Chapter 1

Top-down forecasting

How to leverage market size data to create sales projections

You can approach your sales forecast in two ways. The first one is the “top-down” method.

In a previous blog, we explained how to create a high-level financial forecast for your startup using nothing more than the business model canvas. Step 3 of this process is defining who your customer is. Knowing your customers means knowing your market. And knowing your market size can help you set sales targets!

This way of working is called the top-down method. Often, the TAM SAM SOM model is used to estimate the market size accordingly. To explain the top-down method using the TAM SAM SOM model, we will take the example of fictional cola company called “Happy Cola”.

TAM represents Total Available Market and is the total market size if Happy Cola could sell bottles of cola on a global scale without any competition or internal limitations on its capacity. Happy Cola’s TAM thus consists of the total worldwide demand for cola. Its value equals all colas sold on a global scale, expressed in euros or dollars or, for instance, in liters. Spending several hours researching Google searches and industry reports often provides a good image of the total market in a specific sector.

SAM stands for Serviceable Available Market and is the size of Happy Cola’s niche market: the market that fits with Happy Cola’s geographic reach, type of client and product type. SAM is therefore a fraction or percentage of TAM.

For example, because of the current hype around healthy food, Happy Cola has decided to sell diet cola only (Happy Cola Light) and mainly to adolescents. Furthermore, since Happy Cola is just starting up as a company, it is only focusing on the Dutch market in the short term. Happy Cola’s SAM thus equals the value of all diet colas sold to young adults in the Netherlands and is only a small percentage of TAM (the worldwide cola market).

Related article

Chapter 2

Bottom-up forecasting

Building your sales forecast based on company data and internal capacity

The top-down method results in a sales forecast calculated based on a percentage of the market. This approach mainly leverages market data and defines sales targets based on the market share a company hopes to earn.

The pitfall of this approach is that it might seduce you to forecast sales too optimistically. Often entrepreneurs calculate SOM (equal to sales) by taking a random percentage of the market, without really assessing whether this target is realistically achievable. A tiny percentage of a market might seem insignificant but could be way too optimistic, for instance, in the year of your launch.

Building your sales forecast using the “bottom-up” approach will guard you from this pitfall. The bottom-up approach is less dependent on external factors (the market) but leverages internal data, such as sales data and your company’s internal capacity.

It is doubtful whether Happy Cola, being a startup, is able to achieve sales targets that are established by estimating the desired market share (the top-down method). Will it have enough production capacity to answer the cola demand in the Netherlands? Will its brand recognition spread fast enough? Will it be able to hire enough sales and marketing personnel to cover the full market? Will it be able to reach enough prospects on a daily basis to guarantee the sales volumes? These are all valid questions the top-down approach often does not answer.

Chapter 3

A small case study of sales forecasting

Why it is useful to combine the bottom-up and top-down methods

Happy Cola uses the top-down method and hopes to capture 10% of the Dutch diet cola market next year. The market size (SAM) is €30 million, which implies that Happy Cola needs to sell colas for a total value of €3 million to obtain the desired market share of 10%.

Happy Cola sells large containers of cola for €5,000 per order, which means that Happy Cola needs to generate 600 customers to achieve the intended market share (600 times €5,000 equals €3,000,000). However, a bottom-up analysis shows Happy Cola that it can only generate 500 qualified leads per year with one sales representative. Happy Cola thus knows it will never be able to reach 600 customers.

This example illustrates how Happy Cola’s internal capacity restrains the company from obtaining its desired market share. Hiring more sales representatives could be a solution but is dependent on whether there are enough revenues or funds available to cover the related personnel costs.

Performing a bottom-up analysis not only forces you to think about what is feasible for your company but also to think about the ways in which you will spend your money. Moreover, it shows you whether you might need external financing to increase your capacity and grow faster.

The top-down method might result in targets that are too optimistic; but, on the other hand, the bottom-up approach might fail to show the optimism needed to convince others of the potential of your company. If you are a startup founder and you are looking to raise funding, the bottom-up approach might not do the trick.

Investors usually expect startups to grow fast and gain significant market share rapidly. The bottom-up method might fail to reflect this. It is difficult to create a sales forecast with a steep growth curve if every sales has to be rationalized and if its point of departure is the maximal capacity of your company. The whole reason why external financing is needed is often to expand capacity and grow faster than a company would organically.

Therefore, if you are looking for funding (depending on the type of investor), it may be advisable to use the bottom-up method for your short-term sales forecast (one to two years ahead) and the top-down method for the longer term (three to five years ahead). You will be able to substantiate your short-term targets, and your long-term targets demonstrate the desired market share and the ambition an investor is looking for.

Use the bottom-up method to create short term sales forecasts (1 - 2 years ahead) and the top-down method for the longer term (3 – 5 years ahead) if you want to set ambitious targets.

