Chapter 1

A customer imperative

The ever-evolving customer journey is reliant on the transition to consumption-based business models.

Changing customer needs are at the heart of this switch to consumption-based business models. With an accelerated pace of innovation, customers see the need to maintain flexibility and update their infrastructure to stay competitive, and eliminate some technical debt. Consumption business models allow customers to remain current in their technology, reducing upfront costs and switching costs while only paying for what they actually use. Technology companies that fail to meet the customer need are at risk of losing out to nimbler competitors.

Preparing to migrate – but not yet ready

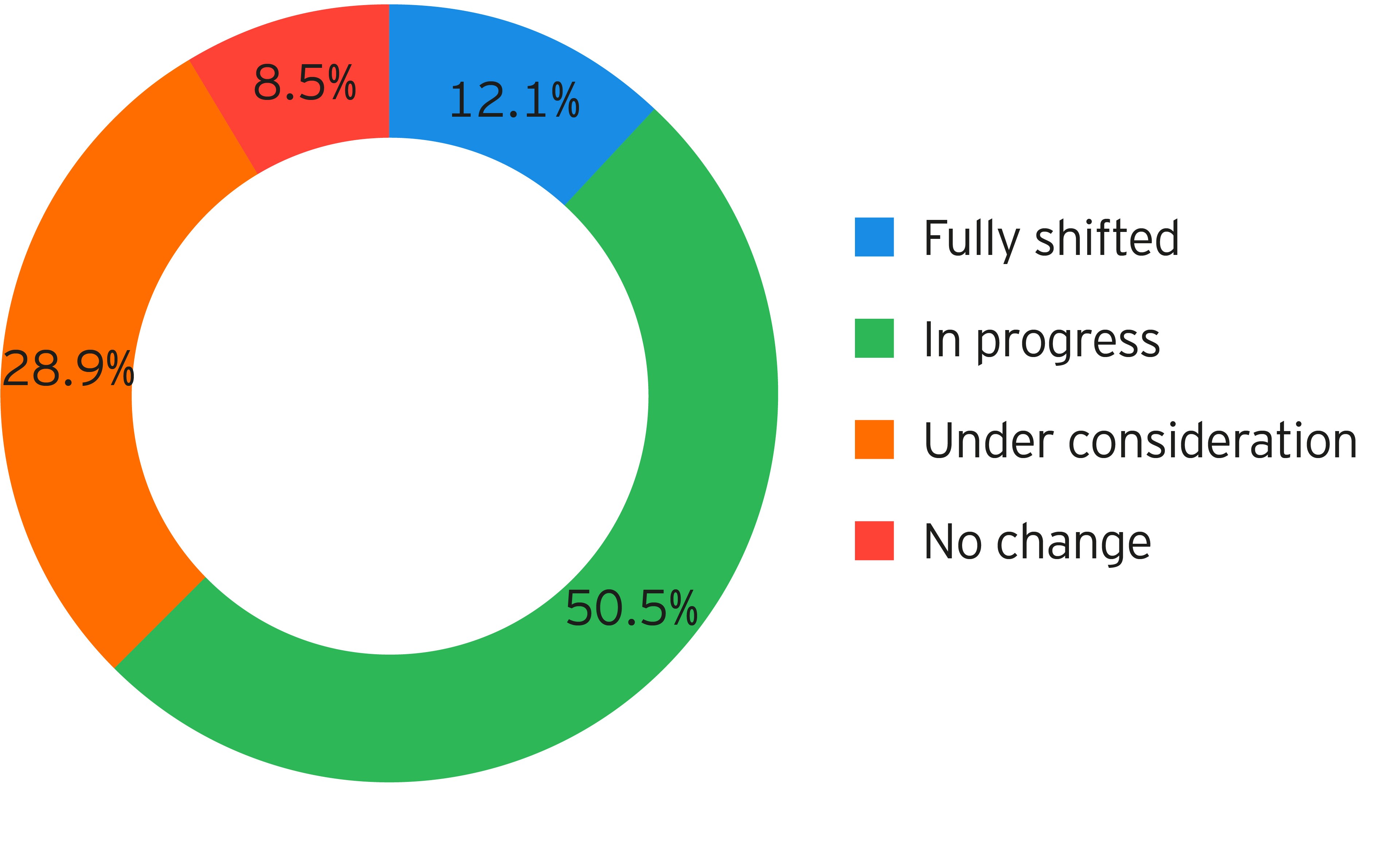

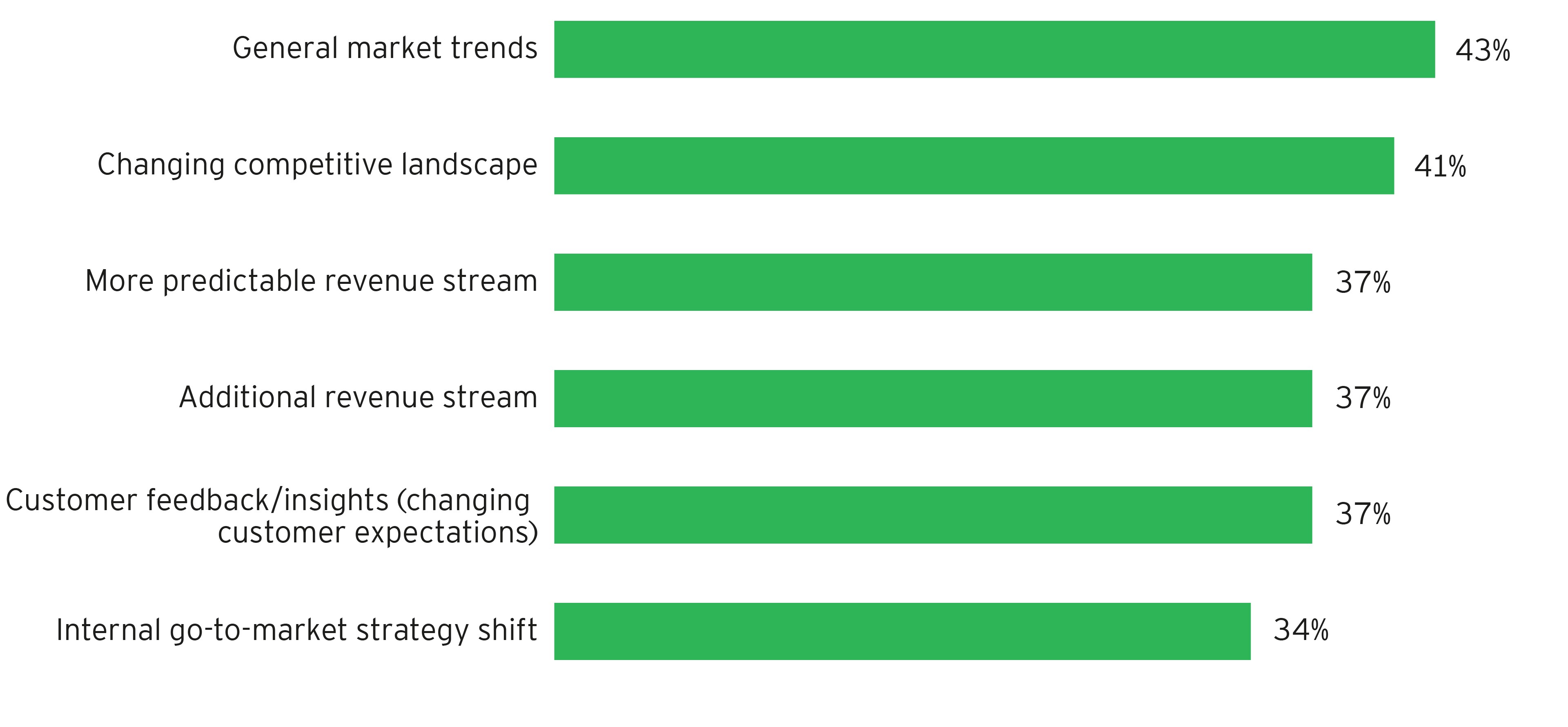

The unstoppable migration to a subscription business model also shines through in EY’s global study of 700 tech companies with annual revenues of at least US$500 million. More than 9 out of 10 have already made the move or are considering doing so, including 12% that have completed it. Survey respondents suggest the top drivers are general market trends, competitive shifts and the prospect of more predictable revenue streams. Improved customer feedback and insights are also strong drivers of change.

