Chapter 1

Consumers have adapted, now they crave normality

As consumers look to the future beyond COVID-19, they have different views on what will be normal.

One of the many things that organizations and individuals have learned from the shared experience of pandemic is how resourceful and adaptable they can be. While 62% of global consumers tell us the way they live has changed significantly in recent months due to COVID-19, 60% feel they are coping well with its impact.

Even so, the understandable desire for life to return to some kind of normality is growing. We’ve been tracking the immediate and near-term spending intentions of consumers for the past three months. The consumers in the segment we define as “Get to normal” has doubled over the last month to reach 40%.

But while the craving for stability is on the rise, 50% of consumers still expect their lives to change significantly in the long term. And the kind of changes they want to make are profound: 53% say their values have changed and they look at life differently. This will have significant implications for what and how they consume.

Heightened concerns around health, hygiene, value for money and waste are characteristic of the Anxious Consumer that we identified in the last edition of the Index. We expect these concerns to reduce as time passes and organizations take the kind of actions needed to help the consumer feel safe. But it’s clear from this latest edition of the Index that pandemic anxiety will have a long half-life.

The number one priority for a significant proportion of “Get to normal” consumers will be to spend within their means and to look after the health of their family. Others will continue to be driven by purpose and experience. These aren’t new drivers of behavior and preference. But the Index suggests that consumers will become much more committed to their values, to their tribes. The Index has identified five new beyond COVID-19 consumer segments that bring this transformation to life. We explore each of them in the next chapter.

Chapter 2

Five segments describe the consumer beyond COVID-19

The experience of living through this crisis is reshaping consumers with new needs, deeper values and higher expectations.

The Index explores five new segments that describe the consumers that organizations will need to engage beyond COVID-19. Each segment reflects the different ways people expect to be living their lives, how they will make choices, and what really matters to them.

Two of these segments highlight the way that many consumers will focus on living within their means and looking after their health, and the health of their families (“Affordability first” and “Health first”). Another two point to the way some consumers will make their environmental and social concerns central to their lives (“Planet first” and “Society first”). And the final one identifies the consumers who will focus on living in the moment and getting the most from every experience (“Experience first”). These segments build on the future scenarios we modeled in FutureConsumer.Now, our collaboration with futurists and industry leaders.

