Chapter #1

The FinTech growth lifecycle

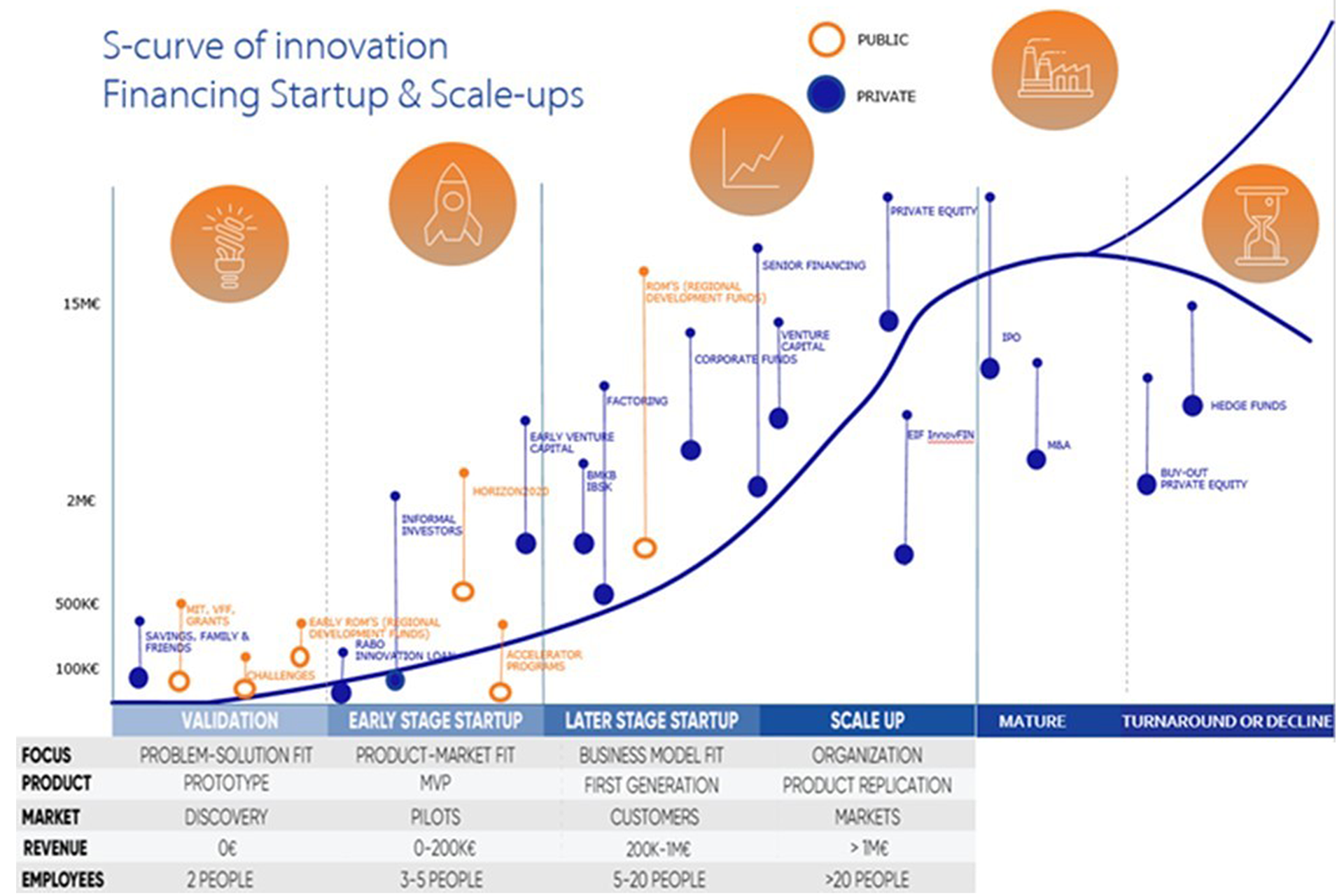

For a FinTech to grow from a start-up into a scale-up, attention needs to be paid to the stage in which the start-up finds itself, in order to attract the appropriate funding.

There are various models that aim to show the lifecycle stages of innovative companies. For this article we used the S-curve, a measurement tool of the speed of adoption of an innovation. Already used in 1903 by Gabriel Tarde, the tool became popular after Everett Rogers used it in 1995 to describe the lifecycle of innovation. Although the S-curve says something about the speed of adoption (early adopters, early majority, late majority and laggards), it is also used to illustrate the growth paths of innovative companies. The stages of the S-curve are validation, early and later stage startup, scale up, mature and turnaround or decline (x-axis). In the model below we have also plotted different financing instruments in volume (y-axis) depending on the stage (x-axis).

