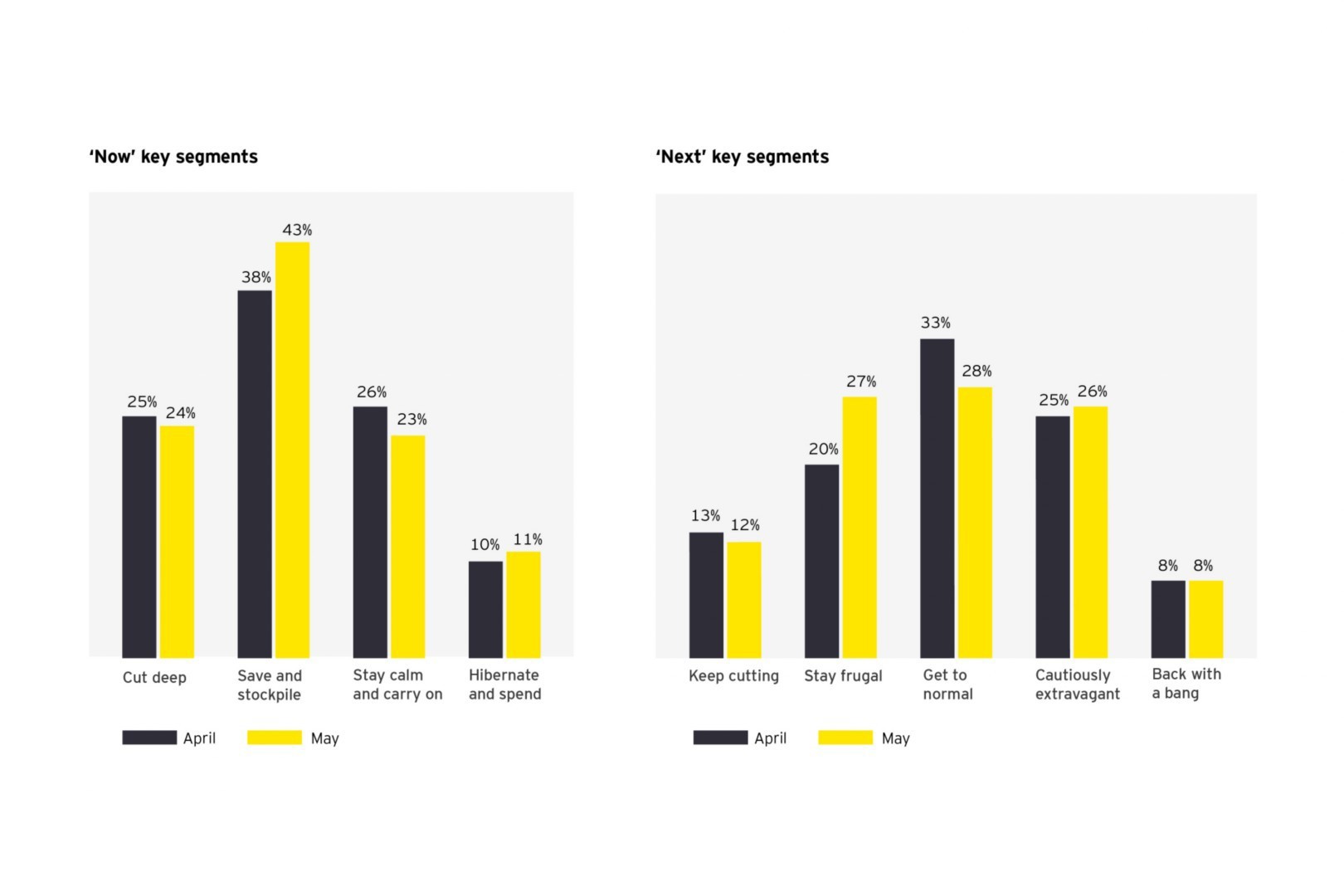

In May, we witnessed an accelerated (albeit small) shift in how cautious consumers were feeling during the pandemic, reaffirming our initial analysis. Compared with 35% globally, more than two-fifths (43%) of UK consumers (versus 38% in April) now fall into the ‘Save and stockpile’ segment. Less than a quarter (24%) are now extremely pessimistic and want to ‘Cut deep’, just above the global average.

This segment, however, has almost disappeared in China (4% of consumers), suggesting that levels of doubt about the future may lessen as easing continues and perceptions about the economy improve.

But beyond the financial, how consumers shop is also changing

Structural trends were already changing our shopping habits before COVID-19 emerged. But UK consumer companies will now need to be even more alert to their customers’ needs as lockdown eases.

Before the pandemic, factors such as whether a product was organic or sustainable, was defined as a luxury item, or could be personalised were important for many consumers. These have now given way to product availability (59%), price (43%) and health or wellness (41%). Seemingly, this is a long-term trend with affordability and health listed in consumers’ expected top three purchase criteria in five years’ time.

