Long-term view

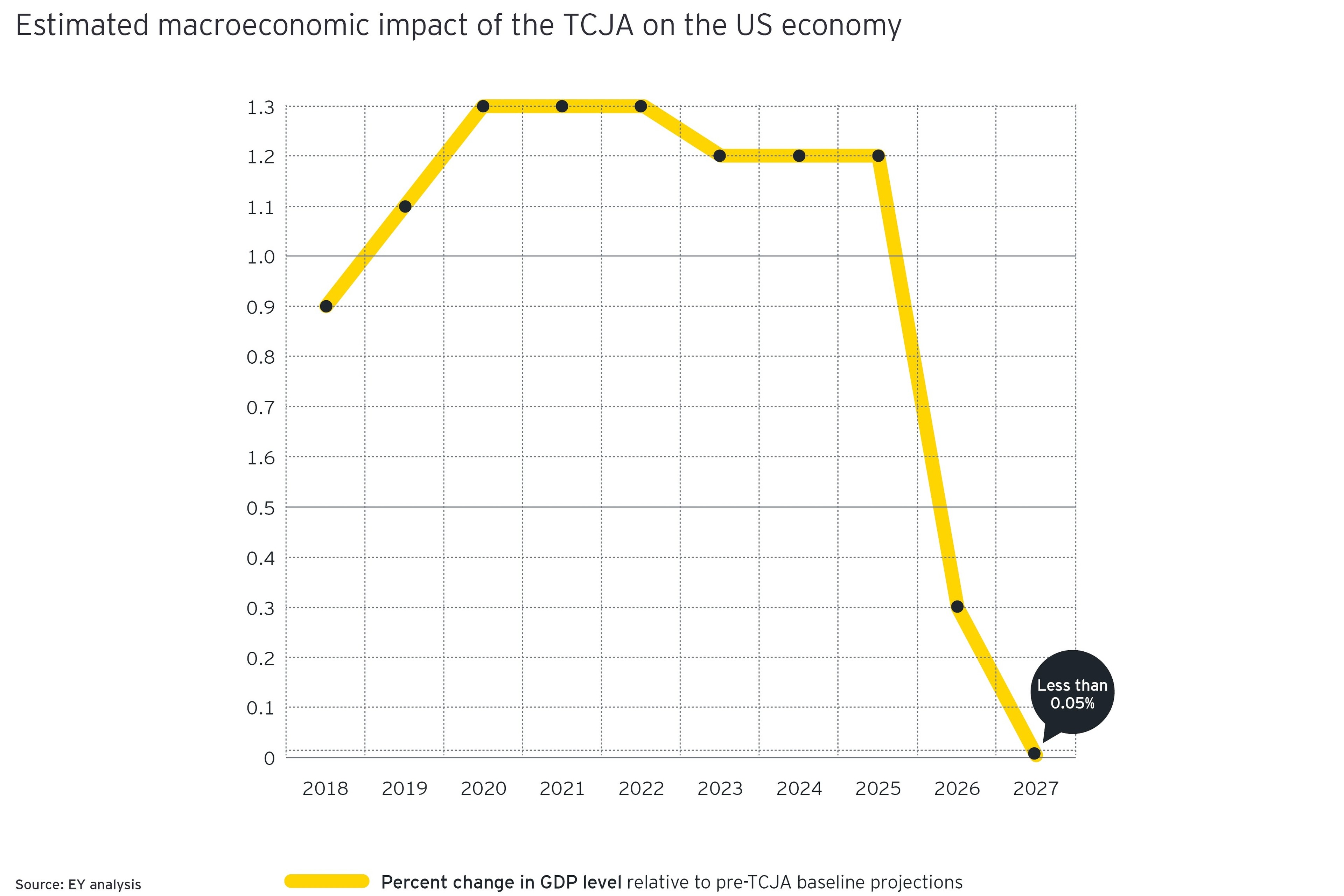

When planning for the future of their US operations in light of the TCJA, businesses should consider both the clear short-term benefits along with the longer-term uncertainty awaiting the US economy.

In the short term, the TCJA offers many incentives for businesses to invest in the US and grow the economy: the reduction in the corporate income tax rate from 35% to 21%; the repatriation of overseas funds; and the full expensing of certain capital expenditures.

