Compliance of the future needs to be:

- Integrated: A formalized and integrated compliance risk program

- Adaptive: Evaluation and improvement of regulatory change management process with multi-skilled compliance resources and dedicated compliance functions

- Advisory: Compliance governance framework including a compliance function to act as an advisor through informed decision-making

- Predictive: Identification and mitigation of emerging compliance risks

- Digitally-enabled: Investment in the digitalization of the compliance risk management process including continuous monitoring, assessments, and reporting

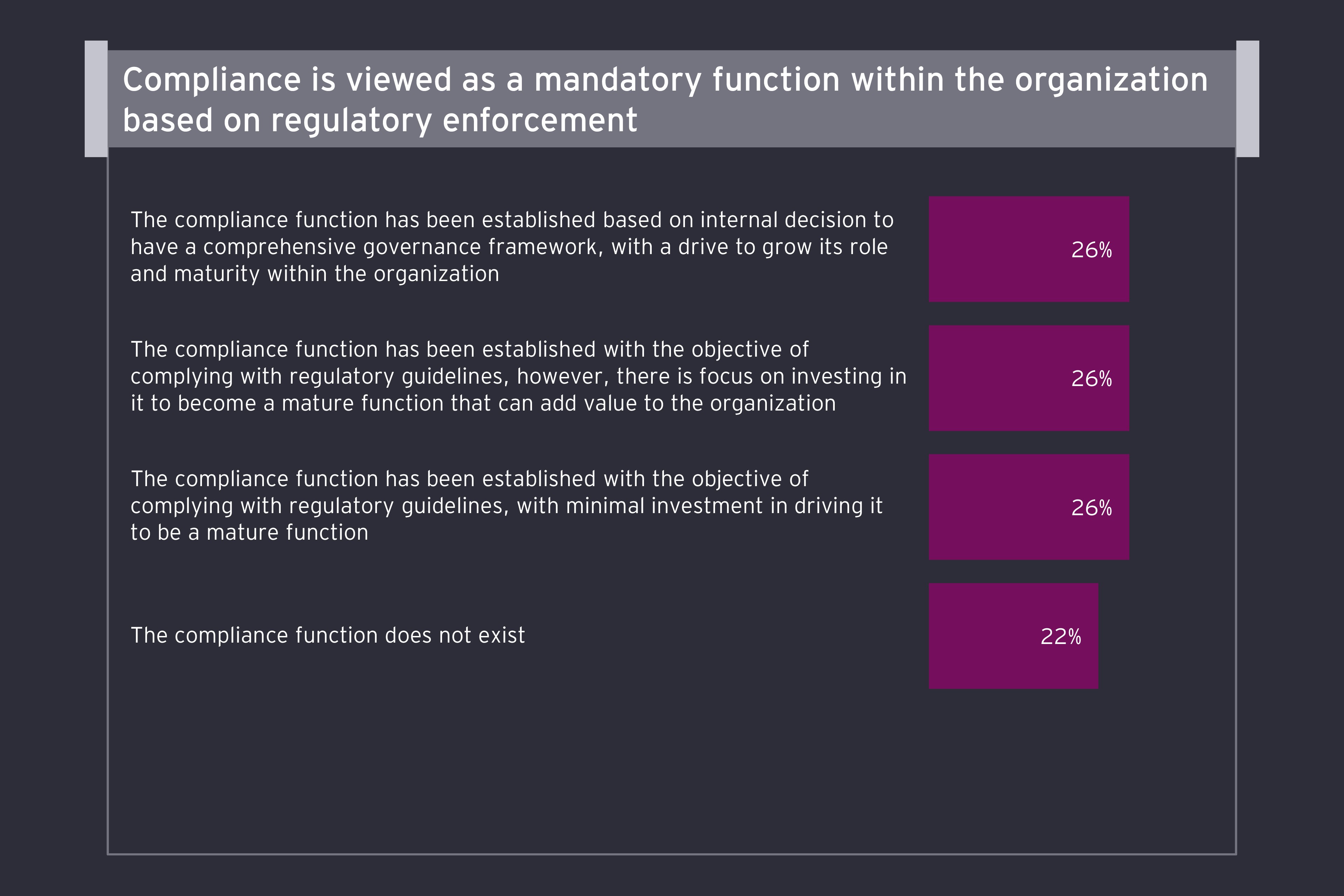

A key priority for organizations is to develop and drive agile and efficient compliance frameworks that are supported by a robust and digitally-enabled process. Key insights from the survey show that more than half of the organizations rated their compliance risk programs as “basic” or “developing'' indicating a lack of defined framework, compliance culture and formal organization. Additionally, only 43% of respondents view the function of compliance as a business enabler and partner in facilitating success.