You can use this model to plot your own FinTech. Innovation is different at every stage; in the validation and startup stage your main focus is market validation, funding and surviving. In the scale-up stage it’s all about entering new markets, expanding and hiring. Lastly, in the mature stage you are facing an increasing number of competitors and lower margins. In the turnaround stage you go back to surviving and making the transition to new business models. One of the major challenges for FinTechs is the length of the sales cycle, with regard to attracting the necessary funding per stage. It can help to get an informal investor on board who is familiar with the process, and their network may facilitate a quicker result..

A few public and private financing options referred to in the model above deserve some further explanation, as we have noticed that these 3 often need further clarification: 1) BMKB/IBSK: this government guarantee is only suitable for FinTech companies without a DNB license (financial institution) 2) FinTech investment funds: large banks in the Netherlands (ABN AMRO, ING Bank and Rabobank) all have their own FinTech investment funds. This could be interesting because banks are looking for new business opportunities themselves in a changing environment, 3) EIF InnovFIN: this is not suitable for financial institutions with their own DNB license.

For every stage of the life cycle there are new funding possibilities and the maximum amount of investment differs. For a FinTech to find the right type of funding, it needs to know where it sits in the life cycle, what is available at each stage and explore funding possibilities early. What we typically see is that VCs are not interested in investing at a very early stage. They want to see some validation first and, depending on the VC, some traction in sales as well. One advantage of talk to VCs at an early stage is that they can provide insights on where the FinTech’s focus should be. Another advantage is that it puts you on VCs’ radar. If there is a market fit, this can speed up the process of raising funding. What we’ve learned in the past is that:

- On average, it takes 6 months to complete a funding round. FinTech’s should be aware that, from an investor’s perspective, the emphasis in a funding round is on the (funding) mix or leverage (debt-equity ratio),

- Funding your organization only with grants might slow down the level of entrepreneurship,

- Attracting a combination of funding solutions can help a scale-up succeed,

- For a start-up to evolve into a scale-up, it is also important for the company to develop a long-term financing strategy that is aligned to its growth path,

- And last- but not least: always develop a fallback scenario. Growth is often more expensive and lengthier than you expect.

Chapter #2

Key learnings to scale up your business

Clear business model vision, attracting capable leadership and dealing with (tax) rules and regulations are key to successfully navigate your growth cycle.

As mentioned by one of the FinTechs we spoke to: “It is a state of mind and state of living to be working at a FinTech”. Initially, start-ups are more focused on growth than on generating profit. Their key priority is showing bright growth figures (hockey sticks) in terms of customers, location expansion, or number of offerings; these factors validate the value proposition and thus the existence of the startup. This results in a focus on day-to-day execution or a firefighting approach by the founders, which can come at the expense of designing, setting up and/or structuring the FinTech’s business model.

It is vital to commit time to tailoring your business model. This should not just be done as a one-off at the outset, but should be a continuous, proactive effort. The most important factor to take into account is to make sure the business model contributes to the desired growth. E.g. a subscription or fee-based offering ensures that the expansion of your business goes hand in hand with further cultivation of profit generation. The rise of subscription based models such as Netflix or Spotify have warmed up consumers to these type of offerings.

Another important element to consider is how to leverage the ecosystem you are operating in. If you develop strong connections with partners in the market, you can position yourself to grow organically as they do. An example of this sort of ecosystem is the ink and printer combination: neither is much use without the other.

At EY we see that startups find it challenging to realize their ambition and envisioned growth in today’s disruptive environment. The EY velocity global digital platform has been developed to support startups and scale-ups to accelerate their growth journey by examining their business and developing a strategy and action plan for growth based on EY’s 7 drivers of growth. It proved to be an important differentiator for building up resilience and stimulating organic growth by examining these growth drivers.

Bring in the right capabilities and skills

To move from the start-up to scale-up phase also requires specific leadership characteristics. Not everyone is cut out to be a FinTech entrepreneur, as it requires a specific mind-set and motivation; necessary qualities include independence, persistence, agility, perseverance and an inherent drive to succeed. For one to grow a business into a scale-up requires more than just willpower. With the high rate of failure in the start-up to scale-up phase, leaders need a distinctive set of functional skills compared to their competitors, functional skills that cannot be copied or developed easily in order to maintain the advantage. These skills are not easily acquired and need a certain amount of time to develop. We often see that scale-up leaders typically have a research background, industry experience, or a combination of the two, which ensures their position as leaders in their respective fields.