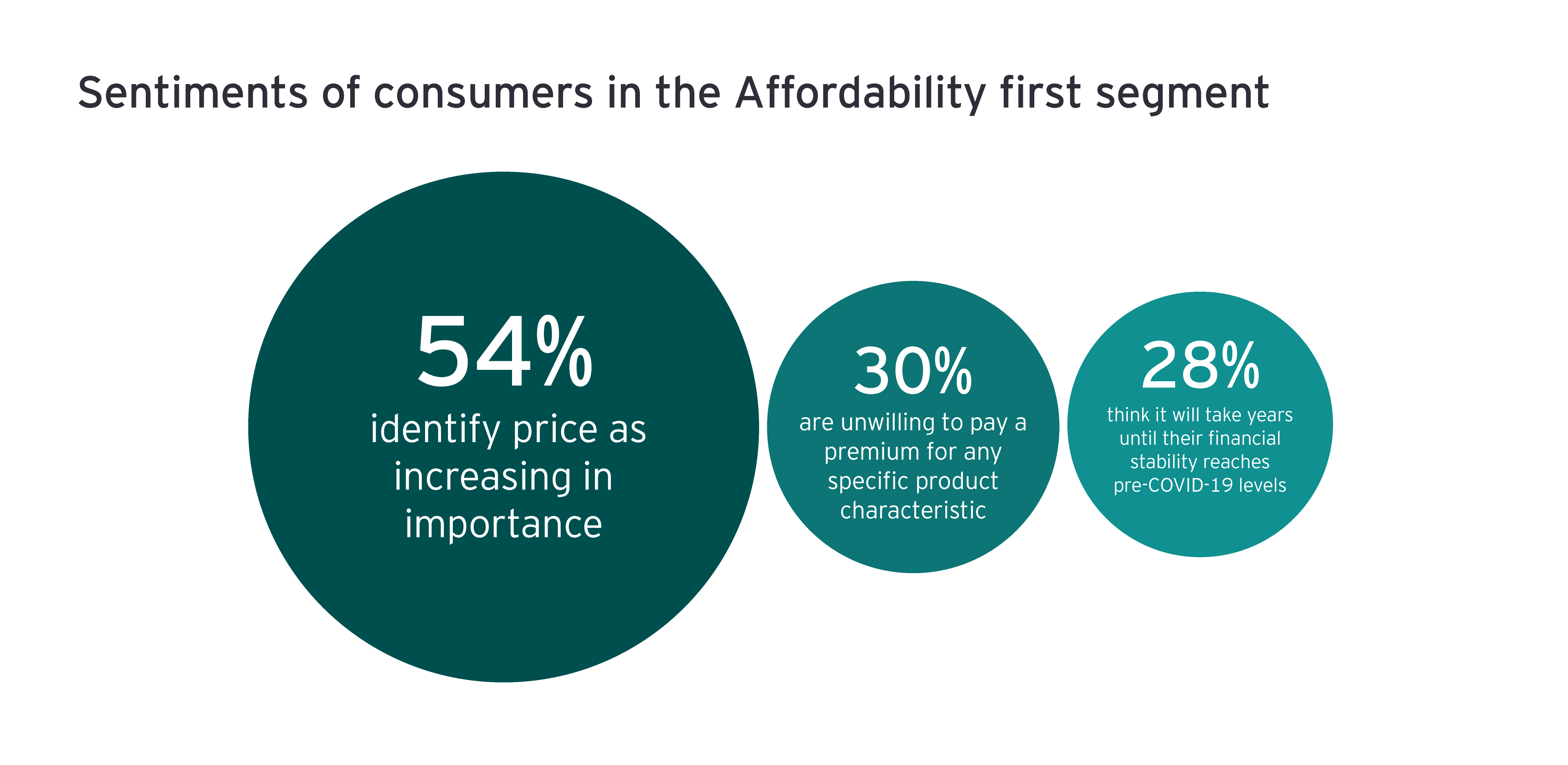

Affordability first

This is the biggest of our future segments, representing 30% of consumers. Their priority is to live within their means. They avoid buying things they don’t really need. And when they do have to make a purchase, they are keen to look for the best deals.

The “Affordability first” consumer is likely to be older than consumers in other segments and to live alone. They are the most pessimistic about how long it will take their country to recover and for financial stability to return. They are the least educated consumer segment and are more likely to be in low-income jobs that pay by the hour.

They don’t much care about what brands they buy, just that a product delivers what they need. They will likely trade down unless companies can convince them that their products are superior. How can your products or brands successfully differentiate beyond price? How will you meet the expectations of these consumers at a price they are willing to pay?

