Over five decades, Kuala Lumpur (KL) has evolved to become a dynamic, digital and diverse regional hub in Asia. KL’s growth transformation is pivoting towards next-generation digital industries, from e-digital platforms, Internet of Things (IoT), robotics, advanced medical technologies through to high-value Global Business Services (GBS).

Digital: next-generation sectors

Recent years have seen multinational corporations (MNCs) take strategic decisions to centralize their Asia-Pacific operations in cost-competitive locations to better manage their supply chain activities. KL is a key beneficiary of these investment waves. Next-generation sectors that are attracting global investors include Industry 4.0 high-technology manufacturers and service providers. Among them are:

- Digital e-platforms: Driven by the strong demand of the young adult segment, Malaysia’s e-commerce sector is projected to grow to nearly US$10b (RM42b) between 2018 and 2022, with a compound annual growth rate (CAGR) of 17%. Supportive government policies and policy frameworks such as the National Fiberisation and Connectivity Plan (NFCP), National eCommerce Strategic Roadmap and Malaysia Smart City Framework have facilitated the e-commerce and digital economy growth in the country. Numerous leading regional e-commerce players have established their regional distribution centers, e-fulfillment hubs and distribution warehouses in KL.

- Robotics and industrial products: Malaysia is rated as a “leading” Asia-Pacific country in its readiness to adopt Industry 4.0 technology, including robotics, by the Readiness for the Future of Production Report 2018, World Economic Forum. Industry analysts anticipate significant robotics adoption opportunities in Malaysia’s small and medium-sized enterprise (SME) sector, of which 98.5% are manufacturing companies.

- IoT: KL is advancing to become a smart city, leveraging IoT-based solutions including artificial intelligence (AI) and big data analytics to generate real-time traffic tracking using video and image recognition technologies. The implementation of Malaysia’s NFCP provides higher speed and quality connectivity to accelerate KL’s digital economy.

- Advanced medical technologies: Malaysia is increasingly recognized as the region’s medical technology hub, producing a broad range of products from medical-grade gloves, diagnostic imaging equipment to high-tech, digital medical technologies. With KL’s conducive technology ecosystem, the capital city continues to attract global MNCs to establish their regional center of excellence (CoE) and core support functions.

- GBS: Leading MNCs, from insurance services to advanced technology innovators, have relocated their Asia-Pacific “high-value, high-impact” central operating models to KL, leveraging Industry 4.0 technologies and information and communications technology (ICT) talent pool. Malaysia ranked top 3 in the Global Services Location Index 2019, AT Kearney, supported by favorable business environment, competitive labor costs and productivity of skilled professionals. Malaysia’s share of global GBS activities has expanded to 42%, with information technology leading Malaysia’s GBS activities, followed by business process and knowledge process.

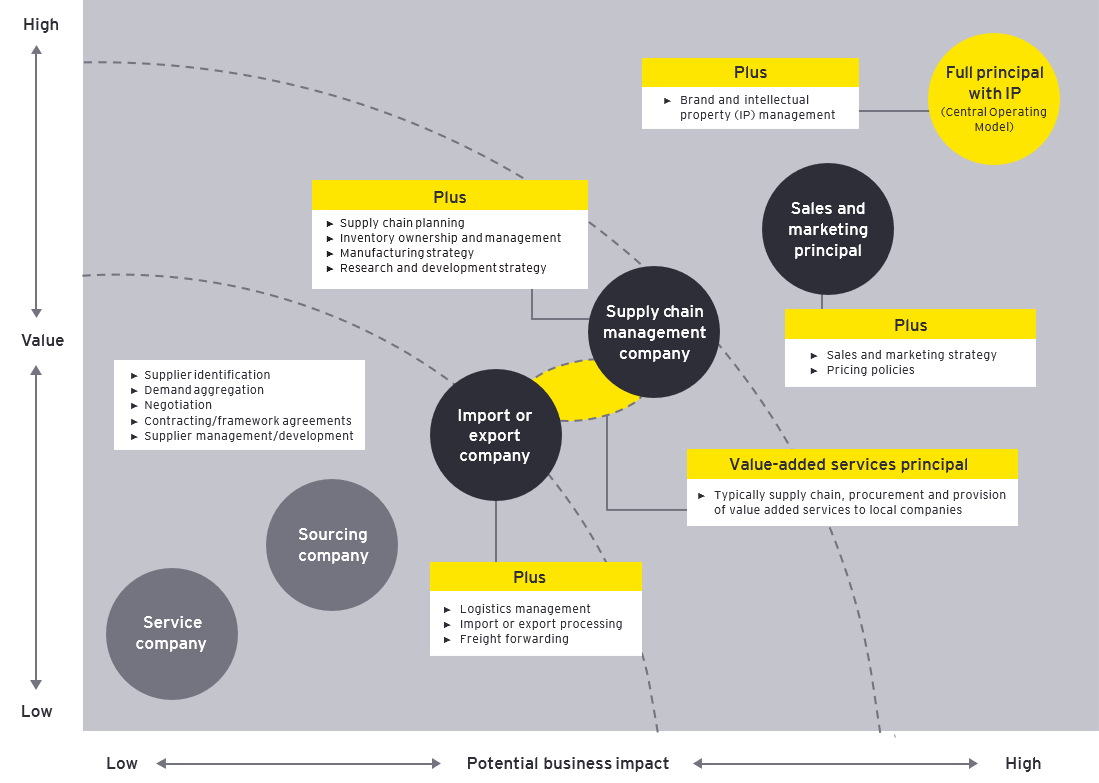

Before the COVID-19 pandemic, amidst a challenging global business environment, leading MNCs were optimizing their business models to aspire for “high-value, high-impact” central operating models.

Chart 1: Optimizing operating business models