Turning to the threats that have slipped down the ranking since last year, one of the most prominent is at number six – “Inability to scale internal digitization initiatives” – down from second place in 2020. As digital transformation has accelerated during the pandemic, driven by shifts including the rapid move to remote working, this risk has receded to a degree. However, it remains a threat to be watched, particularly as telcos grapple with multiple, continuous transformations underway inside their organizations.

The top 10 risks for telecommunications in 2021 and beyond

At a high level, our analysis suggests that telcos will struggle to capitalize fully on the post-recovery unless they focus on ensuring network reach and resilience. Telcos will also need to consider new risks and opportunities across customer priorities, workforce, supply chain, cybersecurity, portfolio management, ecosystem relationships, sustainability and business model innovation. Here’s a brief summary of the 10 biggest risks across the sector.

1. Failure to ensure infrastructure reach and resilience

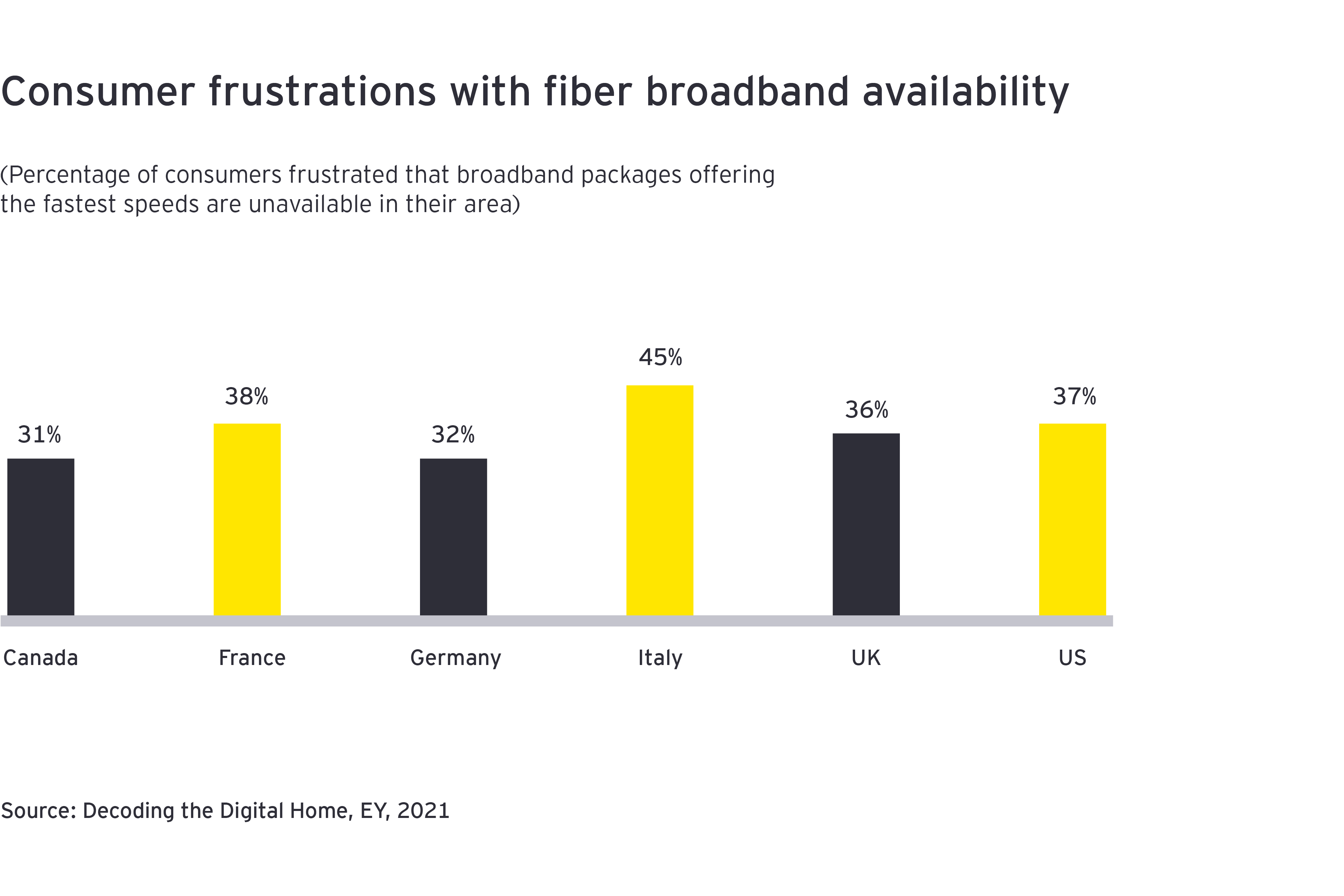

While telecoms networks have withstood higher usage during the pandemic, telcos remain under pressure to improve network performance and coverage. Many users feel frustrated at being unable to access the latest speeds, and there’s a widening gap between network reach and service adoption, particularly in emerging markets. Meanwhile, policymakers are increasing their focus on the digital society – yet the economics of network rollout in remote areas remain challenging, and new technologies are offering disruptive alternatives.

2. Underestimating changing imperatives in privacy, security and trust

EY research1 finds that consumers are more concerned about data privacy and security now than before the pandemic, while rising time online has fueled well-being worries. Operators are facing these shifting sentiments amid rising cyberattacks, with 75% reporting an increase in cyberattacks in the last twelve months. Responding effectively is a key concern: 47%2 say they’ve never been more concerned about their own ability to manage cyberthreats.

Rising cyber-attacks

75%of respondents reported an increase in cyber-attacks in the last 12 months.