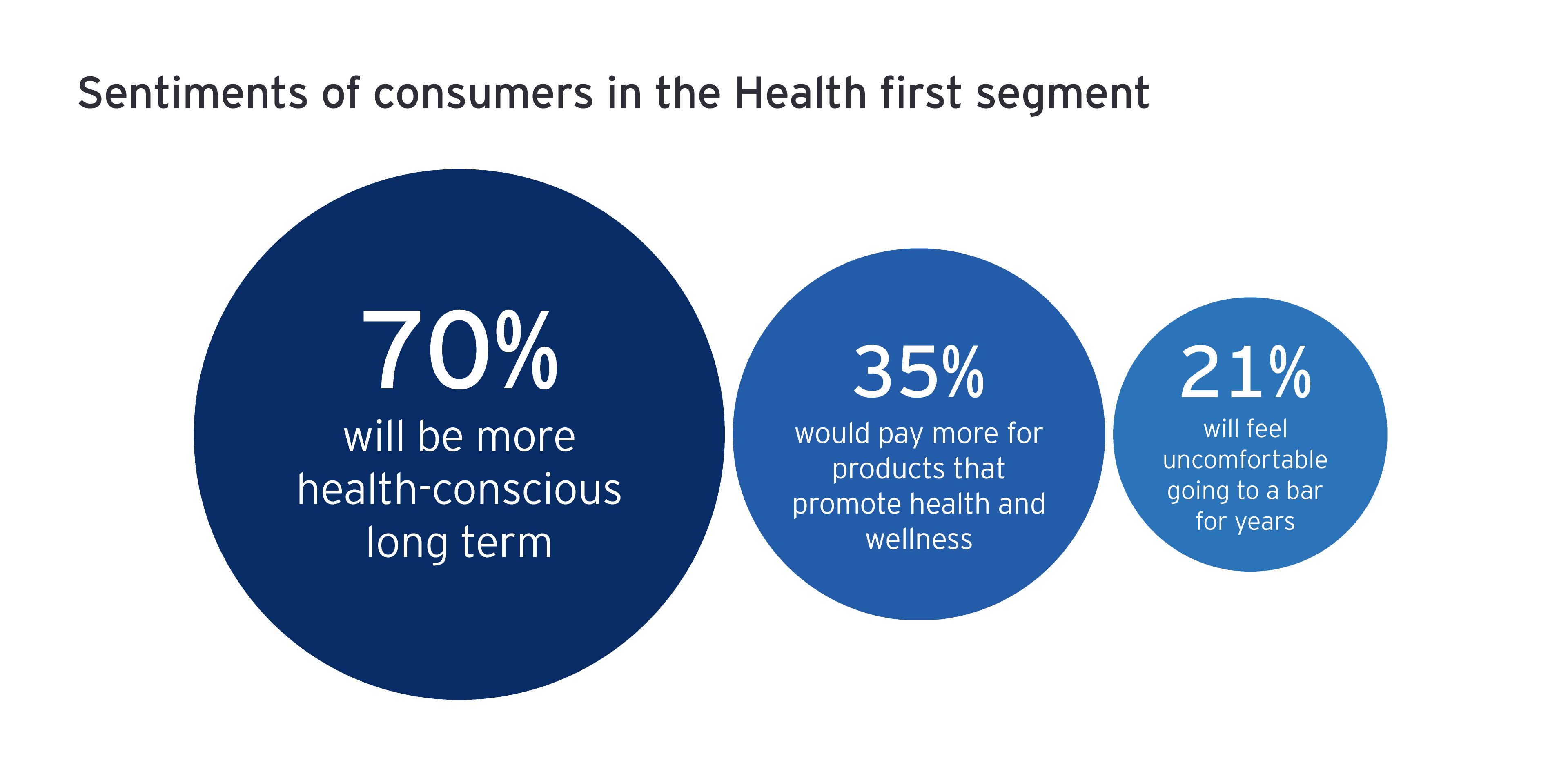

Health first

This is the second largest segment, representing 26% of consumers globally. Their priority is to protect their health and the health of their family, and that will guide the choices they make. They will prefer brands and products they trust to be safe and will minimize unnecessary risks as much as they can. For example, they would rather shop online than in a store, because that feels safer.

“Health first” consumers are the most likely to be living with their family. They are the most pessimistic about how long it will be before “normal” life resumes and are the most likely to think the way they live their lives will change long term as a result of the pandemic. Fifty-nine percent say the pandemic has changed their values and the way they look at life. Fifty-seven percent say healthy or good for me has increased in importance in the products they buy.

It’s understandable that so many consumers are focused on health risks. Retailers and other operators of communal spaces will need to work in a sustained way to make consumers feel safe. How can they demonstrate the health of their products and the safety of their spaces? What scope is there to bundle trusted brands and offer them directly to the consumer?

