Despite an important cultural shift, society has been hesitant to accept cryptocurrencies due to technological, legal and regulatory uncertainties.

When Bitcoin emerged in 2009 as the first digital currency, it was accompanied by scepticism and distrust – and linked to data breaches, hacks and financial crime. However, after initial steps along the road to institutional adoption, Barclays was the first major traditional commercial bank to accept Bitcoin in 2016, whereafter the digital asset industry experienced an ongoing surge in value, with over $4 trillion worth of cryptocurrency traded globally in 2020. Furthermore, this trend has increasingly found favor in Europe, with Central, Northern and Western Europe alone responsible for 25% of the worldwide cryptocurrency business.

The European Commission has started to realize the potential of digital assets, proposing a new Digital Finance package “to further enable and support the potential of digital finance in terms of innovation and competition while mitigating the risks”. This indicates an important cultural shift, as establishing a package of this nature inherently increases the legitimacy of digital assets in general. The EU has also proposed regulation on Markets in Crypto-Assets (MiCA). The European Central Bank launched a Digital Euro Project in July 2021. Both developments suggest that these institutions acknowledge the potential of a digital currency while focusing on sustaining financial stability7.

As cryptocurrencies are known to be volatile by nature, financial institutions tend to adopt them with some reluctance. Governments, regulators and the financial sector in general have also been hesitant in pressing ahead due to technological, legal and regulatory uncertainties. Profound and unrelenting volatility combined with the lack of both a strong regulatory framework and clarity on the origin of each digital asset have made these currencies highly susceptible to money laundering. But to fraud and the purchase of controlled substances or other illegal items as well. The lack of transparency is exacerbated by various other factors. Consider for example the anonymity linked to the unregulated nature of virtual assets, their decentralized nature and the cross-border aspects of cryptocurrencies. A strong regulatory framework could ease some of these concerns.

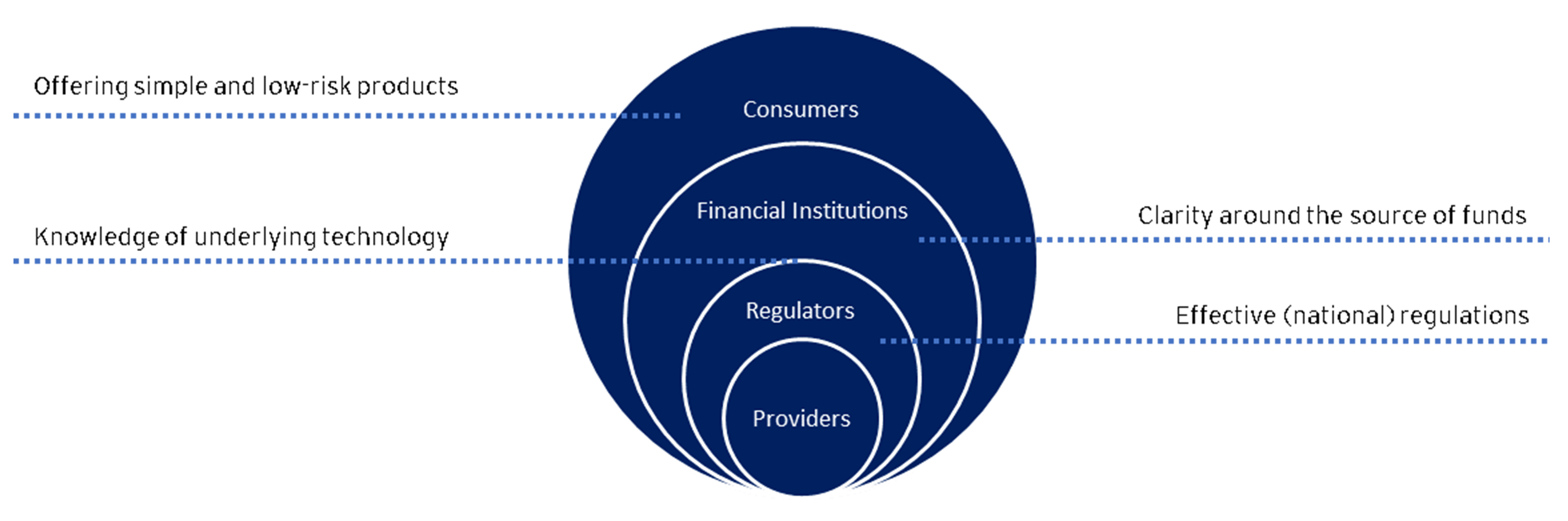

Based on our experience and conversations with parties in this field, we have identified four main opportunities regarding the institutional adoption of cryptocurrencies:

