COVID-19: Short-term Economic Recovery Plan

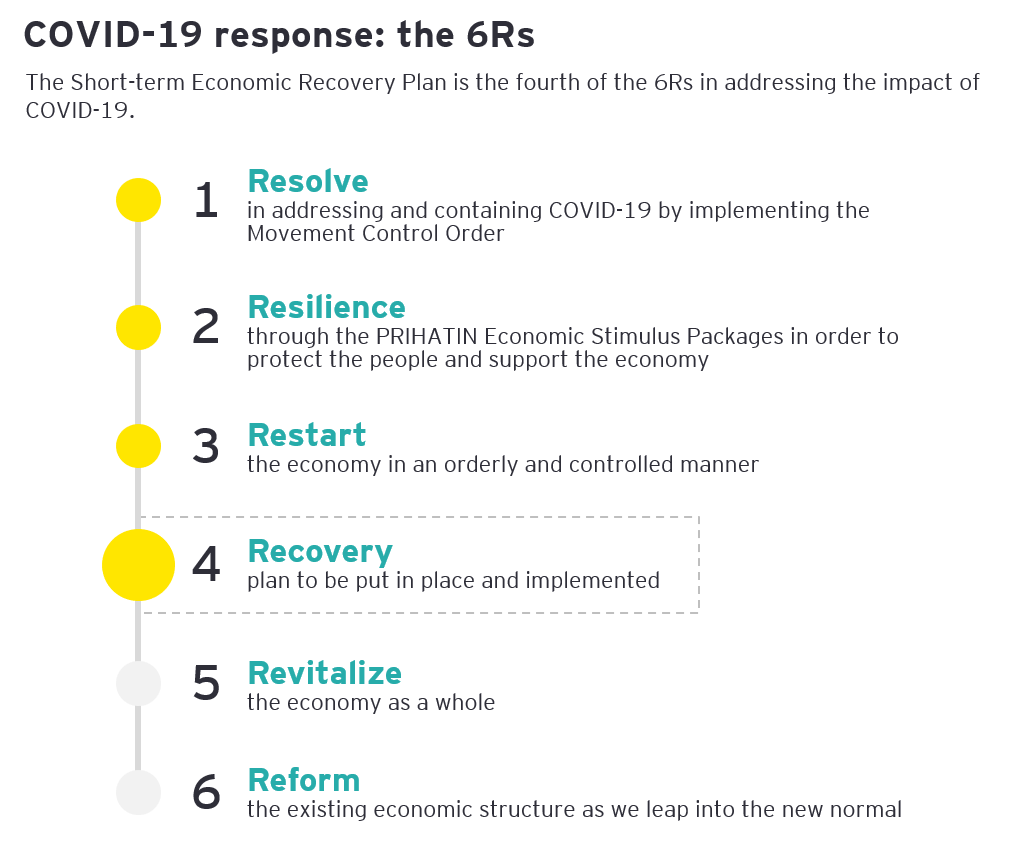

On 5 June 2020, the Prime Minister unveiled the Short-term Economic Recovery Plan (“Plan”). This Plan was unveiled against the backdrop of a pessimistic global economic outlook and a steep decline in Malaysia’s economic growth projections for 2020, from 4.8% to -2% to 0.5%.