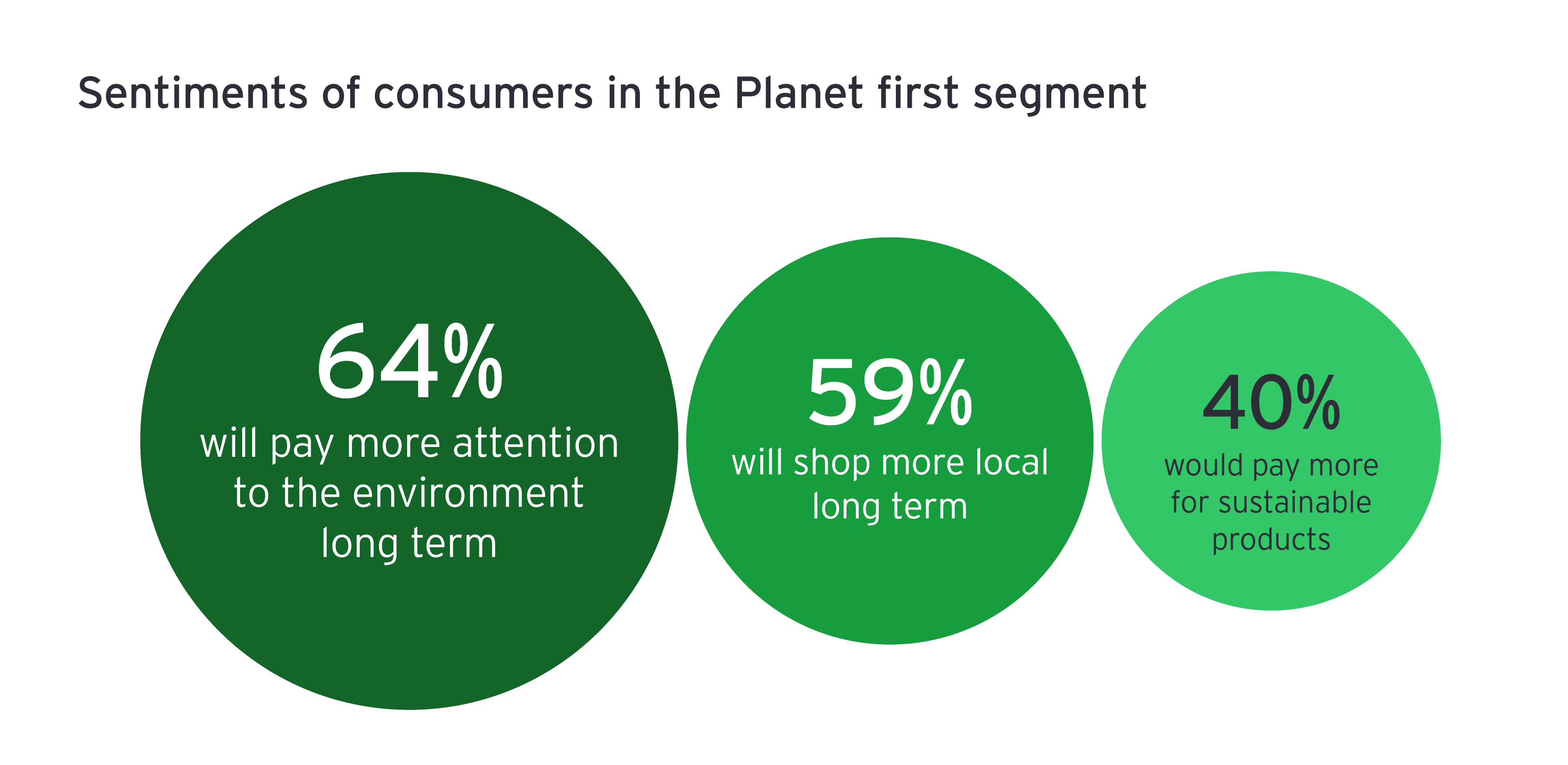

Planet first

The 17% of consumers in this segment are acutely aware of the impact their consumption choices have on the world around them. They will seek out brands that align with their beliefs and people who share their values. They are the most likely to change the products they buy. They would pay a premium for high-quality, ethically sourced sustainable goods and are most likely to support local or independent domestic brands.

“Planet first” consumers are determined to cut waste and reduce their environmental footprint, so they buy locals goods from local shops. If that means they have less choice about what they buy, that’s a cost they are willing to pay — they are determined to do the right thing for future generations. “Planet first” consumers do not skew to a particular demographic cohort; they are spread across all age and income groups.

Sustainability has been a hot topic in recent years. The Index shows that it remains high on the consumer’s expectations, even if other values (health and affordability) are likely to be front of mind in the near term. How will you create the transparency that will build consumer trust? To what extent are both you and your value chain partners able to deliver the sustainability that the “Planet first” consumer expects?

