- 2018 IPO activity charts a steady course despite volatility and uncertainty

- Technology sector leads with record number of 40 unicorn IPOs raising US$32.2b

- 2019 to start cautiously with IPO activity set to rise in second half of the year

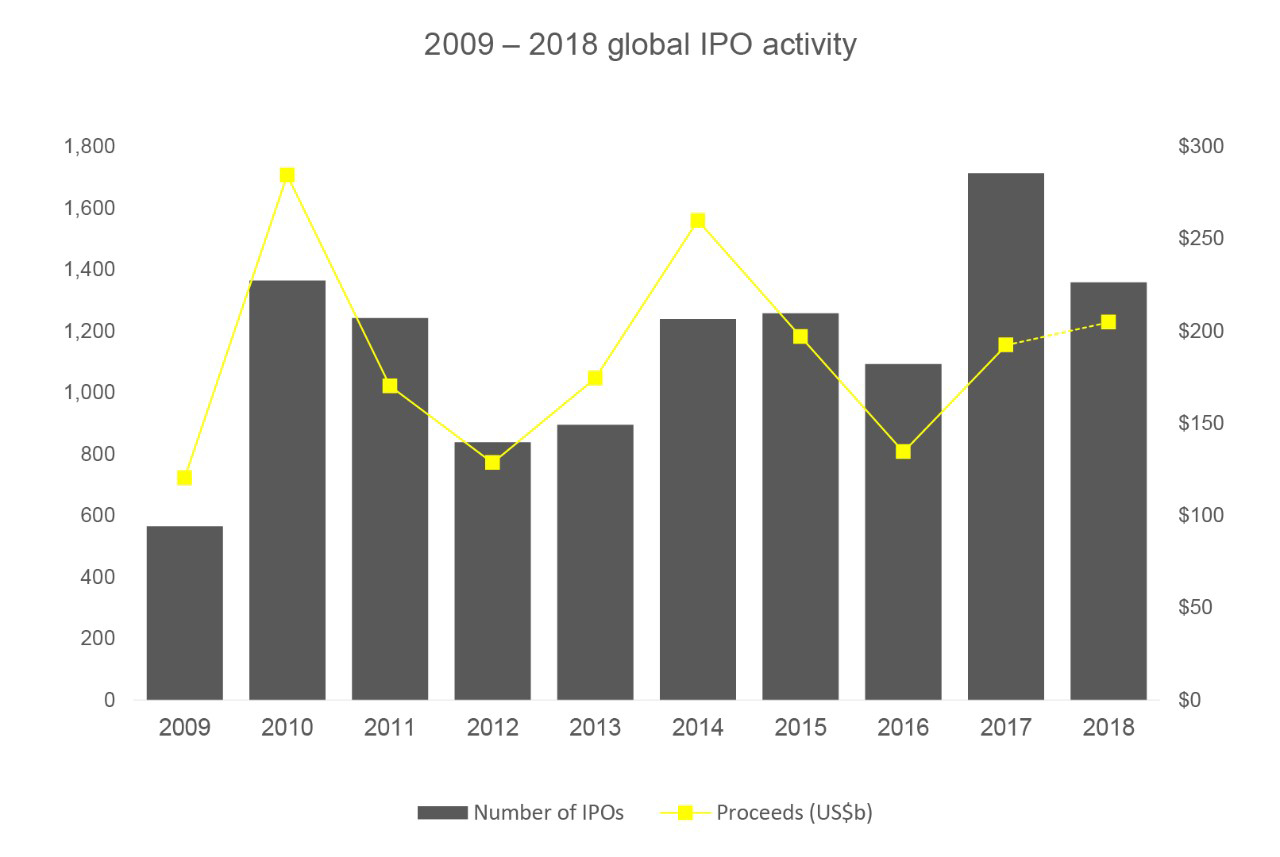

Global IPO proceeds rose in 2018, supported by investor confidence, large pools of liquidity, strong valuations and low interest rates. Year-to-date, 2018 has registered 1,359 IPOs with proceeds of US$204.8b – a 6% increase on proceeds despite a 21% decline in volume. The rise of unicorn-related IPO activity and mega IPOs were key factors in helping to push 2018 proceeds beyond 2017 levels. This trend is expected to continue into 2019, with the backlog of IPO candidates increasing and capital becoming more widely available.

