Overview of UK FinTech center

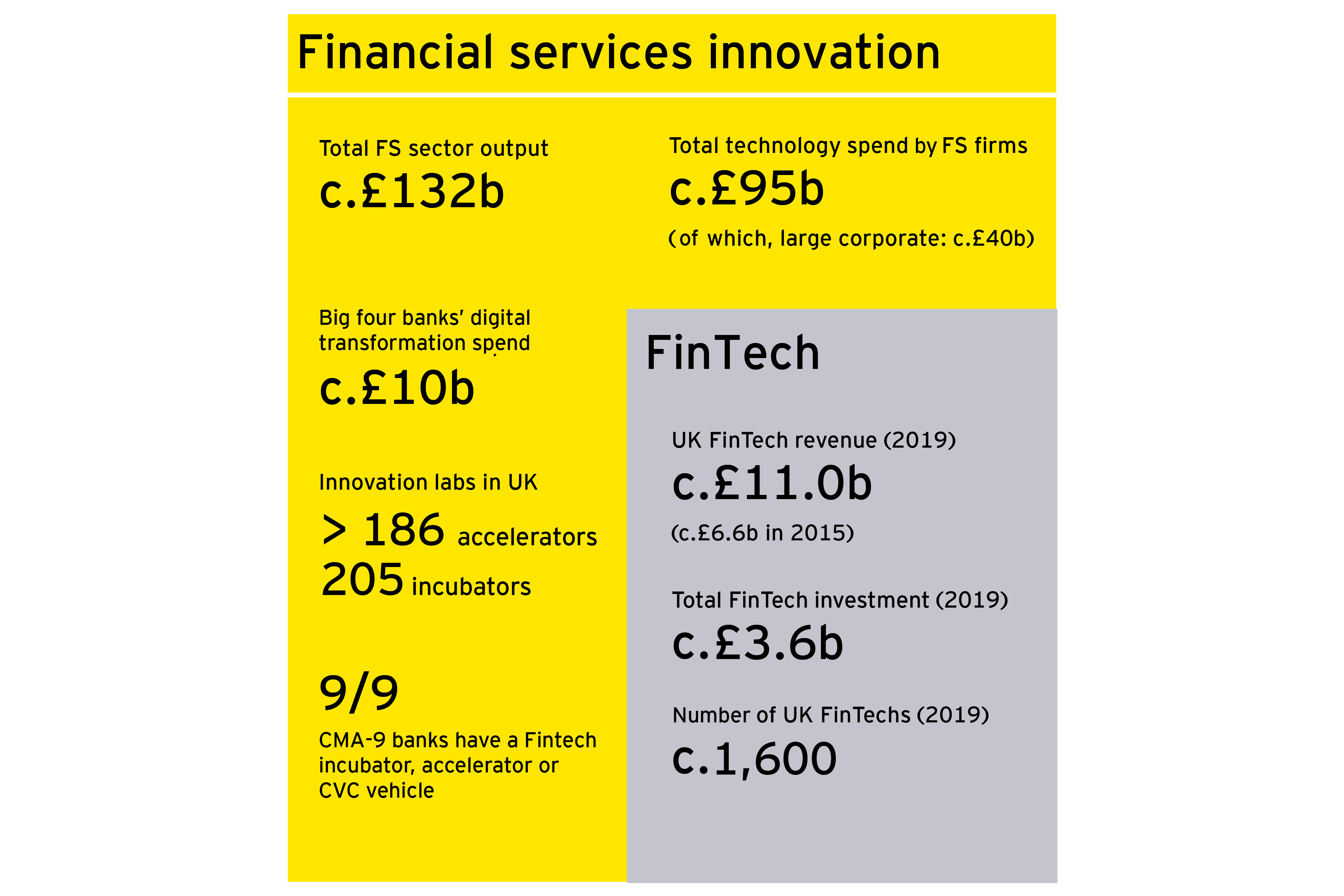

The research in this report shows that the UK is a global leader in FinTech, with a world-class and well-rounded ecosystem. The combination of financial and technical talent is unparalleled, and capital is strong, with nearly £3.6b invested in FinTech in 2019. In policy and infrastructure, the UK has set the global benchmark for policy-led innovation, with key initiatives including the FCA’s regulatory sandbox, open banking and the AI Sector Deal frequently cited as internationally distinctive. And from a demand standpoint, consumers, SMEs, corporates and government are key users of FinTech; more than two-thirds of digitally active consumers now benefit from FinTech services.

Relative to more nascent FinTech ecosystems globally, our hypothesis is that the UK should be better positioned to weather the challenges resulting from the COVID-19 pandemic. FinTech has an important role to play as a catalyst for innovation and inclusion in financial services and should be looking to enhance its role as a growth engine of the economy, as the UK begins its recovery.

The report was commissioned in January 2020 to understand best practices from comparable international markets and develop specific considerations for the next stage of FinTech evolution. The intent of this report is to trigger sustainable innovation that helps to drive the democratization of access to financial services for consumers and SMEs, including those unbanked or underbanked. We also aim to increase the level of choice, competition and national connectivity. Considerations in this report are inspired by our research across eight markets, and how these markets have rapidly progressed their FinTech environments, level of innovation, digital infrastructure and ambitions.

The recommendations, taken holistically, provide the potential for the UK to stimulate greater innovation and inclusion in financial services. The pandemic has showcased the importance of FinTechs’ role within the ecosystem, and as a result the recommendations in this report could be used to accelerate transformation and growth. They are positioned to be pragmatic and achievable as we embark on a period of recovery following the COVID-19 pandemic, supporting growth by ensuring the right access to capital and talent. For example, the focus on FinTech could support a national talent strategy that increases and diversifies the domestic supply of talent, addresses skills gaps and works more closely with academia to attract talent to the sector.

