Chapter 1

How DEs are formed

A critical aspect of the DE strategy is the decision to participate in the ecosystem as an orchestrator, partner or enabler.

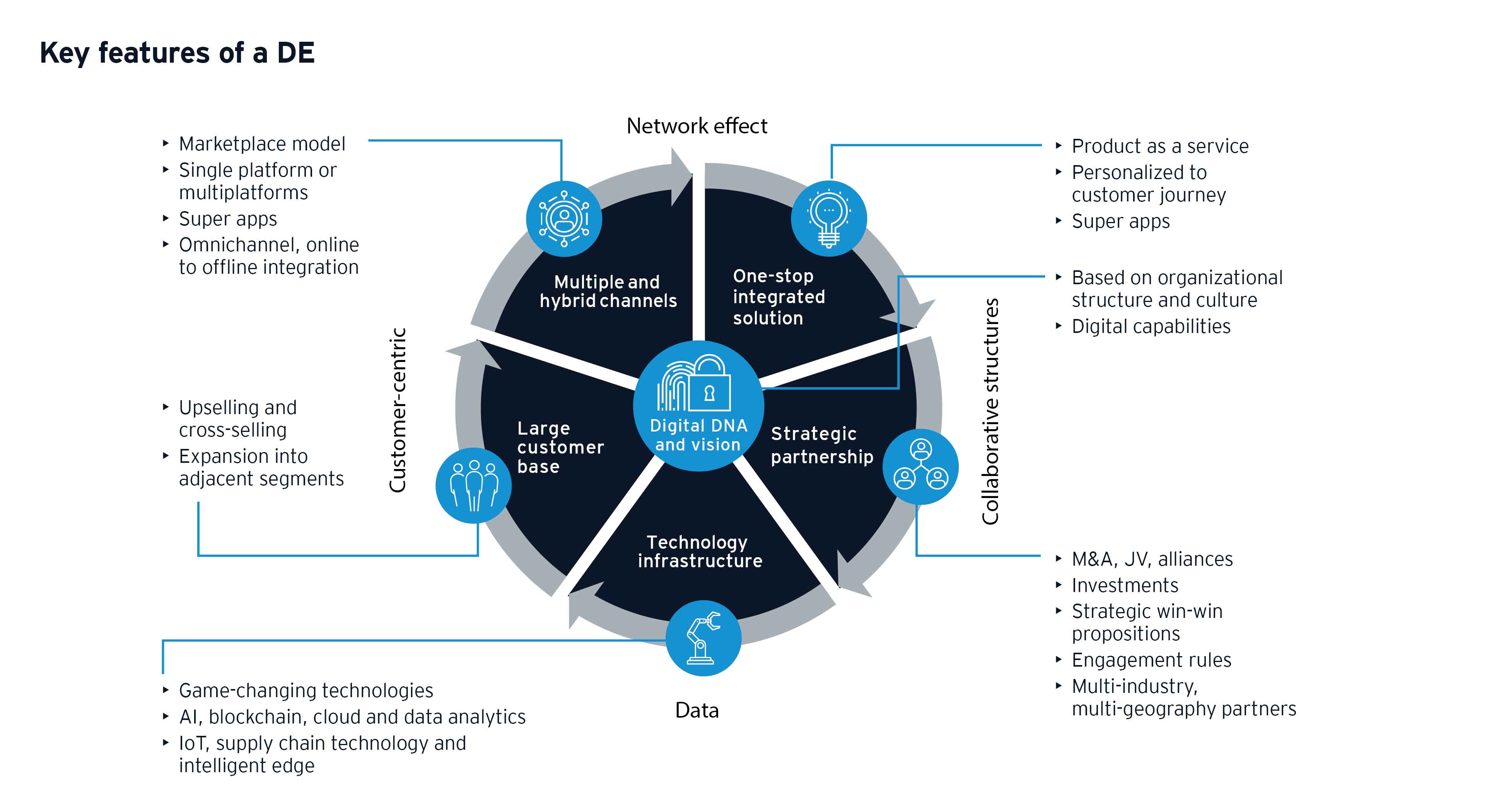

A DE is formed through the combination of platforms — or omnichannel architecture that delivers value to the customer through personalized products and services — and strategic partnerships. DEs are not just about partnerships and M&As; they also involve creating a network of enterprises that facilitates and encourages sharing of data, applications, technology infrastructure and capabilities. The shared elements of a DE tend to complement and enhance one another, resulting in improved innovation, digital experiences and trust, as illustrated below.

Enterprises from various sectors can participate in the DE as an orchestrator, partner or enabler and deciding which role to assume is a critical aspect of the DE strategy. An orchestrator plays a pivotal role in the DE by tying together different entities in the ecosystem. These may be technology leaders or established companies that leverage their capabilities and user base to create platforms to serve customers across the business value chain.

In recent years, another category of digital native start-ups has emerged to take on the role of an ecosystem orchestrator. Southeast Asian decacorns in the ride-hailing and online delivery segments are examples of consumer technology start-ups that have rapidly expanded their capabilities to offer products and services across multiple categories in one integrated experience.