When a start-up moves to the scale-up phase, the founder or original leader may no longer be fully equipped to grow the business. For example, a lack of business experience might hamper their ability to lead or focus on financial growth rather than innovation, and might dampen their entrepreneurial spirit. Leaders in a scale-up need a wider set of skills in order to manage, empower and inspire their employees, skills that are generally less well-developed amongst leaders in (younger) start-ups. Most of these abilities and qualities develop over time, creating a pressing need for start-up leaders to rethink their leadership team and attract additional talent. These new leaders do not necessarily have the skills, vision or creativity to start their own start-up, but they do have the experience acquired through many years of trial and error. Therefore, in order to successfully grow your start-up to a scale-up, the leadership deck needs to be reshuffled from time to time. Leaders need to be able to adapt and be willing to add new (C-level) managers.

Ensure you comply with relevant laws and regulations

It is important to have a clear vision and business model to determine your regulatory responsibilities when scaling up. In order to understand whether you need a license - and if so what type of license is appropriate - you need to consider your scope of services and partnership options (can you collaborate with a 3rd party that already has a license?). If you don’t qualify for an exemption, there are multiple levels of licenses from payment institutions to e-money institutions to credit institutions. The requirements differ per license and are proportional to the scale and maturity of your business. Key considerations to meet the requirements include:

- Governance structure: standardized governance structures are required with for example supervisory boards

- Shareholders or partners: collaboration model scenarios vary based on holdings, voting rights and direct or indirect control

- Outsourcing approach: Whether you qualify as a regulated financial institution or will be providing services to a financial institution, you will be confronted with the EBA guidelines on outsourcing

Licensed companies under the AFM or DNB are required to comply with stricter laws and regulations. To help FinTechs, focused on the BCM sector, understand which new regulations are coming down the pipeline in Europe EY has developed a Regulatory Reform Calendar. Dependent on your regulatory status and risk appetite, you need to decide which laws and regulations to focus on first (must-haves) and which to de-prioritize. You can take a risk based approach to prioritize your compliance efforts.

In the Netherlands, 43% of FinTech companies experienced no problems complying with legislation and regulations within the FinTech domain, according to the 2019 Dutch FinTech census1, even though the Netherlands is perceived as strict and the costs and lead time for licenses and compliance are considered significant. The most challenging regulatory requirements for FinTechs are GDPR, legislation on licenses (such as banking or PSD2 licenses) and remuneration legislation. A recent bill by the Dutch Ministry of Finance on the remuneration policy might ease the latter.

The challenges to comply might differ across borders as the European regulatory landscape is still very fragmented due to differences in regulatory deadlines, implementation requirements or regulation in general. One example is the regulation of digital assets. A myriad of rapid market developments is occurring in the crypto domain, accelerating developments in the crypto start-up sector and outpacing the regulatory framework, which is still fragmented. Therefore the European Commission proposed a new framework in September 2020 – the Markets in Crypto-Assets Regulation (MiCA) - a regulatory framework to help regulate currently out-of-scope crypto-assets and their service providers in the EU and provide a single licensing regime across all member states by 2024.

Understand if your legal position is changing when scaling up

When companies start to scale up their business, VAT is not always the first thing they think about. In most cases, the point of focus is the development and expansion of their (new) services. However, scaling up may raise a couple of key VAT risks; the VAT treatment of new services, the right to recover VAT on costs and the complexities relating to accounting for VAT on services received from abroad.

As you scale up you might start to provide new services for which the VAT treatment needs to be assessed. For VAT purposes, services can be treated as VAT exempt or VAT taxable. When a service is VAT exempt a company does not have to account for VAT, but, paradoxically, is also not allowed to deduct VAT on costs. Therefore, the VAT will become an additional cost.

Scaling up may well be accompanied by incurring a lot of costs which include VAT. The VAT can become an irrecoverable cost, if scale-ups provide VAT exempt services. Sometimes, it only becomes clear at a later stage that the scale-up wasn’t allowed to deduct all VAT on costs (as it related to VAT exempt services). This then needs to be repaid and thus becomes an additional cost. When a scale up receives services from a vendor outside the Netherlands (e.g. marketing services), complexities regarding the accounting for VAT can arise. When a service is purchased from a vendor outside the Netherlands, the scale up is obligated to report the Dutch VAT themselves. In practice we have seen that scale ups are not always aware of these rules, potentially resulting in penalties from the Dutch tax authorities.

