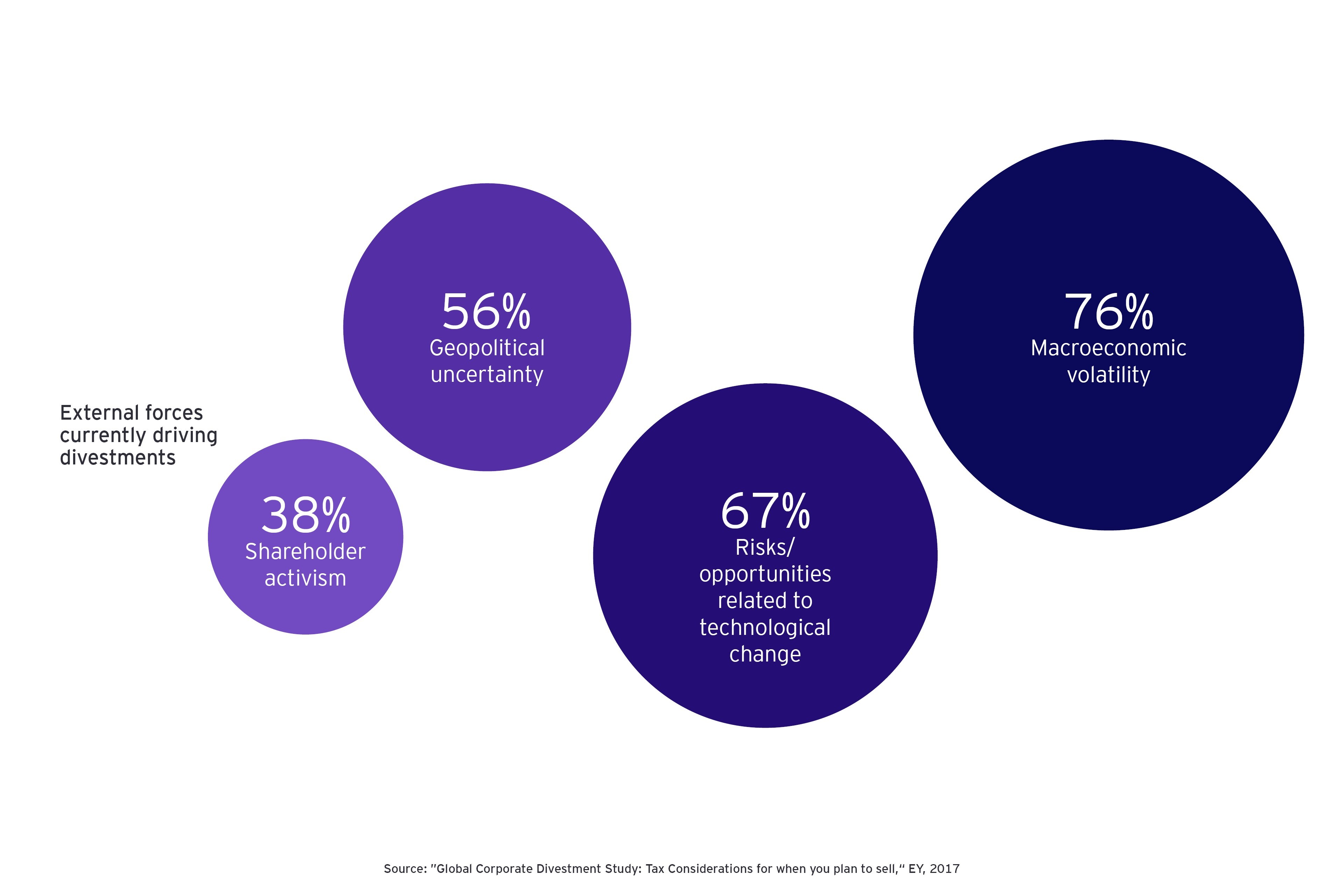

Businesses today are facing macroeconomic, geopolitical and technological uncertainty. This disruptive environment is driving divestments as organizations seek to sell non-core and low-growth assets and invest the proceeds in expanding their main portfolios.

Proceed with caution

Despite growing complexity and uncertainty, respondents in an EY survey had predicted that deal making would remain robust in 2017. Our Global Capital Confidence Barometer, a survey conducted earlier this year of more than 2,300 executives in 43 countries, found that 56% of executives surveyed planned to make an acquisition within the next year.

“Geographical expansion to secure supply chains and increase customer reach will accelerate cross-border M&A,” Steve Krouskos, EY Global Vice Chair Strategy and Transactions, wrote in the report. “Private equity is returning to replenishing mode. Lastly, corporates are increasingly reassessing and reshaping their portfolios, creating a natural pipeline of deal opportunities.”

Tax is among the risks that companies must address today when making acquisitions.

Our M&A survey found that 76% of respondents had failed to complete or had cancelled an acquisition over the past year, and tax implications was cited as the primary reason by 33% — behind issues discovered during due diligence, and concerns about cybersecurity and regulatory or antitrust reviews, but ahead of economic and political instability.