3. Failure to improve workforce structure and skillsets

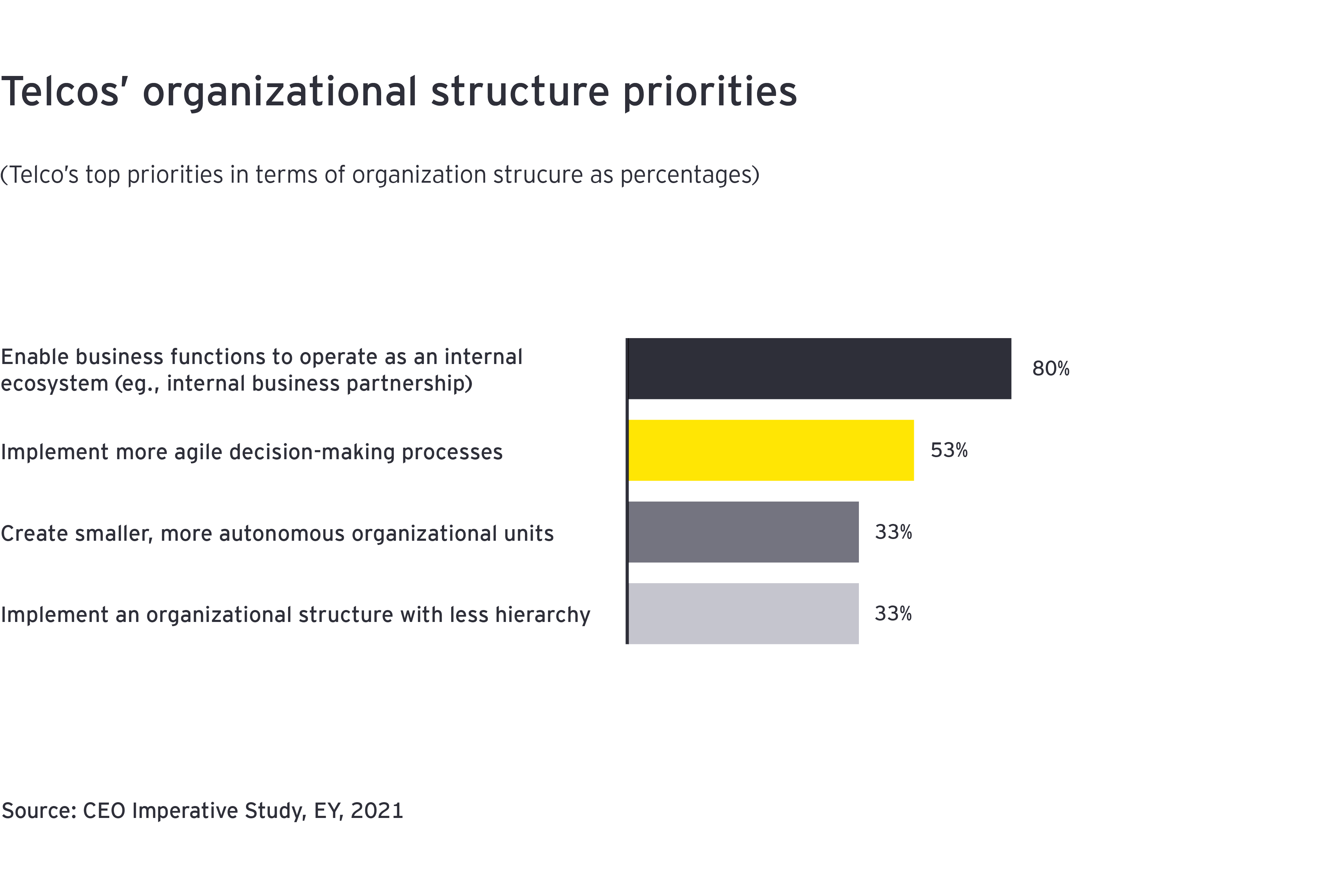

While improving diversity and inclusion (D&I) remains a critical focus, we’re now seeing the focus extend to building organizational structures that support collaborative partnerships between internal functions and customer-facing teams. However, as telcos tackle these structural changes, talent attraction remains challenging, including among graduates. Meanwhile, reskilling programs need to be revamped to keep pace with new technology cycles.

4. Failure to mitigate supply chain disruption

The pandemic has put network and customer premise equipment (CPE) supply chains under unprecedented strain, with lockdowns limiting the availability of engineers and higher demand contributing to the chipset crunch. Government restrictions on “high risk” vendors are also continuing to disrupt long-term 5G deployment plans. And with new technology cycles disaggregating established supply chains, telcos are increasingly considering open radio access network (RAN) solutions to help diversify their supplier relationships.

