Chapter 1

The digital upside of lockdown

Connectivity and content have never been more important to households as the pandemic prompts a surge in adoption of new digital activities.

1. COVID-19 has prompted a surge in new digital activities

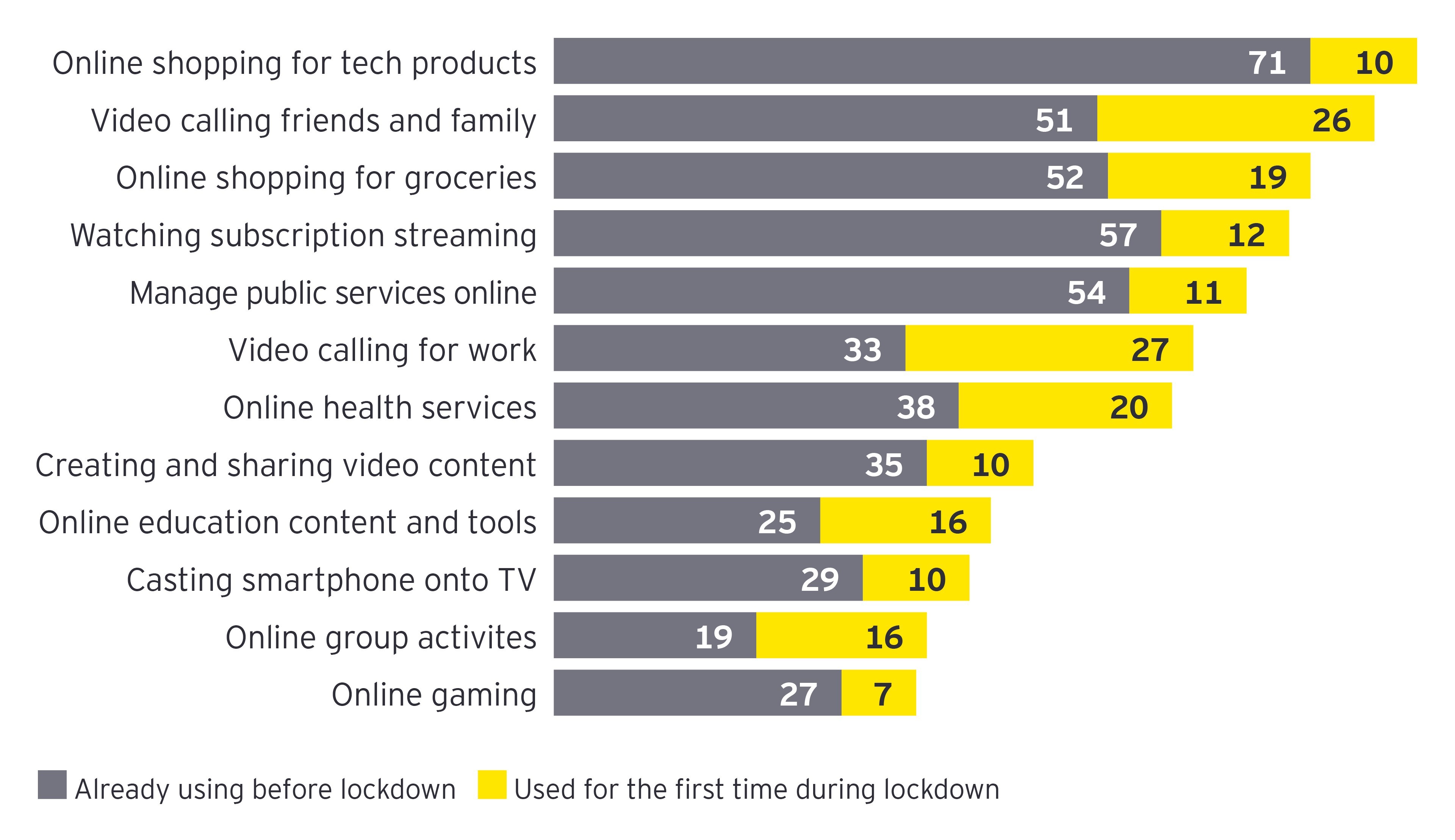

Households have adopted a number of services for the first time since the UK Government began issuing advice to stay at home, in March 2020. Video calling leads the way, while grocery shopping and access to health and education services are going digital at pace. First-time adoption trends in the UK are broadly in line with levels observed in other markets, with the surge in video calling even more pronounced. 26% of UK respondents have called friends and family via video for the first time, compared with 22% of households across all markets surveyed.

