When the doors are closed, are systems and data under lock and key too?

A second significant factor is access to systems and other critical production resources. Today, a number of cities, and in some cases entire countries, are under mandatory lockdown as advised by governmental authorities. Many office-based professionals are requested to work virtually (i.e., from home). In the majority of cases, this is successful and leads to new ways of working.

But, success also depends on resilience of the workplace’s existing virtual and digital infrastructure. For example, the use of physical files and forms, signing and distribution, mass printing, and using bank checks for employee payments may not be possible in the working from home scenario. In the case of offices under lock and key, the use of on-premise only human resources (HR) and payroll software is also rendered impossible.

Bank and government processes could also be impacted as a result of physical restrictions. In the age of digitization, it might be surprising to learn how many tax and social-security institutions around the world still rely on manual filings or lodgments.

Navigating legislative complexity

As a fallback option, temporary payrolls might need to be issued based on last month’s actuals. This relies on access to prior data and files. While this would ensure people are paid, it does not completely or correctly reflect the reality of the pay period. Correction will be required afterwards, both within internal systems and with tax and social security authorities. Some administrative regimes around the world impose severe repercussions in cases of over or underpayments.

In dynamic situations, such as a global health crisis, regulatory regimes may change at short notice. Governments utilize emergency powers where needed – for example, several governments continue to define and make aid packages available for companies to support their businesses. In some cases, filing deadlines are being relaxed.

Labor legislative elements are critical to consider, specific legislative frameworks apply in the cases of work-time reduction, forced leave, release of short-term contractors, or even staff redundancies.

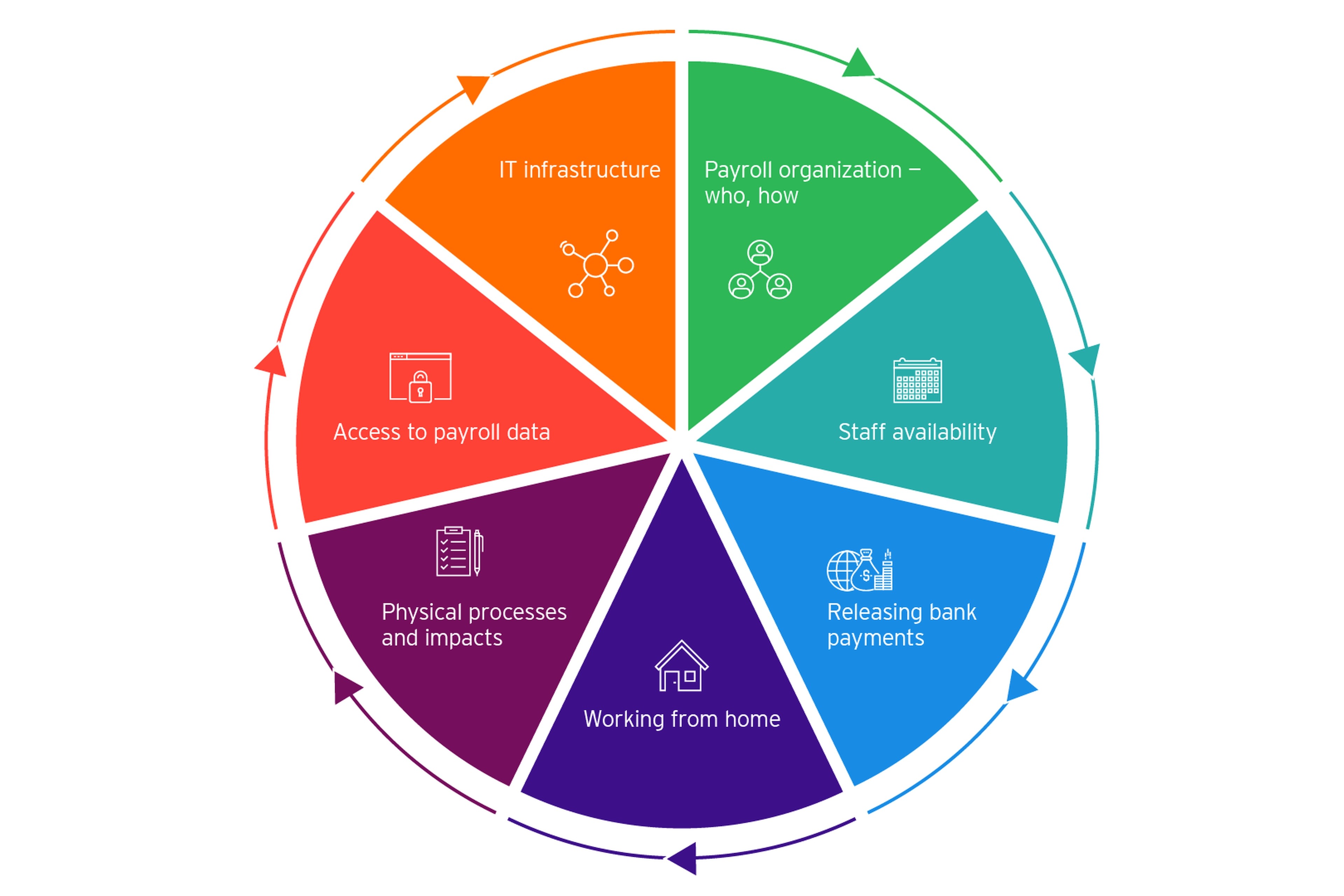

Seven areas to consider when it comes to payroll business continuity planning

Where could a company start in assessing initial payroll risk exposure and business continuity readiness? Below are seven key areas to consider:

Payroll organization

- Who is responsible for performing payroll activities in each location?

- What are the key activities and how are they performed?

- Are there effective business continuity plans in place for all locations, either in-house or third-party providers?

Staff availability

- What percentage of payroll staff or their direct family members might be affected?

- What is the anticipated impact in cases of limited staff availability when considering care responsibilities?

- Has overtime been factored into working arrangements?

Working from home arrangements

- Are the key HR, payroll and Finance personnel correctly equipped to work from home (i.e. use of a laptop, internet with adequate bandwidth, remote access to key applications, an additional monitor where necessary)?

- Does the home working scenario account for data confidentiality?

- Is the work environment suitable?

IT infrastructure

- What are the key technical vulnerabilities or weaknesses?

- Are HR/payroll source systems (remotely) accessible?

- Can all payroll inputs be received on time?

- Is the IT infrastructure secure?

Physical processes

- What physical processes exist in the payroll value chain (such as physical filings, signings)?

- In the case of limited or no physical access, how will impacts be mitigated?

Access to payroll data

- Are last month’s payment files, pay-slips, pay register and general ledger files readily available?

- Is (remote) access guaranteed and secured?

Releasing bank payments

- Is (remote) access guaranteed to release bank payments?

- What is the process for authorizing exceptional payment procedures?

Payroll business continuity is critical

Assessing your payroll status quo and thinking through all the continuity scenarios is not an easy task. Considering and assessing the seven areas outlined above is only a starting point when it comes to strong payroll business continuity plans. When your people are what matters the most, ensuring the continuity of global payroll is paramount.

The connected EY approach to payroll addresses your most pressing challenges across the payroll value chain in mobility, people advisory, finance, tax and law.

Summary

Payroll professionals, often working quietly in the background, are navigating unprecedented times. A strong payroll business continuity plan could be the difference between employees being paid on time, correctly or even at all.