We also address the opportunity across the UK: not just in London, but in vibrant regional clusters, as we look to make the UK, as a whole, the destination of choice for FinTechs. This needs to be underpinned by an integrated national digital agenda, linked to world-leading infrastructure that provides comprehensive, safe and secure access to innovative financial services.

The UK must chart its path for the future at this critical time in its history, creating new jobs, forging new international relationships and defining its role as a leader in technology and data. UK FinTech now has the opportunity to enhance its position as a leading FinTech scale-up environment that develops and nurtures the next cohort of UK-supported, globally leading financial institutions (FIs). This requires us to encourage FinTechs, banks and tech firms to take the next steps to transform financial services and rebuild the UK economy.

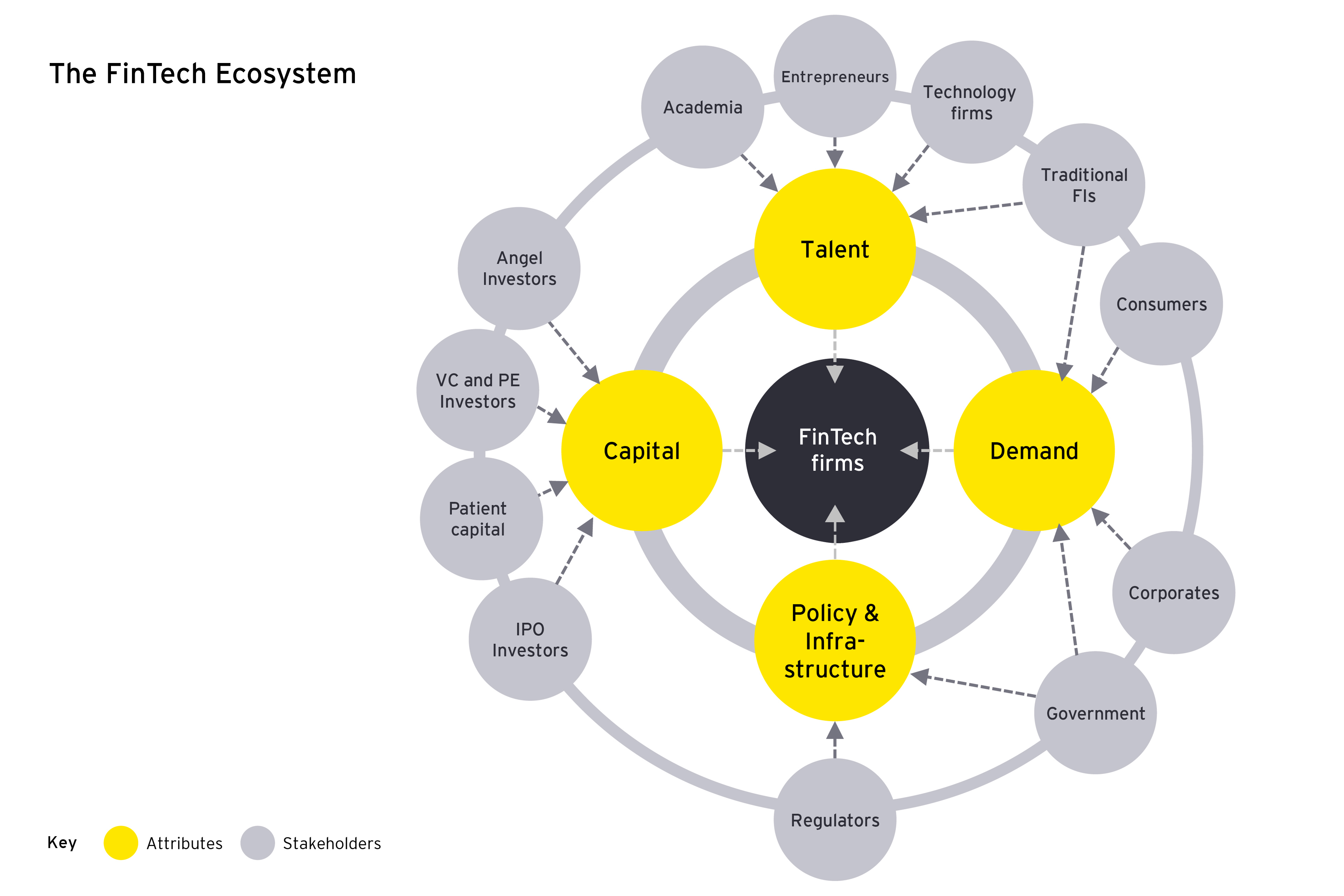

Four components of a well-functioning FinTech ecosystem

The strength of a nation’s FinTech ecosystem is dependent on a wide range of attributes and factors. Before profiling an ecosystem, we believe it is important to consider these attributes, and draw conclusions of where the ecosystem excels and/or is challenged.

We believe a well-functioning FinTech ecosystem is built on four core ecosystem attributes:

- Talent: the availability of technical, financial services and entrepreneurial talent

- Capital: the availability of financial resources for start-ups and scale-ups

- Policy: government policy across regulation, tax and sector growth initiatives, including the presence of digital public infrastructure to facilitate the financial services innovation

- Demand: end-client demand across consumers, corporates, FIs and government

The figure below highlights how these four attributes interconnect and indentifies the network of broader stakeholders.