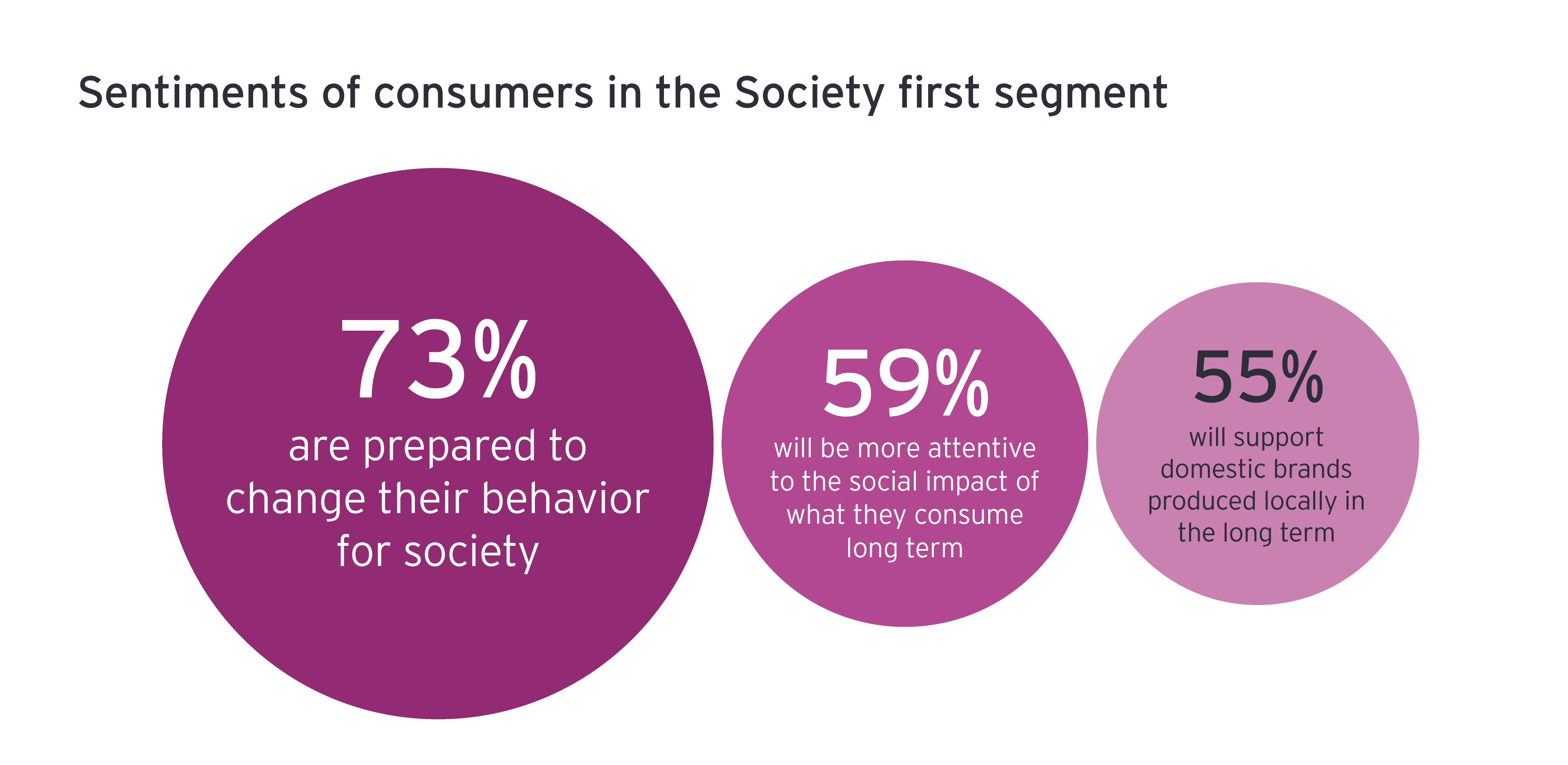

Society first

The 16% of consumers in this segment believe that everyone should work together for the greater good. They pay more attention to the social impact of what they purchase and consume. They buy from organizations that are honest and transparent about what they do. But they don’t take that on trust: they want proof that a business or brand is genuinely putting the needs of society and the community on par with profits. They want to act in ways that benefit society, like sharing personal data to help stop the spread of disease.

