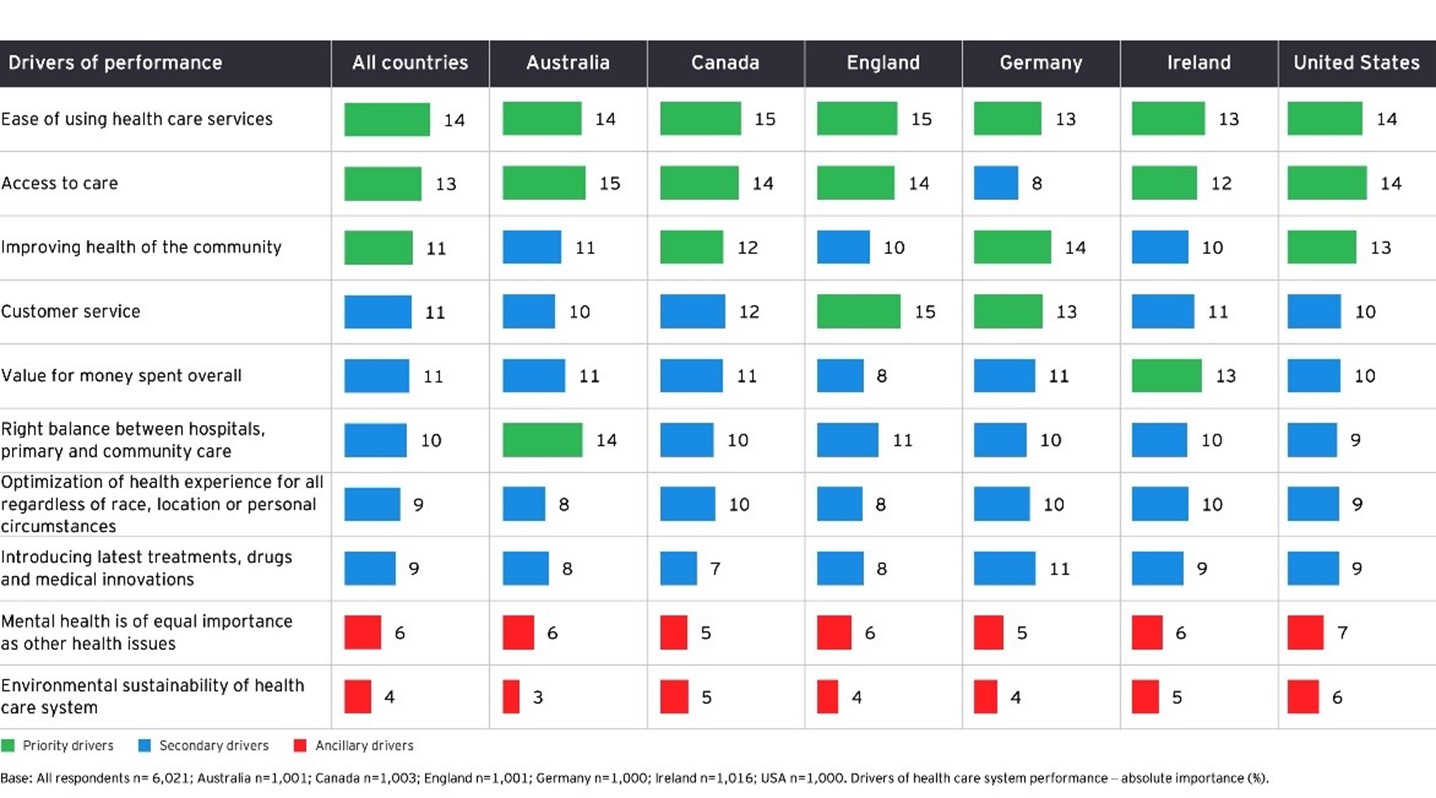

This analysis creates four quadrants defined by plotting the importance of the different aspects of the health care system (on the X axis) and rating those same statements (on the Y axis). This analysis can assist in identifying potential areas of opportunity to leverage.

Five clear priorities for health executives to give consumers the access and experience they value most:

1. Rethink how consumers access your system.

With access to care being most valued by consumers, think through how your consumers engage with various points in your system. Are your processes easy to navigate from a patient perspective? With staff shortages and other challenges, it may be difficult to eliminate all sources of frustration like wait times, but better communication about the cause of waits or what they should expect can make consumers feel less in the dark. Are you communicating to certain groups in meaningful ways? And when patients leave your care, are the next steps seamless, or could they cause confusion? Routing patients to the most appropriate sites of care is also important in reducing unnecessary visits to high-cost sites. The survey findings also show that people want to feel better and lessen their pain, so their engagement with the system should focus on lessening that pain and frustration.

2. Empower consumers with digital tools and technology.

Some of the friction consumers experience when trying to access health care services can be addressed with intuitive digital tools that keep them informed and lead to more consistent engagement. Do you have digital front doors that help them find what they need when they need it? Can you automate communications according to their preference for text, phone or email to keep them informed of their care process or to nudge them to take proactive steps?

