Chapter 1

What businesses should expect next

Three defining features

The next phase will not take us back to where we were before. The pandemic has caused permanent changes in the way individuals live, the way government serves its citizens, and how businesses operate. Things will never be the same again.

The next 12 to 18 months is a chance for business leaders to plan how to adapt and strengthen resilience, while reframing the enterprise to be ready for the new value-based economy that lies beyond.

Feature 1: More digital than ever

Digitalization was a ‘can’ before the pandemic. It’s now a ‘must’. COVID-19 has given many a crash course in digital, which creates significant opportunities.

Take telehealth as an example. The US’s Medicare program, which covers more than 60 million elderly people, has allowed online patient visits. One global life insurance firm is partnering with medical screening providers to provide virtual medical examinations to prospective applicants. This will involve interacting with a nurse to answer medical questions via a video call, along with a pinprick blood test that will be sent to labs for testing.

Companies will also need to accelerate their moves to automate processes from manufacturing to the back office. Robotics can help optimize operations, reduce cost and increase speed.

Different businesses have used Robotic Process Automation (RPA) bots to improve processes in the current period. A Central American bank has employed RPA to speed up processing for a COVID-19 loan forbearance program, while some of the world's largest airlines have employed bots to help manage surging demand of customers cancelling flight reservations.

Feature 2: More collaborative

What’s next after COVID-19 is likely to be characterized by a blurring of market boundaries – of new collaborations to share risk, to co-develop and cooperate – and by more customer intimacy. These new relationships will be both resilient and responsive.

Companies that have shown leadership and agility through the COVID-19 crisis can build on their positive actions to create stronger customer loyalty.

Many companies showed their ability to respond to the crisis quickly, from the German automotive-sponsored Formula 1 team which used reverse-engineered power units to provide CPAP machines for COVID-19 patients, to the French cosmetics firm producing hand sanitizer in response to a shortage in the market. That agility and ability to transform operations to meet sudden new demands provides companies with experience that they can apply to what comes next. Repurposing and transforming to grasp opportunities in a new reality while looking at ways to share know-how and resources provide competitive advantages to those who can master them.

Actions taken during the heat of the crisis can also help position business as a force for social good.

Big tech companies have collaborated to help trace virus infections and provide platforms for community action. This may do much to rebuild consumer trust and confidence

Collaborative, resource-sharing models do not only have the potential to improve enterprise resilience, but also reduce risk. COVID-19 has shown all too clearly the deficiencies in linear, remote supply chains and just-in-time inventory management. The value chains were lean, but they weren’t flexible. By developing value networks, looking at reshoring, distributing dependencies and building clusters for research and development, companies can both accelerate innovation and insulate the enterprise from shocks.

Feature 3: A changing consumer and employee

The impact of the pandemic has created permanent change in the attitudes and experiences of employees and customers: none of us will be quite the same again.

Amid the many challenges of the pandemic, we can see some positive aspects. Reduced travel and industrial activity have resulted in dwindling nitrogen oxide and carbon oxide emissions, clearing the air, allowing fish to return to urban rivers, and allowing asthmatic children who do not suffer from COVID-19 to breathe normally. In some industrialized cities, there have been new peaks in cycle hire as people reclaimed the roads.

How can business, working with government, progress the environmental agenda? What opportunities does this present?

One major global food and beverage company, for example, has ensured its response to the current crisis doesn’t end as we emerge from it. In addition to donating more than $40 million for meals to people at risk, it has recently signed the UN Global Compact “Business Ambition for 1.5°C” pledge, committing to an emissions reduction target across its value chain.

In other places, community action burgeoned as people reached out to unknown neighbors, to the vulnerable and immobile. How can businesses build on this charitable behavior?

Videoconferencing and team apps have become the norm for many employees working from home. For some, productivity has soared as staff have scheduled work when they are most productive; have gained back time from the daily commute; and have been able to integrate work and family life more easily. How can companies restructure work to take advantage of this experience? And how can they support and keep valuable employees whose experiences have been more difficult?

Businesses in sectors acutely affected by the pandemic are already focused on rebuilding trust with their customers.