And with businesses in hibernation and the imperative upon consumers to stay at home, there will be an inevitable rise in online shopping. Almost one in five (17%) consumers said they were expecting to shop more online in the next one to two years. Interestingly, however, the UK’s shift to online purchasing is expected to be slower than the majority of global markets surveyed.

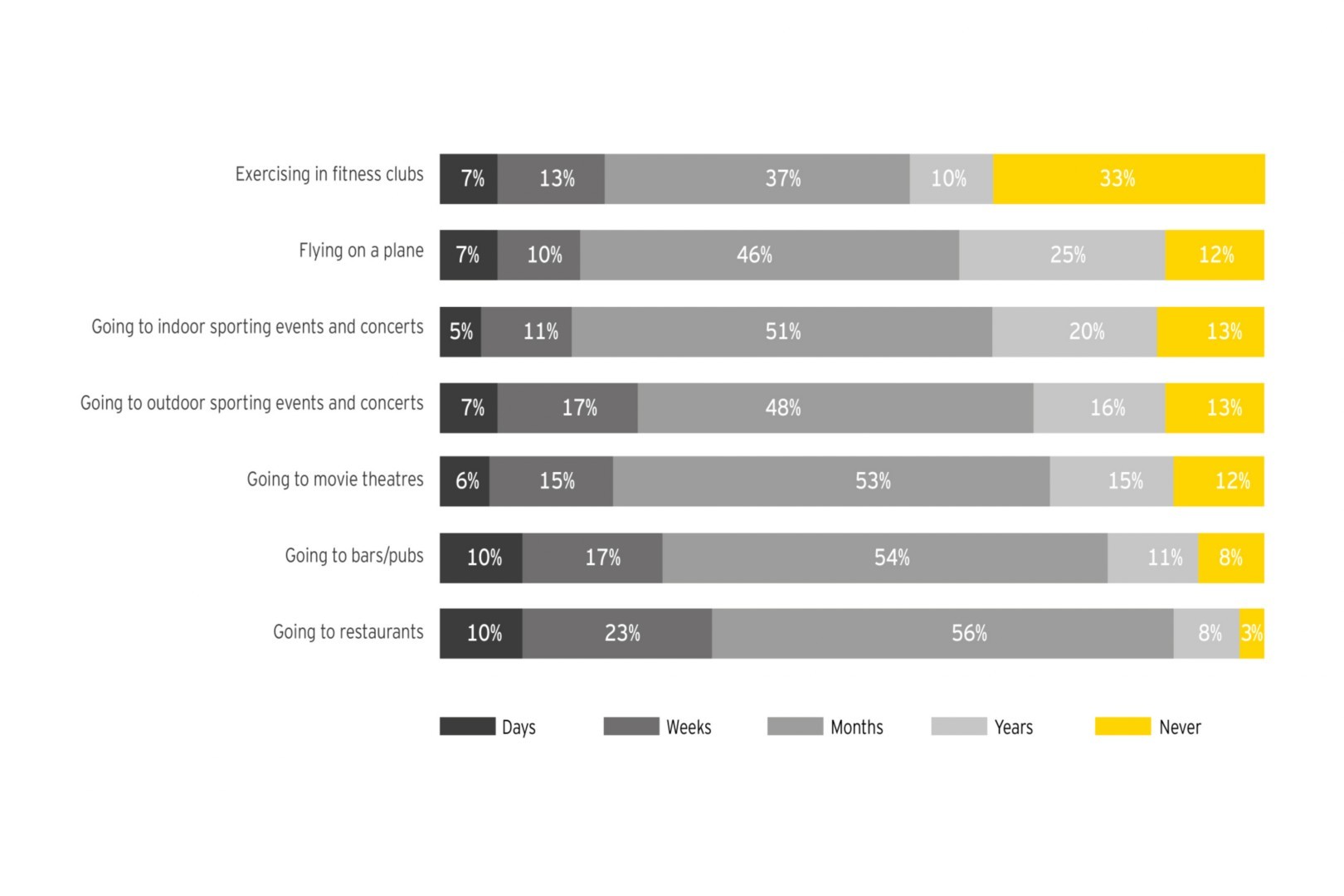

Besides necessity and convenience though, there’s a chance that ecommerce could be supported for months and years to come by the Anxious Consumer, a concept being borne out by people’s fears about returning to ‘normal’ life.

Green shoots of hope

The agility of many businesses, especially small- to medium-sized enterprises, has meant that younger and innovative brands have been able to capture the attention of consumers.

The desire for newness is being led by the younger (predominantly under 45), more tech-savvy ‘Back with a bang’ segment. 35% of this cohort are, over the next couple of years, looking for new and innovative brands produced by startups and show less loyalty to brands they have used previously than other consumer segments.

