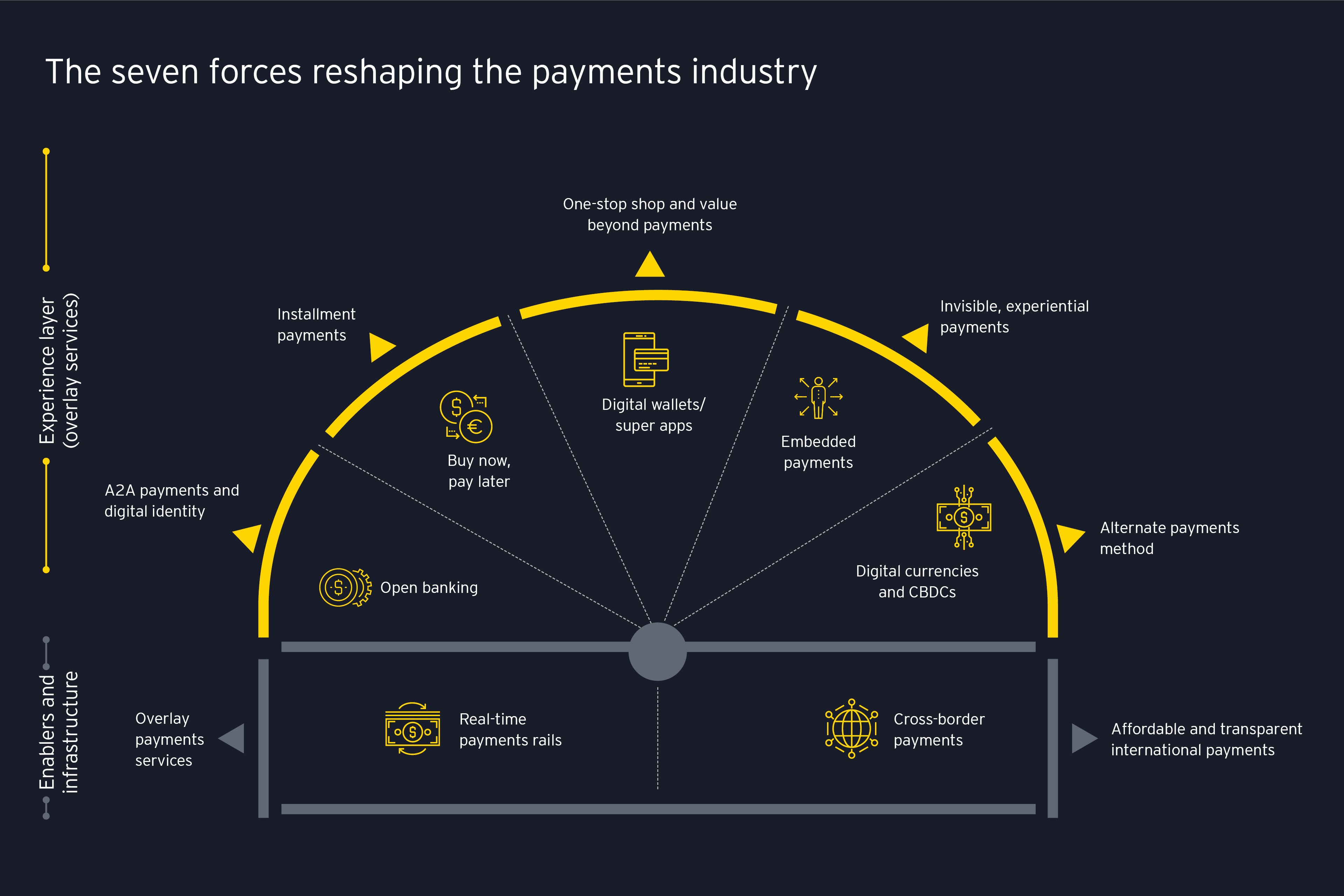

Buy now, pay later and its more sustainable future

Buy now, pay later (BNPL) is a newer payment method that offers instant credit decisioning and payment options via installments at the point of sale. Retailers and merchants use this credit option to drive sales, attract customers and decrease cart abandonment. And consumers choose BNPL for its convenience, low cost and predictable payment schedule.

While BNPL was initially used for lower-cost fashion purchases, its application has expanded. BNPL is now being offered in corporate purchasing and non-discretionary purchases, such as healthcare, legal services and auto repairs. Nonetheless, the BNPL model will need to evolve to deliver sustained profitability given the rising cost of capital and increased regulatory scrutiny.

For banks, BNPL is an opportunity to explore a new channel to drive lending growth and collaborate even further with PayTech partners.

Digital wallets and super apps: a one-stop shop of vast capabilities

Digital wallets are helping to significantly reduce payments transaction fees while offering customers a single destination to manage their finances. By going a step further, super apps are setting out to fulfill almost any financial, leisure or lifestyle need their users may have. The APAC region has witnessed the biggest adoption of digital wallets and super apps compared to North America and Europe, which are still heavily reliant on payment cards and card networks.

However, digital wallet providers outside APAC are striving to transform into super apps by expanding their array of omnichannel services, such as crypto wallets, contactless pay modes and more. Overall, user behavior is driving the evolution of digital wallets. Their popularity is also linked to embedded value-added offerings, such as loyalty programs, security, and the transformation of closed to open loop wallets.

Financial institutions can explore PayTech digital wallet strategies and apply them to existing propositions to extend value to the customer base. We expect to see banks further expanding digital wallets, offering new services in order to grow their user base.

Embedded payments: the future of payments is invisible

As businesses move toward providing their customers with more personalized, frictionless experiences, embedded payments have become a core value proposition. Embedded payments are associated with business models where non-financial services companies (e.g., Uber or Shopify) offer payment functionality to their business customers.

As such, embedded payments are becoming very common for all B2B2C and B2B2B business models like platforms and marketplaces, and PayTechs continue to play a major role in driving adoption rates. Embedded payments are expected to scale and become more invisible as non-financial services providers integrate payments into customer journeys.

PSPs have an opportunity to reimagine their merchants’ acquiring business while exploring new business models. Banks have assets that most payment innovators do not have; it is critical to bring them to merchants and consumers in the e-commerce ecosystem. As consumer and commercial commerce change rapidly, banks need to use data to identify distinct customer verticals that will maximize the value from payment services – and provide tailored solutions for those verticals.

Digital currencies and the future of money

Digital currencies and CBDCs are gaining momentum and rising to the top of agenda for payments providers that are looking for regulated alternatives as first industry solutions emerge. The full benefit of DLT will come from tokenization, programmability and smart contracts, combined with a network effort that allows banks to participate on a single platform (open loop). The ultimate benefit of digital currencies will be instant and atomic settlement, increased automation, transparency and efficiency, as well as support of new business models via programmability of money.

Crypto and digital currencies will offer not only new payment methods, but a new infrastructure enabling instant settlement through DLT, programmability, smart contracts and tokenization. We expect the broader adoption of digital currencies to rise as acceptance by banks, merchants and regulators increases. New use cases are also expected to proliferate.

Banks can explore the value pools and feasibility of incorporating digital currencies into their products and services.