Sustaining positive customer perceptions is key – and telcos will need to escalate their efforts to bridge the digital divide in society, while working with other players such as over-the-top (OTT) streaming providers to optimize customer experiences.

2. Inability to scale internal digitization initiatives

COVID-19 has triggered an industry-wide reappraisal of digital transformation programs, with a greater focus on digital customer engagement and support. EY research shows that more than three-quarters of industry executives are either re-evaluating or adapting the speed of automation and digital transformation initiatives post-pandemic. But issues still need to be addressed in areas like long-range planning, AI skills, and alignment between technology and business strategies.

3. Failure to redesign workforce purpose and inclusion

Talent attraction and workforce diversity are top-of-mind issues for telcos – and in the wake of COVID-19, they have an opportunity to leverage a renewed social purpose to attract the next generation of STEM graduates. However, current talent acquisition priorities are often not aligned with longer-term considerations, with tactical priorities outweighing strategic improvements. There’s also an increasingly pressing need to improve senior female representation and ethnic diversity.

4. Failure to improve capex efficiency and network returns

Telecoms network upgrades are under increasing scrutiny as COVID-19 puts network performance, reach and accessibility in the spotlight. Capabilities likes 5G, full fiber and internet of things (IoT) can bolster service innovation and resilience, and some operators are accelerating their capex programs. Yet return on capital employed continues to decline for many telcos, increasing the need to boost capex efficiency by applying technologies like AI and automation.

5. Underestimating changing imperatives in privacy, security and trust

Customers’ concerns over privacy and security are rising – and COVID-19 has heightened them still further.

Nevertheless, nearly 30% of consumers are willing to exchange their data for tailored services, underlining the opportunities to monetize customer insights.

However the industry still regards cybersecurity primarily as a reactive and compliance-centric process, and telcos have yet to translate their relatively strong public trust into higher net promoter scores or adjacent service revenues.

