Companies could face double taxation unless they devise a strategy to deal with the increasing complexity of multi-jurisdictional taxes.

Filing taxes used to be a relatively straightforward exercise. A taxpayer would compile the relevant data, send it to the tax authority and answer any subsequent questions.The process is much more complicated today.

Taxpayers must comply with new laws as governments around the world implement global tax reforms via the Organisation for Economic Co-operation and Development’s base erosion and profit shifting (BEPS) project. Companies must also file tax data on a regular basis, knowing it will be shared among jurisdictions.

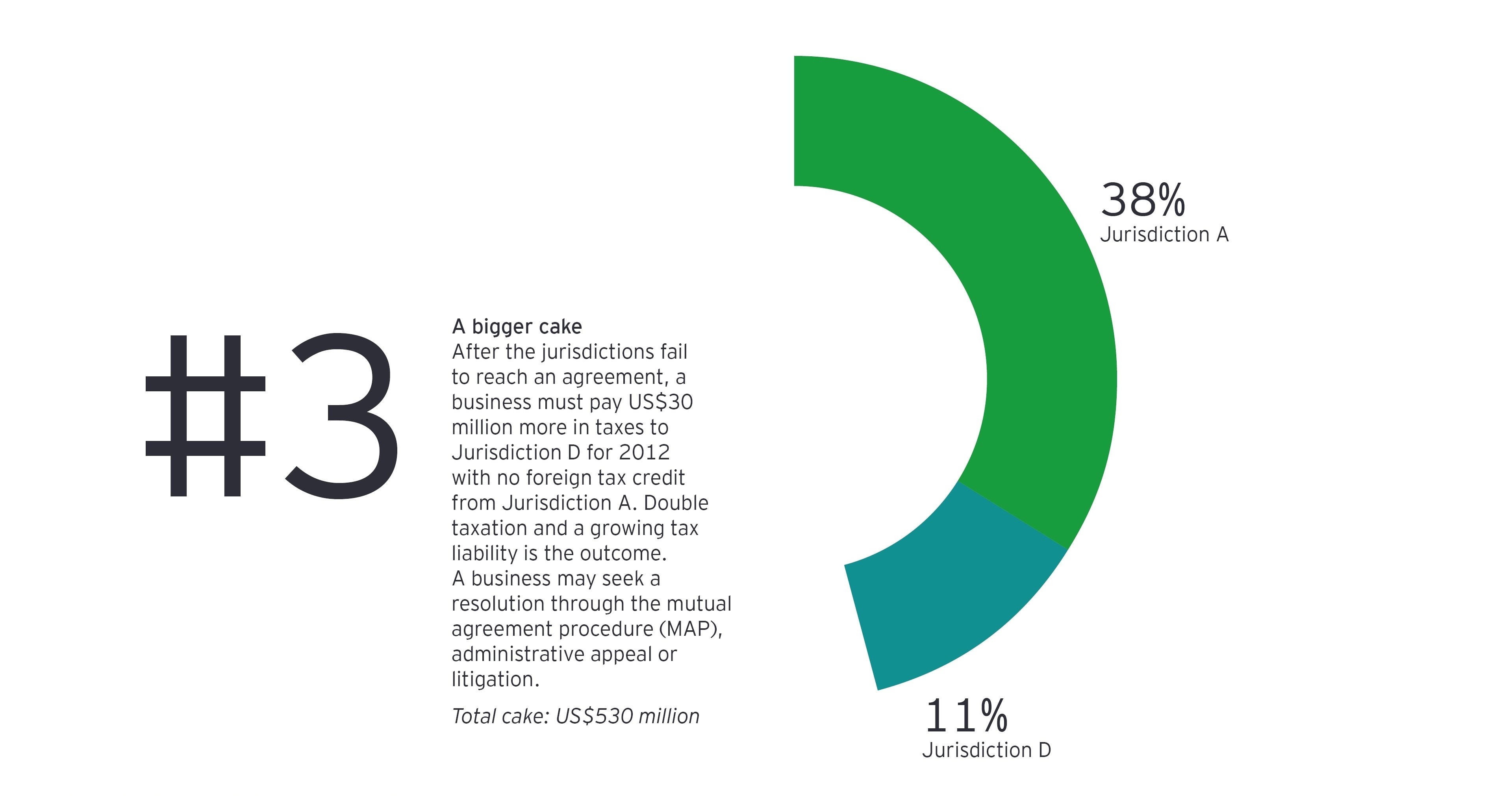

Tax authorities are getting tougher with enforcement, examining tax rulings and positions from the past. As governments maneuver for more tax revenue, multinational organizations could face a growing tax liability. Companies need to devise a strategy to deal with increasingly complex, multi-jurisdictional challenges or face the real possibility of double taxation.