This consumer group, though currently small, offers a glimmer of hope for retailers looking to get back to a ‘new normal’. They have pent-up demand for shopping, and likely want to spend, which could see a domino effect within other consumer segments.

China – a guiding light?

Whilst cautious, China’s consumers are far more likely than their UK peers to be in the ‘Back with a bang’ and ‘Cautiously extravagant’ segments, suggesting they are aiming to spend more money after COVID-19.

The latest Index also shows that, despite 48% (higher than the UK at 23%) strongly agreeing that the way they live will significantly change in the long term as a result of COVID-19, consumers in China are twice as likely than the rest of the world to expect an economic recovery within the next 12 months and almost twice as likely to say they are confident about the future.

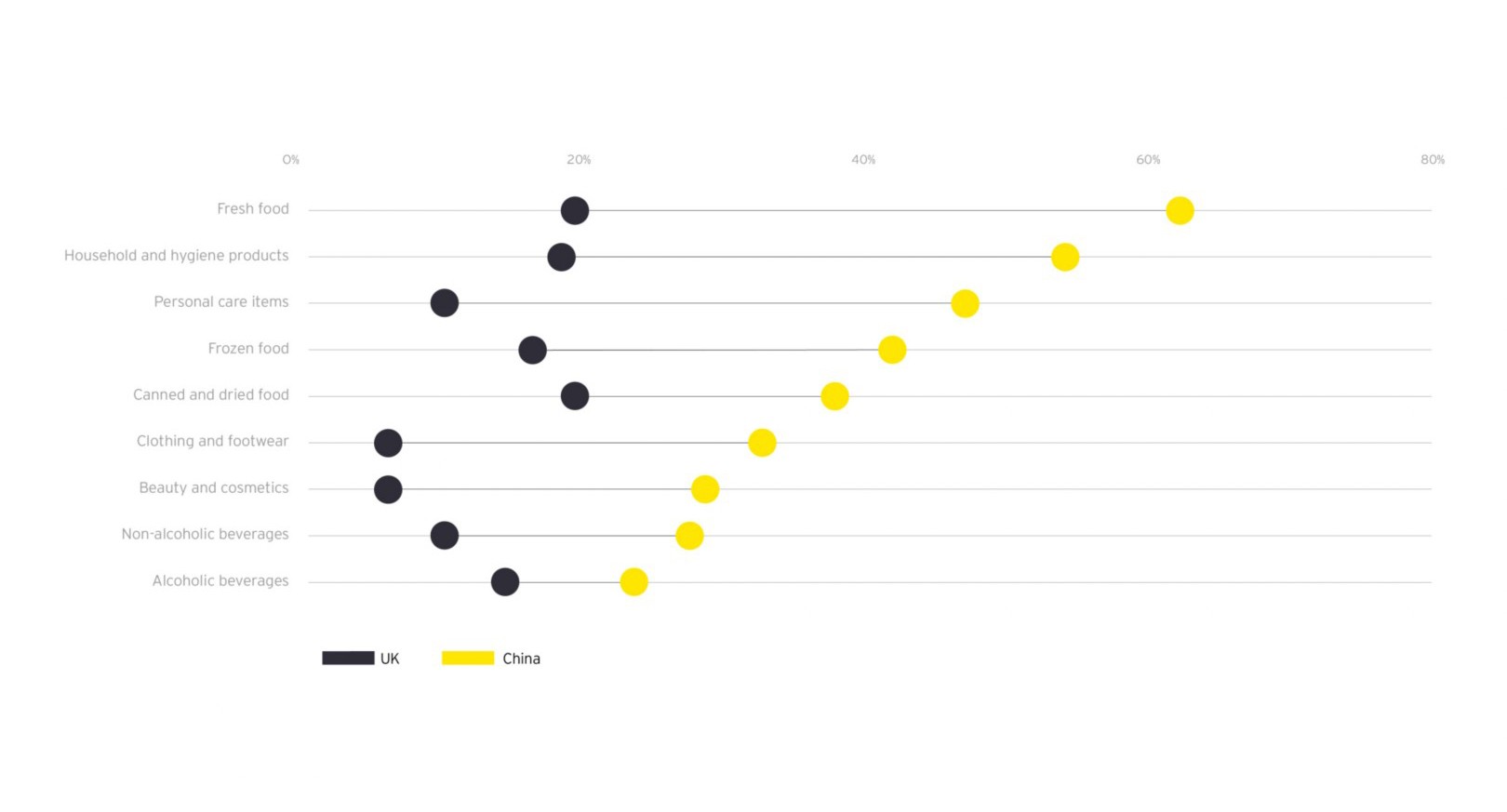

There are encouraging signs too about what Chinese consumers are spending their money on compared with the rest of the world, including the UK. There has been a strong rebound in fresh food (62% expecting to spend more over the next month), beauty and cosmetics (29%) and clothing and footwear (33%) compared with international consumers.