An industry-wide move

Over 90% of tech companies are embracing consumption business models – with just 8.5% holding out against the tide.

Which of the following best describes your organization's shift to a service/subscription model?

Which of the following best describes your organization's shift to a service/subscription model?

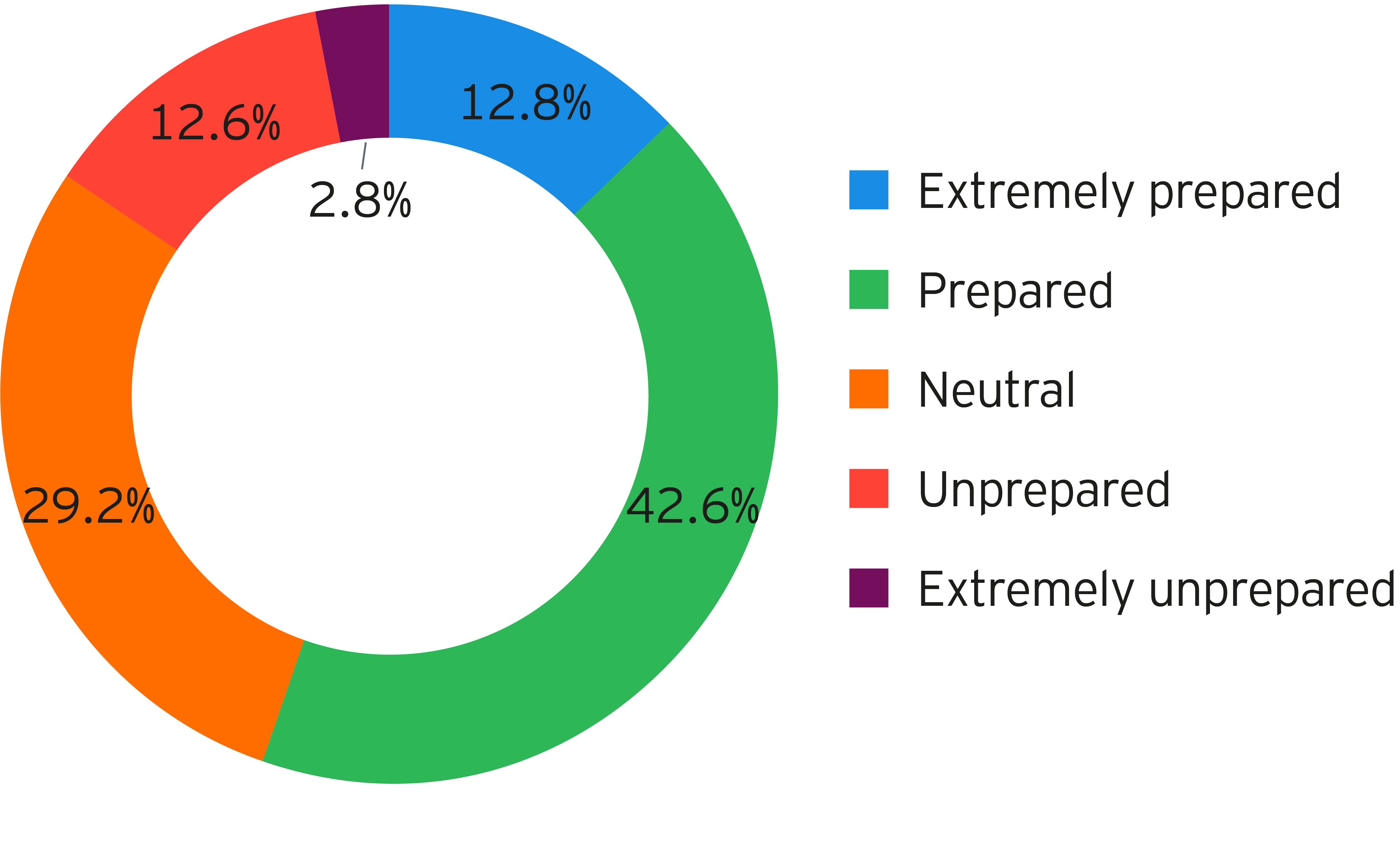

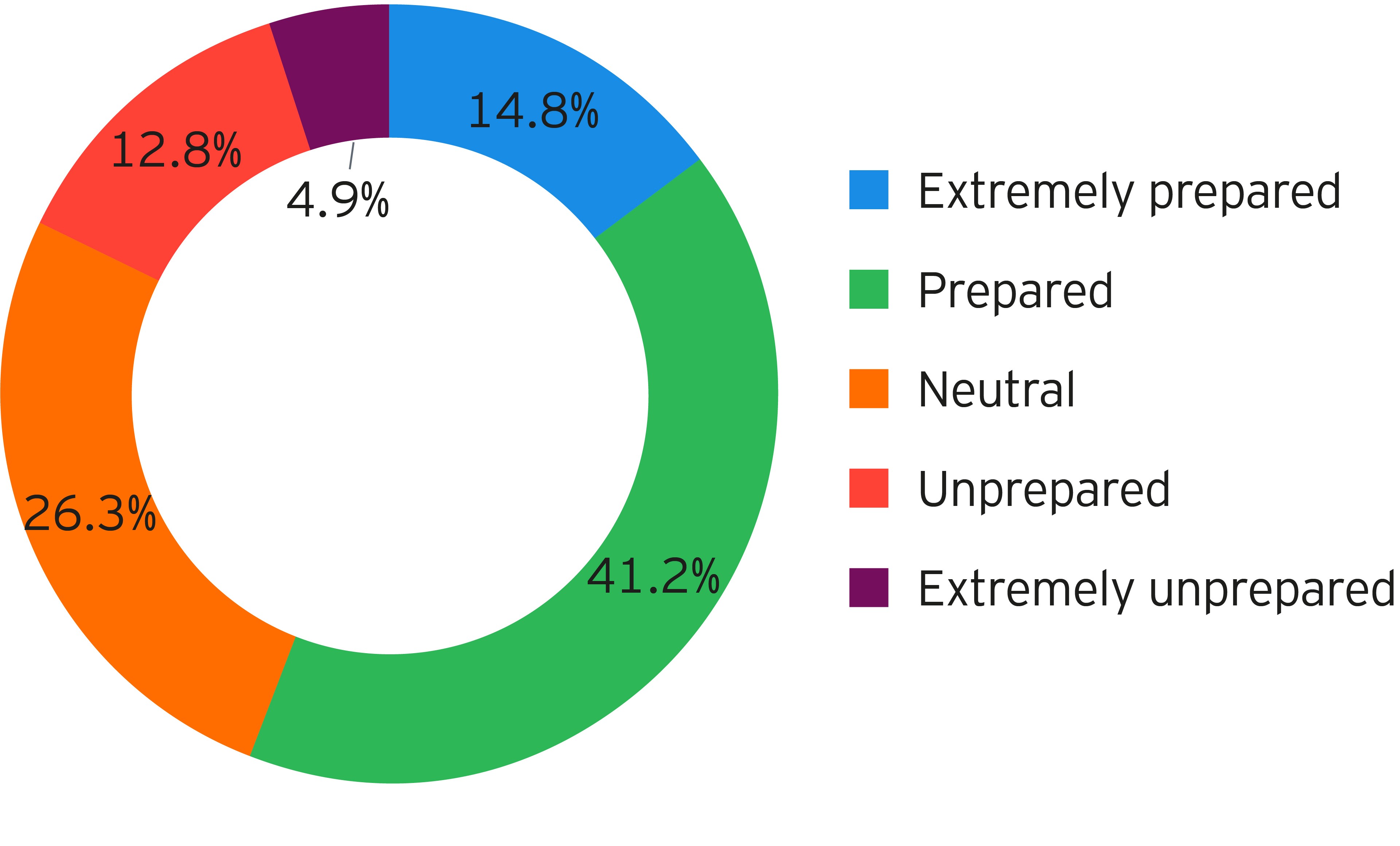

But while the shift to a consumption business model is almost universal, many companies are not prepared to execute it successfully across their enterprise. Forty-five percent are not sure of their organization’s readiness. Study respondents are concerned: marketing teams are unprepared to support the associated go-to-market activity and sales teams lack the talent, skills, and infrastructure to successfully sell their products on a subscription basis to their customers.

Limited readiness

While most companies are moving or have moved to consumptions, only 55% believe they’re ready – and just 56% think their marketing team is prepared for digital go-to-market activity.

State of organizational readiness at your organization to support the expansion into new models

Is your organization's marketing team prepared to support digital go-to-market activity

Much remains to be done to complete the shift…

The gap between companies’ aspirations to move to consumption-based models and their actual preparedness to do so underlines how much they still need to do to get effectively ready. To adopt a consumption business model effectively, an enterprise needs to retune its sales and marketing functions and transform processes such as lead-to-cash, financial planning and analysis, revenue recognition, and digital supply chain.