Chapter 4

Practical example

How to create your sales forecast using Excel

The top-down and bottom-up methods can help with estimating sales targets, but how do you actually put your targets down on paper? Take the following steps:

- Determine your forecast period.

Generally speaking, a forecast should be three to five years ahead. The first year should be presented on a monthly basis (for instance, January through December), and years two through five should be presented annually.

Create a big table, for instance, in Excel, with the first row, from left to right, presenting the next 12 months. Next to that, put years two through five. For some industries, it makes sense to have longer forecasts (e.g. 10 years). In the medical industry, for example, it can take years of R&D before the first revenues are generated.

- Determine in which units you want to present your sales.

Happy Cola can represent its sales in liters but also in bottles. Pick a unit with a clear selling and cost price per piece. This will help in calculating margins. For Happy Cola, bottles are an easier unit to work with because the company sells per bottle and therefore knows the exact selling price per unit sold.

Moreover, it is easy for Happy Cola to calculate the cost price per bottle by dividing the total production costs (labor and purchases of raw materials) by the total number of bottles produced. Some examples of other units are as follows: accountant sales hours, tech company sales licenses, SaaS company sales subscriptions, etc.

- Forecast per sales unit the sales volumes.

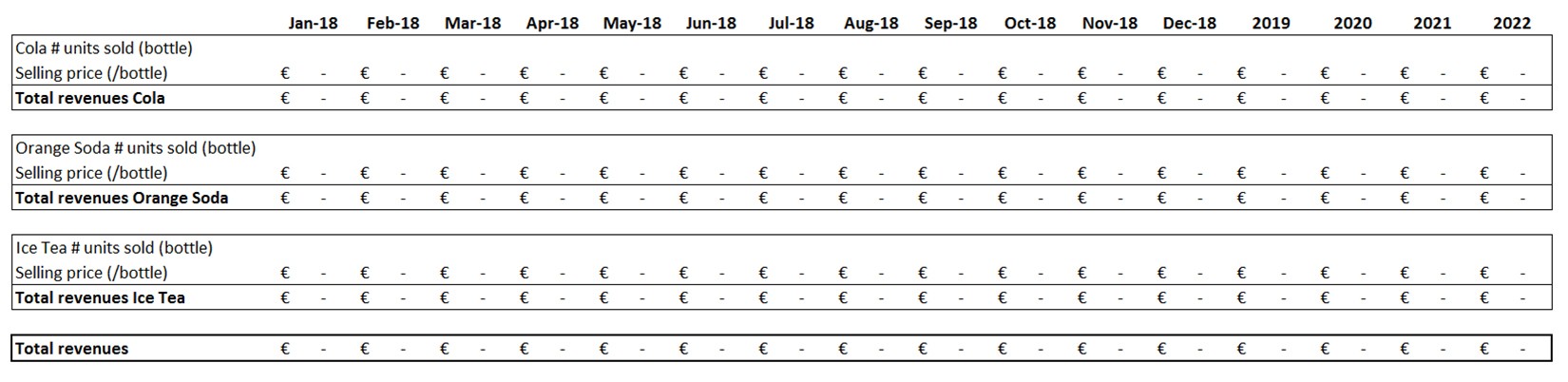

In the table you made for step 1, you created a list of the offerings you sell represented in their related sales units. Every unit has its own row (Happy Cola, for instance, uses bottles of cola, bottles of orange soda and bottles of ice tea as sales units).

Fill in the table with the number of units sold per product. For the next 12 months, do this monthly and for the following two to five years annually. Use historical sales volumes or the top-down/bottom-up approach to substantiate your forecast.

In the case that subscriptions are sold, you need to take an additional step: the number of subscriptions sold is equal to the number of active subscriptions in the previous time period plus the number of new subscriptions sold in the current time period minus the number of subscriptions cancelled in the current time period (the “churn”).

- Add selling prices.

As soon as you have determined your pricing (this blog can help you with that) you can add those to the table you have made in step 3. Add two rows for each offering that you are selling. In the first row, add the selling price per offering.

Happy Cola has different prices for a bottle of cola, orange soda and ice tea. In the second row, multiply the number of units sold with the selling price. Doing this exercise for Happy Cola results in the total revenues per bottle of cola, orange soda and ice tea.

Finally, add one more row in which you add the total revenue streams of the different offerings you sell. Et voilà: you have made yourself a full-fledged five-year sales forecast!

The table below presents an example of what this could look like for Happy Cola but without any numbers. As you might notice, we have included previous years as well: if you have realized sales in the past already, it is useful to add them to show the growth in revenues.

Summary

Sales is the backbone of any company. For startups it is an important indicator of customer traction and it has a large impact on a firm’s ability to raise funding. It can be difficult to forecast sales being a startup, as there is not that much historic sales data available. Combining top-down and bottom-up forecasting methods can help you substantiate your sales projections. Need more support with creating sales projections? Check out our financial planning software for startups.