- Effective nationwide regulation

- Expansion of intrinsic knowledge amongst regulators and financial institutions

- Offering simple and low-risk products

- Increased clarity on the source of funds

First, we will combine the first two opportunities and discuss effective regulation and the knowledge expansion from a regulators perspective. Then, we address the knowledge expansion from a regulatory and technology perspective for financial institutions. Thirdly we will discuss simple and customer-friendly crypto offerings to consumers and lastly, we discuss how clarity around the source of funds can be increased.

1. Effective regulation, open attitude and enhanced technological knowledge amongst regulators will promote cryptocurrency adoption

As discussed above, the use and acceptance of cryptocurrencies has rapidly scaled up to the point where Bitcoin is now officially legal tender in El Salvador. Regulators have followed these dynamic market developments with a watchful eye. After all, a new asset that falls outside the scope of regulatory frameworks can pose vast risks to society. Regulators’ key cryptocurrency concerns are related to financial crime, consumer protection, investor protection, stability of the financial system and taxation (highlighted in more detail in this EY article8). To combat or mitigate these concerns, the EU has proposed regulation on Markets in Crypto-Assets (MiCA9). These are expected to become effective in 2024. MiCA replaces the current registration obligation in the Netherlands for crypto providers, which falls under the Anti-Money Laundering and Anti-Terrorist Financing Act.

At EY, we have supported our clients with crypto payments or assets in building the institutional technology required to monitor and audit financial statements. From a regulatory perspective, we see the most important requirement for MiCA is to make crypto a common good. One way to achieve this ambition is to create a harmonized, common playing field across Europe. Crypto is a digital asset that is not bound by borders. Regulatory differences across countries pose challenges for crypto providers to seamlessly offer their services cross border. For the most part, MiCA would lift these barriers. This would lead to more scalability options for providers.

Establishing a continuous dialogue between regulators and cryptocurrency providers will help to sustain information exchange and enhanced mutual understanding

Alongside these efforts to craft a suitable regulatory framework, there is a second element that would aid the institutional adoption of crypto. If regulators were to adopt an open attitude towards technological innovation as well as embrace a progressive technological knowledge regarding cryptocurrencies, this would enable them to adequately assess and inspect cryptocurrencies – a scenario, including future developments, that was addressed in a recent BIS article10.

Moreover, it would support regulatory efforts to adeptly judge the implications and translate these into adequate supervision. Various FinTech parties to whom we have spoken underline the importance of this element. As highlighted in the Sygnum case study outlined below, an open regulatory approach and attitude can result in productive outcomes for all parties concerned.

Linked to that, however, we regard the significance of recurring discussions between regulators and cryptocurrency providers as a key third element. Establishing a continuous dialogue between these parties will help to sustain information exchange and enhanced mutual understanding. Ultimately, it will contribute to a healthy, adequately regulated financial system.

Sygnum as case study for the emergence of institutional crypto-providers

Riding the wave of emerging crypto markets globally, Sygnum was founded in 2016 in Switzerland, to become the world’s first digital asset bank. One of the founders’ original purposes was to connect today’s high potential, but largely unregulated digital asset industry to the regulated world of traditional finance. Sygnum was rooted from the start in the financial hubs of Switzerland and Singapore.

From this heritage, Sygnum grew to be the first digital asset specialist with both a Swiss banking license regulated by FINMA and a Singapore capital markets services (CMS) license. This unparalleled status nurtured and fostered financial institutions to invest in the digital asset economy. Sygnum harnessed the power of Distributed Ledger Technology (DLT) to shape the development of a trusted digital asset ecosystem that embeds digital assets into regulated banking.

