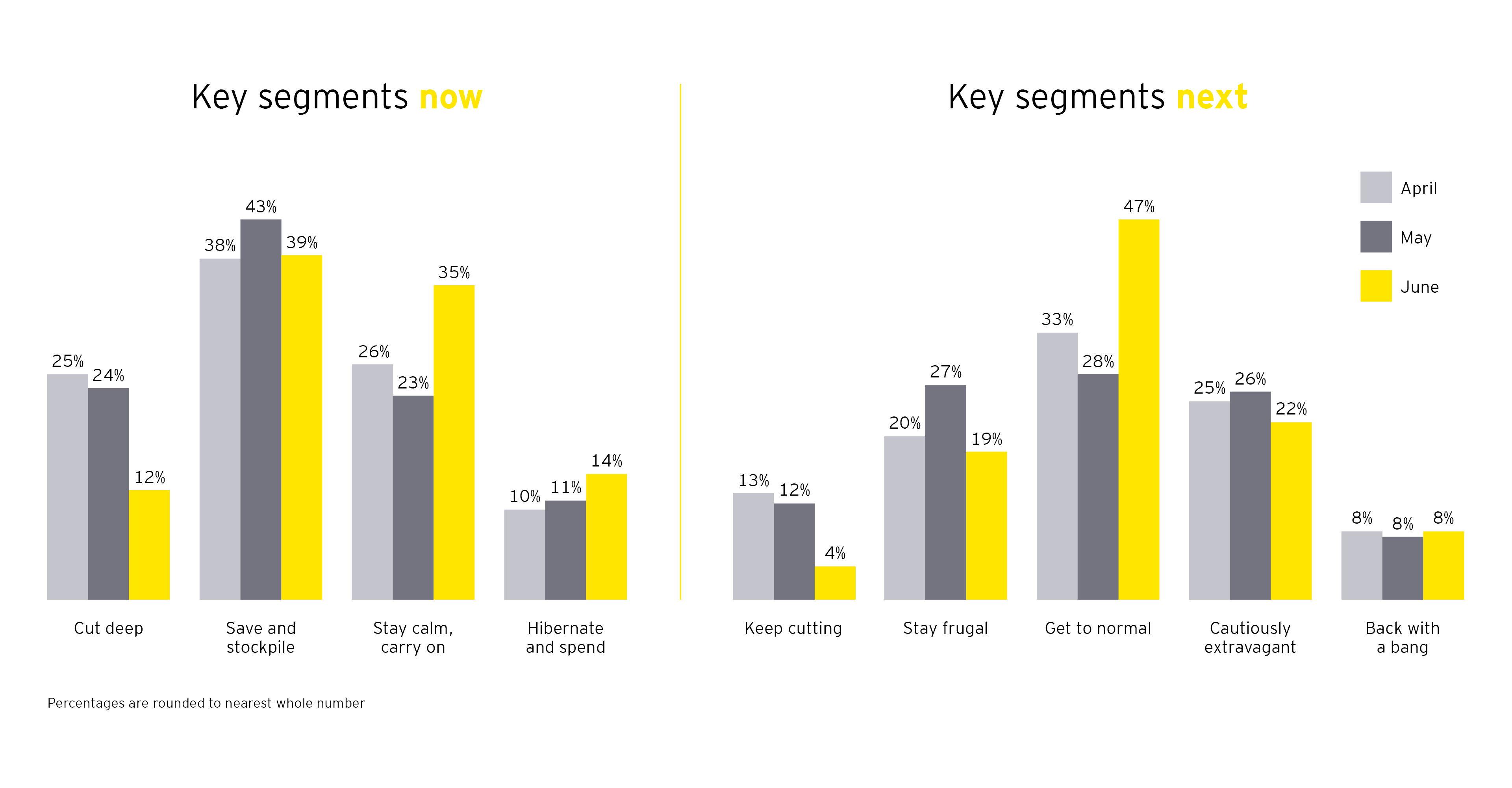

Those who were more focused on cutting spending has also fallen. The ‘keep cutting’ segment, who had already made radical cuts, fell from 12% (May) to 4% (June), while those focused on ‘staying frugal’ fell from 27% to 19%.

This improved optimism indicates that consumers are starting to feel more secure – both in terms of easing lockdown restrictions and the fall in COVID-19 cases, as well as changing attitudes to their finances. Half of UK consumers say they are more aware of their spending and are trying to save more because of COVID-19, regardless of their income level. This is unsurprising – some financial loss has been felt by consumers at all income levels, with low-income segments worst hit. This greater awareness of income and spending has filtered through into increased long-term confidence in future finances. Almost a third of those surveyed (32%) believe they will be in a better financial position a year from now, up from 24% the previous month. Savings have increased too, and while it is difficult to determine whether this is from pent-up consumer demand or consumers insuring against longer-term uncertainty, signs around actual and planned spending suggest at least some level of the former.

Planned and actual spending on both non-essentials (beauty, clothing and footwear), as well as big ticket items (furniture and large electronics), is increasing – an encouraging sign of improving consumer confidence. In April, only 13% of UK consumers said they were planning on spending more on big ticket items in the future. That figure has since risen to 18% (June).

