Chapter 1

Strategy, realized

Many companies want to rebuild their organizations to compete in the digital world but find the “digital divide” difficult to cross.

Traditional companies and their ways of doing things are under attack. Every business process, business model and business ecosystem will be disrupted by technology sooner rather than later. A cloud technology gone viral today has enough established infrastructure and networked users that it can reach 50 million users in less than 35 days.

Digital companies think differently. Instead of starting with a piece of technology and figuring out ways to apply it to their business, digital leaders think of outcomes their customers most value and how to deliver them using digital as a key enabler.

A cloud technology gone viral today has enough established infrastructure and networked users that it can reach 50 million users in less than 35 days.

When a business creates a strategy fit for a digital world, it can forge disruptive business models, spur innovation, create competitive advantage and accelerate benefits broadly across the organization. In defining their own digital strategy, we believe the most successful companies adopt or adapt some subset of the following mindsets. These companies:

- Create a culture of innovation: Digital organizations empower small, autonomous teams from all levels that feed on open innovation, and also look outside their own walls for solution partners. Their goal is to get to market quickly, absorb feedback from customers and iterate, all with an aggressive pace.

- Think a lot about experiences: At the heart of being digital is a passionate focus on knowing what the customer wants and delivering experiences at such a high level that they generate goodwill, loyalty and shared benefits — a true competitive advantage, in other words.

- Focus relentlessly on customers: Digital companies take traditional business models and stand them on their head. For example, traditional companies start with the need to sell product and work outward; digital companies start with a customer’s pain point and mobilize resources to solve it.

- Use data and insight to build competitive advantage: Nearly two-thirds of companies with well-established advanced analytics strategies report operating margins and revenues of 15% or more, according to a joint survey by EY teams and Forbes Insights. That same survey found global companies are investing upwards of US$5 million in analytics software, yet only 12% describe their analytics maturity as “leading.”

- Forge a new partnership between IT and business: IT plays a pivotal role in creating scalable technology platforms and digital foundations on which businesses can operate while also understanding that it must deploy new processes and experiences quickly if the business is going to stay competitive.

Budget for analytics

US$5 millionis being invested in analytics software by global companies.

For success in this digital era, a recalibrated leadership model is required. Being able to innovate and experiment in the context of constant change, and to accept the risks that all that entails, will be a key driver of competitive success in the coming years. It starts with a transformative leader who instils a culture of “yes” across the organization.

You can no longer treat traditional and digital channels separately. They now need to form part of the same corporate strategy.

Organizational design in a digital enterprise must be aligned to motivate the digital savvy employees to speak up and be the voice of the customer. If the organizational design misses the opportunity to support, reward and encourage those behaviors behind the strategy, then a digital strategy is pointless.

Even in the first few moments of the emerging digital enterprise, the benefits of following a strategy fit for a digital world are becoming evident. Here are four:

- Drives innovation and competitive advantage: The movement started with large online omni-channel retailers creating a better customer experience around convenience, price, personalization and discoverability.

- Enables disruptive business models: A digital orientation provides organizations the agility and tools to rethink what business they are truly in and extract competitive advantage.

- Accelerates strategy and benefit realization: Smart tools can provide decision makers with accurate data and a predictive view into the company’s finances, which gives them confidence to make more informed decisions.

- Improves our communities: The digital enterprise is smart in the ways it manages natural resources in a sustainable manner, follows ethical and egalitarian business practices, and creates high-value jobs that spin off benefits for the surrounding community.

Digital first

1,000plus C-level executives identified developing “next gen” leaders as their No.1 challenge in the Global Leadership Forecast 2018.

Digital transformation is less about digital and more about transformation. Less about machines and more about people — helping them flourish in a new environment. Transformation inevitable if a company wants to keep its doors open.

Consequences can be dire for companies that don’t find their digital footing. They will continually be beaten to market by competitors operating from a digital platform. Maybe that’s why more than 1,000 C-level executives identified developing “next gen” leaders as their No.1 challenge.

Chapter 2

Workplace, reimagined

Training workers to participate in the digital age is critical for both businesses and their employees to prosper.

