Chapter 1

The need for business model innovation has never been more urgent

Overlooking the potential for new business models can create opportunities for competitors.

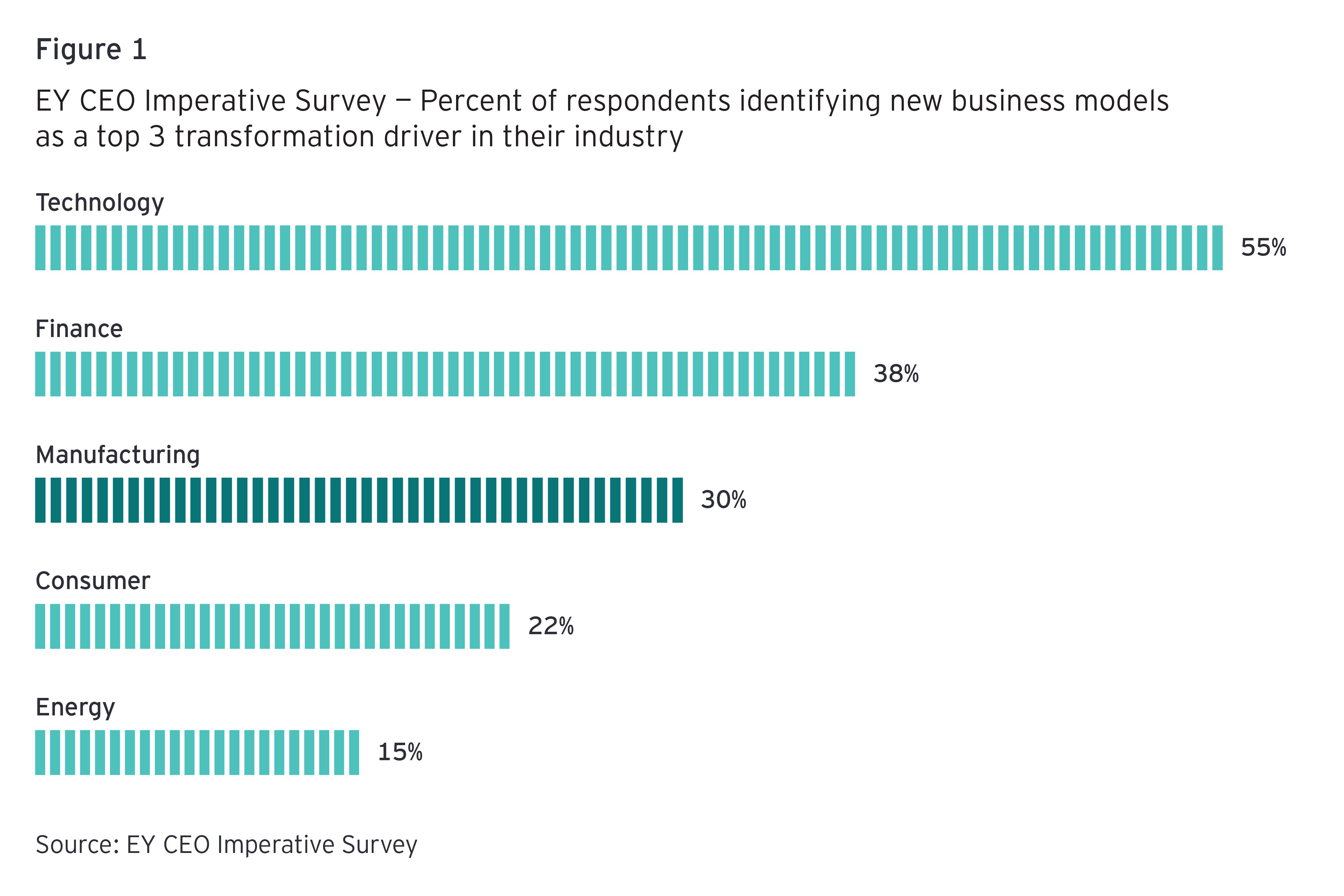

While manufacturing leaders know that true innovation needs to extend beyond product reinvention, they are more likely in general to turn to digital transformation efforts rather than innovating business models. The EY CEO Imperative Survey finds 70% of manufacturing sector respondents see technology and digital innovation as a transformation driver for their companies, while only 30% said the same of new business models. Contrast this with the technology sector, which is leading the way with almost twice the focus on business model innovation — and receiving significant investor credit for it.