Adoption of video calling by UK consumers

26%have tried video calling for the first time.

Adoption of digital services during COVID-19

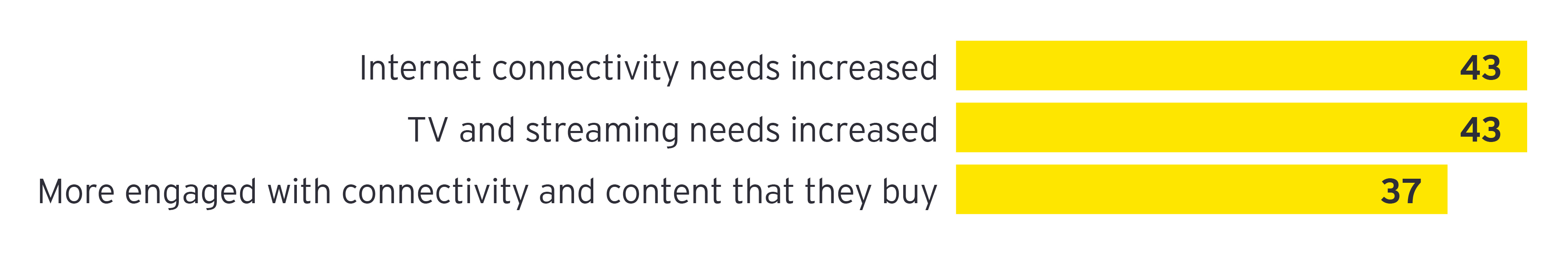

2. Connectivity and content needs are rising

Growing reliance on the digital home has largely translated into greater engagement with the connectivity and content that households buy. Growth in both demand and engagement is reasonably well aligned, indicating that customers are responsive to offers in the market as they look to serve their changing needs.

Demand for connectivity and content during the pandemic

3. TMT providers have coped well with the crisis

Households largely believe that connectivity and content providers have coped well with the crisis. Broadband and mobile providers lead other types of service provider — reflecting the goodwill created by COVID-19 relief packages — while social media platforms lag highlighting ongoing challenges around fake news. Even so, just 11% of households disagree that social media providers have coped well with pandemic.

UK Consumer Perceptions of TMT provider performance

66%believe that broadband and mobile providers have coped well with the pandemic.