The arrival of digital is changing the nature of work — and workers. Automation, enabled by data explosion, is one of the primary reasons for this. The other reason is the exponential improvement in the price per unit of performance of technology. As robotic process automation (RPA), machine learning and AI mature, they do more and smarter work at less cost; however, these technologies also need tending to by humans. Any business that hopes to be competitive must respond to these two imperatives, and quickly.

The smart workplace

800 millionworkers might lose their jobs to machines by 2030.

By one estimate, more than 20% of the global labor force — 800 million workers — might lose their jobs to machines by 2030.

These numbers can present the future of work as a terrifying prospect to some. But, the digital workplace could be a place where capabilities such as collaboration, data savviness and the ability to learn will thrive. Companies that use digital technologies only to cut full-time employees (FTEs) will soon be out of business themselves. Winners will not be determined by how cheaply an assembly line can be run, but rather by the innovativeness of the products produced on it.

According to job-tracker Glassdoor, the average job opening receives 250 applications, yet 30% of those hired leave within 90 days.

Nothing will be more important than recruiting, training and retaining the right workers, who can operate and lead the digital enterprise. According to job-tracker Glassdoor, the average job opening receives 250 applications, yet 30% of those hired leave within 90 days. One fundamental reason for this is that hiring managers often introduce unconscious bias into their selection decisions and reduce workplace diversity. An AI-powered process can not only speed up early-stage, top-of-the-funnel applicant winnowing, it can be programmed to mitigate bias during hiring.

Digital brings new responsibilities

With the creation of the new digital workplace comes new responsibilities that will have to be accepted by business leaders and even by employees themselves. They can be categorized under the following criteria:

- Responsibilities to stakeholders

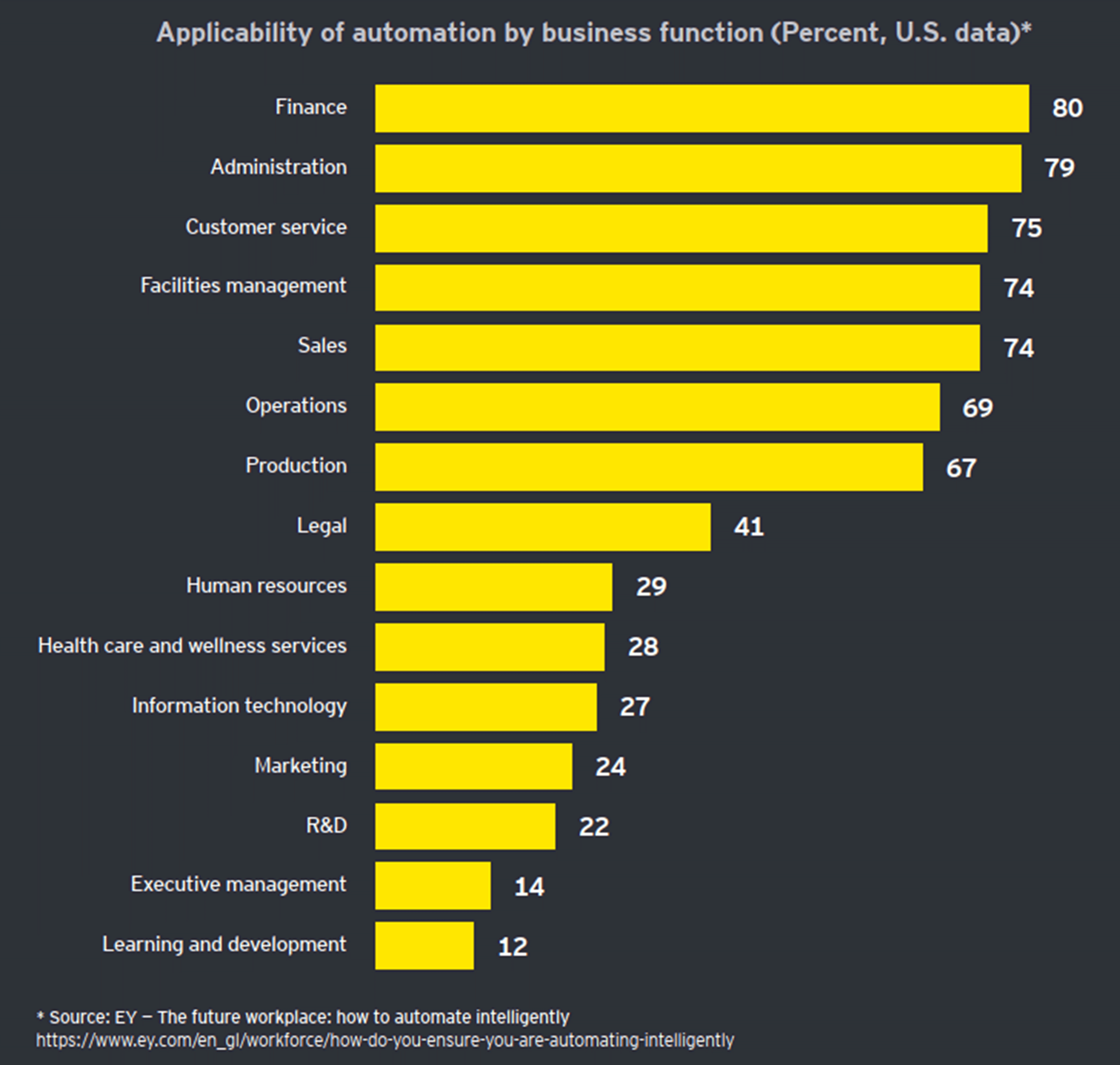

- Automate your business intelligently: Companies can start their automation project prioritization by linking the automation strategy to business priorities and culture transformation; performing an organizational review to identify talent needs and skill gaps; and defining and developing an ecosystem plan to unlock the right talent and technologies.

- Practice responsible reporting: Corporate social responsibility reporting can help educate all stakeholders about whether the business is achieving its environmental, social and governance goals. Investments in areas, such as human capital, can be measured to see how they contribute to a company's long-term profits. Big data can underscore the value of these kinds of investments.

- Automate your business intelligently: Companies can start their automation project prioritization by linking the automation strategy to business priorities and culture transformation; performing an organizational review to identify talent needs and skill gaps; and defining and developing an ecosystem plan to unlock the right talent and technologies.

- Responsibilities to employees

- Bring employees on the journey: Companies moving forward on a large-scale digital transformation should bring all employees into every stage of the journey. It’s important they have input into the purpose of the transformation. This includes leadership’s views on industrywide trends, stakeholder input and reflection on the company’s values.

- Provide employees with the required skills: Training workers to participate in the digital age is critical for businesses and their employees to prosper. Workers will need to be constantly re-skilled for our evolving needs such as digital analytics, AI, customer experience and other in-demand competencies.

- Rethink your approach to career development: Businesses are fundamentally rethinking career development in the digital age. Leading companies not only train their people, they also build learning into their career paths. They support mobility and job rotation. They create teams that are rich in ethnic, gender and racial diversity. They guide workers into jobs that didn’t even exist when they were first hired.

- Bring employees on the journey: Companies moving forward on a large-scale digital transformation should bring all employees into every stage of the journey. It’s important they have input into the purpose of the transformation. This includes leadership’s views on industrywide trends, stakeholder input and reflection on the company’s values.

Only 14% of CEOs have the leadership talent to execute their strategy.

- Responsibilities to society

- Embrace the gig economy: One way the digital enterprise can serve the greater good is by embracing the “gig economy,” which represents a massive shift in how people work. Freelancers increasingly work on their own terms, which suits their goals and the needs of the companies they work with. Enterprises are catching on to the value of creating a network of top contractor talent. An August 2017 study of nine Fortune 500 firms found that, over the previous year, the number of projects sourced via online freelancing platforms increased by 26%.

- Harness big data to promote inclusive capitalism: Big data and advanced analytics produce undreamed amounts of information regarding the performance and impact of businesses around the world — whom they source from, the working conditions of their factories and where their financing comes from. This information can be used by regulators, activists, consumers and most powerfully by companies themselves to make economic growth more inclusive.

- Embrace the gig economy: One way the digital enterprise can serve the greater good is by embracing the “gig economy,” which represents a massive shift in how people work. Freelancers increasingly work on their own terms, which suits their goals and the needs of the companies they work with. Enterprises are catching on to the value of creating a network of top contractor talent. An August 2017 study of nine Fortune 500 firms found that, over the previous year, the number of projects sourced via online freelancing platforms increased by 26%.

Innovation is not merely disruptive. It is also one of the most powerful tools we have for promoting inclusive capitalism — the idea that businesses should work to create long-term value for stakeholders across society.

