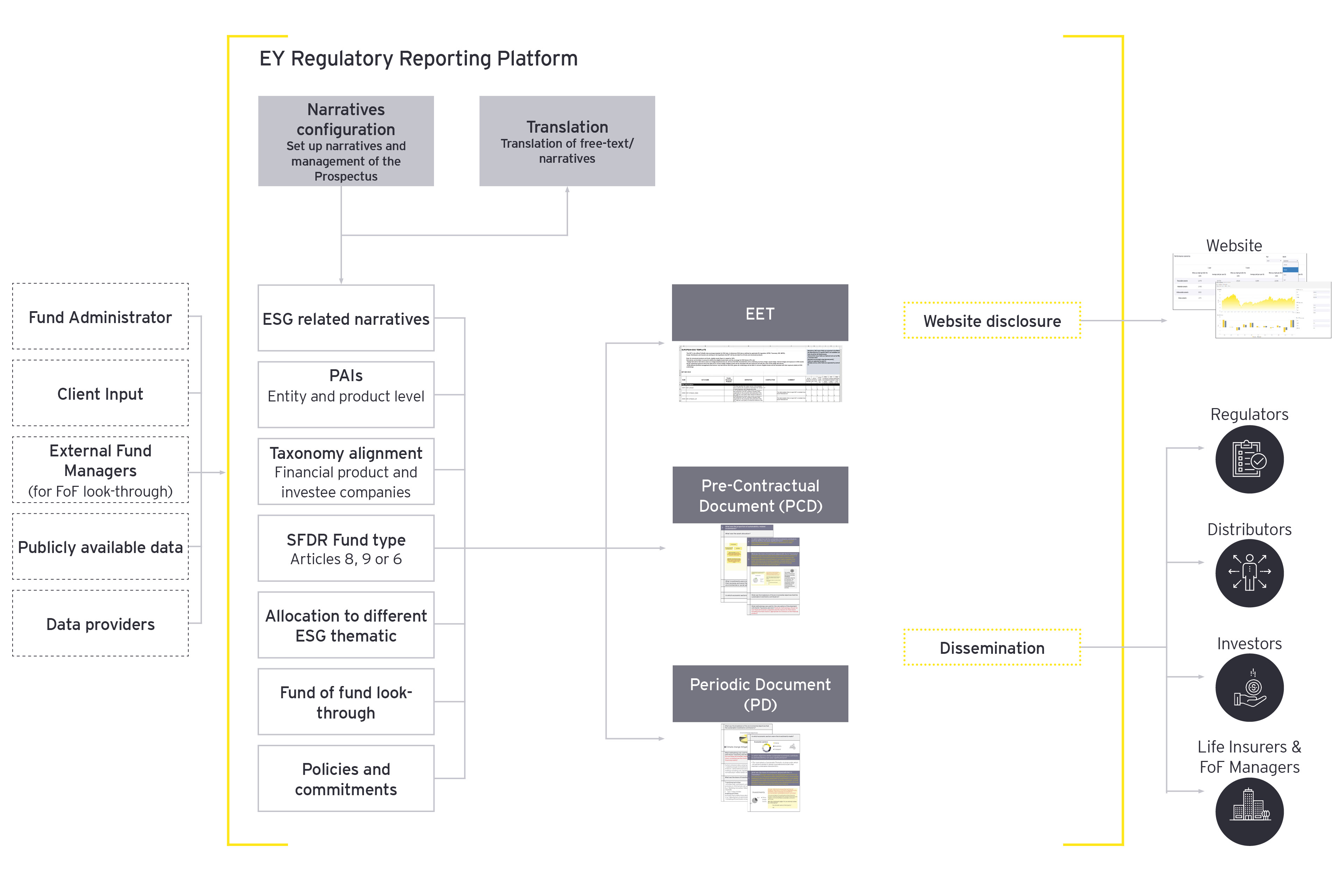

EY is an advocate for the standardization of the ESG data exchange and has therefore been deeply involved in the FinDaTex working group, which is working collectively to establish the European ESG Template (EET). The EET builds on the outstanding success of the EPT and EMT standardization. It is thus no surprise that EY’s life insurance clients see the EET as a natural extension to EY’s PRIIPS data collection service and EY’s data hub, which is connected to 300+ asset managers.

From 1st August 2022, distributors and insurers must comply with the MiFID II & IDD SFDR requirements for suitability assessment. In order to facilitate this regulatory requirement, asset managers will need to disclose the EET by 1st June 2022 (MiFID and IDD fields only).