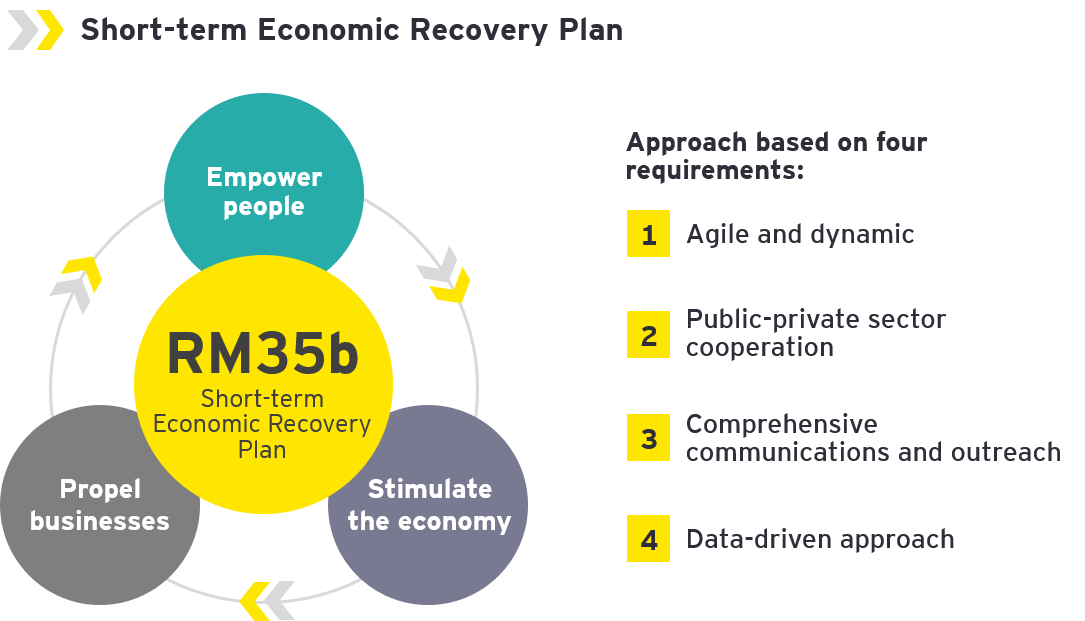

The RM35b Plan was developed around the broad themes of empowering people, propelling businesses and stimulating the economy.

Addressing the now

The announcement saw additional measures to support small and medium-sized enterprises (SMEs) and the rakyat, especially vulnerable groups and the B40. These include the extension of the Wage Subsidy Programme and additional financing measures.

Focusing on the next and the beyond

COVID-19 has accelerated the need for digital transformation. To facilitate and support this, the Government has now introduced various initiatives and measures to encourage digital adoption by businesses.

The Government itself is also accelerating the digitalization of its services in areas such as stamp duty and unclaimed monies matters. It is expected that the Government will continue to increase the use of technology in its interactions with the public and delivery of services under the new norm.

There are also various measures aimed at encouraging local entrepreneurship and promoting investments. For SMEs, measures have been introduced to spur the setting-up of new businesses i.e. income tax rebates and stamp duty exemption for mergers and acquisitions. Further, generous incentives in the form of tax holidays and special reinvestment allowance were announced to encourage investors to relocate large operations to Malaysia.

Combined with our world-class infrastructure network, connectivity and multilingual talent pool, these incentives will position Malaysia as one of the most competitive countries in ASEAN for foreign direct investments. The Government’s promise of greater efficiency, for example the issuance of manufacturing licenses for non-sensitive industries within two days, will also boost investor confidence.

The Government has also introduced a “Buy Malaysia” campaign. As part of this campaign, big supermarket chains will be required to tag Malaysian products and dedicated Malaysian product channels will be introduced on major digital platforms. Further, the Government will co-fund digital discount vouchers to encourage online purchases from local retailers.

Overall, the Short-term Economic Recovery Plan focuses on the right priorities – saving jobs and preserving business continuity, digitalization, encouraging high-value investments and further improving Government efficiency.

People measures |

|

| Addressing unemployment |

|

| Real estate |

|

| Others |

|

Business measures |

|

| Wage Subsidy Programme |

|

| Addressing unemployment |

|

| Digital |

|

| SMEs and micro enterprises |

|

| Tourism |

|

| Bumiputera businesses |

|

| Agriculture |

|

| Creative industry |

|

| Social enterprises |

|

Tax measures - Individuals |

|

| Real estate |

|

| Reliefs and exemptions |

|

Tax measures – Businesses (General) |

|

| Accelerated capital allowance (ACA) for the purchase of machinery and equipment1 |

|

| Deduction for cost of renovation and refurbishment1 |

|

| Flexible Work Arrangements (FWAs) |

|

Tax measures – Businesses (By sector) |

|

| Manufacturing |

|

| SMEs |

|

| Tourism |

|

| Property owners |

|

Tax measures – Indirect Tax |

|

| Penalty remissions |

|

| Tourism |

|

| Automotive |

|

| Commodities |

|

Other measures |

|

| Sukuk PRIHATIN |

|

| Temporary legislation |

|