6. Poor management of investor and stakeholder expectations

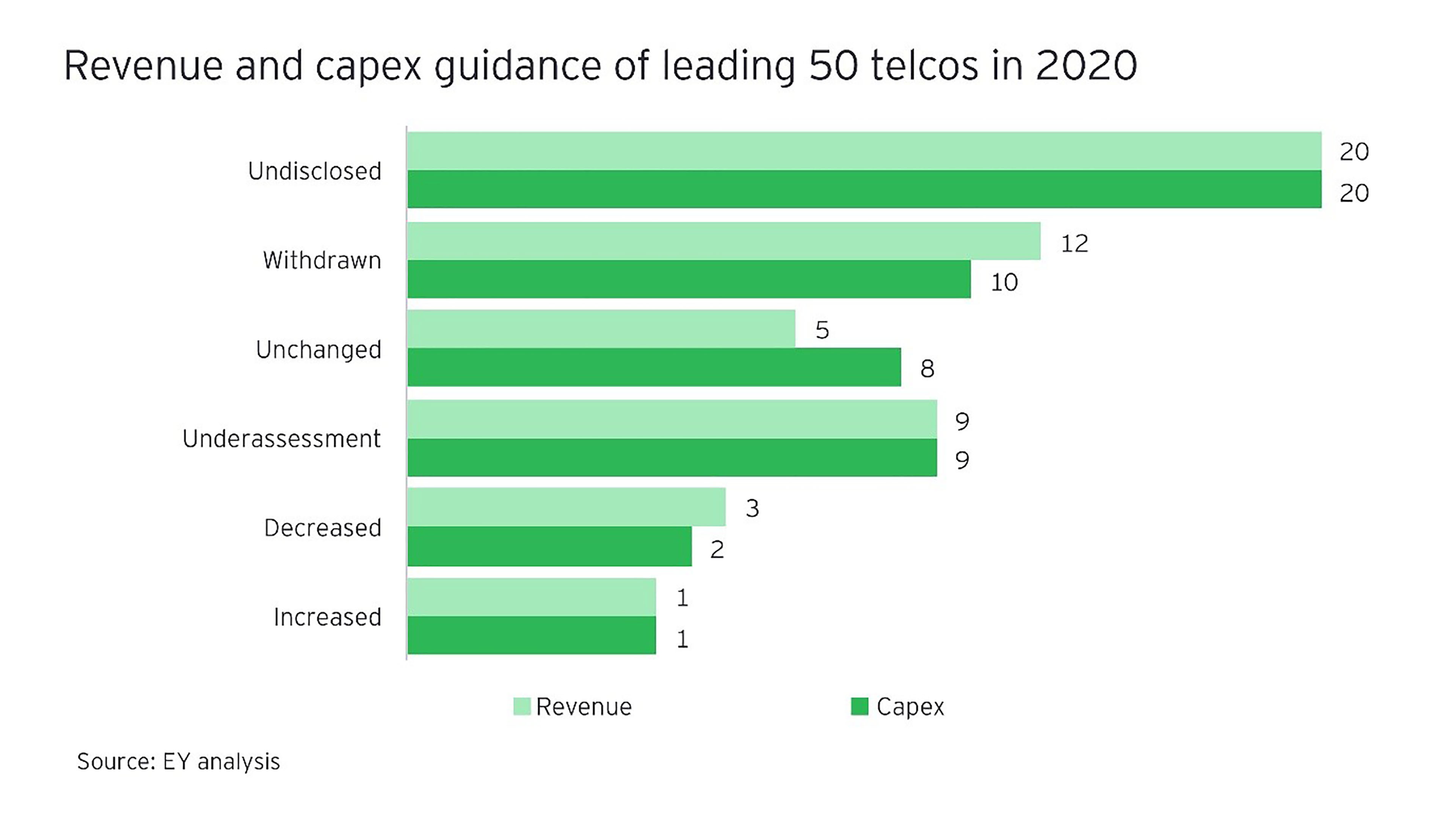

COVID-19 has disrupted forward-looking guidance from operators worldwide, with several withdrawing their full-year guidance for 2020. This caution reflects several factors, with roaming and enterprise revenues still squeezed by lockdowns, and many forecasters projecting flat mobile capex from 2021. Dividend sustainability is also under scrutiny and network infrastructure becoming increasingly politicized. Creating credible investor communications during this unprecedented period will demand both foresight and flexibility.

7. Ineffective engagement with industry verticals and public sector

COVID-19 has accelerated digitization across many industries, suggesting new opportunities for telcos to deliver sector-specific enterprise solutions. While different industries are at varying stages of their 5G and IoT investment programs, they all need support to realize the “next wave” opportunities. Meanwhile, the pandemic has deepened telecoms’ relationships with governments and strengthened its status as a national strategic asset. Making the most of these shifts will require ongoing focus and engagement.

8. Inability to adapt to a changing regulatory landscape

The importance of digital infrastructure during the COVID-19 crisis has prompted regulators to focus more on consumer protection, data privacy and the digital divide. New areas of stakeholder scrutiny are also emerging such as regulation of network equipment supply chains. Meanwhile, COVID-19 has made industry regulation less predictable, with several countries deferring spectrum auctions. Operators must ensure that regulatory burdens remain manageable and reflect telcos’ renewed importance to society.

9. Failure to mitigate evolving disruptive scenarios

Geopolitical and global trade forces are disrupting network equipment supply chains, as a number of countries mandate bans or limits on hardware from Chinese vendors. The costs and effort of removing existing equipment could potentially delay 5G rollouts. Other disruptive trends include diversification of network equipment supplier bases, and equipment vendors targeting private Long-Term Evolution and 5G networks for enterprises, threatening operators with disintermediation.

10. Failure to take advantage of changing market structures

An increasingly diverse wholesale landscape is opening up fresh opportunities. In mobile, 5G network slicing presents growth potential for enterprise-focused mobile virtual network operators (MVNOs), while fixed wholesale is seeing growth in fiber altnets and cable infrastructure wholesaling. There are also opportunities to simplify the network estate and de-risk investments. To capitalize effectively on more efficient market structures, operators will need to reassess their M&A and partnership strategies.

Summary

The COVID-19 crisis has boosted the social role and importance of telecoms while squeezing operators’ revenues across most product categories. As we move beyond the pandemic, success for telcos in the “new normal” will depend on building network resilience and reach while driving positive customer perceptions.