- The worker’s responsibilities

- Facilitate free-flow of ideas: It’s not just companies that have new responsibilities in the digital era. Workers do, too. To contribute to the success of their organizations and their own careers, employees should proactively upgrade their skills and develop new capabilities. As digital flattens organizations and breaks down silos, good ideas and strong opinions need to flow horizontally, from every nook and cranny of the enterprise.

At the end of the day, the idea of a modern workplace boils down to a business’ readiness to participate in innovation. We believe that by doing so we have the best chance to author a future where technology improves the lives of workers, and where businesses and their stakeholders create a sustainable environment rather than an uninhabitable one.

Chapter 3

Customers, understood

What is needed to engage consumers is fairly well understood; however, many organizations are not designed to deliver those experiences.

The next three to five years will prove crucial if companies want to create impactful experiences that attract and delight their customers. To do so, organizations must make significant advances in three areas:

- Traditional organizational structures built around vertical chain of command and business silos need to be redrawn from top to bottom and designed with the customer at the center of the hub.

- Firms need to be much more aggressive about deploying advanced technologies throughout the organization, not just using them to solve departmental problems.

- The customer experience needs to be redefined as an end-to-end, integrated journey that include employees, partners and all stakeholders.

The important thing to keep in mind here is that it’s not technology’s accelerated pace of progress that drives an enterprise’s march to digital; instead, it’s that consumer expectations are moving even faster than companies can keep up with. A Forrester study shows that 17% of Gen Y and 20% of Gen Z consumers will consider dropping a brand if the company’s online chat response is slow.

Consumer expectations

17%of Gen Y and 20% of Gen Z consumers will consider dropping a brand if the company’s online chat response is slow.

Companies need to look more deeply at how they can better deploy their technological assets, and then how organizations themselves can restructure to create difference-making experiences that leave customers craving more. Several powerful forces around customer experience are emerging, as are technologies that can help firms take advantage:

- Efficient application of personalization provides great value: Personalization is seen by many as the next big advantage-creator in marketing. When combined with big data analytics, personalization of products and services creates great value for customers — and often at very little extra cost to the producer.

- Data can unlock new levels of proactive marketing: Intelligent use of data can build trust and loyalty by offering more personalized and relevant experiences that customers truly value. Still, only 52% of organizations offer relevant or personalized promotions during customer interactions, while 37% lack the capability to use analytics to reach customers with tailored communications, according to a joint EY-Forbes survey.

- In customer experience, trust and privacy are two sides of the same coin: From a consumer’s perspective, it’s nice to have your needs anticipated. This is where technologies, such as blockchain, comes in. Such innovations can empower consumers to directly authorize with whom they will share personal data — and possibly charge a fee for that access.

Although 69% of executives understand the benefits of creating personalized experiences for customers, 41% of them say they aren’t using advanced analytics to analyze customer behavior.

Breaking silos: four pillars of customer transformation

“Put the customer at the center of everything you do” has been trusted advice long before digital arrived. But, most organizations organize with the customer outside looking in. They are set up to optimize silos, but silos don’t work for creating end-to-end customer enchantment. There are four dimensions to how we connect the customer experience to break down those silos.

- Challenge your operating model: Traditional operating models do not acknowledge the organizational fluidity needed to enable that customer to be a common asset and a prized focus of everyone in the company. Companies that lead in customer experience build a business innovation capability that allows crosscurrents to flow, and quickly innovate around new technologies. Their motto: innovate, prototype, test, analyze, scale and repeat.

- Challenge your data: Companies have an information gap to fill, and most are behind in getting their customer data organized and accessible. Their hard-won information sits on platforms that don’t speak to other systems. Companies need to fully leverage data for insights that offer competitive advantage. Data is the currency that drives the customer experiences.

Customizing experiences

52%of organizations offer relevant or personalized promotions during customer interactions.

- Challenge your existing systems: Companies have used technology, such as automation, as solutions to problems or process gains rather than as platforms to underlie a customer-driven strategy. There’s much work to be done that connects the dots from your platforms and solutions, whether that means replacing old with new or integrating what’s in place. The cloud is often the best place to start the journey that must involve elements of open architecture and organizational agility.