Airlines, for example, are initiating enhanced between-flight cleaning regimes, sanitizing high touchpoints and installing hospital-grade HEPA (High-Efficiency Particulate Arresters) filtration systems that extract airborne contaminants such as COVID-19.

Sustainable consumption has become an even greater need during the crisis that is likely to have a lasting impact. The economic growth prerogative of pre-COVID-19 is also shifting to embrace other ideals – better wealth distribution, less environmental impact, more security and equilibrium for all. We can see a rebalancing of the trade-offs between financial gain and quality of life.

Related article

Chapter 2

What companies need to do

The four imperatives include a flexible workforce, an agile supply chain, adapting to a new kind of customer, and sustainable finance.

In the ‘now’ of the COVID-19 crisis, some companies are still in survival mode, focused on the health and wellbeing of their employees; the financial stability of their operations and establishing a center from which to manage risk.

“In this period of unprecedented uncertainty, optionality, agility and decisiveness are vital,” says Kelly Grier, EY US Chair and Managing Partner and Americas Managing Partner Emeritus. “Scenario planning that can give you plays that you can run quickly in response to change will help businesses deal with ongoing unpredictability.”

A to-do list for “next” won’t be uniform for companies in every sector or geography. The “next” phase looks different for companies in the airline industry, oil and gas and hospitality from companies in life sciences, food and technology, for example. Not all countries have been equally affected by COVID-19: some countries have experienced no lockdowns while others are likely to be severely restricted for several months.

