Helping Network Rail to get everyone home safe, every day

An ambitious digital transformation strategy has improved railway safety and realised sustainable, long-term benefits.

Implementing tech-enabled cultural change

The EY human-centred approach to digital transformation embedded change in a way that suited the organisation and its people.

Transformation with sustainable benefits

As well as delivering on safety innovation, the technology transformation unlocked long-term, sustainable benefits for Network Rail.

How a global biopharma became a leader in ethical AI

EY teams used the global responsible AI framework to help a biopharma optimize AI governance, mitigate AI risks and protect stakeholders.

How can you make today's AI ready for tomorrow's regulations?

Gaining insight into the review process and effectively improving AI risk management was a challenge.

A detailed independent review of AI governance

EY teams collaborated with the biopharma to review its approach to AI ethics using the global responsible AI framework.

Driving responsible AI to reduce risk to stakeholders

EY teams helped the biopharma safeguard stakeholders, including the public, from AI ethical issues.

Featured press releases

Listing activity on the London stock market saw an uptick in Q1 2024

Listing activity on the London stock market saw an improvement in the first quarter of 2024 with three IPOs raising £283.8m.

11 Apr 2024 London GB

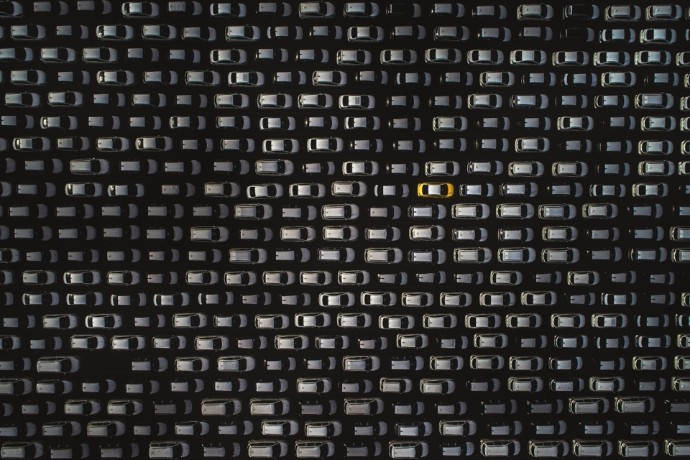

20th consecutive month of growth for new car sales, but consumer demand and EVs remain problematic – EY comments

The new plate month of March 2024 delivered 317,786 new car registrations, marking the 20th consecutive month of growth for the UK auto industry as well as representing a 10.4% year-on-year increase and the best March since 2019.

4 Apr 2024 London GB

More press releases

EY appoints new Transaction Diligence Leader in the North

EY has appointed John Divers, a Partner with over 20 years of experience in the deals market, as the firm’s new Manchester-based Transaction Diligence Leader for the North of England.

27 Mar 2024

EY strengthens South West Audit team with new Partner promotion

EY has strengthened its South West audit team with the promotion of Jemma Inker to Partner. Jemma originally joined EY in 2011 as an Audit Senior and has over 15 years’ experience.

20 Mar 2024

EY announces new Liverpool leader to spearhead growth

EY has announced Liz Jones as its new Liverpool Office Managing Partner. Liz is an audit Partner with over 25 years of experience and will be responsible for leading the firm’s growing team, based on the Albert Dock in Liverpool city centre.

14 Mar 2024

Next