In terms of deal volume Asia-Pacific declined but still dominated with Americas and EMEIA accounting for a higher share of deal volume. The technology, industrials and health care sectors were the most prolific sectors by deal numbers in 2018, together accounting for 652 IPOs (48% of global IPO by deal numbers) and raising US$84.2b in total (41% of global proceeds).

Activity in Q4 2018 (326 IPOs and proceeds of US$53.7b) was 34% lower in deal volume and 10% lower by proceeds compared with Q4 2017. Market volatility and continued geopolitical uncertainty were contributing factors in a strong decline in quarter-over-quarter IPO activity in all regions during Q4 2018, signaling what is set to be a cautious start to 2019. These and other findings were published today in the EY quarterly report, Global IPO trends: Q4 2018 (pdf).

Dr. Martin Steinbach, EY Global and EY EMEIA IPO Leader, says:

“Through a fog of uncertainty, IPO markets around the world found a clear path forward and investment opportunities ultimately delivered returns in 2018, as investor confidence, mega IPOs and the rise of IPOs by unicorn companies helped provide assurance for IPO investors. While the fourth quarter was weak, the year ended as expected, with 2018 activity held back toward the end of the year by geopolitical tensions, trade tensions among the US, China and EU, and the looming exit of the UK from the EU.”

Americas IPO momentum sustained in 2018

With 261 IPOs raising US$60.0b, deal volumes and proceeds of Americas IPO markets in 2018 exceeded 2017 numbers by 14% and 16%, respectively. The US remained in the spotlight as the leading source of IPOs in 2018, accounting for 79% of Americas IPOs and 88% by proceeds.

Twenty-nine percent of US exchange IPOs were cross-border, with 60 companies from 15 countries choosing to list in the US during 2018, an increase from 24% in 2017.

Canada’s Toronto Stock Exchange and Venture Exchange saw 17 IPOs, which raised US$1.1b, accounting for 7% of Americas IPOs and 2% by proceeds, while 26 unicorn companies (raising a total of US$15.0b) came to the US public markets in 2018.

Jackie Kelley, EY Americas IPO Markets Leader, says:

“Despite muted IPO activity in Central and South America exchanges in the second half of 2018, the IPO pipeline continues to build in the Americas. The US IPO markets will finish the year strong, with both volume and proceeds surpassing 2017 levels. A number of unicorn companies brought IPOs to market in 2018, with more on record stating that they will be conducting IPOs in 2019. As we head into the new year, we expect IPO volumes to remain steady, driven by a number of high quality issuers that have kicked off IPO processes.”

Asia-Pacific benefits from megadeals across the region

Asia-Pacific continued to dominate global IPO activity, accounting for six of the top ten exchanges globally by deal number and five of the top ten exchanges by proceeds. However, 2018 deal volumes (666 deals) were down by 31% versus 2017, while proceeds (US$97.1b) were up by 28% due to a number of mega IPOs in the region.

Japan posted 97 IPOs in 2018, a modest 2% increase in terms of volume compared to 2017, but representing a significant 333% increase over 2017 proceeds. This gain can be attributed to the US$21.1b listing of telecommunications giant SoftBank Corp. on the Tokyo Stock Exchange in mid-December – representing one of Japan’s largest ever IPOs – and also the listing of Japan’s first two unicorn IPOs.

New listing rules on weighted voting rights and pre-revenue biotech companies attracted high-profile technology and biotech companies to list in Hong Kong, with Hong Kong’s Main Market and Growth Enterprise Market seeing a rise of 24% by deal number (197 deals) and 120% by proceeds (US$35.4b) in 2018 compared with 2017.

Ringo Choi, EY Asia-Pacific IPO Leader, says:

“Despite a slowdown in Q4 2018 quarter-on-quarter, Asia-Pacific IPO markets continue to be a beacon across the global IPO landscape. However, as we head into 2019, the Asia-Pacific IPO market has reached a crossroads. If fundamental factors improve, such as greater geopolitical certainty, better trade relations or an increase in liquidity, we may see improvements in IPO activity as early as the first half of 2019. However, if the fundamentals remain as they are, we may see a short burst of activity in the first half of 2019, but sustained improvement in IPO activity may not be realized until the second half of the year.”