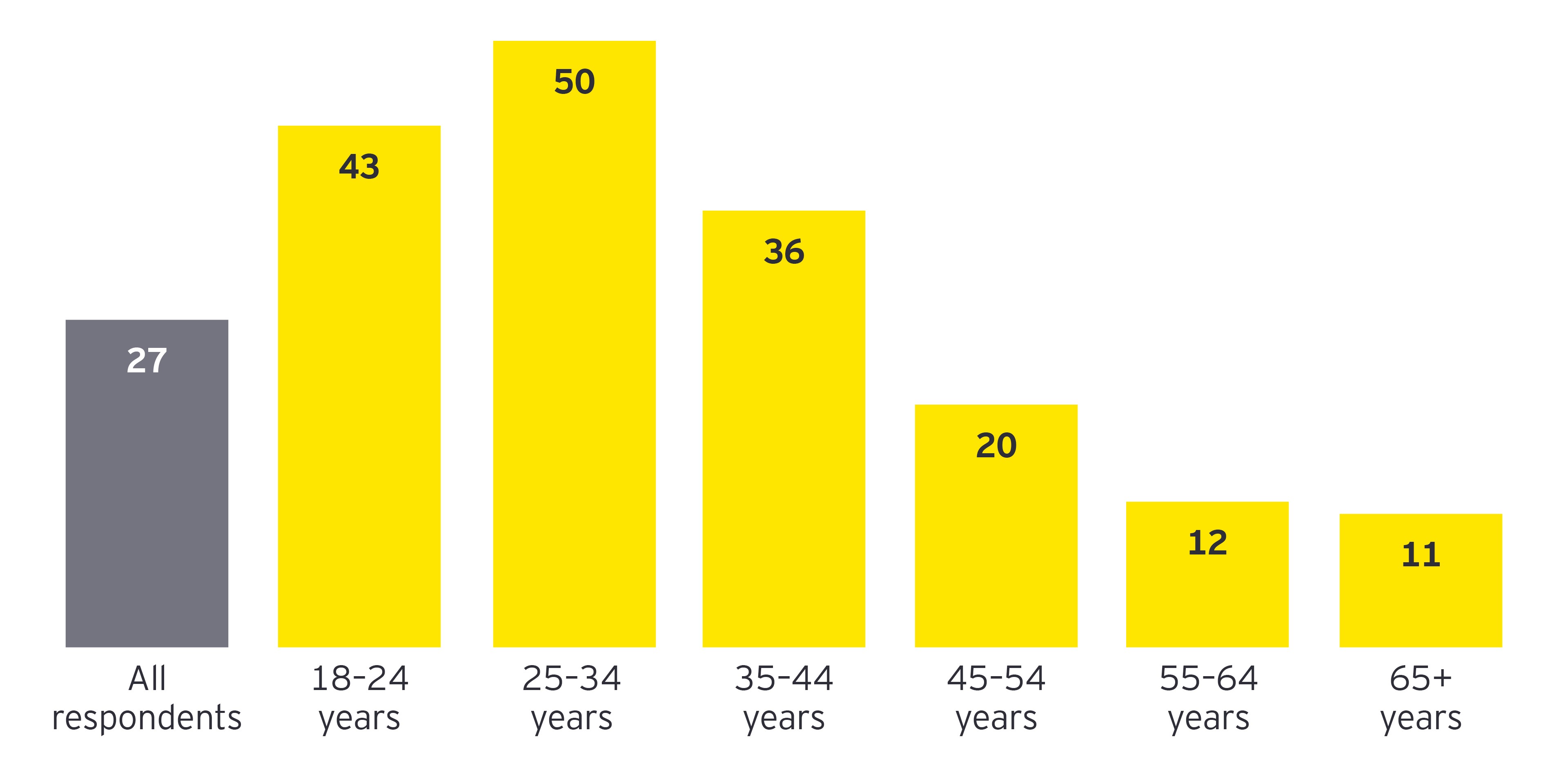

4. Some households show appetite for a ‘one stop shop’

The outlook for monthly spending is broadly encouraging, there are more users prepared to increase rather than cut back on spend. Compared with other markets in our survey programme, appetite to increase spend is a little more muted in the UK; however, this is offset by lower willingness to reduce spend.

In many cases, the pandemic is acting as a catalyst for upgrades: 24% agree the crisis has made 5G more appealing and 24% agree it has also highlighted the importance of upgrading to gigabit broadband. Meanwhile, 27% of households now see the benefits of taking all connectivity and content from a single supplier, with younger groups show the greatest appetite for a ‘one stop shop’.

Attitudes to purchasing all connectivity and content from a single supplier

5. Broadband providers rank ahead of other TMT companies as data custodians

Consumer perspectives on who they trust most to look after their data are revealing. Broadband and utility providers top score, well ahead of different types of technology provider and platform.

While this is good news for connectivity providers, results broken down by age tell a different story. Streaming TV providers rank most highly among 18–24 year olds, while smartphone providers are among the most trusted among both this group and 25–34 year olds. The landscape of trust perceptions is a fluid one and younger users require particular focus since they are typically heavier users of digital products and services.

UK Consumer attitudes on data protection

22%believe broadband providers would keep personal data secure and use appropriately.

Chapter 2

Pressure points in the digital home

Anxiety around data protection and digital well-being are on the rise, with digital over-exposure being a clear household concern.