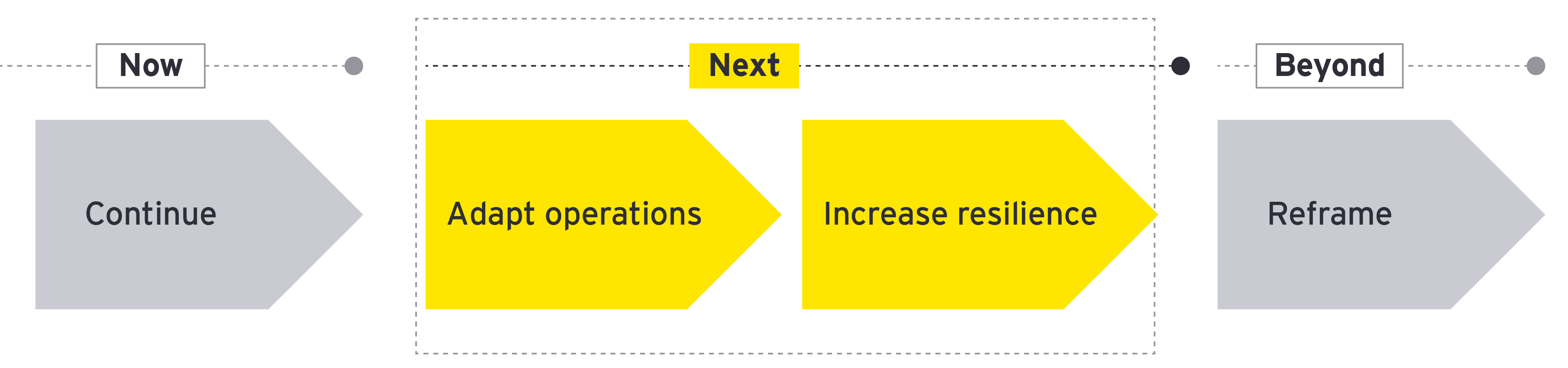

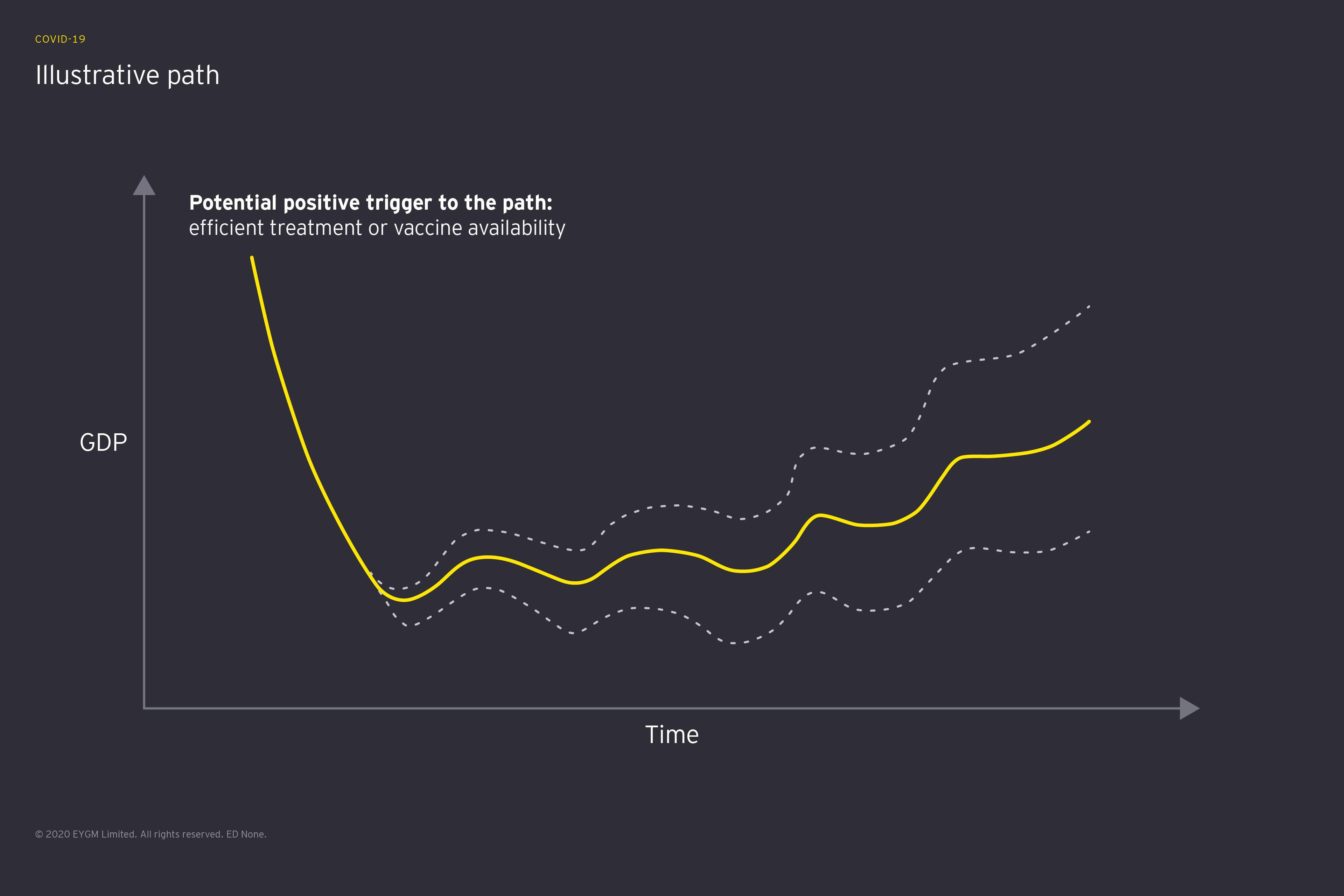

What comes next is unknown, but it is almost certainly volatile. To prepare for this, we see two imperatives: adapt operations and increase resilience.

“Flexibility has always been a business advantage but it will now be critical to survival” says Julie Teigland, EY EMEIA Area Managing Partner. “Flexible employment contracts, owning versus buying-in, diversifying site portfolio risk, making supply chains agile through shared resource models, ensuring sustainable working capital needs – these are all critical to coping with sudden fluctuations in supply and demand.”

Businesses will need to adapt their operations to enable re-opening and commercial viability. Companies should repair the value chain, near-shoring where applicable; reduce portfolio complexity and optimize functions. The pandemic has exposed weaknesses in the architecture of many business operations: while lean and efficient, they were inflexible and difficult to adapt to a rapidly changing environment.

Organizations need to design resilience for a period of recovery with recurring disruptions, not just business as usual. They need to look at lowering the cost base, increase workforce flexibility and reduce risk across the operation.

To be in the best position to take advantage of whatever the saw recovery may offer, the business needs to have the right people in place, financial firepower and the ability to move quickly.

1. Create a flexible workforce

Companies need to create a more flexible workforce, looking at adaptable contracts, contingent workers, and exploring the efficiencies of remote working with the potential impact on real estate needs.