This disparity underscores a significant risk for manufacturing companies. Overlooking the potential for new business models can create opportunities for competitors from adjacent sectors. The risk is particularly acute when these new competitors are also able to capitalize on evolving customer and consumer (end user) expectations. The most successful industrial firms are already learning from consumer-oriented models in sectors such as technology and consumer.

The results of the recent EY CEO Imperative Survey, which looked at trends among “thrivers” (firms with growing revenues) and “survivors” (those with declining revenues), illustrate the importance of business model innovation and transformation more broadly to successful corporate strategy. Per the survey, 45% of manufacturing thrivers are planning business model change, compared with just 32% of survivors. Over the next three years, thrivers (45%) are almost twice as likely as survivors (25%) to be planning changes in their innovation processes. Within the same timeframe, 73% of thrivers plan to increase spending on general transformation initiatives, while only 32% of survivors indicated the same.

Chapter 2

Four ways to build, launch and grow an innovative business model

Manufacturers can thrive in a challenging growth environment by following these principles.

Manufacturers that want to shift from surviving to thriving need to turn their business model innovation intention into action, today. They can do so by building a foundation of innovation on four principles:

1. Strengthen relationships with customers and consumers throughout the value chain

Business model innovation begins with bringing a growth mindset to identifying, understanding and pursuing customers. While most manufacturers are naturally accustomed to considering both direct customers and consumers as key constituencies, leaders should assess all the links in their value chains to ensure a comprehensive understanding of who in the chain is creating the most value and how. Doing so helps leaders align strategic decisions and resources to the needs of constituencies that will ultimately drive revenue growth. This also helps leaders broaden their thinking beyond the immediate next link in the value chain to include a wider range of value creation opportunities.

Thriving manufacturing companies are

1.5xmore likely than survivors to identify changing customer expectations as a major market trend.

In broadening their thinking, manufacturing leaders should also transition from a product-delivery mindset to a value-generation mindset. Implementing these shifts within a company may require both structural and cultural adaptations to best generate value. Leaders must bring a fully open mind to the process of understanding their customers better — and be prepared to disrupt their own teams and structures to maximize value creation. Reorganization without full knowledge of customer needs, on the other hand, can take a company backwards in the value creation process.

2. Establish a presence in the value chain with the strongest market position

As threats from nontraditional competitors rise, manufacturing leaders need to focus their organizations on pursuing and owning value chain positions that offer the greatest opportunities for value creation over time — and embracing the business model innovations required to achieve these goals.

Risk of increasing competition from non-traditional competitors ranks at

#3behind geopolitical risks and climate change, according to the EY CEO Outlook Survey.

Leaders must assess how their organization’s capabilities and offerings align with the value being generated across the value chain. Reviewing one’s activities through this lens can help identify whether the value being captured by the organization is properly aligned with the value created for consumers, or if there are untapped opportunities to create new value — and be recognized for it.

