The better the question

How does a city turn bankruptcy into renewal?

In 2011, 40% of Detroit's streetlights didn’t work and 210 of the city’s 317 parks closed.

On the morning of 11 June 1805, a fire started in a Detroit bakery. The blaze spread quickly, destroying buildings. Despite the best efforts of citizens who tackled the fire, most of the city burned down. The Great Fire of 1805 is commemorated on the city’s flag, which carries the motto, in Latin: “It shall rise from the ashes.”

And rise it did. Grand boulevards were built, the city’s population expanded, its men fought bravely on the fields of Gettysburg, and it thrived in the 20th century, powered by manufacturing and made famous around the world by the automotive industry and Motown Records. But, 200 years after the Great Fire, the city faced another crisis.

By the early 1970s, Detroit’s fortunes had begun to change. Global oil shocks hit the US economy and Americans switched to buying cheaper, more fuel-efficient and reliable Japanese cars. Over the next generation the workforce in the auto factories shrank, the population of Detroit plummeted and the city’s tax base was reduced. It became a byword for urban decline.

In 2011, more than a third of residents lived below the poverty line, 40% of the streetlights didn’t work and 210 of the city’s 317 parks closed. People fled the city, leaving 80,000 abandoned homes and structures. Violent crime was five times the national average and emergency services could not cope. More than US$18 billion in liabilities were covered by annual revenue of just US$1 billion, and access to credit markets dried up.

Detroit, 1893. Founded by French colonists in the 18th century, most of the original settlement of Detroit was destroyed by fire in 1805. As the city rose from the ashes, its streets followed a fresh geometric plan. © Antiqua Print Gallery / Alamy Stock Photo

1893

Detroit, 1893. Founded by French colonists in the 18th century, most of the original settlement of Detroit was destroyed by fire in 1805. As the city rose from the ashes, its streets followed a fresh geometric plan. © Antiqua Print Gallery / Alamy Stock Photo

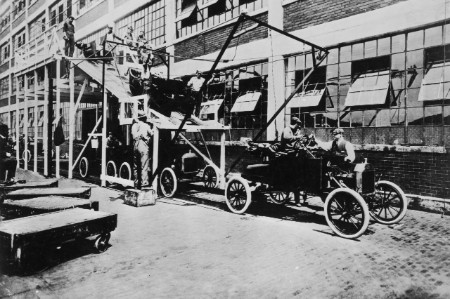

1909

In the early 20th century Detroit’s thriving carriage manufacturing trade prompted the founding fathers of the American car industry to choose the city as their home. This 1909 photograph shows car bodies being lowered onto their chassis on an assembly line. © Chronicle / Alamy Stock Photo

1918

Detroit, 1918. As the car industry grew so did the city. Tens of thousands of people, like these women welding, flocked to Detroit to fill its factories. By 1920 Detroit was the 4th largest city in the U.S. © Science History Images / Alamy Stock Photo

1950

By 1950, even more workers had been drawn to Detroit – the population was 1.8 million. Along with automotive manufacturing innovations, the war-years saw Detroit become home to the Davidson Highway, the nation’s first depressed six-lane highway. © Everett Collection Historical / Alamy Stock Photo

1970s

As familiar automobile names disappeared in the mergers of the 1950s, it was the fuel crises of 1973 & 1979 that saw Detroit’s fortunes falter. As the car buying public sought more fuel-efficient vehicles, Detroit’s manufacturers were forced to close plants and lay off thousands of employees. © ClassicStock / Alamy Stock Photo

1988

As manufacturing declined and the population dwindled, so did the city’s infrastructure. A poignant symbol of this decline was Detroit’s Michigan train station, which fell into dis-repair after Amtrak services ceased in 1988. © sstop/Getty Images

1980s and 90s

The continued loss of jobs combined with the movement of the remaining workers to the suburbs resulted in sections of the city being all but abandoned. © Michael Matthews / Alamy Stock Photo

2013

In 2011 it was estimated that nearly half of Detroit’s property owners failed to pay their taxes. The city of Detroit declared bankruptcy in July 2013. © sstop/Getty Images

2015

With its financial plans approved, it took less than 18 months for Detroit to emerge from bankruptcy. With new-found optimism, the inhabitants rallied and launched community schemes to clear the blighted neighborhoods. © Jim West / Alamy Stock Photo