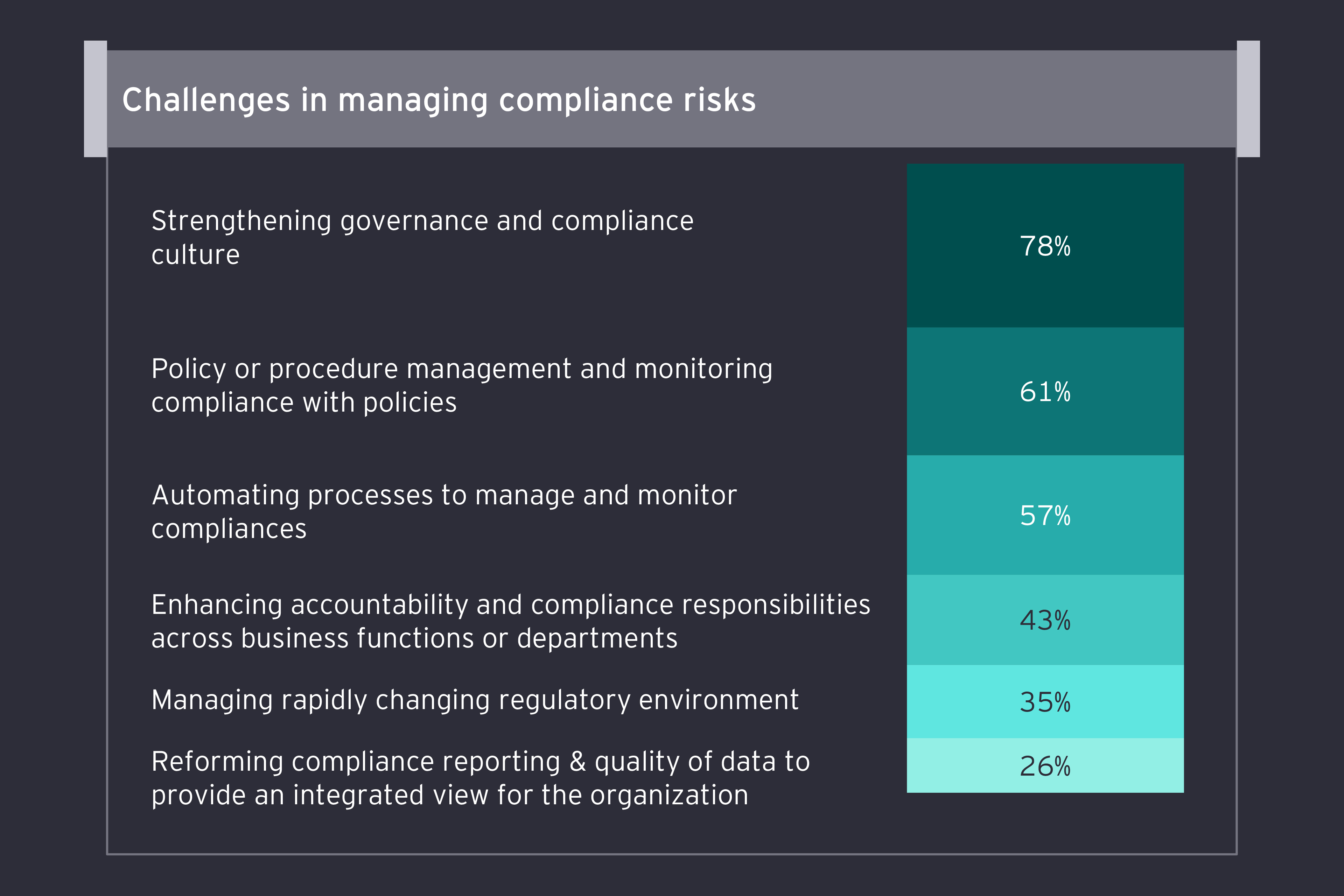

The challenges organizations in MENA face are centered around a lack of accountability and resources. For a majority of respondents, the key implementations toward stronger compliance risk management are related to strengthening governance, compliance culture, policy management, and automating compliance monitoring.

Organizations must also begin to invest in digitalization and automation tools in order to support compliance management.

According to the survey, 65% of respondents do not have a centralized repository of applicable regulatory obligations and 39% of respondents state that no formal training of regulatory obligations is in place.

Moving forward, organizations have the opportunity to leverage technology and improve strategic decision-making through independent compliance functions with a clearly defined framework.