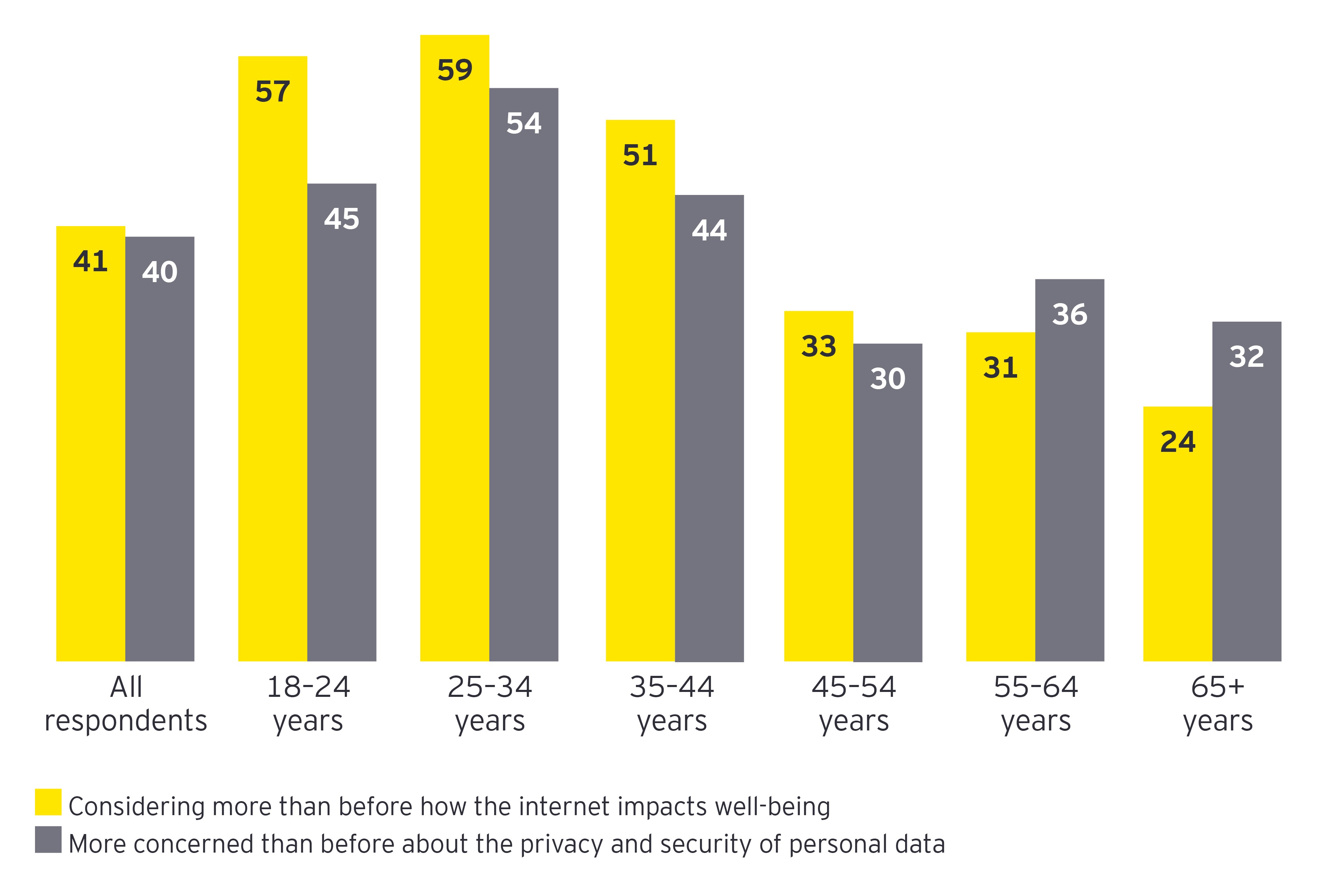

6. Younger groups are most exposed to digital well-being concerns

The pandemic has heightened fears around personal data and the effect of the internet on well-being. 71% of UK households are very cautious about disclosing personal data online. Our research reveals that the pandemic is heightening pre-existing anxieties, with 4 in 10 households more likely to be considering their digital well-being or more concerned about personal data privacy compared with before the crisis. This increase in concern is particularly pronounced among younger age groups.