But nerves remain, especially instore

Although general confidence in finances is increasing, there are exceptions. Consumers in the ‘stay frugal’ segment remain worried, with almost a third (32%) believing they will be worse off a year from now, consistent with the level in May.

As more shoppers have returned to stores, comfort around shopping in person has increased. Consumers are likely to have been reassured by the safety measures that retailers have put in place such as sanitising stations, screens and social distancing. The comfort of shopping in grocery stores has almost doubled since May, up to 48% in June, while the comfort of going to a mall has risen from 15% to 26%.

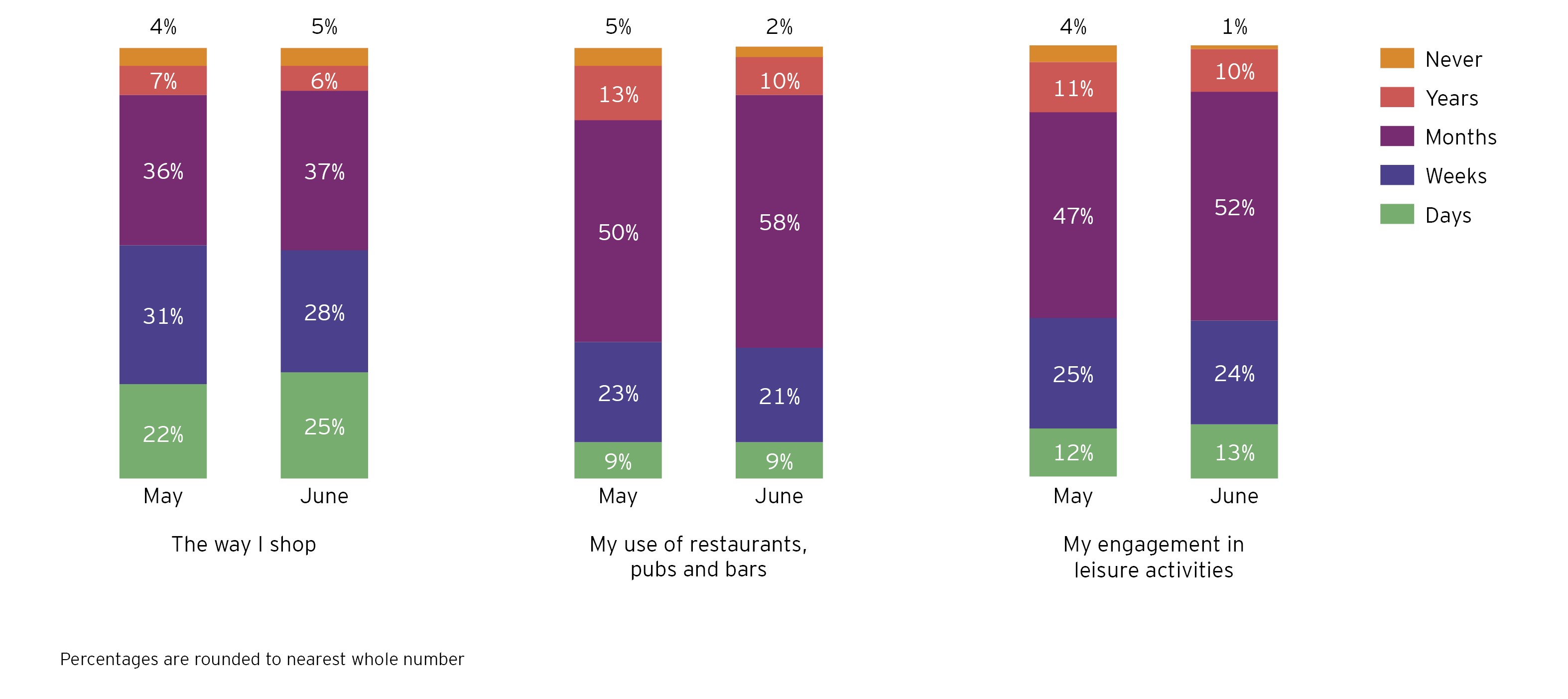

But cautiousness around instore experience persists, with the anxious consumer once again coming to the fore. The proportion of consumers who feel comfortable trying on clothes instore has doubled since May, but still only accounts for 17%. Nearly half (48%) of consumers say it will take months or longer for the way they shop to return to normal.

For those who think the way they shop will change, minimising exposure is a key factor – nearly two-thirds (59%) of consumers will look to consolidate shopping trips into less frequent but larger purchases. Consumers are also more aware of their surroundings, with 63% now more cognisant of hygiene and sanitation, up from 57% the month before.

Online, and investment in the channel, remains critical

For some consumers, nervousness regarding a return to normal is translating into a continued shift to online shopping, which is expected to continue to rise across all segments. Despite stores reopening, consumer intention to shop online in the long term has increased dramatically. In June, 43% of consumers said they will shop more online for products previously bought in stores, compared with 17% in May.