If these activities would ultimately be transferred to the acquirer, then a transfer pricing consideration may arise, triggering a tax liability that may not have previously been identified.

Tax authorities’ response

Tax authorities may analyze how the IP is managed within the group after the transaction, with a particular focus on establishing who is assuming the legal, financial, and business risks connected with the IP, and which parties control which functions.

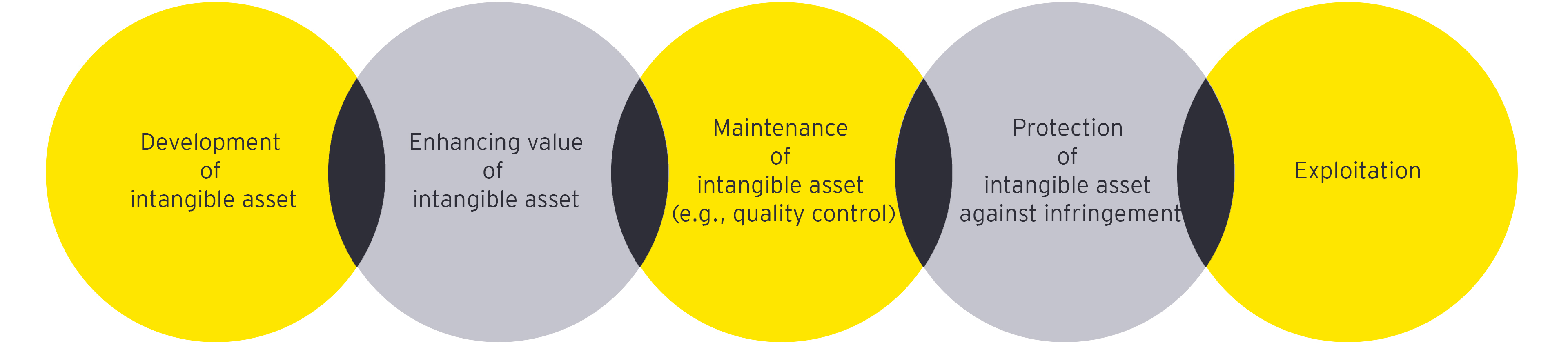

They may also ask whether significant value-added functions are being outsourced and how this outsourcing operates. Based on these criteria, tax authorities may attempt to identify which parties within the group are performing the DEMPE functions of the IP in order to compute an adequate arm’s length compensation.

A further factor that may affect a tax authority’s view is whether the functions of the combined group’s activities change as a result of the acquisition. In some exceptional cases, tax authorities may take the view that, depending on the new distribution of functions after the acquisition, the acquired company has transferred the ownership of the IP to the owner of the business. If there is an economic transfer of the IP, the tax authority could take the view that a transfer has occurred, even though the IP may not legally have been transferred, thus triggering capital gains tax for the legal owner.

Transfer pricing and risk management

In the Swedish case we referred previously, the local tax authorities took the view that there was an economic transfer of the IP to the US because of the risks and functions undertaken by the new American owner of the group.

However, this is a case surrounded by specific circumstances, interpretations can differ in different acquisitions and in different jurisdictions. These interpretations can also be appealed, highlighting the importance of recognizing the potential for similar issues in other countries and in different sectors.

As such transfer pricing considerations and interpretations become more widespread, companies involved in M&A involving intangibles in general – and IP in particular – will want to take steps to assess the relevant tax considerations. Some key considerations include:

- Stress the relevance and importance to this tax topic in the post-acquisition integration process

- Involve the tax function in the integration process because tax impacts can be significant and often unforeseen

- Recognize that the transfer pricing model used before the acquisition might not be valid anymore after integration

- Undertake a functional analysis as part of the integration process to understand which functions are being undertaken as regards the IP, and what, if any, impact this may have on the acquirer’s existing transfer pricing model

- Take time to specifically document DEMPE functions associated with the IP and be able to explain clearly how the IP is managed within the group, and how the compensation is determined based on the distribution of DEMPE functions within the group

- Prepare a file to support the correlation between the functional analysis, the compensation involved in the acquisition, and the treatment of the IP within the group

- Based upon this information, consider contractual protection, insurance, reduction or adjustment of price

- Ensure tax governance as the integration process will be eased if the combined group develops an adequate level of tax governance. This allows the tax function to capture the potential impact of business changes on the tax profile or the position of the company with the aim of capturing tax considerations

Global tax law is constantly developing, and businesses involved in M&A, especially in acquisition and/or exploitation of IP, need to stay abreast of how developments can affect their functional and financial business goals.