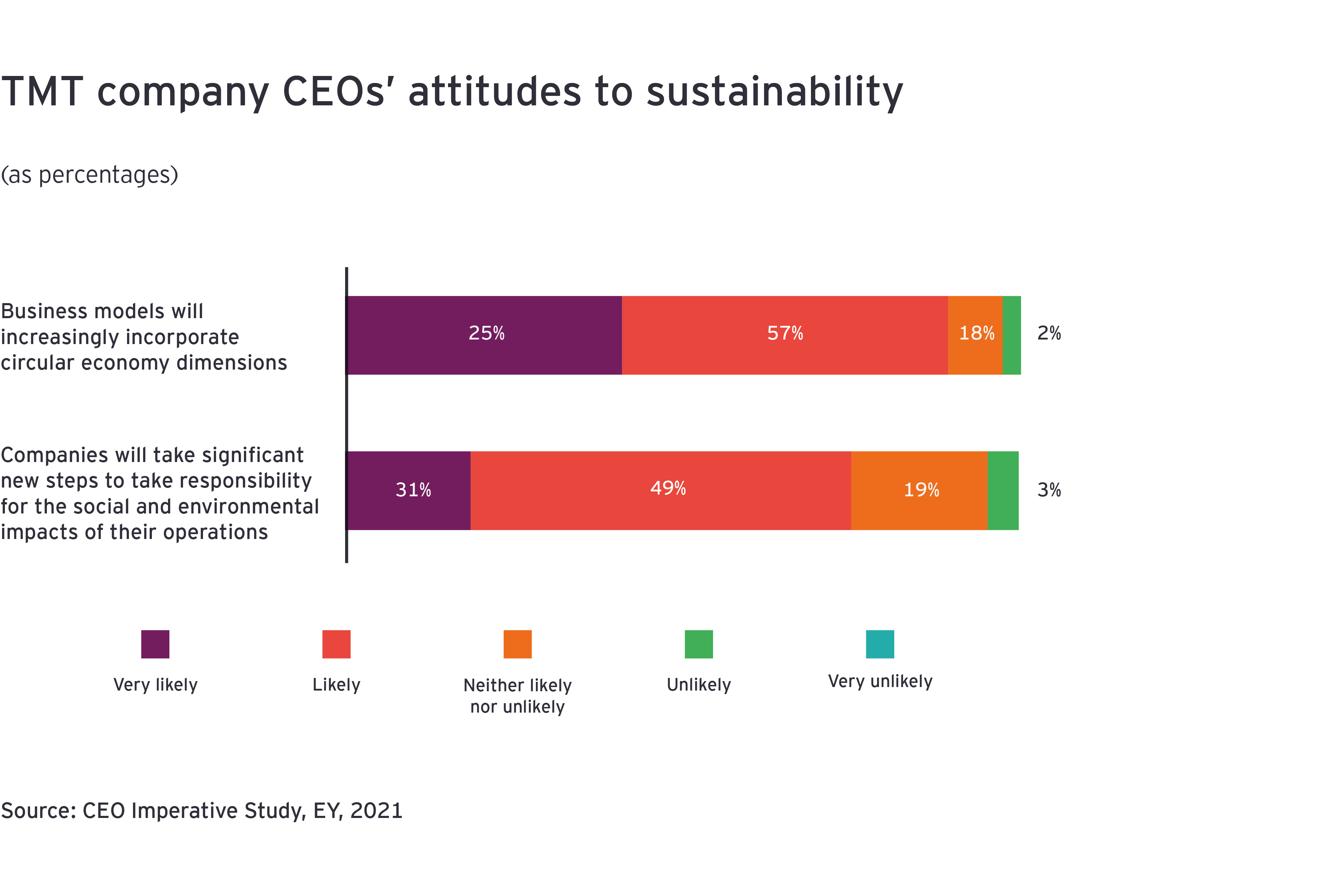

5. Poor management of the sustainability agenda

Changing stakeholder expectations are driving sustainability ever higher up the corporate agenda. For operators, this means tackling energy inefficiencies along their value chains and incorporating circular economy principles into their business models and service offerings, both for enterprises and consumers. In the near term, improving the quality of climate change disclosure requirements also requires attention as regulators and investors push for more information.

6. Inability to scale internal digitization initiatives

COVID-19 forced many telcos to accelerate their digital transformation plans. But these successes have bred new ambitions, with most technology, media and entertainment and telecommunications (TMT) CEOs now planning new transformation initiatives and investments. The biggest barrier to these could be limited boardroom bandwidth, as operators manage multiple continuous transformations inside their organizations. A further danger lies in low customer acceptance of digital tools. 54% of consumers still prefer to use traditional call centers for broadband queries, and 45% believe instant messaging can’t handle complex queries3.

7. Ineffective engagement with external ecosystems

Ecosystems are increasingly important to enterprise customers. EY research4 shows 69% of large enterprises innovate through collaborative ecosystems, and 43% prioritize telecoms and technology suppliers that can articulate their role in them. However, telcos’ ecosystem relationships often lack leadership and are under-prioritized relative to enterprise customers’ view of their importance. Telcos need to focus more on the benefits they can realize from ecosystems, including lower innovation costs and a shorter time to revenue.

Collaborative ecosystems

43%of large enterprises will prioritize suppliers that can articulate their role within changing industry ecosystems.

8. Failure to maximize the value of infrastructure assets

To unlock hidden value, telcos are undertaking divestments, carve-outs and joint ventures involving their infrastructure assets. These deals reflect increasing specialization along the value chain and expanding investor interest. But realizing the resulting opportunities is challenging as delineating core and noncore assets, and optimizing the timing of divestments, is difficult for telcos. Success requires careful assessment of many options, from asset scoping and the degree of separation to tenant rights and commitments involving the separated entity.