COVID-19’s impact on well-being and digital trust

7. Fears surround specific types of content and connectivity

Households are highly aware of threats that are present in the online world. They have specific grievances with heightened relevance for content and connectivity providers. One-third of consumers are very concerned about harmful content their households may encounter and are also wary of using 5G mobile, despite Government and telco assurances of its safety. Once again, younger users stand out: 45% of 25–34 year olds are sensitive to these issues.

The pandemic’s impact on attitudes to data protection and disclosure is also reflected in falling receptivity to share personal data in return for customised services, compared with our household survey conducted one year earlier. Rising anxiety during lockdown periods is clearly putting pressure on the concept of value exchange between consumers and online brands.

UK consumer distrust of content and connectivity

34%of consumers are very concerned about harmful content their household may encounter.

Consumer distrust of content and connectivity

33%are wary about using 5G mobile, despite government/carrier reassurance

8. Cost control is the dominant factor at play for consumers

In the wake of the pandemic, cost control remains the dominant household mindset. Half of households try to spend as little as possible on communications. A similar proportion see bundles as a route to savings, while four in ten think they already pay too much for content that they don’t watch. This is a critical issue for TMT providers since customers expect more support from them: 41% of UK households across markets don’t believe their broadband provider does enough to ensure they are on the best deal, for example. While households’ spending predictions paint a positive picture, their underlying attitudes tell a different story.

UK household perceptions of overpayment and cost savings

Spending on communication services

50%of households try to spend as little as possible on communication services.

Saving costs with broadband bundles

49%of households believe broadband bundles are very important to save costs.