The “Society first” consumer is predominantly an urban professional; this segment has the highest share of people with graduate or doctoral degrees. Many of them feel they are in a better financial situation as a result of the pandemic because there is less to spend money on.

This consumer demands brands that have a clear purpose that aligns with their values; they reject those that don’t. How will you embed a differentiated purpose at the heart of your transformation? How do you ensure your portfolio of products, services and brands is rooted in a consistent set of values?

Experience first

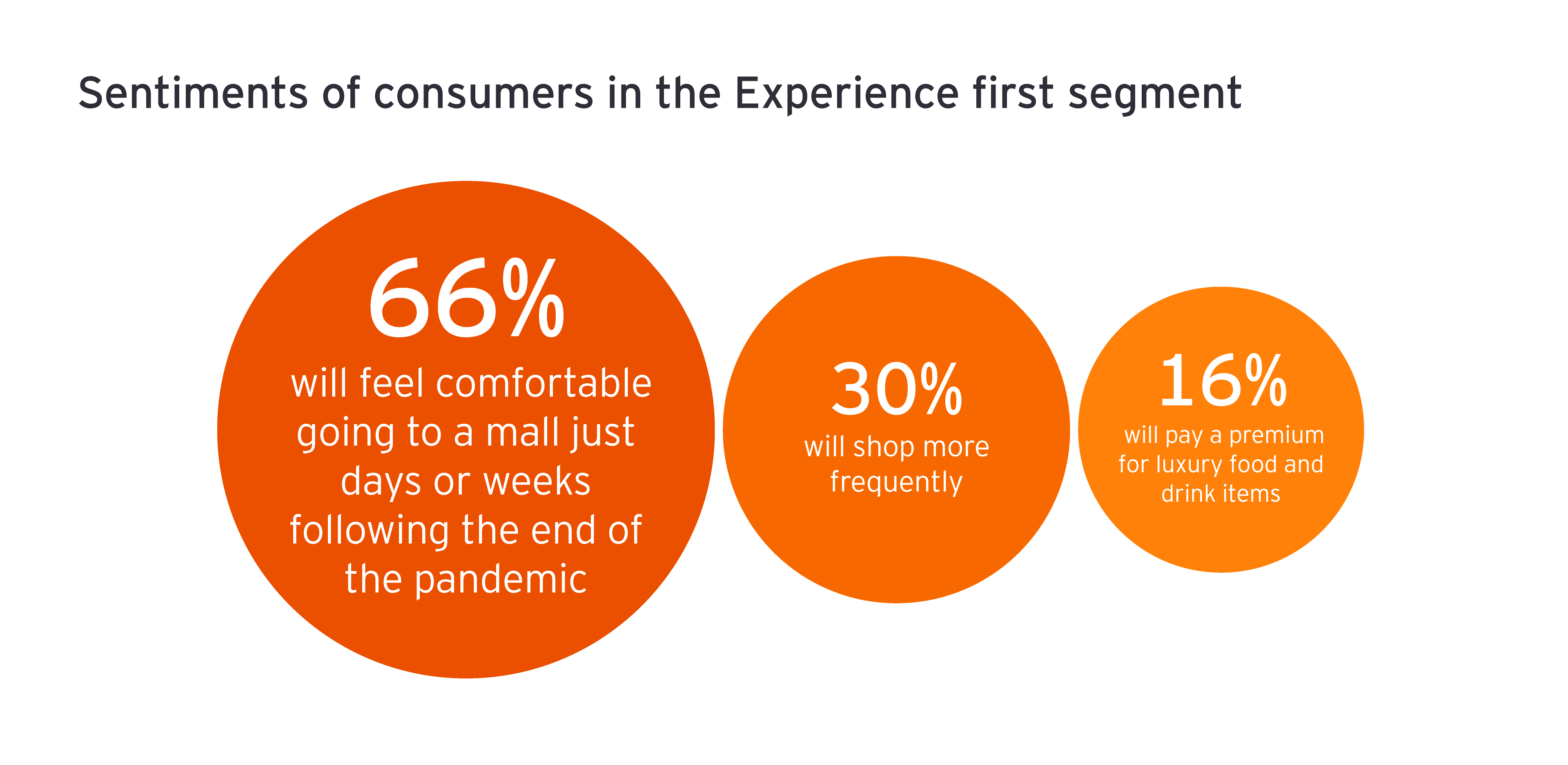

The smallest of our future consumer segments is the one we call “Experience first.” This represents the 11% of consumers who are intent on living for the moment. They are always looking for experiences that help them get the most from life. They like to try new brands, products and services, especially those that feel personalized. And they choose brands that enable them to signal their values and their sense of purpose.