One of the factors paving the road to institutionalization was the relatively progressive attitude of the Swiss regulator concerning digital assets. However, as is the case with many European countries, legislation and regulation on this topic was conspicuous by its absence. Sygnum therefore approached the regulator with a clear and extensive operational plan, addressing relevant risks and issues. The regulator acknowledged the bank’s expertise as illustrated in this elaborate proposal, making it easier for Sygnum to obtain the license.

2. Increased knowledge of technology and the compliance surrounding crypto amongst Financial institutions will mitigate perceived complexity

Another issue hampering institutional cryptocurrency adoption is not so much financial, but emotional. As cryptocurrencies and their underlying Distributed Ledger Technology (DLT)-technology are still seen as highly complex, the lack of knowledge within financial institutions and the regulatory challenges discourage users from crypto adoption.

This lack of subject-matter expertise exposes two separate disciplines within financial institutions that need to better understand how to move towards adoption. First, a yawning knowledge gap about the technology itself causes reluctance to work with cryptocurrencies, as the fear of trading an unfamiliar product leads them to take the safer option and trade with what they know. Second, once financial institutions have attained a (basic) understanding of cryptocurrencies, their preference tends towards ‘crypto risk-aversion’ due to a lack of understanding of compliance and KYC-related issues. Only after financial institutions understand both the nature of the products and related risk mitigation will the emotional hurdle obstructing crypto-adoption be properly straddled. This will not happen overnight.

3. Create customer-friendly cryptocurrency offerings to alleviate complexity

Being a customer in the cryptocurrency playing field is not without risks; regulators are mostly concerned about financial crime and consumer protection. In our conversations with FinTech clients, the importance of identity protection was a key consideration; the fact that cryptocurrencies can be kept in self-custody poses an additional risk linked to consumer protection. To enhance the appeal of cryptocurrency adoption from a consumer perspective, it is important to reduce these risks to a minimum and remove the complexity that consumers experience or perceive.

Institutions and enterprises have an important role to play in making this happen. They can package their cryptocurrency offering in a more customer-friendly manner by creating a framework that promotes peace of mind by hurdling the barriers to cryptocurrency adoption. This could well be similar to the way that credit card firms take responsibility for fraud. However, there are two paramount prerequisites for increased institutional adoption before this scenario becomes realistic. First, a clear regulatory framework as set forth above is absolutely essential for firms and institutions to extend their cryptocurrency offerings, and this will in turn boost customer adoption. Second, there is a lot to be gained by increasing internal knowledge about cryptocurrencies, which we have discussed above as well.

4. Evolving trends and clarity on the source of funds influence institutional adoption globally, and in the EU and NL specifically

Over the last few years, various technological and regulatory global developments have paved the way towards an increase on clarity on the nature and source of cryptocurrencies. Since mid-2020, institutional adoption in the United States has become widespread. It all started with a few prominent companies such as MicroStrategy investing in bitcoin. This bucked the 2017 trend where retail investors provoked each other – and prices rose rapidly. Other than companies placing cryptocurrencies on their balance sheet, the regulation for banks has been subject to change as well. After these regulatory advancements, banks started to offer crypto services to their clients, although these are mostly reserved for retail clients in a quite restrictive manner. This goal to offer crypto services is predominantly achieved through the acquisition of cryptocurrency custody providers.

Furthermore, Payment Service Providers are deep diving into cryptocurrencies. Take Paypal for example, offering cryptocurrencies to customers since November 2020 in the USA and since September 2021 in the UK. It is only a matter of time before these companies expand their offerings across Europe.

New tooling possibilities like Chainalysis and Elliptic, together with the new regulatory frameworks, will expedite institutional adoption over time.

Besides Sygnum, traditional European banks have started to offer cryptocurrency services, or are indicating they will soon do so (examples are SocGen and a range of Spanish banks). In the Netherlands, the Dutch Central Bank (DNB) requires cryptocurrency companies to be registered; currently 25 parties have done so.