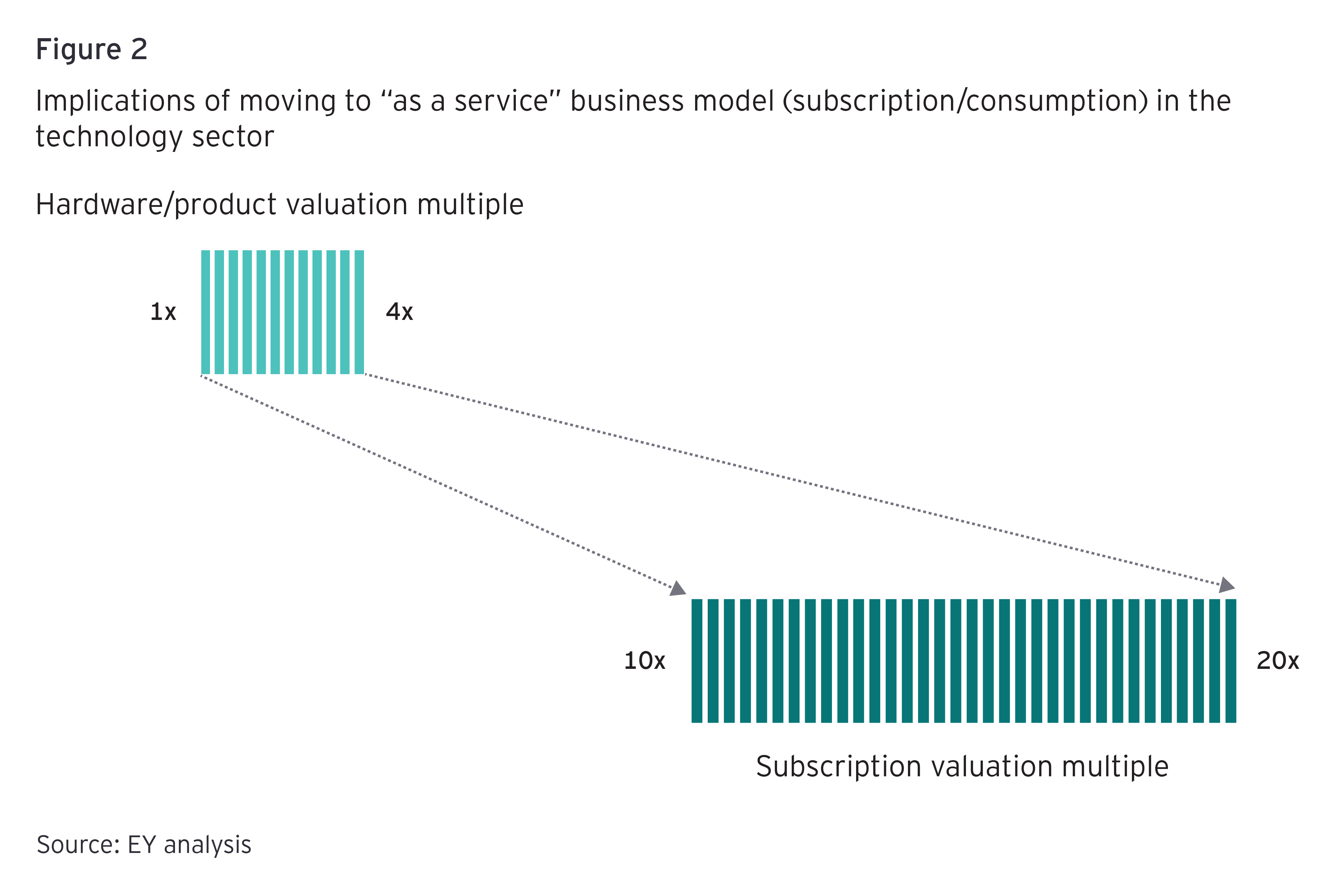

Many manufacturers have succeeded at business model innovation by evolving from a product-based model to a new service- or subscription-based model. These new models frequently draw on existing capabilities (e.g., aftermarket repairs and related ancillary services) while deepening or creating new customer or consumer relationships and providing unparalleled ongoing insights into how these constituencies define value.

3. Shift revenue models from delivery of goods to delivery of value

The first two principles underscore how business model innovation can help firms rethink what value they are delivering and to whom. As the preceding case study also demonstrates, it is also critical for manufacturers to explore changes to the “how” — namely, revenue model shifts and tactics that enable them to capture their fair share of the additional value delivered to customers.