Companies can also participate in the DE by being a partner to the orchestrator to offer capabilities in segments adjacent to the orchestrator or provide domain-specific technology expertise. In Indonesia for example, legacy automotive manufacturers have entered partnerships with ride-hailing start-ups for electric vehicle projects. Technology platforms like mobile payment processing and point-of-sale solution providers are also tying up with ecosystem orchestrators to offer core technology capabilities in the DE.

The third component of a DE is the enabler that adds value to the ecosystem by offering add-on capabilities like analytics and data-driven insights to help optimize ecosystem operations, while maximizing returns. Players in this category have immense opportunities to provide offerings to multiple industries across their respective value chains.

Chapter 2

DE opportunities in sectors across Southeast Asia

While pursuing DE opportunities, traditional players across sectors must also address increasing competitive pressure and other challenges.

Southeast Asia holds great potential for DEs amid a favorable backdrop. The region’s emerging markets are expected to be among the fastest-growing digital economies, driven by rising internet and smartphone penetration, a growing tech-savvy middle-class population and strong governmental support. Market or sharing economy business models are also becoming popular in the region, which has seen the rapid growth of digital native businesses. Some of these businesses are transforming into super apps by bringing multiple segments onto a single platform, offering opportunities for cross-selling, up-selling and reducing sales and marketing expenses. Such apps are on the rise. Super apps across Southeast Asia witnessed a significant US$50b worth of investments from 2016 to 2020. This is expected to offer a US$23b revenue opportunity by 2025, up from US$4b at present.3

While a DE offers all participants across the value chain numerous opportunities, there are also challenges, such as deciding which role to play in the DE and how to achieve it. To realize the DE’s full potential, the organization needs a robust DE strategy, regardless of where it is in its DE journey. The DE strategy must be aligned with the overall strategic vision and consider how existing incumbents and disruptors will affect participation.

The speed and extent of digital transformation varies across different sectors depending on their ability to pivot quickly toward new business models and adapt to change. While consumer-facing sectors like technology, media and telecommunications, financial services and health care are leading in digital adoption, legacy industries like energy and infrastructure have seen limited adoption. Technologies that witness significant adoption across sectors include cloud computing, artificial intelligence (AI) and the Internet of Things (IoT).

Telecommunications

Southeast Asia’s telecommunications industry has seen a shift in demand from the voice segment to the data segment over the last few years, driven by the growth in smartphone and internet penetration as well as digital services.

Increasing competition from OTT providers has shifted telecommunication companies’ focus from B2C to B2B markets, which may present revenue opportunities, such as network and IT services, cloud services, voice and data connectivity.

5G offers operators both opportunities for new digital services and challenges like heavy investments and operating model changes. When combined with IoT, AI and analytics, 5G will enable operators to provide broader B2C digital services (such as augmented reality and ultrahigh definition) as well as B2B ones (such as telehealth and industry 4.0). However, such complex solutions require building a DE that operators can orchestrate to provide these services.

Network planning, building, operation and maintenance will become largely analytics-driven through self-learning AI as well as predictive and preventive interventions. Social media has enabled the formation of digital communities to share network data between peers, which will help increase the customer base for telecommunication companies.

With cross-industry convergence, telecommunications players can expand their business and drive growth in areas like TV and media, cloud services, payments, connected vehicles and smart homes.

Financial services

Convergence of technology and financial services will continue as FinTech start-ups diversify their products, services and geographical presence and partner with incumbents to expand the customer base.

The entry of new players like digital banks is expected to intensify competitive pressure as digital natives leverage their technical and operational expertise. Traditional financial services businesses therefore need to embrace technological transformation and collaborate with other ecosystem participants for sustainable growth.

The industry is expected to see increased collaboration between financial services players and emerging players entering the market, such as Big Techs, telcos, FinTechs and e-commerce firms. For example, Southeast Asian banks can acquire or partner with FinTech players or companies from non-financial segments to create a one-stop, integrated experience for consumers as the COVID-19 pandemic increases demand for online banking services.

Health care

Health care providers across Southeast Asia face a rapidly changing market, with shifting patient demographics, aging populations and understaffed hospitals. Public-private partnerships between hospital operators, medical device manufacturers, HealthTech providers and private equity investors are driving a shift toward digital health care delivery. Adoption of remote health care via computers or mobile devices is on the rise and further accelerating the formation of digital health ecosystems.

By leveraging integrated systems, health care companies can deliver convenience, engagement and value from screening, diagnosis and treatment to recovery and home delivery of medicines. Electronic medical records integrated with telemedicine platforms and connected to patient wearables allow seamless information interchange between offline and online care. Blockchain adoption will also help improve data security and accuracy of electronic health records through storage on a distributed ledger.

Consumer products and retail

Consumer companies are driving growth in digital capabilities as they move toward digital channels and subscription services to sell directly to consumers. However, traditional consumer companies operating solely through a physical retail model also face competition from online marketplaces that have launched private label brands.

