“It is not surprising that family businesses are planning today to protect tomorrow’s businesses from disruption,” says Carrie Hall, EY Americas Family Business Leader. “An eye on opportunity and a focus on long-term strategy — as well as an enviable agility to move forward — have long set family businesses apart from their non-family counterparts.”

Gens X, Y and Z to the rescue

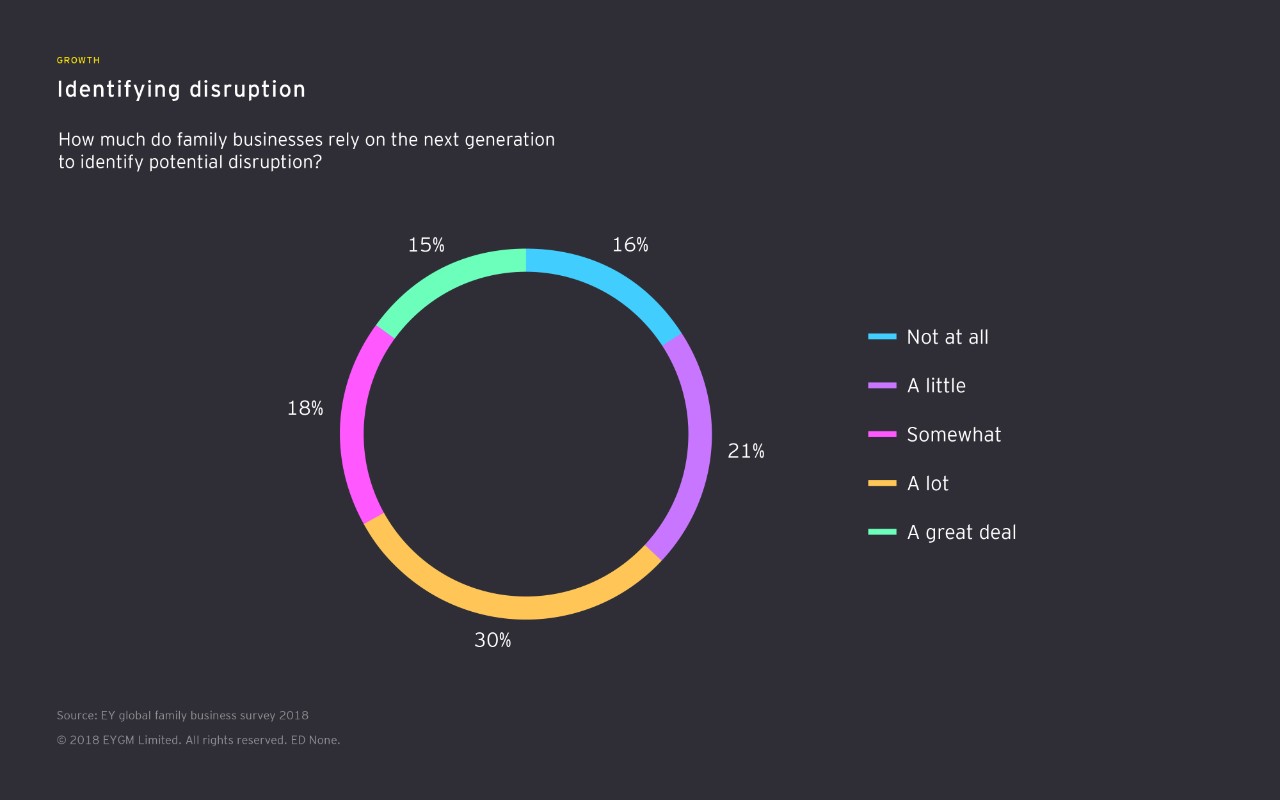

Many of those surveyed recognize the role the next generation can play when it comes to identifying disruptive threats. 30% of respondents say they are utilizing younger family members’ talents “a lot” today — with another 15% indicating they rely on them “a great deal” for help identifying trends that could reshape the marketplace.

Still, that leaves the majority (55%) admitting there is more to be done when it comes to using their (literally) homegrown talent — the first generations that grew up alongside the digital revolution. Change and disruption were a natural part of their life cycle — and these generations may be well-suited to work in a digital landscape that affects every area of business.

The data suggest there is a real opportunity for those family businesses not using the next gen to put them to work. Enhancing the innovation agenda, for example, is one space where younger members might easily excel. “They are digital natives and ready to rethink everything. This is an area where they can make a real contribution,” says Astrachan. “There’s even a bonus: engaging their hearts and minds early on helps maintain continuity and increases family cohesion — both shown to be related to superior operational performance.”

Flexing their hiring power

Attention to the importance of their people has long been a distinguishing hallmark of family businesses. They recognize the critical need for both family members and outside talent to be nurtured — and retained — as they grow into high performers who live the core values of family and business. Roughly 50% of all global respondents intend to create jobs in 2018, with 10% expecting increases of greater than 5%. This is impressive given the U.S. Congressional Budget Office 2017 estimate of 2018 job growth of around 1% for the US. Their growth plans are grounded in their optimism for the world economy in 2018, with nearly 59% predicting growth in their local economies and a mere 7% predicting a contraction.

One fourth-generation family business leader described the search for external talent this way: “In recruiting talent, most businesses focus on factors such as pay, bonuses and working conditions. However, family businesses have an advantage — in many markets, merely being a family business appears to be attractive to high performers. Flexibility, adaptability, speed of change, and desire to take a long-term view of people and investments are desirable attributes.”

The best is yet to come?

It’s good news for the global economy that family businesses have plans in place to continue embracing change into 2018 and beyond. They are the world’s economic backbone. A commonly quoted “family business survival ratio” is 30:10:3 (where 30% of firms survive into the second generation, 10% last into the third generation and 3% survive beyond that point). Contrast this with the average lifespan of a company listed in the S&P 500 index of leading US companies. It has decreased by more than 50 years in the last century, from 67 years in the 1920s to just 15 years today, according to Richard Foster, a professor at Yale University.

Action points

1. Disruption comes from unexpected places — and overnight

Make sure your company, family and plans are agile and resilient enough to adapt to any form of disruption.

- Nurture an empowered environment where people who make mistakes (or fail) in the pursuit of what’s next are still rewarded.

- Create cross-functional, cross-level teams to study every aspect of the business and the market. What are your competitors or similar businesses in other industries doing that could affect or enhance your own innovations, customer segments and/or current products and services?

2. Next gen represents the first truly digital generation

Their comfort in an ever-changing digital world could be a huge asset as your business explores how to create and embrace the bold, tightly integrated digital strategies that will define it for the long term.

- Consider their familiarity with an ever-changing digital landscape as one way to help them make the transition from good owner to good leader, rather than the other way around.

- Give them a solid grounding in general business education to enhance their digital talents. Start with simple financial statement understanding and work up to more the advanced cost-volume-profit relationships.

3. Recognize, nurture and reward the A team

Assuming there is a good cultural fit, you never want to lose your most valuable players.

- Brand yourself as a family business that is known as a great place to work.

- Point to the success of your entrepreneurial culture and how it rewards those who keep it alive.

Summary

Organizations have a lot to learn from family business. To remain relevant in the long-term, they should reward talent and prepare for disruption.