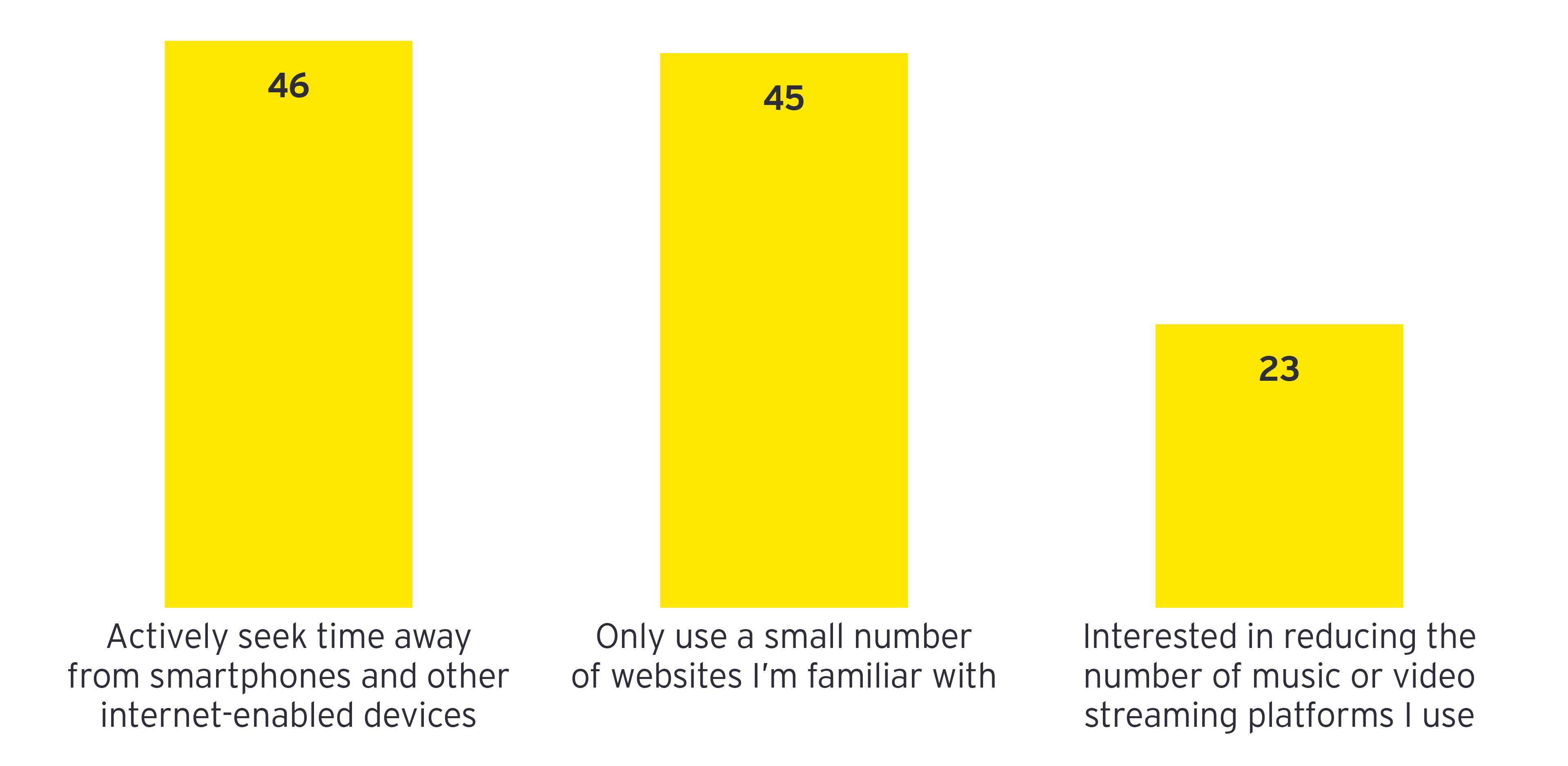

9. Feelings of overload and confusion are pronounced

The digital household could be nearing a saturation point, with 46% of consumers are seeking downtime from smartphones and other internet enabled devices. And consumers are doing more than voice the need for ‘time away’ — many are opting for the familiar by only using a small number of websites while some are keen to reduce the number of streaming platforms they use.

Feelings of fatigue and overexposure extend beyond products and services to relationships with service providers themselves. More than 4 in 10 households agree there is simply too much choice of different service bundles, with younger groups often more overwhelmed than older groups. Meanwhile, 53% of UK households agree that introductory offers complicate their assessment of value, highlighting how price plans themselves are responsible for confusing customers.

UK consumer attitudes to choice of connectivity and content packages

Time away from devices

46%of consumers actively seek time away from smartphones and other internet-enabled devices.

23–34 year olds

54%are overwhelmed by too much choice of connectivity and content bundles.

Household attitudes towards online exposure

10. Trust and value concerns limit the appeal of the smart home

More than half of households see the ability to control white goods via devices or mobile apps as a gimmick or fad, while even more are concerned about potential security flaws and limited data protection controls of smart home devices. Added to this, only 28% of consumers believe that smart home products are reasonably priced. If service providers ignore these warning signs regarding data protection, value and digital fatigue, then new products and services will fail to gain traction.

UK household attitudes towards smart home

Personal data

65%of households are concerned as to what personal information and data is captured and shared by smart home devices.

UK household attitudes towards smart home

28%believe prices of smart home products are reasonable.

What actions can TMT providers take to thrive in the future?

Build better relationships based on trust

Providers have the opportunity to construct a new kind of relationship with customers, and make the most of the goodwill created during the pandemic, by increasing levels of trust and service integrity. Consumers may think that TMT providers have coped well during the crisis, but there’s a difference between coping well and delivering better.

Keep things simple

A surge in demand for new digital activities is leaving many households anxious, feeling overwhelmed with everything that’s on offer. Providers must note that quality of experience is more important than quantity of service options or features. TMTs should reduce customer fatigue, communicate with empathy and provide simpler, more intuitive services in order to thrive.

Don’t take digital natives for granted

Younger groups are not always ‘digital natives’, in fact they outscore older groups on data protection fears driven by the pandemic, while levels of digital demand and anxiety have risen significantly among families with children. Resolving these pain points is essential and these groups are prepared to spend more for the right products and services.

Deliver new forms of value

Looking ahead, there are promising signs of interest in service upgrades supported by a resilient spending outlook. Yet the desire for value is present everywhere and these deep-rooted attitudes may have more say in customers’ future spending levels. As a result, customers need stronger rationales to spend more. New value propositions supported by tangible customer promises will help attract and retain customers in the long term.

Summary

Service providers should take action and ensure they build better levels of trust with their customers, revisit segmentation frameworks and simplify value propositions to take advantage of changing demands. By addressing the pain points that have come with the accelerated adoption of digital services, TMT companies can position themselves much better for long-term upside.