The “Experience first” consumer is the least anxious about their health and finances and about pursuing normal activities such as going to a mall or eating in a restaurant. They are less worried about the impact of the pandemic and less interested in changing the way they live. More than half of them are Millennials or Generation Z.

This consumer is constantly changing what, when and how they want to experience things. How will you tailor your engagement to the “Experience first” shopper in the micro-moment? How will you innovate to keep your brand relevant to a consumer who is always looking for something new?

Chapter 3

Three actions to prioritize now

Ensure your business has the portfolio, brand experience and transparency that consumers will trust.

Many organizations have responded to this crisis with a degree of speed and innovation they probably wouldn’t have thought possible a few months ago. Faced with the unimaginable, they have achieved the extraordinary.

Now they need to protect and grow that sense of agile responsiveness. As we move beyond COVID-19, the ability to plan in the face of uncertainty, resource projects flexibly, and execute at speed will be critical. There are three priorities we want to highlight in this bulletin:

1. Reshape your portfolio so it’s relevant to the future consumer

The Index suggests the ways in which the consumer will change. Now is the time to make sure you have products, services and experiences that feel suitable to their future needs and values. In some cases, that will require M&A activity to dispose of brands that don’t fit and to bring in those that strengthen your offer (we’re already seeing cash-rich companies snapping up distressed players). In other cases, it will mean refreshing and reimagining what you have already, so each offer has a compelling proposition and a relevant brand narrative.

2. Provide digital customer journeys that reflect the way consumers will behave

COVID-19 is accelerating the consumer’s digital adoption faster than all expectations. Beyond COVID-19, brand engagement will be different from the norm today. The brands consumers choose, where they consume them, how they purchase them — everything is in flux. But consumers will still expect brands to give them a seamless experience. The challenge is to create digital customer journeys that feel consistent and engaging to the consumer at each step, from acquisition to conversion to loyalty. An “outside in” assessment that starts with what the experience is like for the consumer will identify points of friction and opportunities to replace physical touchpoints with digital ones. This will help to prioritize the technology and ecosystem investments that add the most value to the consumer.

3. Create the transparency that will be needed to secure consumer trust

The experience of the pandemic has made consumers more mindful about what they buy and how. Some are thinking again about the social and environmental impact of their choices. They want to know where and how products are made and sourced, about the real cost of what they buy. Others value health more than ever, or want value for money without compromising quality. Investors and other stakeholders have become much more interested in whether a company’s behavior lives up to its promises, and how well it communicates this to the consumer. In all these areas, vague assurances won’t be enough. Organizations need to invest in supply chain and data capabilities to provide transparency in a way people can trust.

Shaping the future

Over time, we expect concerns around household budgets and health to diminish in importance as people, communities and economies recover. But they won’t go away entirely.

Organizations will need to work out how to serve a more value-conscious, health-conscious consumer. But there will also be consumers who demand purposeful brands that reflect their environmental and social values. And there will be consumers who simply want to enjoy each moment life offers.

Many organizations believe they already have the right portfolio, marketing and supply chain. However, in our experience, few are resilient enough to deliver against these heightened expectations. Efficiency is important, but it must be balanced against the need to keep developing the capabilities that will deliver growth. Now is an opportunity to actively shape a successful future, not just to protect what worked in the past.

There are more perspectives on how the crisis is shaping a new consumer, including country-level insights, here.

Summary

Consumers around the world have adapted to life in a pandemic. Nonetheless, the third edition of the EY Future Consumer Index tells us most of them are still anticipating deep changes in their lives. Some will be imposed on them — through recession or changes to their health, for example. Others will be an active choice. Together they will have a pivotal impact on consumption patterns and consumer identities for years to come. Here we identify five new consumer segments that will shape demand beyond COVID-19 and three actions leaders should prioritize today.