They need, too, to look at how and when to onboard furloughed staff; how to engage the workforce in the transition to a new normal; how to attract people with the right skills for what comes next.

Innovative responses to the crisis itself can provide a blueprint for building flexibility into employment. Some big-brand US grocers and pharmacies, responding to a surge in demand for shelf-stackers and delivery personnel, have instituted novel collaborative arrangements with companies in some of the hardest-hit sectors (e.g. hospitality, restaurants and retail) to meet these needs. Some companies are cooperating directly to funnel applications to where there are job openings, while others are creating exchanges to connect labor supply and demand.

Companies need to be open and transparent in their communications with their employees, engaging them in the rebound while also recognizing there are likely to be ongoing restrictions in mobility and physical distance that will have to be factored into any return to workplaces.

Videoconferencing has become the standard for business meetings, and this and other work efficiency technologies may provide longer-term options for remote and flexible working, while strengthening cyber security protocols and controls to reduce risk is paramount.

2. Plan for an agile supply network

Linear, global supply chains need to be stress-tested against geopolitical risks, with vulnerabilities minimized. By looking at shared, less distant resources, some onshoring of business-critical activities and the creation of an agile value network, companies can restart production, while mitigating risk of disruptions.

Demand planning and generation modelling needs to be an iterative process that is integrated across the whole business, not conducted in isolation in different functions, each using a different set of variables. As a choppy return to growth creates rapid fluctuations in demand patterns, so supply planning needs to be flexible and responsive.

Shelter-in-place orders and widescale business closures are significantly changing energy usage patterns – producing steep declines in some places and surges in others. Utilities companies in several countries are using artificial intelligence and machine learning to understand these changes and to forecast new consumption loads. This helps reduce costs and improves reliability of delivery.

3. Expect a new kind of customer

Companies need to increase digital customer access and ensure data analytics are optimized across data sources. Incompatible legacy systems that don’t talk to each other will be costly weaknesses that the resilient organization can ill afford. Analyzing customer behavior will provide opportunities for rethinking product and service portfolios in the medium term while throwing up short-term chances.

An app-based ride-hailing company has responded to changing consumer needs and preferences not only by pivoting to deliver groceries to people sheltering at home in Brazil, France, and Spain, but also by offering phone-based services to customers who may not be comfortable using apps.

In other instances, organizations are opening new channels to interact with customers affected by lockdowns. A major Indian bank, for example, launched a suite of basic services through a secure messaging app, while a Nigerian bank has introduced a new self-service banking feature through its online platform and an interactive voice response system.

These kinds of initiatives, launched in the heat of the crisis, can help companies succeed through the next phase of choppy and sluggish growth.

A significant result from the EY Future Consumer Index, published in April 2020, found that 62% of respondents are more likely to purchase from companies doing good for society. Building close relationships with customers by open and frequent communication as well as building a positive reputation through the right actions during the pandemic are winning strategies for what comes next.

4. Develop sustainable finance

Financial resilience will flow from lowering the cost base over the longer term, increasing liquidity in the short term and using virtual scenario planning to cope with downturns and upturns in the medium term. Financial and risk teams should continue to work together on developing plans, on communicating forecasts, however difficult, to both internal and external audit teams as well as investors.

As government support measures taper off, companies should monitor capital needs conservatively as the uncertain environment continues. As the state’s role has expanded to provide emergency relief through the worst of the crisis, governments are expected to continue to look at stimuli to help reboot the economy during the next phase and we will see a new collaboration between industry, regulators, lenders and government to revive the economy.

Conclusion

As organizations transition to this new phase, they must also consider what is to come beyond, as crises of this scale are sure to reshape the competitive landscape. The world on the other side of the crisis may look very different, with different norms, rules, competitors and value propositions. For companies to remain relevant in this new world, they will need to engage with multiple stakeholders to re-frame their future, build long term value and a new value-based economy.

Summary

The next phase is likely to be defined by a saw-toothed economic recovery and long-lasting changes to how we live and work. Transitioning to what comes next will place heavy demands on companies’ ability to adapt and increase resilience to weather after-shocks. They must also consider what is to come beyond.