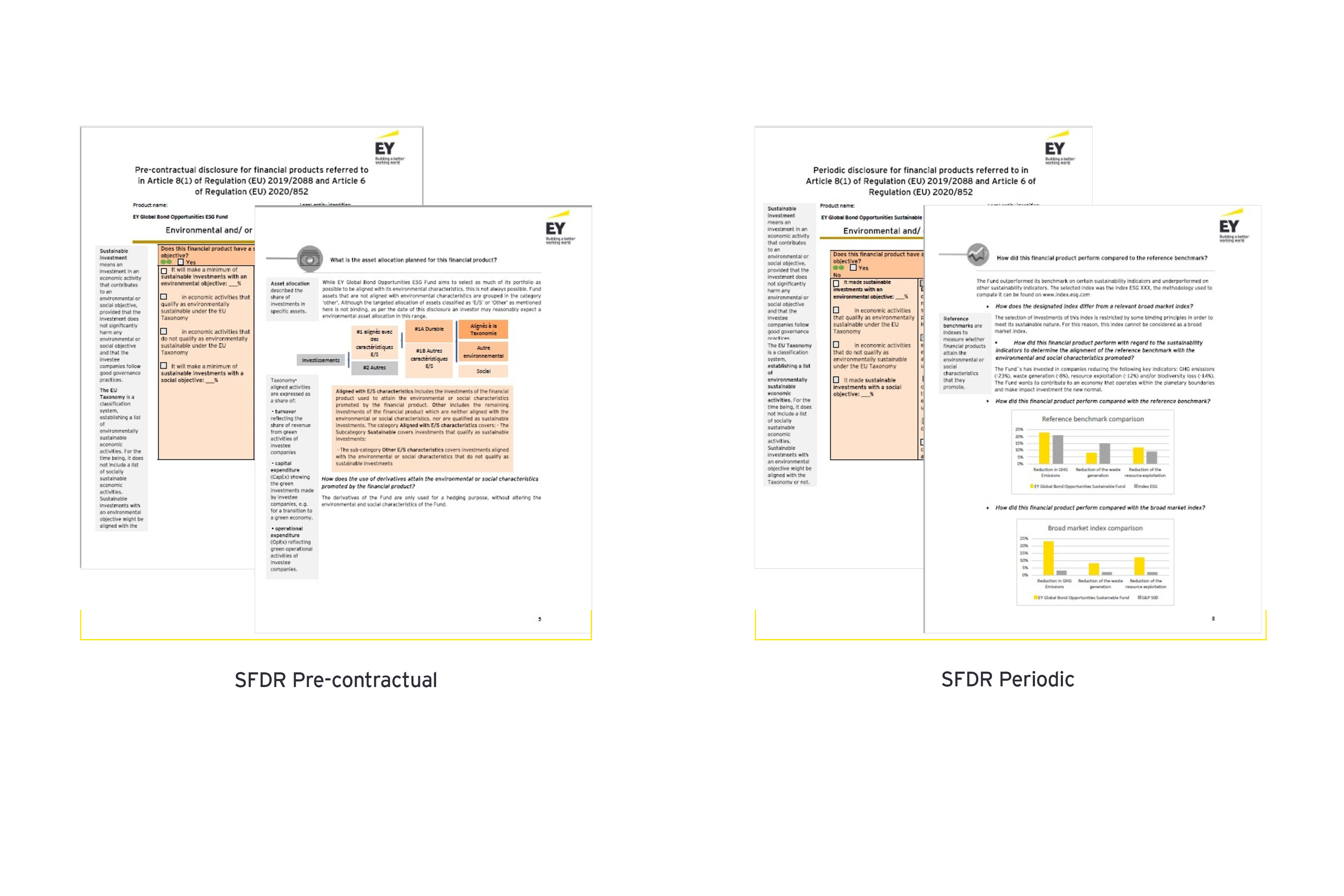

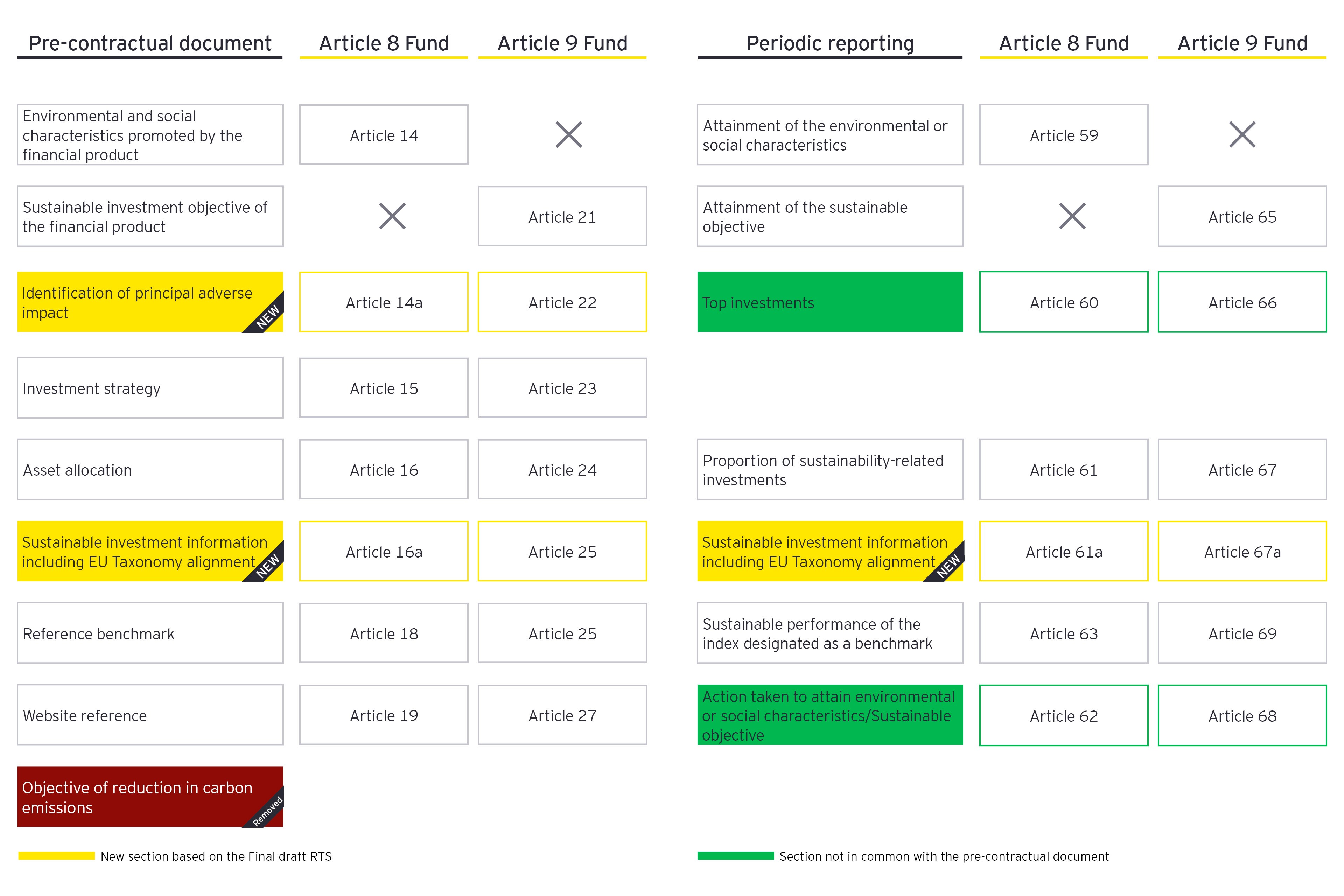

While the RTS requirements for SFDR and Taxonomy disclosures have been postponed to 1st January 2023, the CSSF is encouraging early compliance on a best effort basis. Many asset managers are now focusing on developing pre-contractual information in a separate PDF document and sharing this with distributors and insurers ahead of the deadline.

Meanwhile, the UK’s FCA has published the TCFD final rules for entity and product reporting dedicated to asset managers, life insurers and FCA regulated pension providers. The first reporting date is set to 30th June 2023. On the one hand, asset managers will need to prepare the reports for their funds and portfolios. On the other hand, funds, which are not directly in scope (such as those that are EU domiciled) might need to share the TCFD information through the EET template, because they are included in a UK product.

Have you considered how to efficiently produce the EET, TCFD report, pre-contractual (PCD) and periodic documents (PD) in the relevant languages? Do you know what steps to take to comply?

Contact us to find out everything you need to start producing your SFDR disclosures, Taxonomy alignment and TCFD reporting as well as to familiarize yourself with the 600+ EET fields.

Value add for ESG reporting implementation services

- Impact assessment of your current capabilities on the SFDR & taxonomy, EET & TCFD reporting reqiurements to help you get up to speed quickly

- Implementation to support a fast-track transition

- Reviews of reports, data & process with market insights across Europe

Value add of EY's Regulatory Reporting Service

- Cutting-edge reporting platfrom bringing end-to-end efficiency

- A one-stop service for regulatroy reporting

- Regulatory and market practice knowledge helping you stay compliant

- Exceptional client service