To accelerate the transition – and optimize the resulting revenue and efficiency gains – this end-to-end process transformation must be accompanied by technology enablement across the lead-to-cash value chain, involving areas such as marketing automation, CRM, CPQ, CLM, order management, billing, cash settlement and revenue accounting. A further requirement is the ability to track and report value change to support real-time business decisions.

…but the size of the prize makes it worthwhile

While the degree of operational reorganization required to support the switch to consumptions may appear daunting, the scale and scope of the benefits make it worth the effort and investment.

EY analysis shows these benefits range from optimized revenue potential to enhanced customer relationships to more effective cashflow management and more. The net result is to create a more robust platform for value creation, with increased revenues and customer lifetime value.

What is in it for businesses to switch to a consumption model?

Maximized revenue potential |

|

Enhanced customer relationships |

|

Frictionless product delivery |

|

Enhanced ability to scale |

|

Product/service improvements |

|

Effective cash flow management |

|

Chapter 2

How different is a consumption business model?

Tech companies must gauge their own readiness before making the transition.

So, how can companies gauge their own readiness to make the switch? The first step is to understand how a consumption business differs from a traditional product-focused or a perpetual license business.

Take the way vendors interact with customers. Today’s empowered customers are self-educating on the myriad technology options— forming opinions on preferred vendors through collateral, review sites, social media, and their peers. Successful marketing and sales efforts target those channels where customers go to learn, engaging with the right content and collateral to interest the buyer early at each stage of their buying process.

A consumption business is heavily dependent on continuous customer value creation, and will often provide customers with the opportunity to test products for free and sign up after a trial period. In the sales process, customers expect the same customer experience they get in their consumer-based interactions with vendors—easy to use, seamless, quick, and self-service. After purchase, managing customer success and adoption becomes critical to keep the business, driving to renewals and cross- and up-sell opportunities. Customers demand the flexibility to add, reduce or otherwise change their consumption patterns and have that reflect in their contracts and invoices at any time and frequency.

Companies selling in a consumption business model also tend to drive many more iterations of their offerings, testing out incremental features quickly in the market. And due to their lower up-front cost than traditional sales models, they are better able to attract higher numbers of smaller and mid-market customers.

Ways in which sales, marketing and IT must adapt

These differences drive a need for significant operational and systems change across product development, sales and marketing. For example:

- The marketing and sales functions must roll out campaigns in an accelerated and agile fashion to attract new customers at pace. This requires marketing automation tools to create and test campaigns quickly across multiple channels.

- Product trials play a strong role in customer conversion and adoption, with product trial data used to gauge customers’ propensity for change. To provide leads, the product trial systems need to communicate seamlessly with marketing automation and CRM systems.