- Challenge your external operations strategy: The fourth pillar of transformation is to rethink the external operating model; organizations need to rethink and re-create the way they do business with partners and vendors. Companies need external partners to help create this new trust with new and existing customers. If that model isn’t coherent, then internal and external may be working at odds.

This is all a lot of hard work but leveraging new technologies to create a customer-centric organization is difficult for competitors to challenge. Your customers will become more engaged, loyal and contribute to your brand equity. They will increase sales and in doing so improve enterprise value — ultimately conferring sustainable competitive advantage.

A Harvard Business Review study found that, for companies with transactional business models, “customers who had the best past experiences spend 140% more compared to those who had the poorest past experience.”

Chapter 4

Operations, reinvented

Automating operations to increase productivity, improve efficiency and reduce costs should be the low-hanging fruit of digital transformation.

Start with ever-increasing computer power, IoT, layer in digital analytics, AI and other software smarts, and plug all into the cloud. Add blockchain and the digital enterprise is humming like a Formula One race engine.

Technology, media and telecom companies that adopt this operational excellence model have significantly higher levels of satisfaction with their product quality (39% vs. 16%) and have much higher levels of confidence in managing today’s risks (48% vs. 11%) than those who have not.

Operations executives are already familiar with front-end software technology called robotic process automation (RPA), which enables software bots to perform simple human actions and automate repetitive tasks across multiple business applications at a fraction of the cost of traditional solutions, and without the need to swap out current IT systems.

The next advance comes as intelligent automation (IA) is added to the mix. New automation solutions combine machine learning and cognitive technologies that allow systems to make decisions, something not possible with RPA alone. IA will have a big impact on end-to-end processes such as plans-to-produce, order-to-cash and procure-to-pay, where decisions are required. As the digital industrial world evolves, AI will work together with another powerful technology, the IoT, which connects devices to the internet using embedded software and sensors to communicate with one another.

If organizations relied more on IA coordinated throughout the enterprise, they would win with significant personnel savings, fewer entry errors, faster closes, better customer experiences and freeing up people to do more meaningful work.

Blockchain makes it possible to track and trace integrity. It means consumers can be assured that their organic produce is actually organic or musicians can ensure that royalties are appropriately distributed. In the journey from producer to end user, blockchain can remove friction from the process managing sales orders, shipment orders, providing proof of delivery and authorizing payment to the logistics company.

As powerful as these potential payoffs seem, highest-level benefits will come when the operation’s function is recognized as a driver of competitive advanced rather than as a lever to lower costs.

Smart manufacturing

US$300 billionand above will be spent on smart manufacturing technologies (12% CAGR) by 2023.

When done right, digital operations drive performance in three ways:

- Top-line performance increases through operational agility, service and innovation leadership.

- Risk management is enhanced through reduction of value leakage and protecting the operation through optimizing risk, resilience and sustainability.

- Margin growth is promoted through efficiency and productivity savings gained from rigorous application of operational excellence.

Chapter 5

Risk, redefined

Risk is not just a threat; it’s a prelude to growth.

Leaders should expand their view of risk in the coming years, shift technology and other resources to support that broader vision of risk management as an enabler, and make sure their risk managers and business innovators have the experience and mindset necessary for the challenge. Risk functions need to shift from a posture of risk avoidance to one of risk mitigation and ultimately risk optimization.

Leaders should also pay attention to one crucial element: digital trust.

In an environment churning with fear, uncertainty and doubt, customers and partners are beginning to elevate the value they place on trust at or near the top of other factors that win the deal. Digital enterprises that differentiate themselves on trust, and that transform their partners’ uncertainty into confidence, will be positioned to gain financial health and competitive advantage.

Let's look at several examples of how advanced technology might tame risk and promote opportunity.

Blockchain

One of the oldest and most tradition-bound of industries, maritime insurance, is a testing ground for one of the newest, still maturing technologies to prove its worthiness: blockchain. For hundreds of years, insurance terms were agreed to between insurer and shipowner on paper, sometimes on the very dock where the ship was berthed.

Risk can increase or decrease as a container ship navigates from the Port of Yantian to Miami, depending on weather, engine efficiency and the trustworthiness of dockworkers. Enter blockchain, which is essentially a distributed ledger (or database) stored on potentially thousands of servers that anyone authorized on the network can see and that safeguards the integrity of the data it holds. An insurance-related blockchain solution plays in several areas of the risk management spectrum. When evaluating downside risk, insurers are able to assess their exposure in near real time.