2015

With almost two-thirds of its original population gone, Detroit’s deserted neighborhoods became home to some of the largest urban farming projects in the world. © Jim West / Alamy Stock Photo

2018

At the height of the city’s troubles it was estimated that 40% of the street lighting wasn’t working. Today Detroit it the largest U.S. city to boast all LED street lighting. © Reese Lassman / EyeEm

2018

Parks and public spaces were another victim of the city’s financial woes. Following the bankruptcy, Belle Isle (seen in the foreground) became a state-run park. It received $32 million investment and by 2016 it was the most visited park in Michigan. © pawel.gaul/Getty Images

2018

As the city’s historic buildings continue to be renovated and its blocks revitalized, Detroit’s future looks bright as it continues its post-bankruptcy renaissance. © DenisTangneyJr/Getty Images

On 18 July 2013, Detroit became the biggest US city ever to file for bankruptcy.

Four months later, the City Administration appointed a new Chief Financial Officer, John W. Hill. His task was to stabilize the city’s finances so that the city could restore services for citizens and build a sustainable future. The question asked was: “How can a city turn bankruptcy into renewal?

The better the answer

Focus on long term fiscal stability

Developing a plan of adjustment of debts, including 40-year financial projections.

EY worked with the city on a number of activities before, during and after the bankruptcy phase.

In the period before the city filed for bankruptcy, the tasks included developing short-term cash flow projections, assisting with operational and labor initiatives and developing revenue and cost-saving measures to eliminate the structural deficit.

During the bankruptcy period, EY helped the city to focus on long-term fiscal stability. Activities included development of the City’s Plan of Adjustment of Debts, including 10- and 40-year financial projections to support the plan, negotiations with creditor groups and providing expert testimony.

Once Detroit emerged from bankruptcy, EY’s work continued on projects such as monitoring and implementation of the Plan of Adjustment, cash flow forecasting, financial analysis of departments, labor negotiations support, vendor management and claims resolution.

“I think external resources were key to the city’s success,” explains John. “Especially when those external resources, like the ones from EY, came in with expertise of working with other cities.”

While there’s still a long way to go for Detroit, the city’s recovery has been remarkable. EY’s work with the city has helped to set it on a solid footing again.

The better the world works

The city now has a sustainable future

Street lights now work, and blighted properties have been removed.

When finalized, the financial restructuring plan eliminated US$7 billion of long-term obligations.

This was vital in allowing Detroit to re-enter the municipal debt markets and provided the necessary budget surplus for the city to invest in its future.

The city's financial restructuring has allowed us to make major investments in public safety, blight removal, technology upgrades and other critical areas.

What this means for the citizens is that buses run on time again – so they have a reliable method to get to their destination. It means police and ambulance response times have been cut significantly, improving public safety. It means restoring things that many people take for granted, like working street lights and the removal of blighted properties.

Today, the city is looking to secure its future.

“We’re making sure that we don’t start anything today that we can’t support three years from now,” says John. “And with EY’s help, we have started to create a 10-year financial plan to help this city manage its financial future. It’s a different look at fiscal discipline, and I’m not sure that many other cities are doing this right now.”

Mike Duggan has been Mayor of Detroit since 2014. He says: “The city's financial restructuring has allowed us to make major investments in public safety, blight removal, technology upgrades and other critical areas. To carry forward this progress, we have instilled a new sense of fiscal discipline. Since the time of the restructuring we've registered three consecutive balanced budgets, which will allow us to exit state financial oversight very soon, and have received several bond rating increases.”

Back in 1805, when their city was blazing, the people of Detroit formed a human chain from the river to the fire. They passed buckets of water up the chain in a vain attempt to control and extinguish the fire. In the 21st century, when the city faced ruin, the tools at its disposal were more sophisticated. Displaying the same values of teamwork and public service, the city was able to save itself and rise again, once more living up to the motto of its flag.

How EY can help

Government & Public Sector services

Our Government & Public Sector community brings together more than 20,000 EY people from over 100 countries. All of us share a passion to help governments work better for their people.

Read moreSummary

The financial restructuring work carried out by EY helped eliminate US$7 billion of long-term obligations for Detroit. The city is now able to invest in its citizens and a sustainable future.