Traditional banks play an important role in society as the gatekeepers of the financial system. They need to deal with the Financial Supervision Act (the Wet Financieel Toezicht, or WFT) as well as the Money Laundering and Terrorism financing (Prevention) Act (the Wet ter voorkoming van witwassen en financieren van terrorisme, or Wwft). As such, they need to know the origin of funds, know-your-customer and that parties are not dealing with sanctioned countries.

DNB registration is mandatory for cryptocurrency companies but, despite this, DNB does not hold prudential supervision on the crypto sector. This responsibility still lies with the banks when dealing with their customers’ cryptocurrency transactions.

Currently, various tooling options facilitate the tracking of the origin of crypto transactions, making the process more manageable. Chainalysis, Elliptic and Ciphertrace are offering software already used by governments, the police, and banks – an example is Colonial Pipeline/Elliptic. These tooling possibilities, together with the new regulatory frameworks, will expedite institutional adoption over time.

The market is moving towards a developing playing field that is increasingly regulated, with financial institutions becoming more prepared to step aboard.

To conclude, many regulators, including the Dutch regulatory authority, have yet to introduce any specific initiatives towards new legislation, meaning the first move is largely in the domain of the financial institutions themselves. Effective, nationwide regulation would help them to move forward. Next, increased knowledge of technology and the compliance surrounding cryptocurrencies and digital assets would help regulators and financial institutions to create adequate policies to manage and mitigate related risks. Lastly, financial institutions can play a larger role in increasing the uptake of cryptocurrencies by assuming some of the risk from the consumer by offering customer-friendly packages, and by utilizing tooling possibilities to facilitate tracking of the source. These opportunities provide way to unleash cryptocurrency potential, facilitating a more stable, non-volatile asset.

It is important to realize that this is still a fairly young growth market and that opportunities apply to all players in the framework. Through solutions offered by parties such as Sygnum, Chainalysis or Elliptic, the market is moving towards a more developed, regulated playing field. As these parties help mitigate the risk of trading in cryptocurrencies, financial institutions will feel more comfortable about participating in the market. Given the fact that the global cryptocurrency market has exceeded the $4 trillion mark, the need for increasing expertise on the topic and finding ways to tackle the challenges becomes more fundamental than ever before. The rapid growth of the crypto market is creating significant incentives for financial institutions to develop their knowledge, or risk missing the boat.

Blockchain technologies

Blockchain technology is a technology that makes it possible to do peer-to-peer transactions without knowing or trusting each other. There is no central party involved, it is a distributed system where ledgers are updated everywhere at the same time and place. The applications of blockchain technology are endless; there are many data sharing solutions and it is used in supply chains to make this sector more transparent. Another application is a cryptocurrency, this is a digital form of a currency that is created on the blockchain. In the example of Bitcoin, the bitcoin cryptocurrency is native to the Bitcoin blockchain.

I’d like to thank the FinTech parties we spoke to for their valuable contributions to this article.

References

[1] Global Cryptocurrency Users Reached 221 Million in June 2021 | Finance Magnates

[2] Digital Asset Management Review - October 2021 (cryptocompare.com)

[5] Bitcoin Futures ETFs Are Poised for Milestone With Debut in U.S. - Bloomberg

[6] El Salvador Goes On A $21 Million Crypto Buying Spree As Bitcoin Becomes Legal Tender (forbes.com)

[7] A digital euro (europa.eu)

[8] Four key drivers of the global crypto-asset regulatory risk agenda

[9] *MiCA proposes to regulate the issuance and operation of crypto for three distinct payment token categories: utility tokens, e-money tokens (EMT) and asset referenced tokens (ART) (Four key drivers of the global crypto-asset regulatory risk agenda)

Summary

Lack of nationwide regulation, modest hands-on know-how, lack of clarity on the source of funds and product complexity hamper the widespread adoption of cryptocurrency. We discuss what needs to be done to diminish scepticism and boost acceptance by financial institutions. EY and Rabobank have identified the opportunities that can help organizations overcome their hesitance to become more involved in an initiative that could change the way we think about the digital assets industry.