- A consumption business model requires much stronger collaboration between marketing, sales and the back office due to the stronger role in data-driven lead generation. This means the marketing automation and CRM systems need to be closely integrated.

- Consumption sales requires a closer quoting cycle and quicker turnaround for customer requests, meaning the CPQ systems and underlying quoting, pricing, and contracting capability must be streamlined and optimized.

- Consumption companies are increasingly embracing self-service models and e-commerce capabilities to reduce costs and maximize customer reach and self-assisted sales, including payment options.

- Sales organizations must rethink how they go-to-market, changing focus from a transactional sales model to ongoing relationship management, focused on long-term customer success and adoption. Sales compensation models need to evolve commensurately.

- Since consumption customers may change their consumption at any time, the backend order management and billing system need to agile enough to handle this.

In combination, these shifts mean that a company looking to move smoothly to a consumption business model will need to reimagine its technology infrastructure. Existing IT toolsets may make this challenging. So the question is how to navigate the change.

To reinvent their operations and systems for a consumption world tech companies and EY are focused on these critical path items:

- Packaging, bundle and price metrics design

A leading human capital management SaaS company launched a next-generation HCM platform, and was facing critical decisions on packages and pricing. Together with the EY organization, they developed a range of different metrics options – including new bundled designs – to support aggressive customer acquisition and create more holistic, robust concepts going forward. - Lead-to-cash transformation

A global B2B managed cloud services provider was operating on a home-grown quoting tool, which required a series of approvals to provide customer quotes. Working with EY and a third-party CPQ software vendor, they streamlined the quoting process while delivering product and contract rationalization, pricing, sales process optimization and a channel partner strategy. - Finance transformation planning and design

A global technology conglomerate was seeking to enable sales to cross-sell legacy hardware products and newly-acquired software capabilities which leverage pay-as-you-go consumption business models. The core infrastructure of the organization did not support the new model, so they worked with EY to build a series of new order entry and accounting systems along with modifications to the product master attributes that enabled the client to properly sell, bill, and account for consumption-based software products alongside it’s traditional hardware.

Chapter 3

Getting it right

Knowing the right path forward can help tech companies navigate seamlessly and successfully.

As these case studies illustrate, tech businesses that take the right steps can navigate seamlessly and successfully to a consumption business model that dramatically elevates their growth trajectory. This is something several leading companies have already achieved.

Adobe launched its monthly consumption service in 2012 at almost 100 times less than the cost of the perpetual license. To smooth the transition for its customers, Adobe gave them an overlap period of almost five years during which it offered both the traditional purchase option and consumption services. The company also responded to suggestions from users by introducing lower-cost consumption options with limited functionality for some customer segments. The move to consumption has seen Adobe grow its recurring revenues from US$200 million in 2013 to US$5 billion in 2019.3

PROS, a publicly traded pricing, quoting and revenue management software company, saw an opportunity to reimagine its business as a consumption-based model and stay ahead of customers’ buying expectations. PROS quickly shifted its sales focus to consumption, and created a multi-year plan to drive existing customers to the cloud through innovation. In this process, PROS completely redesigned its next generation solutions with the cloud in mind. The company went from selling 50% cloud solutions in 2015 to 95% in 2017. As of 2019, over half of all customers have made the switch to a consumption business model. Implementation times have dropped by 40% and sales cycle times have dropped by one-third. The financial outcome for making this shift is a 48% consumption revenue CAGR since 2015.

Contact us

EY can develop a custom benchmark to help you understand how you are progressing against leading practice organizations. Get started today.

Summary

Customer flexibility and business resiliency mandate companies look at complimentary business models to maintain relevance, customer satisfaction and competitiveness. Though SAAS business models first gained popularity in the early 2000s, subscription business models are evolving and expanding across all types of companies. Our global survey of 700 technology companies sheds light on how they’re thinking about subscribing to products and services and where they are in this transition. Of the 700 respondents, 90% stated they have or are in process of shifting to a consumption-based business model, and 55% were confident their enterprise was ready to operationalize the shift.