Amid widespread change in the tax world, “there is no time in memory where pricing the risk and cost of taxation within M&A deals has been so challenging,” says Bridget Walsh, EY Global Head of Transaction Tax, who is based in London.

The changes begin with a global tax reform plan, developed by the Organisation for Economic Co-operation and Development (OECD), aimed at increasing transparency and consistency.

“Nations have access to vastly more information about each company doing business within their borders stemming from expanded reporting requirements [e. g., country-by-country reporting],” Walsh says. “The information is being used to reevaluate transfer pricing — essentially where profits can be taxed — and that creates uncertainty within M&A.”

Changing rules

Another new guideline stemming from the OECD initiative limits the amount of interest businesses can deduct, reducing the degree to which companies can use leverage within transactions. The objective of the guidelines and regulation is to prevent profit shifting from jurisdiction to jurisdiction by financial means.

This has particular implications for the private equity (PE) industry, which often uses substantial leverage within its transaction financing structures.

“Private equity investors are having to rethink their approach to the M&A marketplace,” says Erica Lawee, EY Global Development Leader, Transaction Tax, who is based in London. For the most part, this means looking for ways to generate value through less leveraged deal making.

Certain aspects of M&A transactions may be dramatically affected by other changes in the tax environment.

Tax rates are changing, as are rules related to grants and incentives as well as the transferability of loss carryforwards. And tougher enforcement actions and uncertainty about tax rates make the modelling of deals much more difficult.

Yet another source of uncertainty arises from the many unknowns associated with US tax reform.

Tax can have a dramatic impact on asset valuations. With companies not certain of how and when US tax rates and policies will change, deal assumptions become less reliable.

“Not knowing when or how the rules will evolve complicates any transaction involving the US,” Lawee says. “It’s a challenge both for existing portfolios and future deals.”

The global-based nature of today’s business environment poses yet another challenge in terms of accurately assessing and determining a deal’s tax implications.

“M&A has become increasingly global and competitive in nature,” Walsh says. “For example, we see an attractive asset in France being chased by a China-based fund that is, in turn, largely financed by US investors as well as PE bidders from the UK and Canadian pension funds. These types of combinations have now become typical.”

Mind the gap

Marc Demuth, the Paris-based Managing Director of Corporate Finance in charge of Advisory for listed companies, EMEA (Europe, Middle East and Africa) for BNP Paribas, says a good first step for buyers is to understand how the new company and combined assets will be taxed going forward — the effective cash tax rate.

“There can be a huge difference between the tax rate prior to the sale and afterwards,” Demuth says. For example, “the target company might be enjoying a range of tax credits granted on the basis of their activities, perhaps for locating R&D [research and development] activities, central corporate services or their workforce in certain countries.”

Depending on how the organization is reshaped after the sale or acquisition, these incentives may no longer be available, according to Demuth.

Acquirers would also be well advised to consider what is often referred to as the character or the tax basis of the target company or assets.

The asset or company may have characteristics such as tax loss carryforwards that may or may not be transferable to the buyer. Or the buyer might be seeking to use the losses or other characteristics in some manner other than that of the target or benefit from a step-up in tax basis of the assets being acquired — approaches that might be overruled by the responsible tax authorities.

“It is important to perform due diligence to understand how a change of control will impact the tax position of the acquirer or the newly formed entity,” Demuth says.

Other important considerations for both buyers and sellers in any transaction are whether any capital gains taxes or transfer taxes arise from a deal.

Designing deals

Careful consideration of a transaction’s form can have a considerable impact on valuations.

Jesse Lv, EY Greater China Transaction Tax Leader, who is based in Shanghai, explains that in certain cases, sellers and buyers may be able to work together to improve a transaction’s tax efficiency by changing the nature of the terms of sale. A shift from a share-based to asset-based acquisition can improve the tax aspects of a transaction, according to Lv.

“There can be very different tax consequences when you gain control of a target by buying its shares on the open market, vs. structuring the deal as a sale of discrete assets,” Lv says. “Purchasing shares means taking on all of the target’s assets and liabilities, whereas an asset purchase carries fewer tax attributes for the buyer to assume.”

Still, asset-based transactions can be more difficult to execute. There are more legal considerations and greater cooperation is required from the seller who must carve out such assets from its ownership structure, according to Lv.

Luxottica’s Soldani sees the company’s M&A and tax teams as partners — and not only in deal making.

With so much change taking place in areas such as transfer pricing, the company increasingly needs to update its valuations for tax purposes — with valuation being a specialty within the M&A practice.

“So very much so, what we have is a partnership between M&A and tax,” Soldani says.