Premiums can be agreed to quickly, and claim payments made in seconds rather than years. The result is risk better managed through digitalization, automation and increased transparency.

Blockchain also creates opportunity to innovate with pricing or entirely new offerings. This innovative technology allows insurers to better understand and calibrate for risk. By precisely analyzing the asset, its location, the stakeholders involved and the existing threat environment, insurers can provide finer-grain coverage on a sliding scale based on previously agreed-to terms — all embedded in a smart contract. As a cargo ship enters a dangerous area, for example, new rates could be triggered until the ship sails into safer seas.

This isn’t fantasy: in the first use of blockchain to manage risk in maritime insurance, EY and Guardtime teams are working with Microsoft, Maersk and a number of insurance providers offering hull coverage to some 1,000 commercial vessels.

RPA

RPA offers the potential to powerfully enable organizations to automate high-volume, routine, system-based tasks by unleashing a virtual workforce of robots, at less cost than human operators.

One strength of RPA bots is they are quite dependable and incredibly efficient, and can be deployed without the need for much change to underlying platforms.

This becomes a significant asset for tasks like access provisioning. Large companies often use dozens or even hundreds of workers to create user accounts generated by new apps, business services and everything else employees must log in to in order to access the digital ecosystem. Identity and access management processes — if done manually — can take hours. This time can be reduced to minutes by using a software robot, while freeing up human capital for more “brainworthy” jobs.

From a risk management perspective, RPA reduces the potential for everything from audit failures to enterprise attacks by lessening human error, helping ensure dependable data and increasing business norm compliance.

AI

AI approaches risk management with a learning eye. Related technologies, such as machine learning, neural networks, data science and heuristics, enable AI-based applications to learn through experience, similar to human cognition, and compare their growing knowledge of “normal” behavior with suspicious or unknown activity they encounter.

Since these systems can adapt as the risk environment changes, AI tools enhance monitoring in a multitude of areas, including cybersecurity, regulatory compliance and corporate governance. Not only can they detect and warn humans of problems, intruders or breaches, but they can also initiate mitigation against them. Best of all, from a risk perspective, early-learning systems can help prevent threats from even materializing.

All three technologies can be used as disruptive technologies to transform the business and how to manage risk in the business. However, we live in the digital age, where the very technologies used to improve production, quality and security can end up causing serious new problems.

To guard against these uncertainties, companies should build risk prevention into processes, tools and products at the start of their development. This will be more difficult than you think. The whole DNA of people in technology is first to make sure that something works, not to hedge bets in case it doesn’t. That’s a complete mind shift that needs to happen.

How do you get ahead in the new age of risk management?

Organizations have traditionally focused their resources on what risk managers call preventative or avoidable risk. To achieve performance goals over the next few years, companies must broaden their vision beyond the preventative to two other areas: upside risk and outside risk. This enables organizations to expand their focus from the dangers they can control to include the ones they cannot or that they need to balance to better drive performance.

Managing upside risk is increasingly important because the digitization of the enterprise is all about business model innovation and experimenting with new products and services. Where downside risk is focused on saving money, upside risk is also about making money through invention.

MIT researchers report that credit losses for lenders could fall from 6% to 25% by using AI-based tools.

Risk professionals must evolve from their traditional mindset of risk avoidance to one of identifying upside strategic risks. Doing this will require a CEO driving the message, a board that allows the CEO to do so and a culture change throughout the organization that values risk taking where it makes sense. Risk managers must change, too. The risk professional of the future needs to be forward-thinking, digitally savvy and data-smart. They should be able to build models that help management see what can happen when the risk is mitigated.

Finally, one element of risk management that costs little to implement but conveys tremendous competitive advantage when done correctly: building trust with partners, third-party vendors and certainly with customers. Today’s uncertain world makes people and organizations reach out for trusted, dependable partners. Think of trust in your organization as a framework that includes strategy, products and services, and operations execution. A robust risk management program in and of itself can drive trust.

Summary

Digital technologies are helping us build a better working world, improving customer, employee and stakeholder experiences while also increasing the bottom line for shareholders.