For companies to succeed at measuring and pricing value, they need access to data, supported by the right technology to capture, analyze and act on it. Connected products provide manufacturers with a prime opportunity to understand customer usage patterns and to build new offerings — and new business models — based on insights from this data. Digital transformation efforts undertaken by many manufacturers may create a foundation, but the insights that may foster real business model innovation require more than just the right toolkit. Leaders must be ready to reimagine all aspects of their business through the lens of what they know, via their own data, that the rest of the market doesn’t.

Thriving manufacturing companies are

2.5xmore likely to prioritize investments in data and technology over cost reduction efforts.

When working with customer data, trust is essential. If manufacturers are to be paid based on value delivered versus units sold, customers must be willing to trust that data gathered via connected products and services will be used to their benefit as much, if not more so, than that of the manufacturer. Customers should be able to see an accounting of value generated and its alignment with prices or fees, ideally creating a virtuous cycle of openness with the manufacturer. Ongoing transparency makes it easier to identify opportunities that may be addressed by new business models.

4. Build a partner ecosystem to innovate at scale beyond sector boundaries

Business model innovation requires companies to re-examine, and often challenge, their own core competencies. Sometimes a value creation opportunity demands capabilities outside the company’s experience or beyond its sector. In these cases, manufacturing leaders should focus on building or joining an ecosystem.2

To build a high-performing ecosystem, manufacturing leaders need to define where partnerships would best support value creation and delivery by extending capabilities, market presence, and innovation more effectively than through organic investment or acquisitions. While ecosystems generally provide value creation opportunities for all participants, leaders seeking to build one should look for ways to ensure their organization “owns” it for greater control over how the additional value is allocated.

In the EY 2021 Ecosystem Survey,

2 in 3manufacturing companies say that ecosystems are more effective than traditional growth strategies.

Through these partnerships, manufacturers should also follow leading practices in sourcing, building and managing ecosystems. Ecosystems work best when regular C-suite reviews, KPIs, dedicated budgets and clear organizational ownership are clearly articulated and followed consistently.

Chapter 3

Key questions for a business model innovation journey

Answers may help leaders see critical knowledge gaps or risk areas before beginning the process.

As manufacturing companies seek sustainable, profitable growth, the incentives for laying the internal and external groundwork for business model innovation are clear. Nevertheless, it’s not surprising that sector CEOs are prioritizing more tangible and predictable actions (e.g., investments in data and technology) over significant changes in their offerings.

Even if business model innovation doesn’t appear anywhere on management’s to-do list, leaders should still ensure they are thinking carefully about the current and future state of their business model and its relationship to the value chain. The answers to these questions may reveal critical knowledge gaps or risk areas that should be addressed, regardless of the specific solution:

- Value of offering: Where and how is value created by your company’s products and services?

- Value to customers: Where would your customers say your products and services deliver value? How do you know this?

- Pricing of value: How does your company set prices? What is the relationship between your prices and the value delivered to customers?

- Forms of value: What forms of value exchange could you be taking advantage of beyond just fees for products? Would you be better off charging less and receiving additional data, IP rights, or access to new types of customers?

- Value from competitors: Where are your competitors creating and delivering value?

- Ecosystem partners: How are partnerships adding to the value of your products and services?

- Products, processes and people: Do you have the right products, processes and people within your organization to maximize value? If not, where is the greatest need for change?

Related articles

Summary

For manufacturers, the best opportunities for growth are no longer in increasing unit sales or market expansion. New business models based on a more accurate understanding of value creation are at the heart of successful growth strategies. Competitors, often supported by ecosystem partnerships, are redefining value delivery. When manufacturers take control of their unique data and insights and commit themselves fully to the possibilities of business model innovation, they are poised not only to take a seat at the table – but to sit at its head.