B2B customers are contributing to a new energy system, and utilities need to transform to keep up and keep their business.

Earlier this year, EY released industry-first data that showed the world’s utilities are on a countdown to a new energy system, driven by 10 key technological and consumer trends. Now new developments in some B2B energy customer segments hint that the first milestone on this journey – grid parity – may be achieved by these consumers much earlier. This accelerates the need for utilities to evaluate just how to respond to changes and reposition their business for radical transformation.

Multiple drivers pushing businesses to generate their own energy

As I’ve covered in a previous blog, distributed generation and the digital grid have put utilities on a countdown to a new energy future. And the growing trend toward self-generation places utilities at very real risk of irrelevancy – sooner than many may think.

At a community level, microgrids and energy aggregation schemes are allowing residential consumers to bypass the grid, while governments are exploring how to use new technologies – including the digital grid – to build the smart, sustainable cities needed to meet the demand of growing urban populations. These initiatives – and their impact on the traditional energy supplier – will be explored in an upcoming blog.

But it’s the impending grid defection of many B2B customers that may hit utilities hardest first, and bring forward the tipping points to a new energy system.

The energy B2B customer market is highly segmented but can be broadly categorised as Industrial and Commercial (I&C), small and medium-sized enterprises (SMEs) and microbusinesses. These consumers typically represent a small proportion of the total number of electricity and gas meter points for a utility, but business energy use is significant. In the UK, for example, business consumers account for nearly 40% of total energy demand (pdf).

For these customers, energy supply is not just a service but part of a wider solution to improve competitiveness, reduce costs, ensure business continuity and, increasingly, build a better, greener brand. But many are frustrated by the continuing inability of their electricity providers to recognize their needs beyond price.

More are seeking to take control of their own electricity supply through developing off-grid options, or entering into long-term power purchase agreements with renewable developers. Some, as my colleague Stuart Hartley discussed in a recent blog, are driven mostly by rising energy prices and risks of outages; but others, including some of the world’s biggest brands, are motivated by a desire to build strong sustainability credentials.

B2B grid parity may accelerate energy tipping points

How utilities respond to these developments may be a critical variable in defining the journey toward a new energy future. Will they ignore the threat or embrace the opportunity? Those that act now can take a proactive role in providing the support and ancillary services that B2B customers will need as they adopt alternative energy options, while being part of the transformation. But are they equipped to do so?

Serving B2B customers more effectively starts by understanding them better. But truly understanding the customer has never been a strong skillset for utilities, even as the rise of both digitized data and customer power have created an opportunity to do so and increasingly made it a priority.

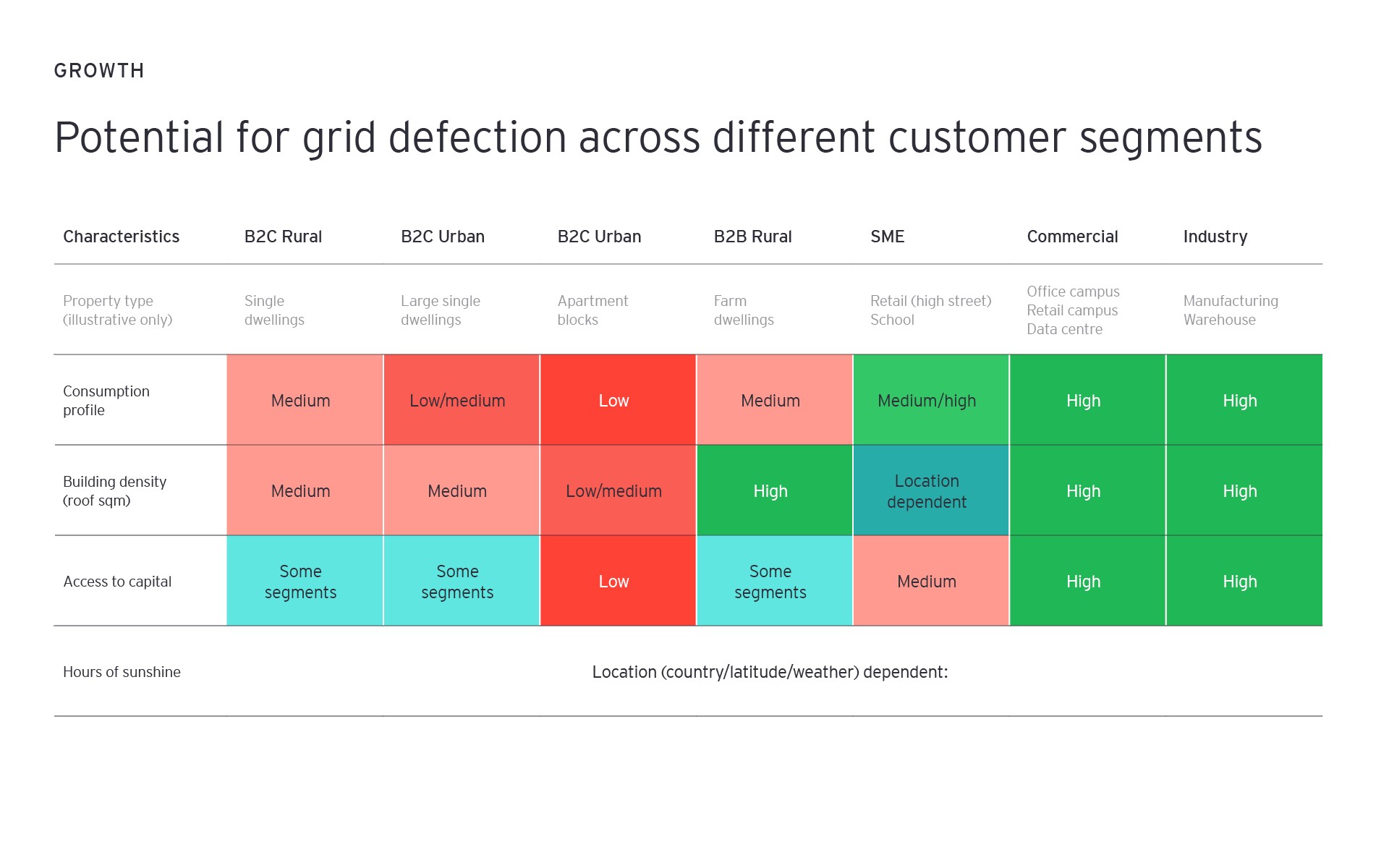

Now the pressure to know the electricity consumer, and specifically to understand which B2B customer segments will be first to take their business off-grid – is more important than ever. The first step in doing so may be analyzing B2B consumers by considering four key elements:

- Consumption profile: Organizations that expend most or all of their energy usage during daylight hours – such as shopping malls or schools – can use solar generation without much need for energy storage.

- Density and rooftop size: Those businesses with large footprints – such as furniture megastores – have huge potential to install onsite solar generation.

- Average daytime sunlight hours: Clearly businesses in regions with abundant sunshine can more easily generate solar power.

- Access to capital: Investing in self-generation facilities requires significant upfront costs.

By considering how these factors interact, we can see that it is highly feasible that some customer segments in certain regions may be ready to leave the grid much sooner than others.