Divestment is tricky, too

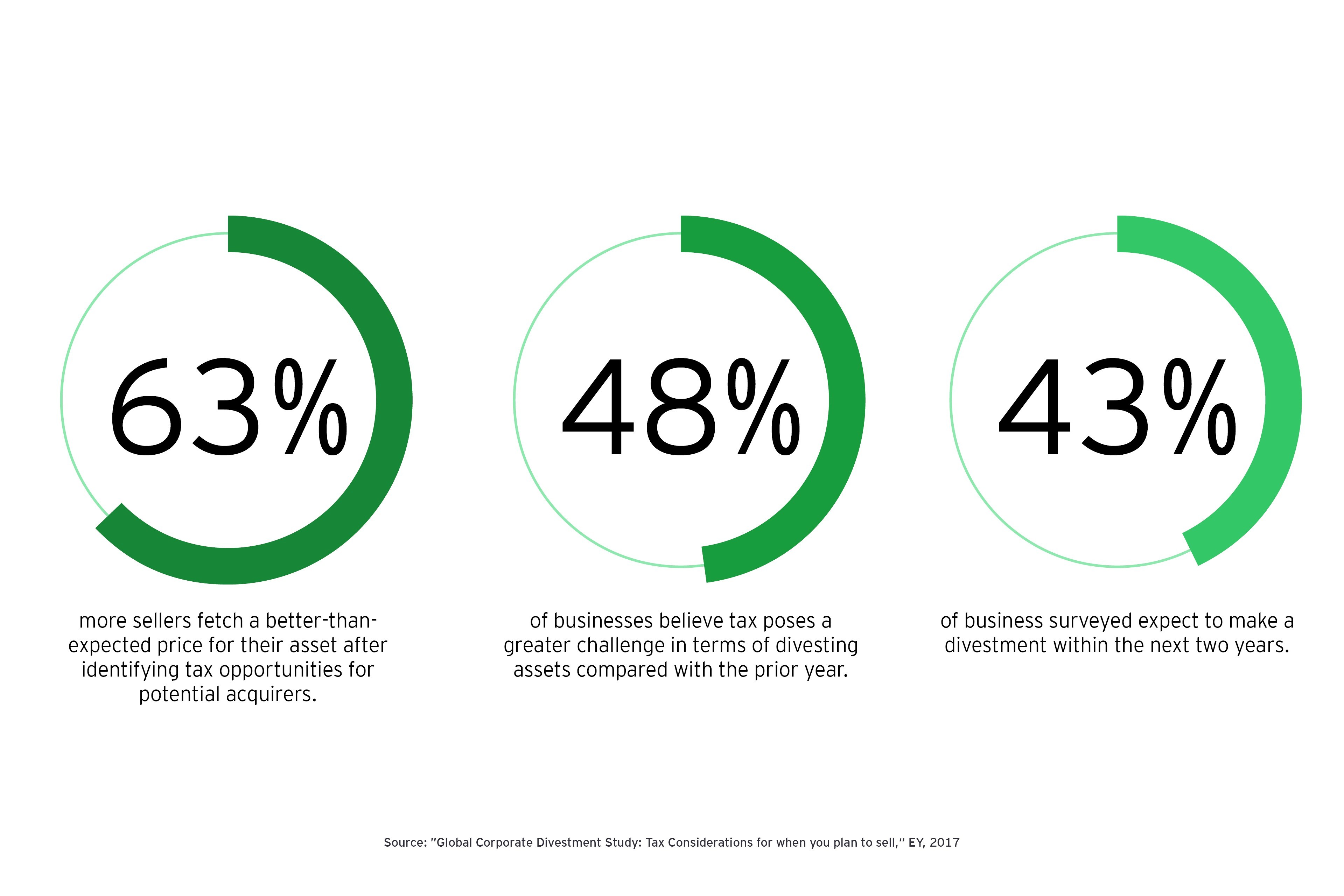

Accurately determining potential tax risks from a divestment is often a complex task for sellers today. Nevertheless, it is key for sellers to understand these tax risks early on in the divestment process, and to identify potential tax upsides for buyers in order to secure the best price for their asset.

Key action points

- In response to today’s high and still-rising tax uncertainty, it is advisable to engage tax expertise early on in deal development to assess potential tax challenges, risks and synergies. While tax should never be a driver of M&A, it can have a significant impact on transaction valuation and outcome.

- Various elements within a transaction, such as the tax rate in the target country or whether grants, incentives or loss carryforwards are transferable, can be an important factor in deal valuation.

- Shifting from the purchase of a target’s shares to instead acquiring a target’s carved-out assets can sometimes improve the tax effectiveness of an acquisition.

- With so many regulations and tax rates in flux and with enforcement action on the rise worldwide, companies need to make certain their transactions take tax costs, compliance and risks into full account.

This article was originally published in Tax Insights on 11 September 2017.

Summary

Despite growing complexity and uncertainty, respondents in an EY survey predicted that deal making would remain robust in 2017. Our Global Capital Confidence Barometer, a survey of more than 2,300 executives in 43 countries, found that 56% of executives surveyed planned to make an acquisition within the next year.