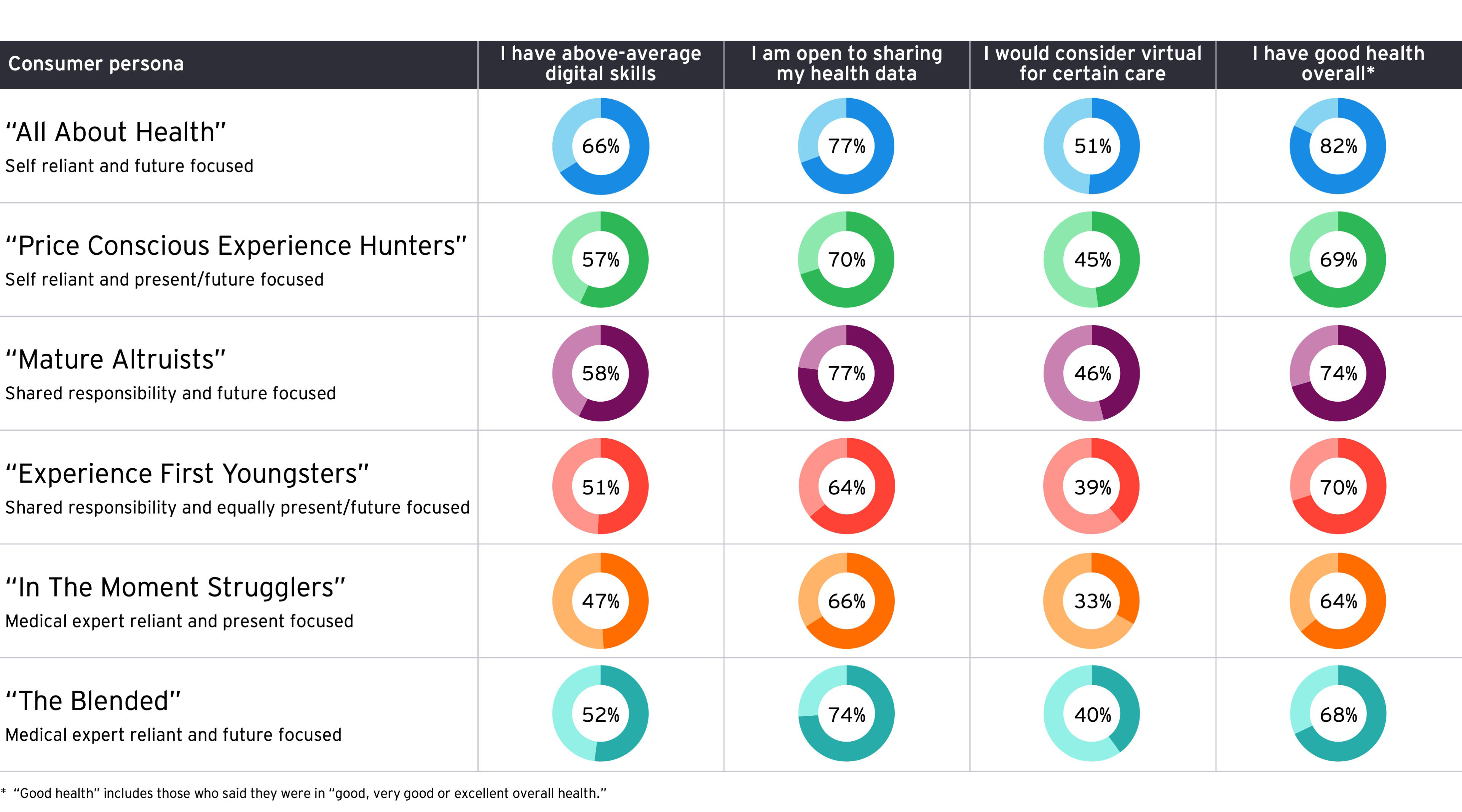

3. Design better consumer experiences with data insights about your populations and their preferences.

The first step for health organizations is to root their consumer engagement strategies in a deep understanding of their customers guided by data insights about the reality of how they live their lives. Consumers at different stages of life value different modes of care — busy professionals and rural residents may value virtual visits more, while an elderly patient without a smartphone may value seeing their physician face to face. Design care pathways according to those different personas, the barriers to care they face, and their preferences

4. Improve the virtual experience and integrate it seamlessly where it makes sense.

The survey results suggest more work for health organizations when it comes to the virtual care experience to build trust and better relationships with consumers. As learned during the pandemic, it takes extra skill to develop personal relationships through a computer or phone screen, and the survey results suggest consumers doubt their ability to bond with clinicians over video. Training efforts to boost the ways that clinicians can make patients feel seen and heard during virtual visits can help improve the experience and increase consumer confidence in it. Opportunities exist to expand virtual in areas where consumers indicated interest: to offer more convenience or address delays in scheduling. Personalized strategies that again consider the lives of the patient and their preferences can help land on integrated strategies that make sense. Communications with consumers should stress the message that virtual care is part of the overall process and not less than other care modes.

5. Educate consumers on the value of data sharing and new technologies to improve health.

While consumers indicated openness to data-sharing, they were a bit more hesitant about products that could be perceived as too futuristic for now. As the care delivery model shifts toward the home, powered by wearables and informed by patient data, consumers need to be brought along step by step so they can develop comfort with health care settings that may seem unconventional today. The survey found that 60% to 67% of individuals believe that remote monitoring and delivery of patient care will become a reality in the next ten years, so health systems can start educating them on how these technologies can help keep consumers healthier at home longer and provide better value for the system and the consumer.

Special thanks to the following individuals who contributed greatly to the EY Global Consumer Health Survey 2023:

Aishwarya Benjwal, EY Health Sciences and Wellness Analyst; Sheryl Coughlin PhD, EY Health Sector Analyst; Rachel Hall, EY US Consulting Digital Health and Smart Health Experience Leader; Kenny O’Neill, Principal, Digital Health Consulting, Ernst & Young LLP; Aakanksha Kaul, EY Health Sciences and Wellness Analyst; Crystal Yednak, EY Global Health Senior Analyst.

Summary

The EY Global Consumer Health Survey 2023 found that access to care is the top factor they perceive as highest in value. In light of this finding, health executives should focus on removing barriers and delivering the hassle-free care models consumers want. The high value consumers place on cost-effectiveness and relief from pain and anxiety should also be prioritized in efforts to improve health care systems globally.