EMEIA increased global IPO market share riding the wave of global geopolitical tensions

In EMEIA, deal volumes (432) and proceeds (US$47.7b) were down in 2018. EMEIA’s 2018 IPO activity was 16% and 26% lower, respectively, than 2017 in terms of number of deals and proceeds, with geopolitical tensions having a clear impact on IPO activity.

Despite this, EMEIA exchanges remained strong as the world’s second largest IPO market providing two of the global top five megadeals in 2018, and contributing four unicorn IPOs (which raised US$2.7b). EMEIA increased global IPO market share with 32% of global deal numbers and 23% by proceeds in 2018. Moreover, EMEIA accounted for three of the top ten exchanges by proceeds (Germany, UK and India) and two by volume (India and NASDAQ OMX).

Main market IPOs that launched in 2018 posted first-day returns of nearly 10% and have outperformed most main market indices in 2018, solidifying investor confidence in the EMEIA IPO market.

Steinbach says:

“The EMEIA IPO market continues to be buffeted by waves of uncertainty owing to geopolitical tensions, trade issues between the US, EU and China, and the looming exit of the UK from the EU. Yet, the region increased its global market share and hosted two of the five largest IPOs globally during 2018. While the flow of IPO activity may remain slower than usual in Q1 2019, with strong economic fundamentals and the backing of investors, we expect EMEIA IPO markets will remain a dominant force globally in 2019. We expect to see IPOs from a diversified group of IPO-bound companies from unicorns, family businesses, carve-outs and high growth businesses.”

2019 outlook: a cautious start will lift in second half of the year

Looking ahead, a number of uncertainties are likely to prevail in 2019. Trade tensions between the US, China and the EU; the outcome of Brexit; and uncertainty with respect to the stability of a number of European economies, are set to continue and ultimately determine overall IPO sentiment. At the same time, with interest rates expected to rise in the US, the European Central Bank may in time feel the pressure to follow suit, which will also influence IPO activity in the quarters to come.

While 2019 IPO deal numbers could be below those recorded in 2018, it is likely that global proceeds could meet or exceed high 2018 levels, particularly if a greater number of unicorn companies and more companies from the technology, industrials, consumer products and health care sectors come to the public capital markets in 2019, as expected. Cross-border activity is expected to maintain its momentum well into 2019, with the US, Hong Kong and London continuing to be the top destinations for IPO activity.

-ends-

Notes to Editors

About EY

EY is a global leader in assurance, tax, transaction and advisory services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities.

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. For more information about our organization, please visit ey.com.

This news release has been issued by EYGM Limited, a member of the global EY organization that also does not provide any services to clients.

About EY’s Growth Markets Network

EY’s worldwide Growth Markets Network is dedicated to serving the changing needs of high-growth companies. For more than 30 years, we’ve helped many of the world’s most dynamic and ambitious companies grow into market leaders. Whether working with international, mid-cap companies or early stage, venture backed businesses, our professionals draw upon their extensive experience, insight and global resources to help your business succeed. ey.com/growthmarkets

About EY’s Initial Public Offering Services

EY is a leader in helping companies go public worldwide. With decades of experience, our global network is dedicated to serving market leaders and helping businesses evaluate the pros and cons of an initial public offering (IPO). We demystify the process by offering IPO readiness assessments, IPO preparation, project management and execution services, all of which help prepare you for life in the public spotlight. Our Global IPO Center of Excellence is a virtual hub, which provides access to our IPO knowledge, tools, thought leadership and contacts from around the world in one easy-to-use source.

ey.com/ipo

About the data

The data presented in the Global IPO trends: Q4 2018 report and press release is from Dealogic and EY. Q4 2018 (i.e., October-December) and 2018 (January-December) is based on priced IPOs as of 5 December 2018 and expected IPOs in December. Data is up to 5 December 2018, 12 p.m. UK time. All data contained in this document is sourced to Dealogic, CB Insights, Crunchbase and EY unless otherwise noted.