9. Inability to take advantage of new business models

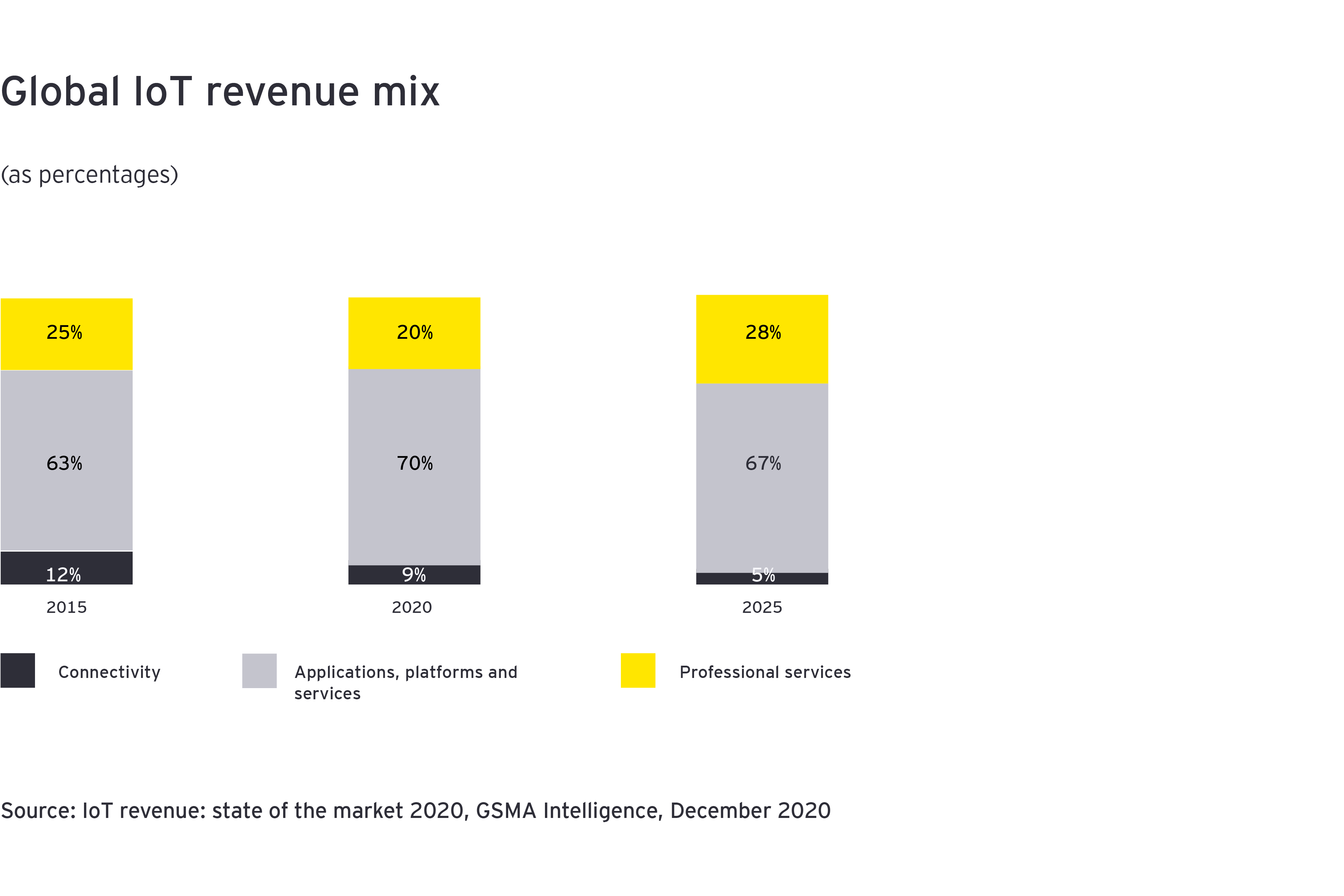

Connectivity represents a declining share of IoT revenues, and cellular IoT average revenue per user (ARPU) remains low. So, as 5G-enabled IoT offerings roll out, monetizing these effectively requires new business models that combine connectivity with apps and services. The growth in private 5G networks for enterprises is another catalyst for business model innovation. Retail and wholesale business models, including “network-as-a-service” offerings that leverage telcos’ technical expertise and spectrum assets, are becoming more important.

10. Inability to adapt to changing regulatory landscape

Regulatory and policy priorities are shifting post-pandemic, with an intensifying focus on consumer protection, the digital divide and the network equipment supply chain. The emphasis varies by region, and the maturity of sector regulation varies significantly between developed and emerging regions. But nowhere is the lack of certainty greater than around spectrum releases, where there’s a lack of clarity around auction timings and reserve prices. Meanwhile, newer concepts such as spectrum sharing and “set-asides” for private networks remain contentious.

How should operators mitigate these risks?

As operators consider how best to meet these risks and challenges head-on, mitigation strategies require a new approach. Understanding the interrelationships between different risks can unlock new opportunities. For example, sustainability principles can help inform changing digitization objectives while also creating additional opportunities to redesign business models. At the same time, an asset-right attitude toward infrastructure can help unlock new routes to improving network reach.

Alongside this, it is vital to recognize that many of the leading risks have different repercussions across different parts of the organization. Tactical moves to counter supply chain disruption can benefit from long-range strategic thinking about the disaggregation of industry value chains. Bringing a multilayered perspective to risk mitigation – one that brings in different competencies from different parts of the business – will be essential going forward.

Summary

The global recovery in telecoms sector share prices means operators are now better positioned than a year ago to respond to a shifting threat landscape. However, the risks facing telcos, such as sustaining network quality and positive customer perceptions, addressing cyberthreats, workforce redesign, supply chain disruption and sustainability, are substantial and rank high on the industry agenda.