With this in mind we would recommend reviewing the tax consequences of scaling up early on in order to save additional costs.

Chapter #3

Looking towards the future

Unicorns are successful because they scale both nationally and internationally.

Mollie and Messagebird – both (co-)founded by Adriaan Mol – were elevated to unicorn status last year, meaning that we now have four unicorns in The Netherlands. Together with Bunq and Bitfury, these companies are valued at over 1 billion euros2. FinTech Adyen operates in the same business as Mollie but is even bigger. After their IPO in 2018 the company grew extremely fast with a current market cap of almost 59 billion euro.

When looking at the number of unicorns on a global scale we see that the US (53%) and China (20%) are leading the charge by far, followed by India and the UK.3

| United States | 369 |

| China | 138 |

| India | 32 |

| United Kingdom | 29 |

| Germany | 17 |

The key for their success seems to be scaling both nationally and internationally. This is easier for home countries with enormous markets such as the US and China. Furthermore we see a business-first mentality in both countries. In the US, there is a relatively mature FinTech community, capital is abundant across the growth lifecycle (with experienced VC and PE communities), and new regional hubs (outside of California and New York) are anchored on industry specialization and university connection leading to a large pool of talent. With a current FinTech adoption of only 46%, much more growth is expected.

In China – and more specifically Hong Kong – there is a growing presence of non-financial services players in the FS market. There is also a well-established financial services hub where 70 of the top 100 global banks have a presence, providing strong access to ‘Fin’ talent.

What does this mean for The Netherlands? We have a relatively big and mature FinTech sector, and FinTechs value The Netherlands for our English language proficiency, our digital infrastructure and open culture. Amsterdam in particular is valued as a European startup hub, and with a high FinTech adoption level, our country is attractive for both startups as VCs and PEs.

The majority of FinTech services being used – globally and in The Netherlands - re money transfer and payments services. Payments are here to stay and the following trends are likely to remain pertinent:

- Invisible payments: Customers expect a seamless shopping experience and will be frustrated by payment solutions that require any effort (e.g. entry of payment data). Lines between shopping and paying continue to blur with the payments system operating in the background;

- Artificial Intelligence (AI) and Machine Learning (ML) in product lifecycle: The use of AI and ML is set to move beyond helping combat fraud and improve operations to providing granular insights across all areas of the payments value chain;

- Open banking: The sharing of data enabled by open banking allows organizations to work together to improve processes across the payments chain – from Know Your Customer (KYC) to fraud, rewards, and marketing;

- Digital identities: The use of biometrics, in combination with other verified data, can help build digital identity (ID) solutions that help payments providers more efficiently and safely verify customers’ identity.

In line with these payments trends, growth is expected on embedded finance (e.g. pay now and pay later programs, embedded insurance options) and Banking as a Service offerings.

(source: Dutch FinTech Census 2019; UK FinTech: Moving mountains or moving mainstream; CB Insights; EY: Seven themes impacting the future of payments; EY analysis)

For the purpose of this article, we define FinTechs as organizations that combine innovative business models and technology to enable, enhance and disrupt financial services. In this context, we define Start-ups as companies that focus around a single product or service, which the founders want to bring to market. These companies typically don’t have adequate capital available, leading to a high level of uncertainty accompanied with a high rate of failure. When these start-ups start to grow substantially, they become Scale-ups (XM), a start-up that has entered a distinct company growth phase, and, as defined by the OECD, has achieved growth of 20% or more in either employment or turnover year on year for at least two years. Furthermore, these scale-ups have a minimum employee count of 10 at the start of the observation period and have grown to more than €10 million within 5 years. Some of these start-ups might become Unicorns, which we define as privately held start-up companies that are valued at over €1 billion.

I’d like to thank Edwin van de Wijngaard, Startup & Scale-up banker Rabobank, Jeroen van Linschoten, Manager Transaction Banking Rabobank Wholesale Clients Netherlands and Folkert de Jong, Associate at Rabobank Financial Institutions Group as well as Lysanne Jurjens, Senior Manager Business Transformation and EY NL FinTech Lead, Nikki Paes, EY Manager Business Transformation and Daphne Sweers EY Senior Consultant Business Transformation, for their valuable contribution to this article.

Summary

The FinTech growth cycle, from the development of an innovative idea until its evolution towards a big, international corporation, is filled with various challenges. Ensuring financial stability, attracting capable leadership, clear business model vision and dealing with (tax) rules and regulations are all key to successfully navigate your growth cycle – and potentially emerge as the next unicorn.