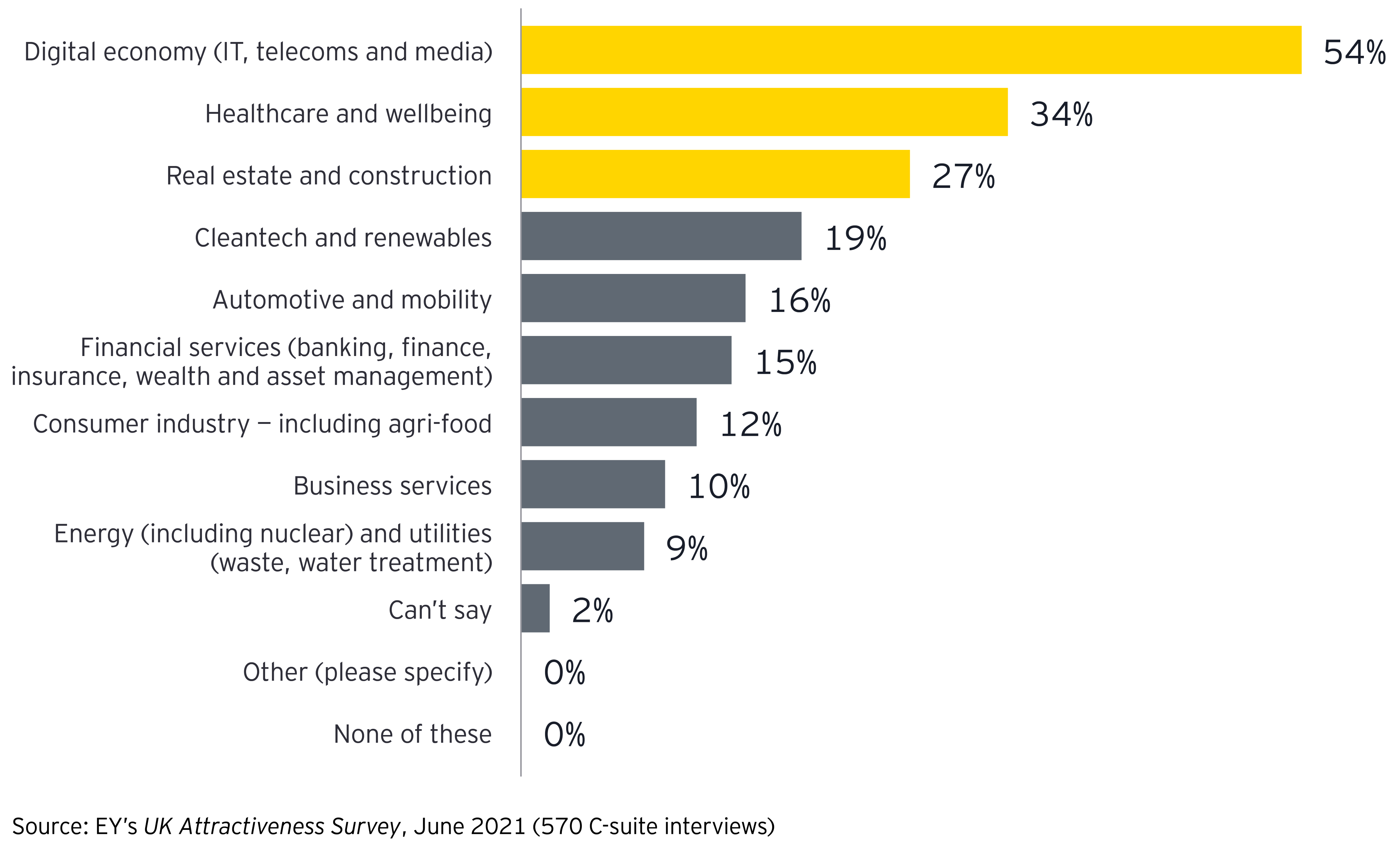

The optimistic mood was further supported by the UK’s strong FDI performance in sectors including life sciences, transportation and logistics, and food, and its continued European leadership in attracting 'new' projects from first-time investors. While all of this underscored the UK’s dynamism and adaptability, the most striking illustration of the country’s shift towards higher-value projects was its securing 114 R&D investments, only one project behind the European leader, France. As recently as 2018, France was securing almost twice as many R&D projects annually as the UK.

There were some clear impacts from the COVID-19 pandemic

That said, UK FDI did not fully escape the impacts of the pandemic. While the UK retained its leadership in European digital investments, its digital project numbers fell by 25%, almost double the European decline. And while the UK’s share of all European projects rose for the second year running after three years of decline following the Brexit vote, FDI activity in financial services, manufacturing and HQ remained well below their peak levels.

Previous optimism over new origins of investment into the UK was also quashed in 2020. There were declines in projects from 9 of the 10 fastest-growing new sources of FDI into the UK — only China bucked the trend with small increase. Investments from Japan continued to decline, and investments from the EU and the US accounted for some 67% of all UK FDI projects in 2020, up from 64% in 2019.