A sticky situation: the modern tax predicament explained through a cake allegory

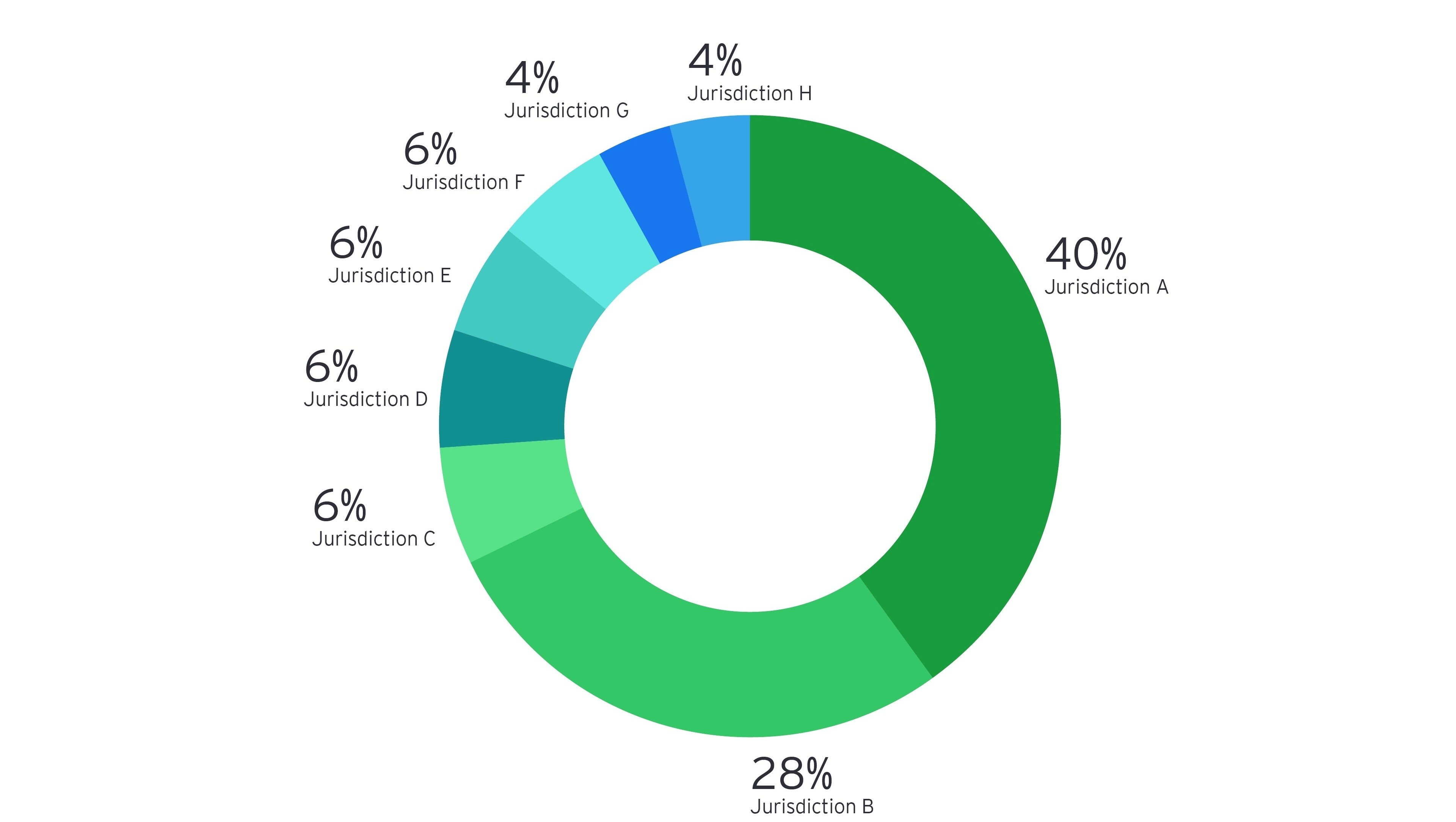

Five years ago, a business paid taxes in seven jurisdictions outside its home market and brought the income it earned back to Jurisdiction A, receiving a credit for the taxes paid elsewhere.