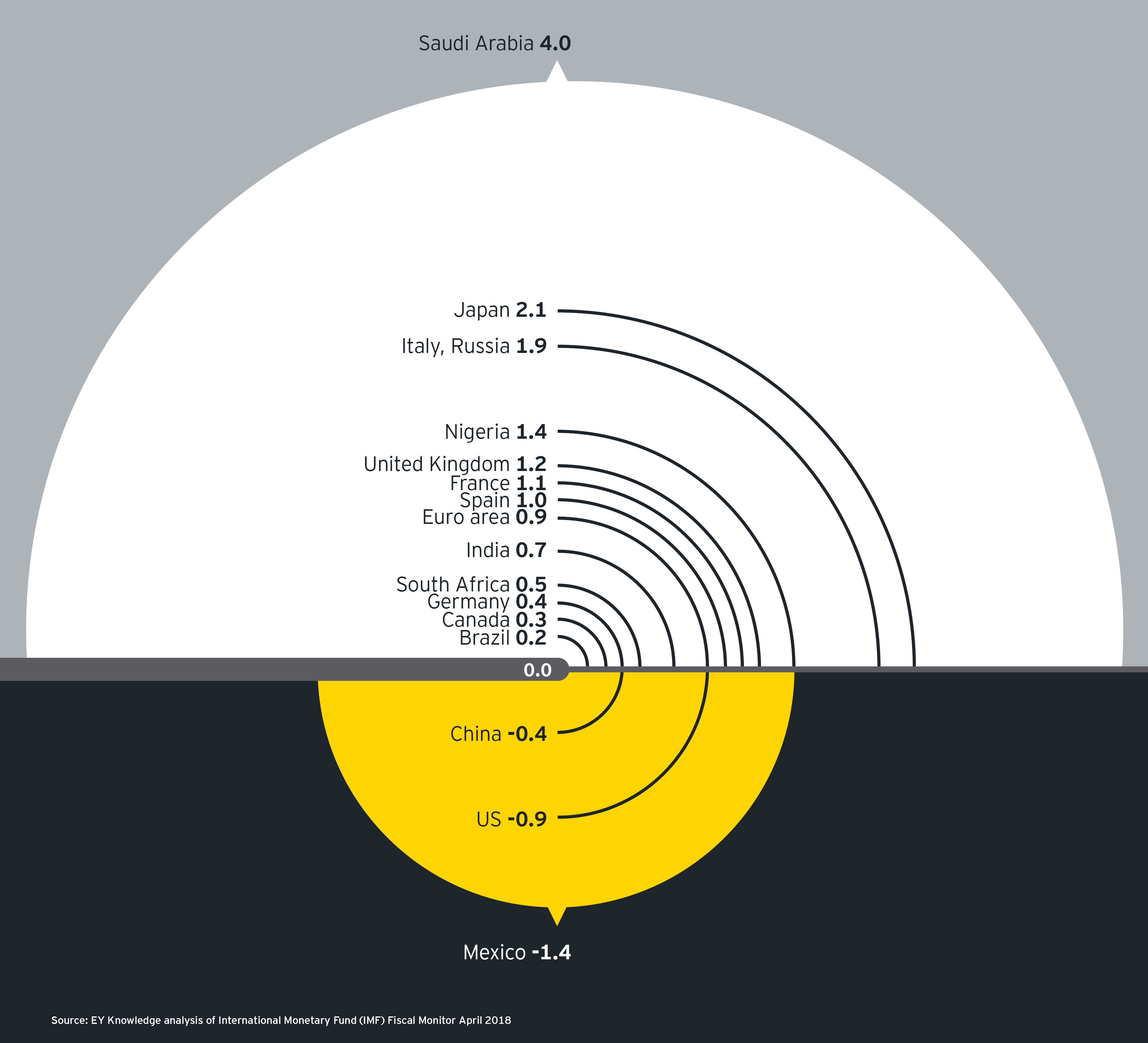

On the other hand, the TCJA can’t alleviate all of the long-term risks to the US economy. Changes to inflation, interest rates, global trade policies and government debt levels could all impact the US economy’s performance going forward.

Sources: “The Budget and Economic Outlook: 2018 to 2028”, Congress of the United States Congressional Budget Office, April 2018; “The Senate’s Tax Cut Would Generate Little New Long-Run Economic Growth”, Benjamin R. Page, Tax Policy Center, 11 December 2017; “Analyzing the acroeconomic impacts of the Tax Cuts and Jobs Act on the US economy and key industries”, EY, 2018; “World Economic Outlook”, April 2018, International Monetary Fund.

This article was originally published in Tax Insights on 23 August 2018.