Consumer packaged goods businesses are seeking to own end-to-end supply chains and enhance each stage with technology like IoT and robotics to create intelligent supply chains. The physical store of the future is expected to be repurposed as a distribution center and a means to gather customer data, while IoT-enabled manufacturing will improve factory processes through predictive maintenance and proactive monitoring of product quality and safety.

Real estate

The increasing use of smart sensors to identify potential issues and allow predictive maintenance is part of a broader shift toward IoT-enabled smart cities. With increasing funding in the property technology segment, PropTech start-ups are expected to thrive in the region as traditional players continue to partner with these firms and invest in them.

Real estate companies are recognizing the blockchain opportunity to improve efficiency, security and transparency through use cases such as property search, smart contracts and lease due diligence. The rise of the on-demand economy is reshaping tenant expectations of how real estate is consumed and leading to new models, such as co-working, flexible leases and alternative accommodations.

Real estate firms are expected to transition from being physical space owners to becoming real estate services management companies offering building insights and additional value-added services.

Chapter 3

Implementing the DE

A stepwise process for designing the DE that considers the company’s DE maturity level is crucial to start off on the right foot.

After identifying the DE opportunity and objective of its participation (core business growth, entry into a new market segment through digital offerings or optimization within operations), the organization should follow a stepwise process for designing an ecosystem as shown below.

The first step is for the organization to consider whether its business model is more suited to the role of an orchestrator, partner or enabler in the DE after assessing its digital and platform maturity and partnership ecosystem. To assess its DE maturity level, the enterprise must consider whether it is a DE adapter, accelerator or attacker based on its digital capabilities and level of transformational impact.

Most enterprises begin as DE adapters where digital transformation might be a pilot program and limited to a particular business unit or geographical market. The company leverages partnerships and platforms to create value for customers.

DE accelerators scale up digital transformation to a company or industry level by adding more digital capabilities and creating value from the platform economy. They offer a single platform that aims to connect users to it seamlessly. This can not only disrupt the company but also its industry as the organization redefines how business is conducted in the industry by being a first mover.

DE attackers drive large-scale transformation across multiple industries through cross-sector collaborations and technology capabilities across different parts of the value chain. Such businesses have a multi-platform model that can ultimately be transformed into a one-stop shop offering products and services across different industries in one integrated experience.

The enterprise must also determine the nature of the ecosystem, product market fit and monetization model to create value from the ecosystem. To further sustain and scale up the ecosystem’s capability and reach, key enablers for the DE must be identified, such as the technology stack, organization structure and culture, talent pool and external resources that need to be progressively developed to create a sustainable DE.

Finally, understanding and mapping the enterprise DE maturity within the ecosystem, building and growing partnerships, identifying the potential DE pitfalls and designing a risk mitigation plan are critical to building a successful DE.

To build a successful DE, the organization needs to get digital transformation right and identify the most appropriate business model to leverage as an ecosystem participant after assessing its DE maturity level.

Chapter 4

Mobilizing the DE

DE orchestrators have the option to take a “build”, “buy” or partner approach to mobilize DEs.

Enterprises should ultimately aim to be a DE orchestrator, which defines the ecosystem’s reference architecture, has greater control over the ecosystem dynamics and often outperforms other entities in revenues and profits.

Orchestrators can mobilize DEs through a “build”, “buy” or partner approach, with financial transactions ranging from minority investments and JVs to alliances and M&As. In the “build” approach, the orchestrator starts its own platform and then organically adds industry partners to expand. The “buy” approach involves investing strategically in platform-based businesses to expand existing capabilities and the customer base. The third way is to partner by leveraging alliances and JVs to jointly develop and go to market with a platform-based offering that connects customers and other stakeholders across different industries.

In the organization’s DE journey, it is critical to get digital transformation right to derive value from data and drive business growth as well as determine the most appropriate operating and organization model to build the DE. Building an integrated, future-ready IT and data architecture and a digitally enabled workforce to drive digital transformation is crucial.

The organization needs to consider how to retain quality partners for new growth, technology and competitive reasons through a strong value proposition. Other key considerations include finding ways to build a data-analytics and personalization engine for a superior customer experience, develop a one-stop solution offering or commercialize the value chain end-to-end for the industry.

DEs have become increasingly critical to success across more sectors and this trend is likely to intensify in the wake of the COVID-19 crisis as digital interactions continue to gain greater importance in both B2B and B2C activities. It is therefore not a question of whether enterprises across sectors should participate in a DE but how for sustainable growth, especially in a world changed drastically by the pandemic. Given the complex structure of DEs, defining the right approach is crucial to capture maximum value from them.

Summary

Digital transformation has become more critical than ever to help maintain business continuity and relevance in the wake of the COVID-19 crisis. This shift has driven Southeast Asian enterprises to accelerate digital transformation and explore partnerships with a wide range of businesses, leading to the creation of DEs.

Organizations across various sectors need to assess and understand their DE maturity level to determine the right business model to leverage as an ecosystem participant, which is key to building a successful DE.